Annual Report 2010 - Scana Industrier ASA

Annual Report 2010 - Scana Industrier ASA

Annual Report 2010 - Scana Industrier ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

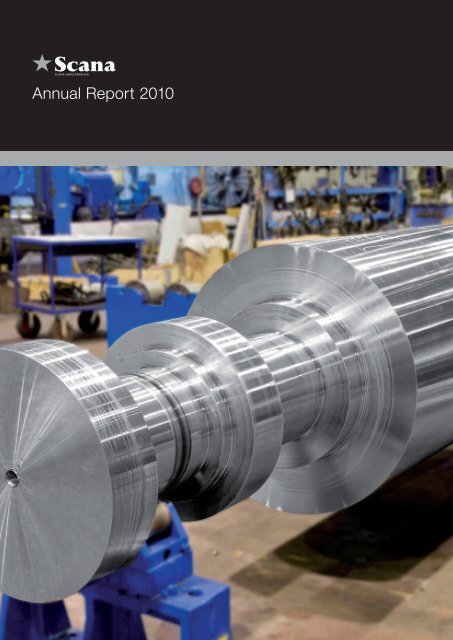

3 THE SCANA GROUP4 Objectives and means5 Group Management and Board of Directors6 Comments from the CEO8 Historical highlights10 Business areas12 BUSINESS AREA STEEL14 <strong>Scana</strong> Steel Björneborg16 <strong>Scana</strong> Steel Booforge17 <strong>Scana</strong> Steel Söderfors18 Leshan <strong>Scana</strong> Machinery Ltd20 <strong>Scana</strong> Steel Stavanger21 <strong>Scana</strong> Steel AB22 BUSINESS AREA MARINE24 <strong>Scana</strong> Propulsion28 <strong>Scana</strong> Skarpenord30 <strong>Scana</strong> Korea Hydraulic Ltd.32 BUSINESS AREA OIL & GAS34 <strong>Scana</strong> Subsea35 <strong>Scana</strong> Offshore Vestby36 <strong>Scana</strong> Offshore Technology37 <strong>Scana</strong> Offshore Services38 ENVIRONMENTAL IMPACT40 ANNUAL ACCOUNTS <strong>2010</strong>41 Directors’ report47 <strong>Scana</strong> group profit and loss account48 <strong>Scana</strong> group balance sheet49 <strong>Scana</strong> group cash flow statement50 <strong>Scana</strong> group statement of change inshareholders equity51 <strong>Scana</strong> group notes83 Parent company profit and loss account84 Parent company balance sheet85 Parent company cash flow statement86 Parent company notes91 Declaration by the Board of Directors andthe CEO and group chief executive92 Auditors´ report94 Shares and shareholders <strong>2010</strong>96 Articles of association98 key figuresThe front page picture shows a semi finished shaft typical for the Energy segment within <strong>Scana</strong> Steel.

3THE SCANA GROUP<strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong> (<strong>Scana</strong>) is a Nordic industrial group operating in three business areas:Steel, Marine and Oil & Gas.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>The main products for the Steel area are the productionof customized steel forgings and castings for the oil andgas, energy, marine, machine and tool industries.The Marine area develops and produces gears, propulsionsystems and valve control systems for ships.The main products for the Oil and Gas area are designand production, marketing and sale, in addition tomaintenance and repair of equipment and steelcomponents for the oil and gas industry.The companies in the three business areas provideproducts and system solutions for three market segments;namely marine, energy and steel and machinery.<strong>Scana</strong>’s technology, unique materials knowledge andextensive production experience form the basis of ourcompetitive power. Our aim is to be the preferred supplierto leading companies within our market segments.The majority of our customers are located in Europe, theAmericas and Southeast Asia.The group has as at 31.12.<strong>2010</strong> 1 759 employees, ofwhich 675 work in China. The head office is situatedin Stavanger. The group has operative companies inNorway, Sweden, China, Poland, USA, South-Korea,Brazil and Singapore, and representatives in a series ofcountries, worldwide.<strong>Scana</strong>’s technology, unique materials knowledgeand extensive production experience”form the basis of our competitive power.

4<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Objectives and meansThe majority of <strong>Scana</strong>’s companies service one or several of three market segments:marine, energy, steel and machinery. <strong>Scana</strong> possesses market-leading knowledge inthese areas, and in the future the company will sell a greater portion of finished productsand solutions.<strong>Scana</strong> creates progress”Business conceptThe objective of the company is to own and managemanufacturing industry, commercial activities and relatedactivities. The objectives of the company also includeinvesting in other companies that can promote thecompany’s primary activities.<strong>Scana</strong> shall be a market-driven industrial group with nicheproducts for growing markets.Vision<strong>Scana</strong> creates progress.Bythis, we maintain that:<strong>Scana</strong> <strong>Industrier</strong> shall be a profitable industrial group.The head office shall be in Scandinavia, with industrialbases and centres for technology and market expertisein Europe and Asia. The group shall serve customersthroughout the entire world.<strong>Scana</strong> shall have a reputation for excellent customerresponse, strong competition, robust quality and deliveryreliability, and be an attractive and challenging workplace.<strong>Scana</strong>’s finances shall be sufficient to develop the groupindustrially and commercially.Main aim and strategiesThe main aim of the group is to increase the shareholders’values.On this basis, the following primary strategies have beendetermined:1. Continued organic growth in all business areas.2. Maintain a good operating margin and effectivefinancial management.3. Strengthen the group’s strategic position throughacquisitions• in order to strengthen our market position• in order to increase capacity• in order to supplement our product range or value chain.4. Develop the repair and service concept within the marineand energy areas.

