Annualreport

Annualreport

Annualreport

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business Management Report<br />

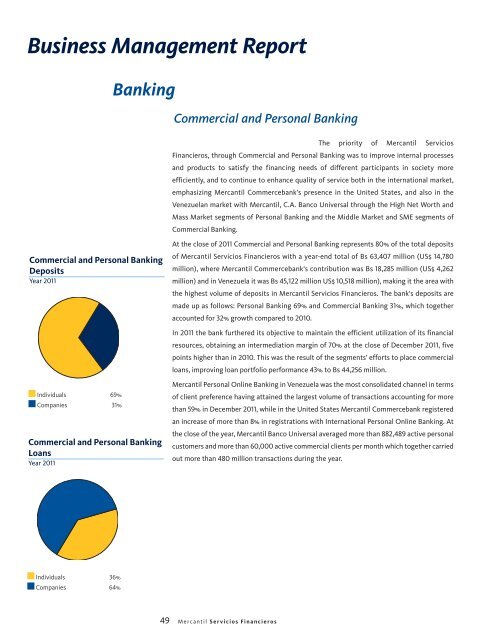

Commercial and Personal Banking<br />

Deposits<br />

Year 2011<br />

Individuals 69%<br />

Companies 31%<br />

Commercial and Personal Banking<br />

Loans<br />

Year 2011<br />

Individuals 36%<br />

Companies 64%<br />

Banking<br />

Commercial and Personal Banking<br />

The priority of Mercantil Servicios<br />

Financieros, through Commercial and Personal Banking was to improve internal processes<br />

and products to satisfy the financing needs of different participants in society more<br />

efficiently, and to continue to enhance quality of service both in the international market,<br />

emphasizing Mercantil Commercebank's presence in the United States, and also in the<br />

Venezuelan market with Mercantil, C.A. Banco Universal through the High Net Worth and<br />

Mass Market segments of Personal Banking and the Middle Market and SME segments of<br />

Commercial Banking.<br />

At the close of 2011 Commercial and Personal Banking represents 80% of the total deposits<br />

of Mercantil Servicios Financieros with a year-end total of Bs 63,407 million (US$ 14,780<br />

million), where Mercantil Commercebank's contribution was Bs 18,285 million (US$ 4,262<br />

million) and in Venezuela it was Bs 45,122 million US$ 10,518 million), making it the area with<br />

the highest volume of deposits in Mercantil Servicios Financieros. The bank's deposits are<br />

made up as follows: Personal Banking 69% and Commercial Banking 31%, which together<br />

accounted for 32% growth compared to 2010.<br />

In 2011 the bank furthered its objective to maintain the efficient utilization of its financial<br />

resources, obtaining an intermediation margin of 70% at the close of December 2011, five<br />

points higher than in 2010. This was the result of the segments' efforts to place commercial<br />

loans, improving loan portfolio performance 43% to Bs 44,256 million.<br />

Mercantil Personal Online Banking in Venezuela was the most consolidated channel in terms<br />

of client preference having attained the largest volume of transactions accounting for more<br />

than 59% in December 2011, while in the United States Mercantil Commercebank registered<br />

an increase of more than 8% in registrations with International Personal Online Banking. At<br />

the close of the year, Mercantil Banco Universal averaged more than 882,489 active personal<br />

customers and more than 60,000 active commercial clients per month which together carried<br />

out more than 480 million transactions during the year.<br />

49 Mercantil Servicios Financieros