Annualreport

Annualreport

Annualreport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

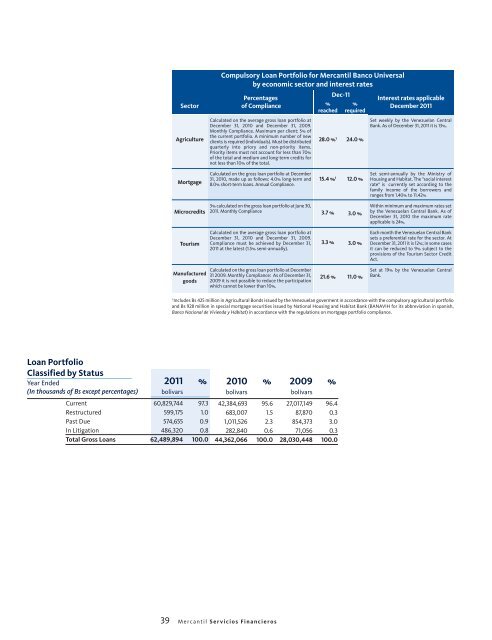

Loan Portfolio<br />

Classified by Status<br />

Year Ended<br />

(In thousands of Bs except percentages)<br />

Current<br />

Restructured<br />

Past Due<br />

In Litigation<br />

Total Gross Loans<br />

2011<br />

bolivars<br />

60,829,744<br />

599,175<br />

574,655<br />

486,320<br />

62,489,894<br />

Sector<br />

Agriculture<br />

Mortgage<br />

Microcredits<br />

Tourism<br />

Manufactured<br />

goods<br />

Percentages<br />

of Compliance<br />

1 Includes Bs 425 million in Agricultural Bonds issued by the Venezuelan goverment in accordance with the compulsory agricultural portfolio<br />

and Bs 928 million in special mortgage securities issued by National Housing and Habitat Bank (BANAVIH for its abbreviation in spanish,<br />

Banco Nacional de Vivienda y Hábitat) in accordance with the regulations on mortgage portfolio compliance.<br />

%<br />

97.3<br />

1.0<br />

0.9<br />

0.8<br />

100.0<br />

39 Mercantil Servicios Financieros<br />

Compulsory Loan Portfolio for Mercantil Banco Universal<br />

by economic sector and interest rates<br />

Calculated on the average gross loan portfolio at<br />

December 31, 2010 and December 31, 2009.<br />

Monthly Compliance. Maximum per client: 5% of<br />

the current portfolio. A minimum number of new<br />

clients is required (individuals). Must be distributed<br />

quarterly into priory and non-priority items.<br />

Priority items must not account for less than 70%<br />

of the total and medium and long-term credits for<br />

not less than 10% of the total.<br />

Calculated on the gross loan portfolio at December<br />

31, 2010, made up as follows: 4.0% long-term and<br />

8.0% short-term loans. Annual Compliance.<br />

3% calculated on the gross loan portfolio at June 30,<br />

2011. Monthly Compliance<br />

Calculated on the average gross loan portfolio at<br />

December 31, 2010 and December 31, 2009.<br />

Compliance must be achieved by December 31,<br />

2011 at the latest (1.5% semi-annually).<br />

Calculated on the gross loan portfolio at December<br />

31 2009. Monthly Compliance: As of December 31,<br />

2009 it is not possible to reduce the participation<br />

which cannot be lower than 10%.<br />

2010<br />

bolivars<br />

42,384,693<br />

683,007<br />

1,011,526<br />

282,840<br />

44,362,066<br />

%<br />

95.6<br />

1.5<br />

2.3<br />

0.6<br />

100.0<br />

2009<br />

bolivars<br />

27,017,149<br />

87,870<br />

854,373<br />

71,056<br />

28,030,448<br />

%<br />

reached<br />

28.0 % 1<br />

15.4 % 1<br />

3.7 %<br />

3.3 %<br />

21.6 %<br />

Dec-11<br />

%<br />

96.4<br />

0.3<br />

3.0<br />

0.3<br />

100.0<br />

%<br />

required<br />

24.0 %<br />

12.0 %<br />

3.0 %<br />

3.0 %<br />

11.0 %<br />

Interest rates applicable<br />

December 2011<br />

Set weekly by the Venezuelan Central<br />

Bank. As of December 31, 2011 it is 13%.<br />

Set semi-annually by the Ministry of<br />

Housing and Habitat. The "social interest<br />

rate" is currently set according to the<br />

family income of the borrowers and<br />

ranges from 1.40% to 11.42%<br />

Within minimum and maximum rates set<br />

by the Venezuelan Central Bank. As of<br />

December 31, 2010 the maximum rate<br />

applicable is 24%.<br />

Each month the Venezuelan Central Bank<br />

sets a preferential rate for the sector. At<br />

December 31, 2011 it is 12%; in some cases<br />

it can be reduced to 9% subject to the<br />

provisions of the Tourism Sector Credit<br />

Act.<br />

Set at 19% by the Venezuelan Central<br />

Bank.