5Group management and board of directors<strong>Scana</strong> has a decentralised organisation in which a large part of the group’s technical andcommercial expertise shall be located in the companies. <strong>Scana</strong>’s group management teamand finance and accounts functions are based at the head office in Stavanger, Norway.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Group Management:Board of DirectorsRolf Roverud, Group CEORolf Roverud (born 1958) took up theappointment of Group Chief Executive in<strong>Scana</strong> <strong>Industrier</strong> on January 1, 2008. Hehas previously had a number of leadingpositions in Saga Petroleum, and camefrom the position of Vice Chief Executivein NSB AS. Mr Roverud is an economicsgraduate and holds a master’s degree instrategy and management.Kjetil Flesjå, Group Director / CFOKjetil Flesjå (born 1967) has a Master inBusiness Administration and came to <strong>Scana</strong>from a position in Fokus Bank. Flesjå hasa thorough expertise in banking and acomprehensive experience with corporatefinance processes, including acquisi tionsand sales, financial risk analysis, balanceand liability strategies, in addition to anextensive analytical experience.Jan Henry Melhus,Group Director Oil and GasJan Henry Melhus (born 1963) is educatedas production engineer with additionaleducation within marine technology. Hehas more than 20 years of experience from<strong>Scana</strong>’s areas of commitment. Mr. Melhuscame to <strong>Scana</strong> from the position of directorfor GE Oil & Gas. He has previously heldleading positions at Vetco Gray, GMCgroup, NAT and ABB Group.Frode Alhaug, Chairman of the BoardFrode Alhaug (born 1949) was elected aschairman of the board in <strong>Scana</strong> <strong>Industrier</strong><strong>ASA</strong> in 2008. He worked as the group’sCEO from 2005-2007 and chairman/member of the board since 2000-2005.Mr. Alhaug is vice chairman of the board inHelse Sørøst RHF. Previously Mr. Alhaugwas CEO in Moelven <strong>Industrier</strong>. Mr. Alhaugis <strong>Scana</strong>’s third largest shareholder.Bjørn DahleBjørn Dahle (born 1947) worked in theoffshore industry from 1966 and as anindependent investor and entrepreneursince 1971. Mr. Dahle is among <strong>Scana</strong>’slargest shareholders.Mari SkjærstadMari Skjærstad (born 1969) has a lawdegree from the University of Oslo, withadditional education within organisationand management. She is a partner in thelaw firm Johnsrud, Sanderud & SkjærstadAS and has worked as legal counsel since1995. Mrs. Skjærstad is also a boardmember in a number of other companies,including Mesta, Norfund and Forsvarsbygg.Martha Kold BakkevigMartha Kold Bakkevig (born 1963) has extensiveexperience in Management, Strategyand R&D within Technology and BusinessDevelopment. She has a PhD (Dr.scient.)from Norwegian University of Science andTechnology (1995) and a PhD (Dr. Oecon.)from BI Norwegian School of Management(2007). Bakkevig is Managing Director inDeepWell, a well intervention companylocated i Haugesund.John Arild ErtvaagJohn Arild Ertvaag (born 1955) runs hisown investment business through hiscompany Camar AS. The investments areprimarily within oil and gas, industry andcommerce. He holds a number of boardpositions in both listed and non-listedcompanies. Camar AS is the secondlargest investor in <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>.

