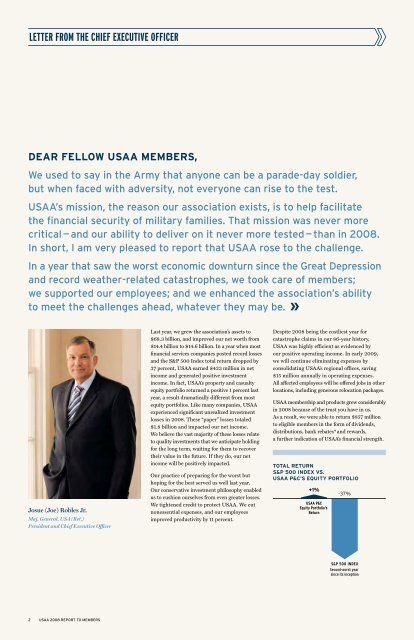

Letter from the CHIEF EXECUTIVE OFFICERDear fellow <strong>USAA</strong> <strong>Members</strong>,We used <strong>to</strong> say in the Army that anyone can be a parade-day soldier,but when faced with adversity, not everyone can rise <strong>to</strong> the test.<strong>USAA</strong>’s mission, the reason our association exists, is <strong>to</strong> help facilitatethe financial security of military families. That mission was never morecritical — and our ability <strong>to</strong> deliver on it never more tested — than in <strong>2008</strong>.In short, I am very pleased <strong>to</strong> report that <strong>USAA</strong> rose <strong>to</strong> the challenge.In a year that saw the worst economic downturn since the Great Depressionand record weather-related catastrophes, we <strong>to</strong>ok care of members;we supported our employees; and we enhanced the association’s ability<strong>to</strong> meet the challenges ahead, whatever they may be.Josue (Joe) Robles Jr.Maj. General, USA (Ret.)President and Chief Executive OfficerLast year, we grew the association’s assets <strong>to</strong>$68.3 billion, and improved our net worth from$14.4 billion <strong>to</strong> $14.6 billion. In a year when mostfinancial services companies posted record lossesand the S&P 500 Index <strong>to</strong>tal return dropped by37 percent, <strong>USAA</strong> earned $423 million in netincome and generated positive investmentincome. In fact, <strong>USAA</strong>’s property and casualtyequity portfolio returned a positive 1 percent lastyear, a result dramatically different from mostequity portfolios. Like many companies, <strong>USAA</strong>experienced significant unrealized investmentlosses in <strong>2008</strong>. These “paper” losses <strong>to</strong>taled$1.8 billion and impacted our net income.We believe the vast majority of these losses relate<strong>to</strong> quality investments that we anticipate holdingfor the long term, waiting for them <strong>to</strong> recovertheir value in the future. If they do, our netincome will be positively impacted.Our practice of preparing for the worst buthoping for the best served us well last year.Our conservative investment philosophy enabledus <strong>to</strong> cushion ourselves from even greater losses.We tightened credit <strong>to</strong> protect <strong>USAA</strong>. We cutnonessential expenses, and our employeesimproved productivity by 11 percent.Despite <strong>2008</strong> being the costliest year forcatastrophe claims in our 86-year his<strong>to</strong>ry,<strong>USAA</strong> was highly efficient as evidenced byour positive operating income. In early 2009,we will continue eliminating expenses byconsolidating <strong>USAA</strong>’s regional offices, saving$15 million annually in operating expenses.All affected employees will be offered jobs in otherlocations, including generous relocation packages.<strong>USAA</strong> membership and products grew considerablyin <strong>2008</strong> because of the trust you have in us.As a result, we were able <strong>to</strong> return $857 million<strong>to</strong> eligible members in the form of dividends,distributions, bank rebates* and rewards,a further indication of <strong>USAA</strong>’s financial strength.<strong>to</strong>tal returns&p 500 index vs.usaa p&c’s equity portfolio+1%<strong>USAA</strong> P&CEquity Portfolio’sReturn-37%S&P 500 INDEXSecond-worst yearsince its inception2 <strong>USAA</strong> <strong>2008</strong> REPORT TO MEMBERS

