Government & Corporate Bond Funds

Government & Corporate Bond Funds

Government & Corporate Bond Funds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Nations <strong>Funds</strong><br />

Notes to financial statements (continued) (unaudited)<br />

Change of Registered Investment Company<br />

On June 8, 2001, the <strong>Government</strong> Securities Fund, a newly established shell portfolio of <strong>Funds</strong> Trust (the ‘‘Successor<br />

Fund’’), acquired the assets and liabilities of its predecessor fund, which was a series of the Company, pursuant to a plan<br />

of reorganization approved by each predecessor fund’s shareholders. The predecessor fund had the same name,<br />

investment objective and principal investment strategies as the Successor Fund. The acquisition was accomplished by a<br />

tax-free exchange of shares of the Successor Fund in an amount equal to the value of the outstanding shares of the<br />

predecessor fund. The financial statements of the Successor Fund reflect the historical financial results of the predecessor<br />

fund prior to the reorganizations.<br />

Change of Registered Investment Company<br />

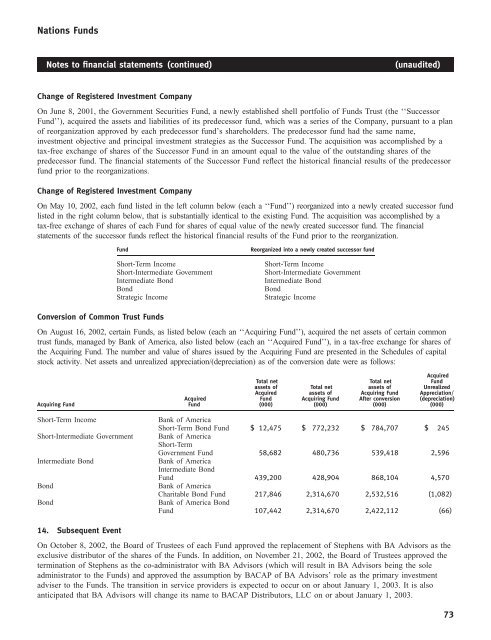

On May 10, 2002, each fund listed in the left column below (each a ‘‘Fund’’) reorganized into a newly created successor fund<br />

listed in the right column below, that is substantially identical to the existing Fund. The acquisition was accomplished by a<br />

tax-free exchange of shares of each Fund for shares of equal value of the newly created successor fund. The financial<br />

statements of the successor funds reflect the historical financial results of the Fund prior to the reorganization.<br />

Fund Reorganized into a newly created successor fund<br />

Short-Term Income Short-Term Income<br />

Short-Intermediate <strong>Government</strong> Short-Intermediate <strong>Government</strong><br />

Intermediate <strong>Bond</strong> Intermediate <strong>Bond</strong><br />

<strong>Bond</strong> <strong>Bond</strong><br />

Strategic Income Strategic Income<br />

Conversion of Common Trust <strong>Funds</strong><br />

On August 16, 2002, certain <strong>Funds</strong>, as listed below (each an ‘‘Acquiring Fund’’), acquired the net assets of certain common<br />

trust funds, managed by Bank of America, also listed below (each an ‘‘Acquired Fund’’), in a tax-free exchange for shares of<br />

the Acquiring Fund. The number and value of shares issued by the Acquiring Fund are presented in the Schedules of capital<br />

stock activity. Net assets and unrealized appreciation/(depreciation) as of the conversion date were as follows:<br />

Acquired<br />

Total net Total net Fund<br />

assets of Total net assets of Unrealized<br />

Acquired assets of Acquiring Fund Appreciation/<br />

Acquired Fund Acquiring Fund After conversion (depreciation)<br />

Acquiring Fund Fund (000) (000) (000) (000)<br />

Short-Term Income Bank of America<br />

Short-Term <strong>Bond</strong> Fund $ 12,475 $ 772,232 $ 784,707 $ 245<br />

Short-Intermediate <strong>Government</strong> Bank of America<br />

Short-Term<br />

<strong>Government</strong> Fund 58,682 480,736 539,418 2,596<br />

Intermediate <strong>Bond</strong> Bank of America<br />

Intermediate <strong>Bond</strong><br />

Fund 439,200 428,904 868,104 4,570<br />

<strong>Bond</strong> Bank of America<br />

Charitable <strong>Bond</strong> Fund 217,846 2,314,670 2,532,516 (1,082)<br />

<strong>Bond</strong> Bank of America <strong>Bond</strong><br />

Fund 107,442 2,314,670 2,422,112 (66)<br />

14. Subsequent Event<br />

On October 8, 2002, the Board of Trustees of each Fund approved the replacement of Stephens with BA Advisors as the<br />

exclusive distributor of the shares of the <strong>Funds</strong>. In addition, on November 21, 2002, the Board of Trustees approved the<br />

termination of Stephens as the co-administrator with BA Advisors (which will result in BA Advisors being the sole<br />

administrator to the <strong>Funds</strong>) and approved the assumption by BACAP of BA Advisors’ role as the primary investment<br />

adviser to the <strong>Funds</strong>. The transition in service providers is expected to occur on or about January 1, 2003. It is also<br />

anticipated that BA Advisors will change its name to BACAP Distributors, LLC on or about January 1, 2003.<br />

73