Historical highlights1652<strong>Scana</strong>’s oldest company, <strong>Scana</strong> Booforge, is<strong>2010</strong>9established in Karlskoga.1656Permission is granted to build a forgeham mer at the Vismes estuary. This formsthe basis for Björneborg’s growth anddevelopment.1911Stavanger Electro-Stålverk is established.Today, <strong>Scana</strong> Steel Stavanger AS is Norway’sonly special steel works and is located inStrand municipality.1987<strong>Scana</strong> <strong>Industrier</strong> is founded through a mergerbetween ScanArmatur AS and ScanPaint AS.1989The actuator and valve control systemmanufacturer <strong>Scana</strong> Skarpenord AS is takenover by <strong>Scana</strong> <strong>Industrier</strong>.1991<strong>Scana</strong> <strong>Industrier</strong> buys Stavanger Staal AS,now <strong>Scana</strong> Steel Stavanger AS.1993<strong>Scana</strong> <strong>Industrier</strong> buys Björneborgs JärnverkAB, now <strong>Scana</strong> Steel Björneborg AB, one ofthe oldest ironworks in the world.1994<strong>Scana</strong> <strong>Industrier</strong> buys a company steepedin forging traditions: Booforge AB, now<strong>Scana</strong> Steel Booforge AB. Production waspreviously run by Alfred Nobel’s Bofors.1995<strong>Scana</strong> <strong>Industrier</strong> is listed on the Oslo StockExchange.1996<strong>Scana</strong> Steel Stavanger AS secures its ownpower supply through the licence allocationto Jørpeland Kraft AS, a third of which isowned by <strong>Scana</strong>.1997<strong>Scana</strong> establishes itself in China throughthe joint venture company Leshan <strong>Scana</strong>Machinery Company Ltd.1998<strong>Scana</strong> buys Volda Mekaniske Verksted AS,now <strong>Scana</strong> Volda AS.1999<strong>Scana</strong> signs an agreement with Caterpillar,making <strong>Scana</strong> Volda a preferred supplierof propellers, reduction gears and controlsystems for Caterpillar’s diesel engines.2000The first complete year of operation for <strong>Scana</strong>Korea Hydraulic Ltd. This company hasincreased <strong>Scana</strong>’s market share considerablyin one of the world’s largest shipbuildingnations.2001<strong>Scana</strong> increases its capital, which givesthe company NOK 106 million in new sharecapital.2002Smedvig sells his share majority in <strong>Scana</strong> toleading employees in <strong>Scana</strong> <strong>Industrier</strong>.2004<strong>Scana</strong> Korea Hydraulic becomes one of fivesubcontractors to be given the prestigious“Quality Gold Mark” by Samsung HeavyIndustries, one of the world’s largestshipyards.2005<strong>Scana</strong> establishes the offshore servicecompany <strong>Scana</strong> Offshore Technology ASin collaboration with International OilfieldServices AS. The new company aims tofurther develop the group’s activities withinservice and maintenance.2006<strong>Scana</strong> acquires the companies “BrødreneJohnsen AS” and “AMT AS”, now <strong>Scana</strong>Offshore Vestby AS, in collaboration withInternational Oilfield Services AS. Theseacquisitions confirm the company’sexpressed objectives for growth within oiland gas.2008<strong>Scana</strong>’s turnover reaches almost NOK 2.9billion after a peak in activity in all of thegroups key areas. <strong>Scana</strong> Offshore Services isestablished after an acquisition of business inHouston. The company strengthens <strong>Scana</strong>’sposition in the USA and Singapore.2009<strong>Scana</strong> buys ABB’s marine activities in Polandand establishes <strong>Scana</strong> Zamech Sp.Zo.o. Theacquisition strengthens and complements<strong>Scana</strong>’s activities within the business areaMarine. <strong>Scana</strong>’s establishment of business inBrazil will create big opportunities for growthin an exciting market. <strong>Scana</strong> also establishes<strong>Scana</strong> Subsea delivering subsea and risercomponents to the oil and gas industry.<strong>2010</strong><strong>Scana</strong> emphasizes consolidation andefficiency of operations to strengthenour competitive power. The order intakeincreases significantly towards the end ofthe year.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>

10<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Business Areas<strong>Scana</strong> is organized into three business areas with a decentralized organization, in which theproduction units are separate legal entities.StEEl<strong>Scana</strong> Steel Björneborg AB,SwedenForged special components.<strong>Scana</strong> Steel Booforge AB, SwedenArms for forklift trucks and specialisedforging and heat treatment.<strong>Scana</strong> Steel Söderfors AB, SwedenRolled special profiles and rolled/forged rods and billets, mainly inspecial steel.Leshan <strong>Scana</strong> Machinery Ltd, ChinaSteel rolls and castings. <strong>Scana</strong> owns80 %.<strong>Scana</strong> Steel Stavanger AS, NorwayHigh-alloy castings and forgings, andwear-resistant steel.<strong>Scana</strong> Steel AB, SwedenManages <strong>Scana</strong>’s real estate inKarlskoga, Sverige.MarinePROPULSION<strong>Scana</strong> Volda AS, NorwayGears, propellers and propulsionsystems.<strong>Scana</strong> Mar-El AS, NorwayElectronic remote control systemsfor the propulsion and navigation ofvessels.<strong>Scana</strong> Zamech sp. zo. o, PolandGears and propeller systems.<strong>Scana</strong> Singapore Pte. Ltd.Design, engineering, repairs andmaintenance of drilling equipment.VALVE CONTROL SYSTEMS<strong>Scana</strong> Skarpenord AS, NorwayHydraulic actuators and valve controlsystems.<strong>Scana</strong> Korea Hydraulics Ltd,South KoreaHydraulic actuators and valve controlsystems. <strong>Scana</strong> owns 49 %.<strong>Scana</strong> Skarpenord ShanghaiService Station, ChinaHydraulic actuators, valve controlsystems and service.OIL & GAS<strong>Scana</strong> Subsea AB, SwedenSubsea and riser systems for the oil& gas industry.<strong>Scana</strong> Do Brasil Industrias, BrazilSales and marketing of <strong>Scana</strong>’sproducts in Brazil and on the SouthAmerican continent.<strong>Scana</strong> Offshore Vestby AS, NorwayEngineering, design, constructionand production of special equipmentfor the petroleum industry.<strong>Scana</strong> Offshore Technology AS,NorwayRepair, maintenance and recertificationof equipment for the oil industry.<strong>Scana</strong> Offshore Services Inc, USADesign, engineering, repair andmaintenance of drilling equipment.