<strong>2008</strong> Industry Competitive PerformanceCategory industry <strong>USAA</strong>Financial strength ratings Numerous downgrades Highest possible **Outlook Negative StableLeverage high Very lowLayoffs Numerous noneNet worth Decreased IncreasedSee more in-depth discussion atusaa.com/<strong>Report</strong>To<strong>Members</strong>Watch <strong>USAA</strong>’s CEO and Chairman discusshow the association fared in <strong>2008</strong> and listen<strong>to</strong> a conversation between Chris Claus, presiden<strong>to</strong>f the <strong>USAA</strong> Financial Services Group,and some of his <strong>to</strong>p portfoliomanagers about theongoing market turmoil.Government bailout Yes, please No, thank youViable business Bankruptcies and failures Strong and growing<strong>USAA</strong>’s Property and Casualty Insurance Groupremains among the few <strong>to</strong>p-rated U.S. companiesby Standard & Poor’s, A.M. Best and Moody’s ata time when well-respected competi<strong>to</strong>rs weredowngraded. <strong>USAA</strong>’s Life Insurance Companywas also awarded the highest ratings fromStandard & Poor’s and A.M. Best. We earn theseratings not only because of our financial strength,our strategic plans and our corporate governance,but also because of you, our members — who youare and the loyalty you have for <strong>USAA</strong>.<strong>USAA</strong> served as a haven for its 6.8 millionmembers, many of whom discovered that <strong>USAA</strong>is not just their insurer, but a trusted sourcefor financial advice, banking and investments.We achieved record market share in everyeligibility category. Overall market shareincreased by 2 percentage points, continuing <strong>to</strong>support our position as provider of choice formilitary families. Of the <strong>USAA</strong> members whostarted the year with us, more than 96 percentstayed with us in <strong>2008</strong>, and for the first time,members owned an average of five <strong>USAA</strong> productsper household — a very good indication of theirtrust in <strong>USAA</strong>.The best service got even betterLast year, we mobilized <strong>to</strong> help our memberswho were hit hard by a record number ofwildfires, hurricanes and other s<strong>to</strong>rms.We deployed our world-class claims team ofhundreds of catastrophe adjusters and supportpersonnel who moved in<strong>to</strong> affected areas assoon as it was safe <strong>to</strong> do so. Many of them wereaway from their homes and families for extendedperiods, helping more than 150,000 memberswho suffered damage <strong>to</strong> their homes and otherproperty. By year-end, we closed 97 percen<strong>to</strong>f <strong>2008</strong> catastrophe claims.<strong>USAA</strong> returned$857 million<strong>to</strong> members in the form of dividends,distributions, bank rebates * and rewards.*Includes amounts returned <strong>to</strong> members, associates and other cus<strong>to</strong>mers.<strong>USAA</strong> continuously improves how we serve you,and we showed you that in two especiallyimportant ways. First, <strong>to</strong> further strengthenour military connection, we increased militaryrecruiting, hiring 472 employees with militaryexperience, which represented 21 percent ofour <strong>2008</strong> hires. This included efforts <strong>to</strong> recruitwounded warriors and Purple Heart recipients —some of whom are featured in this very report onpages 16 and 17.Second, we made it easier for members <strong>to</strong> dobusiness with <strong>USAA</strong> in whatever channel theyprefer. In <strong>2008</strong>, more than 600,000 membersembraced the new MOBILE.<strong>USAA</strong>.COM.It provides access <strong>to</strong> your accounts from yourmobile device <strong>to</strong> pay bills, transfer funds, requestan au<strong>to</strong> ID card, place s<strong>to</strong>ck trades and more.Forty-six percent of the use came from activeduty military because they can now do businesswith <strong>USAA</strong> on the go, from anywhere in the world.**<strong>USAA</strong> Property and Casualty Insurance Group from the threemajor rating agencies<strong>USAA</strong> <strong>2008</strong> REPORT TO MEMBERS 3