Government & Corporate Bond Funds

Government & Corporate Bond Funds

Government & Corporate Bond Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

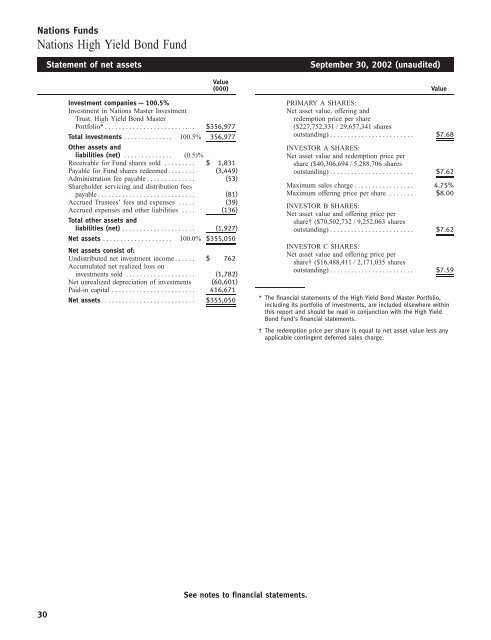

Nations <strong>Funds</strong><br />

Nations High Yield <strong>Bond</strong> Fund<br />

30<br />

Statement of net assets September 30, 2002 (unaudited)<br />

Value<br />

(000) Value<br />

Investment companies — 100.5% PRIMARY A SHARES:<br />

Investment in Nations Master Investment Net asset value, offering and<br />

Trust, High Yield <strong>Bond</strong> Master redemption price per share<br />

Portfolio*************************** $356,977 ($227,752,331 / 29,657,341 shares<br />

Total investments ************** 100.5% 356,977<br />

outstanding)************************ $7.68<br />

Other assets and INVESTOR A SHARES:<br />

liabilities (net) ************** (0.5)% Net asset value and redemption price per<br />

Receivable for Fund shares sold ********* $ 1,831 share ($40,306,694 / 5,288,706 shares<br />

Payable for Fund shares redeemed******** (3,449) outstanding)************************ $7.62<br />

Administration fee payable**************<br />

Shareholder servicing and distribution fees<br />

payable****************************<br />

(53)<br />

(81)<br />

Maximum sales charge *****************<br />

Maximum offering price per share *******<br />

4.75%<br />

$8.00<br />

Accrued Trustees’ fees and expenses ***** (39)<br />

Accrued expenses and other liabilities **** (136)<br />

INVESTOR B SHARES:<br />

Net asset value and offering price per<br />

Total other assets and<br />

liabilities (net) ********************* (1,927)<br />

share† ($70,502,732 / 9,252,063 shares<br />

outstanding)************************ $7.62<br />

Net assets ******************** 100.0% $355,050<br />

Net assets consist of:<br />

Undistributed net investment income****** $ 762<br />

INVESTOR C SHARES:<br />

Net asset value and offering price per<br />

share† ($16,488,411 / 2,171,035 shares<br />

Accumulated net realized loss on<br />

investments sold ******************** (1,782)<br />

Net unrealized depreciation of investments (60,601)<br />

Paid-in capital ************************ 416,671<br />

Net assets*************************** $355,050<br />

See notes to financial statements.<br />

outstanding)************************ $7.59<br />

* The financial statements of the High Yield <strong>Bond</strong> Master Portfolio,<br />

including its portfolio of investments, are included elsewhere within<br />

this report and should be read in conjunction with the High Yield<br />

<strong>Bond</strong> Fund’s financial statements.<br />

† The redemption price per share is equal to net asset value less any<br />

applicable contingent deferred sales charge.