11<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Businessareas

12<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>BUSINESS AREA stEElThe steel business area has a several hundred yearlong tradition in the Swedish steel industry with regardto the companies <strong>Scana</strong> Steel Björneborg, <strong>Scana</strong> SteelBooforge and <strong>Scana</strong> Steel Söderfors, in addition to thecooperation with Motala Verkstad AB. This businessarea also includes Leshan <strong>Scana</strong> Machinery Companyin China, plus the Norwegian company <strong>Scana</strong> SteelStavanger.The companies each have an independent and longhistory, and specialise in different production areas.The business area supplies complete products toworkshops, the marine industry and the oil and gasindustry. Production takes place at <strong>Scana</strong>’s ownproduction facilities, which include melting plants,forges, rolling mills, foundries and heat treatment andmachining units. Production is of a high standardand complies with ISO-certified quality assurancesystems. The business is characterised by high levels ofmetallurgical expertise and strong market positions inthe respective product areas.Strategic position<strong>Scana</strong> maintains a high standard with regard to itsproduction as well as a broad product range. Getting afoothold in this industry is difficult since both productionfacilities and infrastructure represent major investments,and because it is also extremely challenging to acquiresufficient levels of metallurgic and technical expertise.<strong>Scana</strong> is one of few players in its area with integratedproduction facilities that include both melting/productionof steel, heat treatment and machining of components.Few of <strong>Scana</strong>’s competitors have their own steelworksand have to buy billets and semi-finished goods in orderto be able to offer finished steel products. This gives<strong>Scana</strong> a clear competitive advantage, which the groupwill develop further.In the period from 2008-<strong>2010</strong>, more than NOK 200million has been invested in the steel companies. Theinvestments increase capacity and delivery precision,and reduce risk and production costs. In <strong>2010</strong>, <strong>Scana</strong>expanded the production capacity in China with regardto rolls and larger rings. <strong>Scana</strong>’s investments alsoincluded a new forge manipulator at Björneborg, whichis able to handle tonnage up to 75 tonnes and lengthsup to 24 metres.Products<strong>Scana</strong> is a leading supplier of specialised products insteel and customises solutions for various uses. Keyelements are close collaboration with the customer andhigh quality. <strong>Scana</strong>’s technological expertise is pivotal tothe production and in connection with the developmentof new, customised products. <strong>Scana</strong>’s productioncapacity in terms of steel produced in-house is around150,000 tonnes of melted material.<strong>Scana</strong> offers a broad range of products weighing from50 kg to 45 tonnes, in lengths up to 24 metres. <strong>Scana</strong>is a market leader in the upper weight and length range,particularly with regard to cylindrical products. <strong>Scana</strong>has a large capacity within heat treatment. This renderspossible specific material qualities and extended tensilestrength, an important competitive advantage.Markets and customersOur special products provide us with customers amongthe great international players in industries such asmarine, oil/gas and energy. <strong>Scana</strong> offers optimumdesign and material alternatives, which, combinedwith short delivery times and good logistics, provide acompetitive total solution.Special steel customers are primarily steel companies,major wholesalers and end users. <strong>Scana</strong> has enteredinto several long-term collaboration agreements with anumber of key customers. This provides a good basisfor developing the business concept further.The development is heading in the direction ofcustomers requesting supplies of finished productsdelivered directly to their own facilities. High quality andtechnical expertise, combined with precise deliverieshave all helped <strong>Scana</strong> capture a strong position in themarket.

