IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

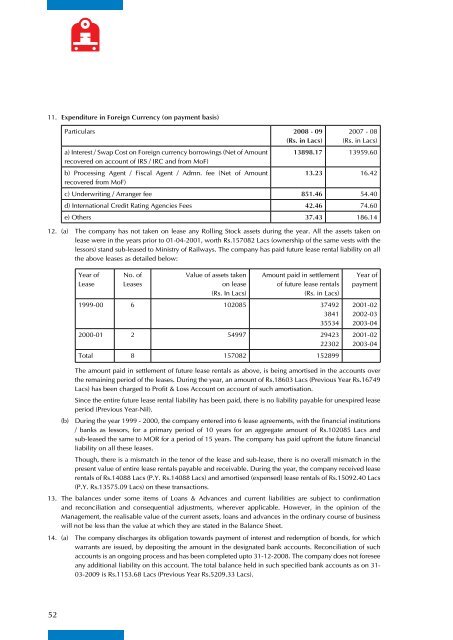

11. Expenditure in Foreign Currency (on payment basis)Particulars 2008 - 09(Rs. in Lacs)2007 - 08(Rs. in Lacs)a) Interest / Swap Cost on Foreign currency borrowings (Net of Amount 13898.17 13959.60recovered on account of IRS / IRC and from MoF)b) Processing Agent / Fiscal Agent / Admn. fee (Net of Amount 13.23 16.42recovered from MoF)c) Underwriting / Arranger fee 851.46 54.40d) International Credit Rating Agencies Fees 42.46 74.60e) Others 37.43 186.1412. (a) The company has not taken on lease any Rolling Stock assets during the year. All the assets taken onlease were in the years prior to 01-04-2001, worth Rs.157082 Lacs (ownership of the same vests with thelessors) stand sub-leased to Ministry of <strong>Railway</strong>s. The company has paid future lease rental liability on allthe above leases as detailed below:Year ofLeaseNo. ofLeasesValue of assets takenon lease(Rs. In Lacs)Amount paid in settlementof future lease rentals(Rs. in Lacs)1999-00 6 102085 374923841355342000-01 2 54997 2942322302Total 8 157082 152899Year ofpayment2001-022002-032003-042001-022003-04The amount paid in settlement of future lease rentals as above, is being amortised in the accounts overthe remaining period of the leases. During the year, an amount of Rs.18603 Lacs (Previous Year Rs.16749Lacs) has been charged to Profit & Loss Account on account of such amortisation.Since the entire future lease rental liability has been paid, there is no liability payable for unexpired leaseperiod (Previous Year-Nil).(b) During the year 1999 - 2000, the company entered into 6 lease agreements, with the financial institutions/ banks as lessors, for a primary period of 10 years for an aggregate amount of Rs.102085 Lacs andsub-leased the same to MOR for a period of 15 years. The company has paid upfront the future financialliability on all these leases.Though, there is a mismatch in the tenor of the lease and sub-lease, there is no overall mismatch in thepresent value of entire lease rentals payable and receivable. During the year, the company received leaserentals of Rs.14088 Lacs (P.Y. Rs.14088 Lacs) and amortised (expensed) lease rentals of Rs.15092.40 Lacs(P.Y. Rs.13575.09 Lacs) on these transactions.13. The balances under some items of Loans & Advances and current liabilities are subject to confirmationand reconciliation and consequential adjustments, wherever applicable. However, in the opinion of theManagement, the realisable value of the current assets, loans and advances in the ordinary course of businesswill not be less than the value at which they are stated in the Balance Sheet.14. (a) The company discharges its obligation towards payment of interest and redemption of bonds, for whichwarrants are issued, by depositing the amount in the designated bank accounts. Reconciliation of suchaccounts is an ongoing process and has been completed upto 31-12-2008. The company does not foreseeany additional liability on this account. The total balance held in such specified bank accounts as on 31-03-2009 is Rs.1153.68 Lacs (Previous Year Rs.5209.33 Lacs).52