IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

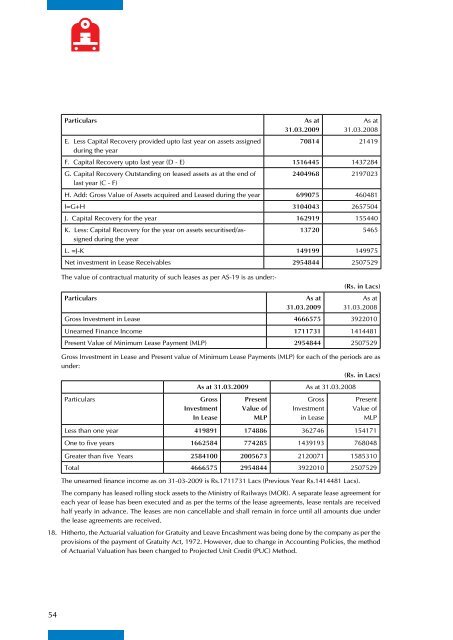

ParticularsE. Less Capital Recovery provided upto last year on assets assignedduring the yearAs at31.03.2009As at31.03.200870814 21419F. Capital Recovery upto last year (D - E) 1516445 1437284G. Capital Recovery Outstanding on leased assets as at the end oflast year (C - F)2404968 2197023H. Add: Gross Value of Assets acquired and Leased during the year 699075 460481I=G+H 3104043 2657504J. Capital Recovery for the year 162919 155440K. Less: Capital Recovery for the year on assets securitised/assignedduring the year13720 5465L. =J-K 149199 149975Net investment in Lease Receivables 2954844 2507529The value of contractual maturity of such leases as per AS-19 is as under:-ParticularsAs at31.03.2009(Rs. in Lacs)As at31.03.2008Gross Investment in Lease 4666575 3922010Unearned <strong>Finance</strong> Income 1711731 1414481Present Value of Minimum Lease Payment (MLP) 2954844 2507529Gross Investment in Lease and Present value of Minimum Lease Payments (MLP) for each of the periods are asunder:(Rs. in Lacs)ParticularsAs at 31.03.2009 As at 31.03.2008GrossInvestmentIn LeasePresentValue ofMLPGrossInvestmentin LeasePresentValue ofMLPLess than one year 419891 174886 362746 154171One to five years 1662584 774285 1439193 768048Greater than five Years 2584100 2005673 2120071 1585310Total 4666575 2954844 3922010 2507529The unearned finance income as on 31-03-2009 is Rs.1711731 Lacs (Previous Year Rs.1414481 Lacs).The company has leased rolling stock assets to the Ministry of <strong>Railway</strong>s (MOR). A separate lease agreement foreach year of lease has been executed and as per the terms of the lease agreements, lease rentals are receivedhalf yearly in advance. The leases are non cancellable and shall remain in force until all amounts due underthe lease agreements are received.18. Hitherto, the Actuarial valuation for Gratuity and Leave Encashment was being done by the company as per theprovisions of the payment of Gratuity Act, 1972. However, due to change in Accounting Policies, the methodof Actuarial Valuation has been changed to Projected Unit Credit (PUC) Method.54