13<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Steel

14<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Ingvar WinboSCANA STEEL BJÖRNEBORG<strong>Scana</strong> Steel Björneborg refines steel in an integrated chain that includes steelworks, heat treatment,forge with a 4,500 tonne press and a well-equipped machining workshop.The company was founded 354 years ago, making itone of the group’s most venerable companies – not tomention one of the oldest forges in the world.Due to low demand and high pressure on prices,following a financial recession and an economicdown turn in the heavy steel industry, the company’sorder reserve and turnover has decreased. But witha number of cost cutting measures, the result is stillpositive.Markets and customers<strong>Scana</strong> Steel Björneborg exports 70 % of its turnover,directly or through other companies in the group. Thelargest market is Europe, but export also goes to theUSA, Asia and other parts of the world.The entire steel industry has throughout <strong>2010</strong> beenfaced with a low demand and increased competitiondue to a much larger capacity in both Europe and Asia.As a consequence, the organization and crew of thecompany has been adjusted accordingly and marketinghas been intensified. <strong>Scana</strong> Steel Björneborg has,adhering to our long-term strategy, continued our workon increasing the refinement of our products. The resultfor <strong>2010</strong> is an increasing number of customers orderinga higher number of finished products, especially in themarine business area.In 2011, a slight increase in market demand is expected.The business as a whole will experience an increasingforge capacity in the world. <strong>Scana</strong> Steel Björneborg willcontinue to focus on established customer relations,cooperation with other <strong>Scana</strong> companies and also onnew markets.Investments for the futureIn the course of the recent three years, large,productivity-increasing investments have been carriedout, and the majority were concluded during thesummer of 2009. Investments for increased productioncapacity, more advanced testing equipment and abetter environment, has continued in <strong>2010</strong> as well. Themost important completed investments in the course of<strong>2010</strong> were:• Upgrades of lathes for the machining workshop• Continued development of the steelworks, part 2,through purchase of a new transformer. Installation ofthe arc oven transformer is due during summer 2011,and for ovens some time during summer 2012. Theseinvestments will increase capacity to 115,000 tonnesannually.• Upgraded equipment for heat stability testing,completed and run-in. With this test equipment, axlescan be tested at high temperatures, meeting theparticularly high demands of energy customers.• New CTOD test equipment for the testing of steel,especially for customers in oil and gas. Having thismachine in-house shortens the lead-time for e.g.risers with several weeks.• New pendulum impact tester increasing safety andcapacity.• New cooler intake and new dam hatches minimize therisk of flooding and cooler liquid breakdowns.• Equipment to ensure that no radioactive materials areled onto the property.

15<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Investments have been carried out according toschedule, resulting in more reliable productionequipment with a higher total capacity, plus moreadvanced test facilities. The company is well preparedfor an increased demand for forged steel productsweighing up to 45 tonnes and a length of 24 metres.Increased productivity and qualityIn the course of the year, <strong>Scana</strong> Steel Björneborg hasintroduced “Lean Production” in all production divisions,partly under our own auspices and partly within theframework of a programme by Chalmers tekniskehøyskole, called “The Production Lift”. Our goal hasbeen to attain a high and even quality through control ofevery process. This also contributes to a higher deliveryprecision.The costs for quality divergences are now less,as a direct result of the aforementioned work, andcombined with the programme for cost reduction, thishas contributed to increased competitive power. Theprogramme continues through 2011, and several ofthe company’s workers are involved and contribute tothe improvements. This is a continuation of the earlierwork where we systematically shorten the lead-time forall products. The company has introduced bottleneckcontrol, setting a maximum limit for the number ofproducts at work in critical processes.We want to ensure that the company’s workersare highly skilled, which in turn leads to improvedquality. The company identifies critical skills using acompetence matrix, in addition to certification of specificskills through practical and written tests. A recentlyintroduced salary system for employees is an incentiveto further develop one’s skills and competence.All in all, the aforementioned measures entail that ourwork in progress have decreased drastically, our deliveryprecision has increased, the throughput times areshortened and the divergences are more than halved.Products<strong>Scana</strong> Steel Björneborg delivers customer designedproducts for four market segments: industrial, marine,machine and energy. The company’s main products areforged, rotation symmetrical, large and long componentsof steel with a high technical content. <strong>Scana</strong> SteelBjörneborg also supplies raw forged and semi-finishedbillets. The products are for instance axles, shafts, joints,risers, poles and sheet metal.The company’s products are often key components forthe customer, and are delivered with different degreesof completion, depending on customer requirements.The company has an on-going cooperation with materialinstitutes to further increase the quality of our products.

16<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Håkan Schill<strong>Scana</strong> Steel Booforge<strong>Scana</strong> Steel Booforge is a world leader in the production of large arms for forklift trucks – armsthat can lift in excess of 10 tonnes. With <strong>Scana</strong>’s expertise in free form forging, the company canmanufacture large forks and other forged products according to any specification with stringentdemands for strength. Since 2009, Booforge also manufactures masts and lifting carriages, andthus complete lifting systems in the heavy segment.Markets and customersThe company is mainly aimed at forklift truck andmachine manufacturers, as well as other steelworks.In addition the company has customers within oil andgas and the food industry. The customers are primarilylocated in the Nordic region and in other parts ofEurope. <strong>Scana</strong> Steel Booforge exports approximately 15% of its production. The company’s largest customersinclude Cargotec, Konecranes, Svetruck, Sandvik, AlfaLaval, Moorlink og <strong>Scana</strong> Steel Björneborg.The market for <strong>Scana</strong> Steel Booforge’s core products –forks, free form forging and heat treatment – has beenimproved in <strong>2010</strong>. The order intake has increased by 30% for these products. The demand for racks and liftingcarriages was temporarily weakened as a resultof aggressive pricing from Eastern Europe.Products<strong>Scana</strong> Steel Booforge’s main products are:• Forged arms for forklift trucks• Lifting equipment for forklift trucks• Heat treatment of larger goods• Free form forged componentsIn <strong>2010</strong> <strong>Scana</strong> Steel Booforge also has invested inmarketing, resulting in, among other things, a newwebsite: www.booforge.com. The strengthening of<strong>Scana</strong> Steel Booforge as a brand in the forklift truckindustry has increased demand and global sales. Tofurther expand our global activities, new sales channelsand dealer networks are being established.A special research and development function wasestablished in <strong>2010</strong>, where Booforge can perform as amore active partner in customer collaboration in a valuechain perspective, and develop supplemental products.With a stronger market focus, our own technological development and increased efficiency in the production, <strong>Scana</strong>Steel Booforge AB emerges well prepared for the future.

