Management’s responsibility for financial reportingThe management of <strong>USAA</strong> is responsible forthe integrity and objectivity of the financialinformation presented in this annual report.Due <strong>to</strong> the volume of financial informationcontained in the audited consolidated financialstatements, which includes the financialstatements as well as the accompanyingfootnotes, we have chosen not <strong>to</strong> include thefull audited consolidated financial statementsin this <strong>Report</strong> <strong>to</strong> <strong>Members</strong>.The financial statements that appear in thisdocument have been selected from the auditedconsolidated financial statements <strong>to</strong> give basicand necessary financial information about <strong>USAA</strong>.Certain prior year amounts were reclassified <strong>to</strong>conform <strong>to</strong> the current year presentation. Theselected financial information was prepared by<strong>USAA</strong> in accordance with Accounting PrinciplesGenerally Accepted in the United States ofAmerica (GAAP), except for the key statu<strong>to</strong>rydata, which was prepared in accordance withStatu<strong>to</strong>ry Accounting Principles (SAP).Management believes the financial informationcontained in the audited consolidated financialstatements fairly presents <strong>USAA</strong>’s financialposition, results of operations and cash flows.A copy of the complete audited consolidatedfinancial statements of <strong>USAA</strong>, includingErnst & Young LLP’s unqualified independentaudi<strong>to</strong>rs’ report thereon, is available upon request<strong>to</strong> <strong>USAA</strong> headquarters in San An<strong>to</strong>nio, Texas.<strong>USAA</strong>’s internal controls are designed <strong>to</strong>reasonably ensure that <strong>USAA</strong>’s assets aresafeguarded from unauthorized use or dispositionand that <strong>USAA</strong>’s transactions are authorized,executed and recorded properly. In addition,<strong>USAA</strong> has a professional staff of internalaudi<strong>to</strong>rs who moni<strong>to</strong>r these controls on anindependent basis. The Finance and AuditCommittee of <strong>USAA</strong>’s board of direc<strong>to</strong>rs engagedErnst & Young LLP as independent audi<strong>to</strong>rs <strong>to</strong>audit <strong>USAA</strong>’s financial statements and expressan opinion thereon. Ernst & Young LLP’s auditincluded consideration of <strong>USAA</strong>’s internalcontrols over financial reporting as a basis fordesigning audit procedures that support theirfinancial statement audit opinion, but not forthe purpose of expressing an opinion on theeffectiveness of <strong>USAA</strong>’s internal controls overfinancial reporting.The Finance and Audit Committee of <strong>USAA</strong>’sboard of direc<strong>to</strong>rs consists of five members,who are not officers or employees of <strong>USAA</strong>. Thiscommittee meets periodically with management,internal audi<strong>to</strong>rs and Ernst & Young LLP <strong>to</strong>ensure that management fulfills its responsibilityfor accounting controls and preparation of theconsolidated financial statements and related data.Josue (Joe) Robles Jr.Maj. General, USA (Ret.)President and Chief Executive OfficerKristi A. MatusExecutive Vice PresidentChief Financial Officer<strong>USAA</strong> HIGHLIGHTSAssets owned grew <strong>to</strong> $68 billion.The increase is due <strong>to</strong> a conservative and well-managed investmentportfolio, increases in consumer loans taken out by <strong>USAA</strong> members andrecord annuities purchased by members.Years Ended December 31 <strong>2008</strong> 2007 2006TOTAL MEMBERS (in millions) 6.8 6.4 5.9TOTAL PRODUCTS (in millions) 28.9 26.7 23.9TOTAL EMPLOYEES (in thousands) 21.9 22.7 21.7<strong>Members</strong> (in millions)<strong>USAA</strong> Consolidated (Dollars in millions)Revenue $12,912 $14,418 $13,416Expenses 12,489 12,563 11,086Net Income 423 1,855 2,330Assets owned $68,296 $67,177 $60,269Assets owned and managed 119,550 125,140 113,475Total liabilities 53,730 52,810 47,145Net worth 14,566 14,367 13,1245.25.55.96.46.82004200520062007<strong>2008</strong>MEMBER DISTRIBUTIONS<strong>USAA</strong> returned $857 million <strong>to</strong> members in the formof dividends, distributions, bank rebates and rewards.Our financial strength, expense control and efficiency efforts enabled<strong>USAA</strong> <strong>to</strong> weather the difficult financial environment and <strong>USAA</strong>’s largestcatastrophe losses in its 86-year his<strong>to</strong>ry.Distributions <strong>to</strong> members (in millions)$670$694$795$910$857Years Ended December 31 (Dollars in millions) <strong>2008</strong> 2007 2006Subscriber’s Account distributions $170 $255 $221Au<strong>to</strong>mobile policyholder dividends 69 108 105Total au<strong>to</strong>mobile policyholder dividends andSubscriber’s Account distributions 239 363 326Subscriber’s Account senior bonus † 121 104 88Subscriber’s Account terminations 85 71 62Total property and casualty distributions 445 538 476Life Insurance Company policyholder dividends 44 45 44Federal Savings Bank rebates and rewards 368 327 275Total distributions <strong>to</strong> MEMBERS $857 $910 $795† <strong>Members</strong> with more than 40 years of membership may be eligible for the Senior Bonus, which is an additionaldistribution from the member’s Subscriber’s Account.2004200520062007<strong>2008</strong>12 <strong>USAA</strong> <strong>2008</strong> REPORT TO MEMBERS

