IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

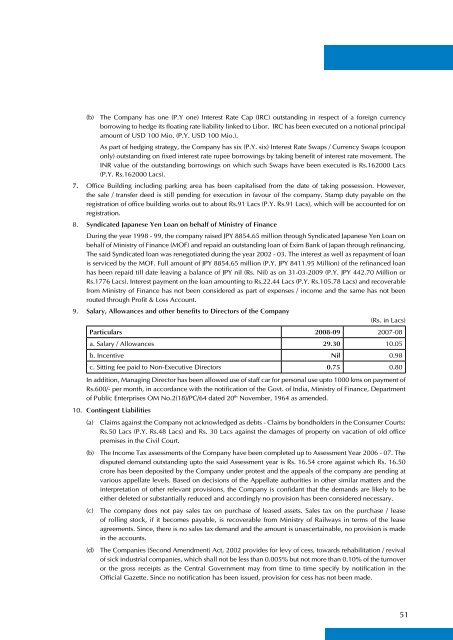

(b) The Company has one (P.Y one) Interest Rate Cap (IRC) outstanding in respect of a foreign currencyborrowing to hedge its floating rate liability linked to Libor. IRC has been executed on a notional principalamount of USD 100 Mio. (P.Y. USD 100 Mio.).As part of hedging strategy, the Company has six (P.Y. six) Interest Rate Swaps / Currency Swaps (coupononly) outstanding on fixed interest rate rupee borrowings by taking benefit of interest rate movement. TheINR value of the outstanding borrowings on which such Swaps have been executed is Rs.162000 Lacs(P.Y. Rs.162000 Lacs).7. Office Building including parking area has been capitalised from the date of taking possession. However,the sale / transfer deed is still pending for execution in favour of the company. Stamp duty payable on theregistration of office building works out to about Rs.91 Lacs (P.Y. Rs.91 Lacs), which will be accounted for onregistration.8. Syndicated Japanese Yen Loan on behalf of Ministry of <strong>Finance</strong>During the year 1998 - 99, the company raised JPY 8854.65 million through Syndicated Japanese Yen Loan onbehalf of Ministry of <strong>Finance</strong> (MOF) and repaid an outstanding loan of Exim Bank of Japan through refinancing.The said Syndicated loan was renegotiated during the year 2002 - 03. The interest as well as repayment of loanis serviced by the MOF. Full amount of JPY 8854.65 million (P.Y. JPY 8411.95 Million) of the refinanced loanhas been repaid till date leaving a balance of JPY nil (Rs. Nil) as on 31-03-2009 (P.Y. JPY 442.70 Million orRs.1776 Lacs). Interest payment on the loan amounting to Rs.22.44 Lacs (P.Y. Rs.105.78 Lacs) and recoverablefrom Ministry of <strong>Finance</strong> has not been considered as part of expenses / income and the same has not beenrouted through Profit & Loss Account.9. Salary, Allowances and other benefits to Directors of the Company(Rs. in Lacs)Particulars 2008-09 2007-08a. Salary / Allowances 29.30 10.05b. Incentive Nil 0.98c. Sitting fee paid to Non-Executive Directors 0.75 0.80In addition, Managing Director has been allowed use of staff car for personal use upto 1000 kms on payment ofRs.600/- per month, in accordance with the notification of the Govt. of India, Ministry of <strong>Finance</strong>, Departmentof Public Enterprises OM No.2(18)/PC/64 dated 20 th November, 1964 as amended.10. Contingent Liabilities(a) Claims against the Company not acknowledged as debts - Claims by bondholders in the Consumer Courts:Rs.50 Lacs (P.Y. Rs.48 Lacs) and Rs. 30 Lacs against the damages of property on vacation of old officepremises in the Civil Court.(b) The Income Tax assessments of the Company have been completed up to Assessment Year 2006 - 07. Thedisputed demand outstanding upto the said Assessment year is Rs. 16.54 crore against which Rs. 16.50crore has been deposited by the Company under protest and the appeals of the company are pending atvarious appellate levels. Based on decisions of the Appellate authorities in other similar matters and theinterpretation of other relevant provisions, the Company is confidant that the demands are likely to beeither deleted or substantially reduced and accordingly no provision has been considered necessary.(c) The company does not pay sales tax on purchase of leased assets. Sales tax on the purchase / leaseof rolling stock, if it becomes payable, is recoverable from Ministry of <strong>Railway</strong>s in terms of the leaseagreements. Since, there is no sales tax demand and the amount is unascertainable, no provision is madein the accounts.(d) The Companies (Second Amendment) Act, 2002 provides for levy of cess, towards rehabilitation / revivalof sick industrial companies, which shall not be less than 0.005% but not more than 0.10% of the turnoveror the gross receipts as the Central Government may from time to time specify by notification in theOfficial Gazette. Since no notification has been issued, provision for cess has not been made.51