Government & Corporate Bond Funds

Government & Corporate Bond Funds

Government & Corporate Bond Funds

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

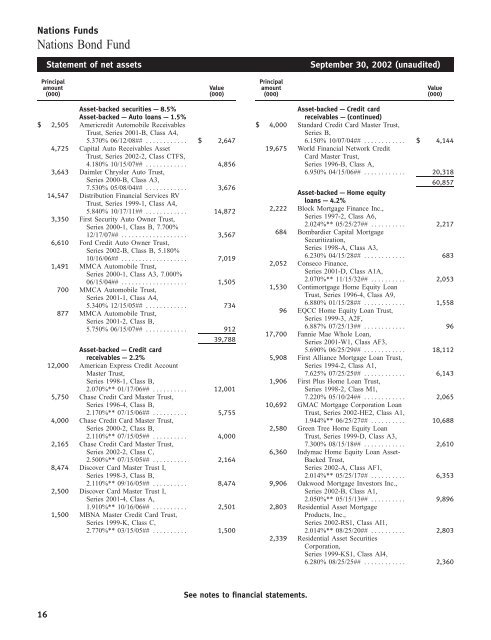

Nations <strong>Funds</strong><br />

Nations <strong>Bond</strong> Fund<br />

Statement of net assets September 30, 2002 (unaudited)<br />

Principal Principal<br />

amount Value amount Value<br />

(000) (000) (000) (000)<br />

Asset-backed securities — 8.5% Asset-backed — Credit card<br />

Asset-backed — Auto loans — 1.5% receivables — (continued)<br />

$ 2,505 Americredit Automobile Receivables $ 4,000 Standard Credit Card Master Trust,<br />

Trust, Series 2001-B, Class A4, Series B,<br />

5.370% 06/12/08## ************ $ 2,647 6.150% 10/07/04## ************ $ 4,144<br />

4,725 Capital Auto Receivables Asset 19,675 World Financial Network Credit<br />

Trust, Series 2002-2, Class CTFS, Card Master Trust,<br />

4.180% 10/15/07## ************ 4,856 Series 1996-B, Class A,<br />

3,643 Daimler Chrysler Auto Trust, 6.950% 04/15/06## ************ 20,318<br />

14,547<br />

3,350<br />

6,610<br />

1,491<br />

700<br />

877<br />

Series 2000-B, Class A3,<br />

7.530% 05/08/04## ************<br />

Distribution Financial Services RV<br />

Trust, Series 1999-1, Class A4,<br />

5.840% 10/17/11## ************<br />

First Security Auto Owner Trust,<br />

Series 2000-1, Class B, 7.700%<br />

12/17/07## *******************<br />

Ford Credit Auto Owner Trust,<br />

Series 2002-B, Class B, 5.180%<br />

10/16/06## *******************<br />

MMCA Automobile Trust,<br />

Series 2000-1, Class A3, 7.000%<br />

06/15/04## *******************<br />

MMCA Automobile Trust,<br />

Series 2001-1, Class A4,<br />

5.340% 12/15/05## ************<br />

MMCA Automobile Trust,<br />

Series 2001-2, Class B,<br />

3,676<br />

14,872<br />

3,567<br />

7,019<br />

1,505<br />

734<br />

2,222<br />

684<br />

2,052<br />

1,530<br />

96<br />

Asset-backed — Home equity<br />

loans — 4.2%<br />

Block Mortgage Finance Inc.,<br />

Series 1997-2, Class A6,<br />

2.024%** 05/25/27## **********<br />

Bombardier Capital Mortgage<br />

Securitization,<br />

Series 1998-A, Class A3,<br />

6.230% 04/15/28## ************<br />

Conseco Finance,<br />

Series 2001-D, Class A1A,<br />

2.070%** 11/15/32## **********<br />

Contimortgage Home Equity Loan<br />

Trust, Series 1996-4, Class A9,<br />

6.880% 01/15/28## ************<br />

EQCC Home Equity Loan Trust,<br />

Series 1999-3, A2F,<br />

60,857<br />

2,217<br />

683<br />

2,053<br />

1,558<br />

16<br />

5.750% 06/15/07## ************ 912<br />

6.887% 07/25/13## ************ 96<br />

17,700 Fannie Mae Whole Loan,<br />

39,788 Series 2001-W1, Class AF3,<br />

Asset-backed — Credit card 5.690% 06/25/29## ************ 18,112<br />

receivables — 2.2% 5,908 First Alliance Mortgage Loan Trust,<br />

12,000 American Express Credit Account Series 1994-2, Class A1,<br />

Master Trust, 7.625% 07/25/25## ************ 6,143<br />

Series 1998-1, Class B, 1,906 First Plus Home Loan Trust,<br />

2.070%** 01/17/06## ********** 12,001 Series 1998-2, Class M1,<br />

5,750 Chase Credit Card Master Trust, 7.220% 05/10/24## ************ 2,065<br />

Series 1996-4, Class B, 10,692 GMAC Mortgage Corporation Loan<br />

2.170%** 07/15/06## ********** 5,755 Trust, Series 2002-HE2, Class A1,<br />

4,000 Chase Credit Card Master Trust, 1.944%** 06/25/27## ********** 10,688<br />

Series 2000-2, Class B, 2,580 Green Tree Home Equity Loan<br />

2.110%** 07/15/05## ********** 4,000 Trust, Series 1999-D, Class A3,<br />

2,165 Chase Credit Card Master Trust, 7.300% 08/15/18## ************ 2,610<br />

Series 2002-2, Class C, 6,360 Indymac Home Equity Loan Asset-<br />

2.500%** 07/15/05## ********** 2,164 Backed Trust,<br />

8,474 Discover Card Master Trust I, Series 2002-A, Class AF1,<br />

Series 1998-3, Class B, 2.014%** 05/25/17## ********** 6,353<br />

2.110%** 09/16/05## ********** 8,474 9,906 Oakwood Mortgage Investors Inc.,<br />

2,500 Discover Card Master Trust I, Series 2002-B, Class A1,<br />

Series 2001-4, Class A, 2.050%** 05/15/13## ********** 9,896<br />

1.910%** 10/16/06## ********** 2,501 2,803 Residential Asset Mortgage<br />

1,500 MBNA Master Credit Card Trust, Products, Inc.,<br />

Series 1999-K, Class C, Series 2002-RS1, Class AI1,<br />

2.770%** 03/15/05## ********** 1,500 2.014%** 08/25/20## ********** 2,803<br />

2,339 Residential Asset Securities<br />

Corporation,<br />

Series 1999-KS1, Class AI4,<br />

6.280% 08/25/25## ************ 2,360<br />

See notes to financial statements.