Annualreport

Annualreport

Annualreport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

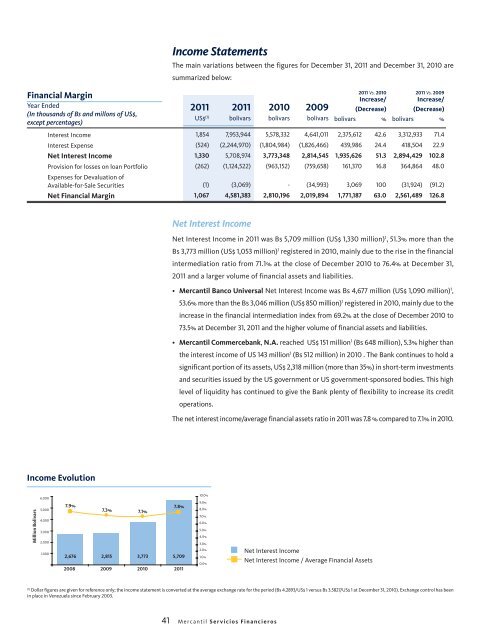

Financial Margin<br />

Year Ended<br />

(In thousands of Bs and millons of US$,<br />

except percentages)<br />

Interest Income<br />

Interest Expense<br />

Net Interest Income<br />

Provision for losses on loan Portfolio<br />

Expenses for Devaluation of<br />

Available-for-Sale Securities<br />

Net Financial Margin<br />

Income Evolution<br />

Million Bolivars<br />

6.000<br />

5.000<br />

4.000<br />

3.000<br />

2.000<br />

1.000<br />

7.9%<br />

2008<br />

7.3%<br />

7.1%<br />

Income Statements<br />

The main variations between the figures for December 31, 2011 and December 31, 2010 are<br />

summarized below:<br />

2011<br />

US$ (1)<br />

1,854<br />

(524)<br />

1,330<br />

(262)<br />

(1)<br />

1,067<br />

2011<br />

bolivars<br />

7,953,944<br />

(2,244,970)<br />

5,708,974<br />

(1,124,522)<br />

(3,069)<br />

4,581,383<br />

Net Interest Income<br />

5,578,332<br />

(1,804,984)<br />

3,773,348<br />

(963,152)<br />

Net Interest Income in 2011 was Bs 5,709 million (US$ 1,330 million) 1 , 51.3% more than the<br />

Bs 3,773 million (US$ 1,053 million) 1 registered in 2010, mainly due to the rise in the financial<br />

intermediation ratio from 71.1% at the close of December 2010 to 76.4% at December 31,<br />

2011 and a larger volume of financial assets and liabilities.<br />

• Mercantil Banco Universal Net Interest Income was Bs 4,677 million (US$ 1,090 million) 1 ,<br />

53.6% more than the Bs 3,046 million (US$ 850 million) 1 registered in 2010, mainly due to the<br />

increase in the financial intermediation index from 69.2% at the close of December 2010 to<br />

73.5% at December 31, 2011 and the higher volume of financial assets and liabilities.<br />

• Mercantil Commercebank, N.A. reached US$ 151 million1 (Bs 648 million), 5.3% higher than<br />

the interest income of US 143 million1 (Bs 512 million) in 2010 . The Bank continues to hold a<br />

significant portion of its assets, US$ 2,318 million (more than 35%) in short-term investments<br />

and securities issued by the US government or US government-sponsored bodies. This high<br />

level of liquidity has continued to give the Bank plenty of flexibility to increase its credit<br />

operations.<br />

The net interest income/average financial assets ratio in 2011 was 7.8 % compared to 7.1% in 2010.<br />

7.8%<br />

2,676 2,815 3,773 5,709<br />

2009 2010 2011<br />

10.0%<br />

9.0%<br />

8.0%<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

41 Mercantil Servicios Financieros<br />

2010<br />

bolivars<br />

-<br />

2,810,196<br />

2009<br />

bolivars<br />

4,641,011<br />

(1,826,466)<br />

2,814,545<br />

(759,658)<br />

(34,993)<br />

2,019,894<br />

2011 Vs. 2010<br />

Increase/<br />

(Decrease)<br />

bolivars %<br />

2,375,612<br />

439,986<br />

1,935,626<br />

161,370<br />

3,069<br />

1,771,187<br />

Net Interest Income<br />

Net Interest Income / Average Financial Assets<br />

42.6<br />

24.4<br />

51.3<br />

16.8<br />

100<br />

63.0<br />

2011 Vs. 2009<br />

Increase/<br />

(Decrease)<br />

bolivars %<br />

3,312,933<br />

418,504<br />

2,894,429<br />

364,864<br />

(31,924)<br />

2,561,489<br />

(1) Dollar figures are given for reference only; the income statement is converted at the average exchange rate for the period (Bs 4.2893/US$ 1 versus Bs 3.5827/US$ 1 at December 31, 2010). Exchange control has been<br />

in place in Venezuela since February 2003.<br />

71.4<br />

22.9<br />

102.8<br />

48.0<br />

(91.2)<br />

126.8