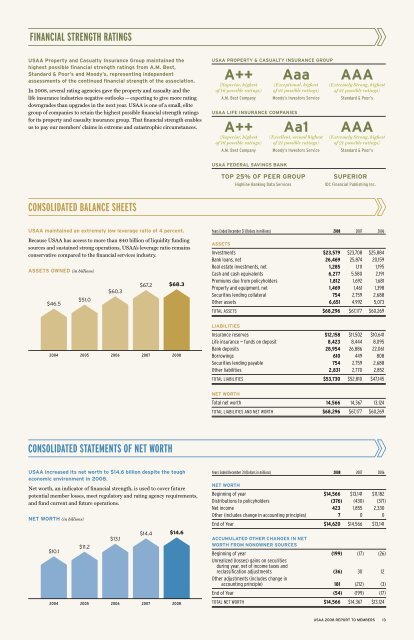

Financial strength ratings<strong>USAA</strong> Property and Casualty Insurance Group maintained thehighest possible financial strength ratings from A.M. Best,Standard & Poor’s and Moody’s, representing independentassessments of the continued financial strength of the association.In <strong>2008</strong>, several rating agencies gave the property and casualty and thelife insurance industries negative outlooks — expecting <strong>to</strong> give more ratingdowngrades than upgrades in the next year. <strong>USAA</strong> is one of a small, elitegroup of companies <strong>to</strong> retain the highest possible financial strength ratingsfor its property and casualty insurance group. That financial strength enablesus <strong>to</strong> pay our members’ claims in extreme and catastrophic circumstances.<strong>USAA</strong> property & casualty insurance groupA++(Superior, highes<strong>to</strong>f 16 possible ratings)Aaa(Exceptional, highes<strong>to</strong>f 21 possible ratings)AAA(Extremely Strong, highes<strong>to</strong>f 21 possible ratings)A.M. Best CompanyMoody’s Inves<strong>to</strong>rs Service<strong>USAA</strong> life insurance companiesA++ Aa1(Superior, highest (Excellent, second highes<strong>to</strong>f 16 possible ratings) of 21 possible ratings)A.M. Best CompanyMoody’s Inves<strong>to</strong>rs ServiceStandard & Poor’sAAA(Extremely Strong, highes<strong>to</strong>f 21 possible ratings)Standard & Poor’s<strong>USAA</strong> federal savings bankTop 25% of peer groupHighline Banking Data ServicesSuperiorIDC Financial Publishing Inc.CONSOLIDATED BALANCE SHEETS<strong>USAA</strong> maintained an extremely low leverage ratio of 4 percent.Because <strong>USAA</strong> has access <strong>to</strong> more than $40 billion of liquidity fundingsources and sustained strong operations, <strong>USAA</strong>’s leverage ratio remainsconservative compared <strong>to</strong> the financial services industry.Assets owned (in billions)$46.5$51.0$60.3$67.2$68.3Years Ended December 31 (Dollars in millions) <strong>2008</strong> 2007 2006AssetsInvestments $23,579 $23,708 $25,884Bank loans, net 26,469 25,874 20,159Real estate investments, net 1,285 1,111 1,195Cash and cash equivalents 6,277 5,580 2,191Premiums due from policyholders 1,812 1,692 1,681Property and equipment, net 1,469 1,461 1,398Securities lending collateral 754 2,759 2,688Other assets 6,651 4,992 5,073Total ASSETS $68,296 $67,177 $60,269Liabilities2004200520062007<strong>2008</strong>Insurance reserves $12,158 $11,502 $10,641Life insurance — funds on deposit 8,423 8,444 8,095Bank deposits 28,954 26,886 22,061Borrowings 610 449 808Securities lending payable 754 2,759 2,688Other liabilities 2,831 2,770 2,852Total LIABILITIES $53,730 $52,810 $47,145Net WorthTotal net worth 14,566 14,367 13,124Total liabilities and net WORTH $68,296 $67,177 $60,269CONSOLIDATED STATEMENTS OF NET WORTH<strong>USAA</strong> increased its net worth <strong>to</strong> $14.6 billion despite the <strong>to</strong>ugheconomic environment in <strong>2008</strong>.Net worth, an indica<strong>to</strong>r of financial strength, is used <strong>to</strong> cover futurepotential member losses, meet regula<strong>to</strong>ry and rating agency requirements,and fund current and future operations.Net worth (in billions)$10.12004$11.22005$13.12006$14.42007$14.6<strong>2008</strong>Years Ended December 31 (Dollars in millions) <strong>2008</strong> 2007 2006Net WorthBeginning of year $14,566 $13,141 $11,182Distributions <strong>to</strong> policyholders (376) (430) (371)Net income 423 1,855 2,330Other (includes change in accounting principles) 7 0 0End of Year $14,620 $14,566 $13,141Accumulated Other Changes in NetWorth from Nonowner SourcesBeginning of year (199) (17) (26)Unrealized (losses) gains on securitiesduring year, net of income taxes andreclassification adjustments (36) 30 12Other adjustments (includes change inaccounting principle) 181 (212) (3)End of Year (54) (199) (17)Total net WORTH $14,566 $14,367 $13,124<strong>USAA</strong> <strong>2008</strong> REPORT TO MEMBERS 13