18<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Johnny SjöströmLeshan <strong>Scana</strong> Machinery LtdLeshan <strong>Scana</strong> Machinery Co. was founded in 1998 and is a Norwegian-Chinese joint venture,where <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong> owns 80 %. Local authorities in China own the remaining 20 %.Leshan manufactures rolls for the steel industry andcast special products for the steel, energy, oil andgas, construction and shipping industry. Leshan is arespected supplier in the Chinese market and is amongthe leading in the Chinese roll manufacturing industry.The company has an annual capacity of 20,000 tonnesrolls and cast products.Leshan´s vision is to be a leading manufacturer of rolls.This strategy entails manufacturing niche productsof a high quality. <strong>Scana</strong> collaborates closely with thecustomers to develop existing and new products.Products and marketRolls are the company’s core product and are utilised byLeshan’s customers to make profile steel, hot materialsand plates. Chinas entire production of steel totals670 million tonnes, or roughly 50 % of the world’s totalproduction. The production is expected to increase tomore than 1,000 million tonnes towards 2020. Leshan<strong>Scana</strong> is a strong brand and has world leading steelproducers on our client list.In spite of surplus capacity in the Chinese market,Leshan <strong>Scana</strong> has increased the order intake with anexcess of 300 %, compared to 2009. But substantialcompetition, plus increased energy and raw materialsprices, has lessened profitability. Towards the end of<strong>2010</strong>, Leshan <strong>Scana</strong> carried through cost reductionsand workforce downsizing to strengthen our competitivepower.Castings are mainly used in the power generation,petroleum, cement, construction and shippingindustries. Leshan <strong>Scana</strong> is certified according tointernational class companies like DNV, ABS, LRS, BV,GL, RINA and NK. <strong>Scana</strong> is an important supplier ofcast nodes and connectors to several large projects inChina, like the EXPO<strong>2010</strong> in Shanghai and Bird’s NestStadium in Beijing, for the Olympic Games 2008.The sales ratio between rolls and castings is 85 % and15 %, respectively. Sales are largely generated fromthe domestic market, but some of the production isexported to India, Turkey, Malaysia and Taiwan. Throughcooperation with international partners, the goal is toincrease export sales considerably towards 2015.The company has adopted and implemented the “LeanProduction” philosophy to optimise production andreduce cost.Leshan <strong>Scana</strong> is completing a large investmentprogramme for a new production line for large rings.The project will be completed in 2011 and ensurethe company a leading role in this area as well. Thecompany will introduce new technology, improvetechnical skills, plus strengthen product and marketdevelopment.Change of directors at Leshan: Johnny Sjöstrom (at left) becomes newManaging Director at Leshan <strong>Scana</strong>. Ingvar Winbo, who works as managingdirector at <strong>Scana</strong> Steel Björneborg, has taken the role as new Chairman of theBoard for Leshan.The investment will also bring positive side effects,such as increasing the maximum weight of castings toa theoretical value of 50 tonnes, and the total meltingcapacity to over 100 tonnes. This will improve theflexibility.

20<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Jan-Øyvind Jørgensen<strong>Scana</strong> Steel Stavanger<strong>Scana</strong> Steel Stavanger’s customers are users of special steel and high alloy steel with stringentrequirements for design and documentation. These are mainly found in the oil and gas, marine,energy, mining and general mechanical industries.<strong>Scana</strong> Steel Stavanger was founded in 1910 and hasproduced steel since 1913. The business is located atJørpeland, near Stavanger, Norway. The company’sbusiness concept was based on the idea of remeltingscrap steel from the local cannery industry and shipscrapping. <strong>Scana</strong> <strong>Industrier</strong> bought the company in 1991.Markets and customers<strong>Scana</strong> Steel Stavanger operates in a global market, butthe majority of our customers are in Scandinavia andnorthern Europe. The company competes in the marketof high alloy forged components and complex, cast,special components. <strong>Scana</strong> Steel Stavanger AS is, inaddition to <strong>Scana</strong> Leshan in China, the only company in<strong>Scana</strong> with a foundry.In <strong>2010</strong>, <strong>Scana</strong> Steel Stavanger had an export share of65 %, with the main export going to the UK, Swedenand Germany. There is tough competition in the market.<strong>Scana</strong>’s competitive edge is that we are a relatively smallplayer able to produce small series, where quality anddelivery times are vital. Our deliveries are often specialproducts, custom made to meet the client’s needs.In <strong>2010</strong>, the company secured its first steel deliverycontract to the down-hole product “Liner hanger”.With extreme demands for corrosion and mechanicalproperties, this is a product that fits the company’sstrategy of higher alloy and processing degrees inproducts.Furthermore, <strong>Scana</strong> Steel Stavanger AS has in <strong>2010</strong>secured large contracts in the mining industry. Thecontract with LKAB in Sweden to adjust the crushinglevel at the site in Kiruna was important. These deliveriesare due in 2011.Aker Solutions has awarded the company several largeorders for delivering anchor handling equipment, wherethe end customer is, among others, Petrobras in Brazil.<strong>Scana</strong> Steel Stavanger AS also landed contracts forintegrals with Jack & St. Malo at the end of <strong>2010</strong>, to bedelivered spring and summer 2011.ELG Carrs in the UK tripled the order volume of <strong>Scana</strong>Steel Stavanger AS from 2009 to <strong>2010</strong> of forgedproducts of the material quality Super Duplex.For <strong>Scana</strong> Steel Stavanger AS, <strong>2010</strong> started off with7 weak months, followed by 5 months of higher orderintake and activity. The order intake in <strong>2010</strong> was40 % higher than in 2009. The company views 2011with optimism and a higher predictability in the market.<strong>Scana</strong> Steel Stavanger AS has secured a contract for delivering protective components to the downfall pits at a new crushing level for LKAB’s processing facilities at Kiruna.

