Fall 1983 – Issue 30 - Stanford Lawyer - Stanford University

Fall 1983 – Issue 30 - Stanford Lawyer - Stanford University

Fall 1983 – Issue 30 - Stanford Lawyer - Stanford University

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

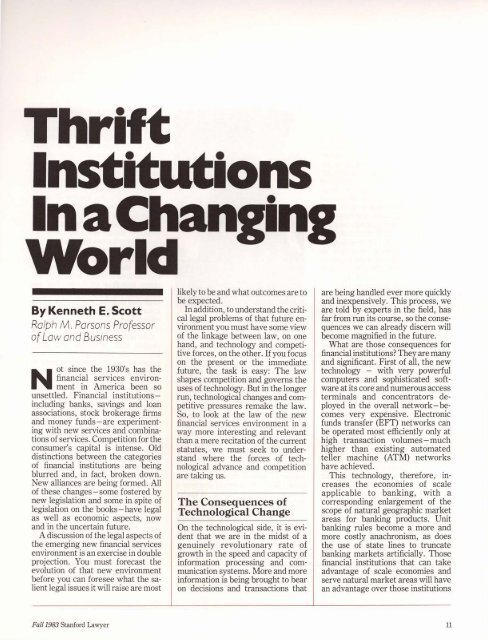

ThriftIn it ionsInaChanorldIn•By Kenneth E. ScottRolph M. Parsons ProfessorofLow and BusinessNot since the 19<strong>30</strong>'s has thefinancial services environmentin America been sounsettled. Financial institutionsincludingbanks, savings and loanassociations, stock brokerage firmsand money funds-are experimentingwith new services and combinationsof services. Competition for theconsumer's capital is intense. Olddistinctions between the categoriesof financial institutions are beingblurred and, in fact, broken down.New alliances are being formed. Allof these changes - some fostered bynew legislation and some in spite oflegislation on the books - have legalas well as economic aspects, nowand in the uncertain future.A discussion of the legal aspects ofthe emerging new financial servicesenvironment is an exercise in doubleprojection. You must forecast theevolution of that new environmentbefore you can foresee what the salientlegal issues it will raise are mostlikely to be and what outcomes are tobe expected.In addition, to understand the criticallegal problems of that future environmentyou must have some viewof the linkage between law, on onehand, and technology and competitiveforces, on the other. If you focuson the present or the immediatefuture, the task is easy: The lawshapes competition and governs theuses of technology. But in the longerrun, technological changes and competitivepressures remake the law.So, to look at the law of the newfinancial services environment in away more interesting and relevantthan a mere recitation of the currentstatutes, we must seek to understandwhere the forces of technologicaladvance and competitionare taking us.The Consequences ofTechnological ChangeOn the technological side, it is evidentthat we are in the midst of agenuinely revolutionary rate ofgrowth in the speed and capacity ofinformation processing and communicationsystems. More and moreinformation is being brought to bearon decisions and transactions thatare being handled ever more quicklyand inexpensively. This process, weare told by experts in the field, hasfar from run its course, so the consequenceswe can already discern willbecome magnified in the future.What are those consequences forfinancial institutions? Theyare manyand significant. First of all, the newtechnology - with very powerfulcomputers and sophisticated softwareat its core and numerous accessterminals and concentrators deployedin the overall network-becomesvery expensive. Electronicfunds transfer (EFT) networks canbe operated most efficiently only athigh transaction volumes-muchhigher than existing automatedteller machine (ATM) networkshave achieved.This technology, therefore, increasesthe economies of scaleapplicable to banking, with acorresponding enlargement of thescope of natural geographic marketareas for banking products. Unitbanking rules become a more andmore costly anachronism, as doesthe use of state lines to truncatebanking markets artificially. Thosefinancial institutions that can takeadvantage of scale economies andserve natural market areas will havean advantage over those institutions<strong>Fall</strong> <strong>1983</strong> <strong>Stanford</strong> <strong>Lawyer</strong> 11