IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

IRFC FINAL - Indian Railway Finance Corporation Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

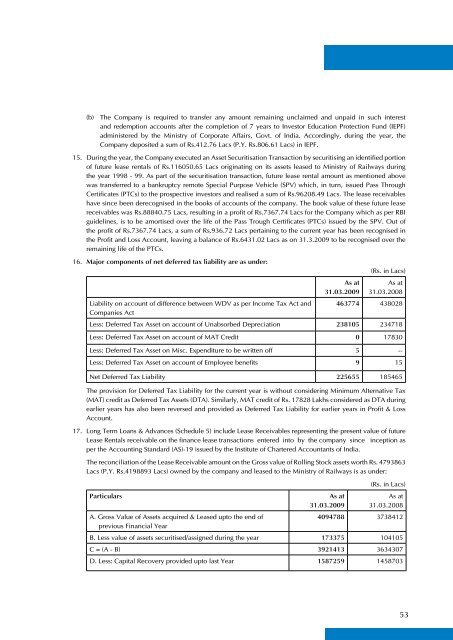

(b) The Company is required to transfer any amount remaining unclaimed and unpaid in such interestand redemption accounts after the completion of 7 years to Investor Education Protection Fund (IEPF)administered by the Ministry of Corporate Affairs, Govt. of India. Accordingly, during the year, theCompany deposited a sum of Rs.412.76 Lacs (P.Y. Rs.806.61 Lacs) in IEPF.15. During the year, the Company executed an Asset Securitisation Transaction by securitising an identified portionof future lease rentals of Rs.116050.65 Lacs originating on its assets leased to Ministry of <strong>Railway</strong>s duringthe year 1998 - 99. As part of the securitisation transaction, future lease rental amount as mentioned abovewas transferred to a bankruptcy remote Special Purpose Vehicle (SPV) which, in turn, issued Pass ThroughCertificates (PTCs) to the prospective investors and realised a sum of Rs.96208.49 Lacs. The lease receivableshave since been derecognised in the books of accounts of the company. The book value of these future leasereceivables was Rs.88840.75 Lacs, resulting in a profit of Rs.7367.74 Lacs for the Company which as per RBIguidelines, is to be amortised over the life of the Pass Trough Certificates (PTCs) issued by the SPV. Out ofthe profit of Rs.7367.74 Lacs, a sum of Rs.936.72 Lacs pertaining to the current year has been recognised inthe Profit and Loss Account, leaving a balance of Rs.6431.02 Lacs as on 31.3.2009 to be recognised over theremaining life of the PTCs.16. Major components of net deferred tax liability are as under:As at31.03.2009(Rs. in Lacs)As at31.03.2008Liability on account of difference between WDV as per Income Tax Act and 463774 438028Companies ActLess: Deferred Tax Asset on account of Unabsorbed Depreciation 238105 234718Less: Deferred Tax Asset on account of MAT Credit 0 17830Less: Deferred Tax Asset on Misc. Expenditure to be written off 5 --Less: Deferred Tax Asset on account of Employee benefits 9 15Net Deferred Tax Liability 225655 185465The provision for Deferred Tax Liability for the current year is without considering Minimum Alternative Tax(MAT) credit as Deferred Tax Assets (DTA). Similarly, MAT credit of Rs. 17828 Lakhs considered as DTA duringearlier years has also been reversed and provided as Deferred Tax Liability for earlier years in Profit & LossAccount.17. Long Term Loans & Advances (Schedule 5) include Lease Receivables representing the present value of futureLease Rentals receivable on the finance lease transactions entered into by the company since inception asper the Accounting Standard (AS)-19 issued by the Institute of Chartered Accountants of India.The reconciliation of the Lease Receivable amount on the Gross value of Rolling Stock assets worth Rs. 4793863Lacs (P.Y. Rs.4198893 Lacs) owned by the company and leased to the Ministry of <strong>Railway</strong>s is as under:ParticularsA. Gross Value of Assets acquired & Leased upto the end ofprevious Financial YearAs at31.03.2009(Rs. in Lacs)As at31.03.20084094788 3738412B. Less value of assets securitised/assigned during the year 173375 104105C = (A - B) 3921413 3634307D. Less: Capital Recovery provided upto last Year 1587259 145870353