Managing director: Sten IsraelssonSCANA STEEL AB<strong>Scana</strong> Steel AB is a small, prospering and cost efficient real estate firm that manages <strong>Scana</strong>’sreal estate in Karlskoga, north-east of Väneren in Sweden.21<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>The company owns 35,000 m 2 of real estate in total.This mainly consists of industrial premises, withadditional office and service areas. The business islocated on the old industrial site of Bofors, and theproperties were acquired in 1997, when <strong>Scana</strong> bought apart of Bofors AB.After structural changes in the defence industry, a needhas arisen to see new activity in the halls; to replace theexisting tenants’ lessened need for rented area.Logistics and geographyFrom a Swedish perspective, Karlskoga is locatedalmost in the middle of a centre for logistics. And withthe improved road E18 towards Örebro and Karlskoga,Karlskoga today represents a strong, competitivealternative to other closely situated places.Business has been positive in <strong>2010</strong> for <strong>Scana</strong> Steel ABand its tenants. Especially the logistics companies haveseen a positive development and are asking for larger areas.ServicesToday, six external companies rent areas for a total of23,000 m 2 . The remaining areas are rented and utilisedby <strong>Scana</strong> Steel Booforge AB.Today, two companies are operating on the premises,on a surface area covering just over 15,000 m 2 .One of these companies are KGA Logistik AB, ownedby Galatea Spirits AB. KGA Logistik AB is one of the fivelargest distributors of beer, wine and spirits in Sweden.

22<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Business area MARINEThe Marine business area consists of companies thatsupply equipment and services for ship propulsion andmanoeuvring. The core market of the business area is inthe shipping industry, and key customers are shipyards,shipping companies and agencies. The business areaalso supplies products such as valve control systems tothe oil and gas industry.Strategic positionThe business area is an important market playerthat can supply complete and technically leadingsolutions and has a presence in the most centralmarkets. Within the product area <strong>Scana</strong> Propulsion,<strong>Scana</strong> will coordinate sales, marketing, purchases,product development and manufacture concerningpropellers, gears, thrusters and remote control. Thesteel companies have products that are components inthe propulsion companies’ products, and this renderspossible a considerable value chain control and addedvalue within the <strong>Scana</strong> group.Products<strong>Scana</strong> develop, produce and delivers controllable pitchpropellers, reducuction gears, tunnel thrusters, hydraulicactivators, ship propulsion and manoeuvring systems fornew constructions, re-constructions and repairs.Markets and customersThe business area operates primarily in the globalshipbuilding and ship repair markets. Our customersare shipyards, shipping companies, consultancy firmsor other system suppliers. <strong>Scana</strong> has sales officesin Singapore, China, Korea, the USA and Brazil.Establishing a representation office in Shanghai for saleand service of gears and propulsion systems has provento be a strategic success, given <strong>Scana</strong>’s strengthenedposition in the Asian market, both commercially andtechnically. Through our own facilities and an extensiveagent and distributor network, the business area hasdeveloped a worldwide representation network.<strong>2010</strong> has seen a bustling activity in the completionof ships in Asia, based on contracts entered duringthe contract boom of 2006-2009. In 2009 and <strong>2010</strong>,however, the number of new contracts has been thelowest in a 10-year perspective. The combination of ahigh number of cancelled orders and a global orderdeficiency has led to economic difficulties and bankruptciesfor several shipyards, globally. This has in turnreduced delivery times from 2-3 years to approximately1 year. Contracts signed in <strong>2010</strong> are mainly for deliveriesin 2011, except for series stretching into 2013.<strong>Scana</strong> has so far suffered only to a limited extent fromfinancial crisis cancellations in Norway or globally. Fewernew contracts the recent two years have, however, madethe market for <strong>Scana</strong>’s products dwindle. This effect willspill over into 2011, but demand is expected to increasegradually towards the end of the year. <strong>Scana</strong>’s increasedfocus on service and maintenance will dampen the effectof temporarily reduced new sales.<strong>Scana</strong> Propulsion is one of Europe’s leading manufacturers of ship propulsion and manoeuvring systems. We supply systems to most vessel types, from fast boatsand yachts to fishing boats, ferries and special ships within the oil and gas business. The image shows construction of electronic control systems at <strong>Scana</strong> Mar-El ASin Dalen, Norway.

23<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Marine

24<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong><strong>Scana</strong> Volda, managing director: Kristian Sætre<strong>Scana</strong> Mar-El, managing director: Egil Kongsbakk<strong>Scana</strong> Zamech, managing director: Jacek Pabian<strong>Scana</strong> PropulsionThe product area <strong>Scana</strong> Propulsion was established to coordinate and increase the market interestfor <strong>Scana</strong>’s propulsion technology: propellers, gears, thrusters and remote control. <strong>Scana</strong>Propulsion is marketed as a complete equipment package in the global ship equipment market.The restucturing will continue through 2011.The companies that form <strong>Scana</strong> Propulsion are:<strong>Scana</strong> Volda, formerly Volda Mekaniske Verksted, wasestablished in 1913 in Volda, Norway, and was takenover by the <strong>Scana</strong> group in 1998. Volda Mek. startedas an engine factory and later developed into includingshipbuilding and production of propellers and gears. Atthe end of the 1980s, the last hull was delivered – andthe shipyard was removed in 1997.Since 1966, gears and propulsion systems have beenthe most important products. <strong>Scana</strong> Volda has been aConsortial Partner to MaK (Caterpillar) since 1996. From2009 <strong>Scana</strong> Volda has held a leading role in the productgroup <strong>Scana</strong> Propulsion, which also consists of <strong>Scana</strong>Mar-El, <strong>Scana</strong> Zamech in Elblag, Poland, and <strong>Scana</strong>Singapore.<strong>Scana</strong> Mar-El is located in Dalen in Telemark,Norway, and has been a part of <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>since 1996. <strong>Scana</strong> Mar-El is one of Europe’s leadingmanufacturers of maritime control systems for shippropulsion and manoeuvering, in addition to controlsystems for special applications. Since the start in 1974,the company has delivered about 3,000 control andnavigational systems.<strong>Scana</strong> Zamech’s origins date back to 1837 whenFerdi nand Gotlob Schichau opened the machine workshop“Schichau Werke” in Elblag, Poland. The work shopmanufactured elements for steam engines, equipmentfor sugar factories, oil mills and lumber mills as well ashydraulic presses and rollers. In 1855, the first seagoingship with a steel hull and a propeller was launchedfrom “Schichau Werke”. <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong> acquiredthe company in 2009. The company has an extensiveservice activity, in addition to being responsi ble for <strong>Scana</strong>Propulsion’s sales to Poland, the Baltic and Russia.<strong>Scana</strong> Singapore was established in 1996 and isowned 100 % by <strong>Scana</strong>. The company is responsiblefor sales and service on <strong>Scana</strong>’s marine products inSouth-East Asia. Personnel local to the area performproduct service and installation, in addition to service onrelated products for external companies.

25The product area <strong>Scana</strong> Propulsion is representedthrough offices, strategic partners and agentsthroughout Norway, Poland, Iceland, the Netherlands,Turkey, Singapore, India, China, Korea, the USA,Brazil and Chile. By structuring our organisation inthis manner, <strong>Scana</strong> Propulsion can nurture closerrelationships with customers regarding both sales andservice preparedness for the marine fleet.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong><strong>Scana</strong> Marine Service is a special profit centre in thegroup and performs service and after market activitiesto the product area. <strong>Scana</strong> Marine Service has servicepersonnel at every sales office, in addition to serviceagreements with independent companies in selectedmarkets.The companies constituting <strong>Scana</strong> Propulsion havegained a good international reputation and export 80 %of their products, in total.Markets and customers<strong>Scana</strong> Propulsion’s core segment is offshore, merchantvessels, speedboats, passenger ships and fishery.Geographically, the main activity is located in Asia, withChina as the largest building market, involving Europeanshipyards and design firms. In Brazil, there is a bustlingactivity in the offshore and merchant segment as aresult of Petrobras’ extensive development programme.This is an important market for <strong>Scana</strong> Propulsion.<strong>Scana</strong> Propulsion’s hallmark is technologically advancedsolutions and a strong market position for ships fordemanding operations, like anchor handling vessels andother special vessels.<strong>Scana</strong> Propulsion is marketed as a complete equipmentpackage in the global ship equipment market, but theproducts are also independent units. Gears from <strong>Scana</strong>Volda are an example of a strong brand in the market,and similarly, control systems from <strong>Scana</strong> Mar-El andthrusters from <strong>Scana</strong> Zamech.In collaboration with Caterpillar, <strong>Scana</strong> offers completepropulsion packages for ships, consisting of engine,gears, propellers, axles, tunnel thrusters and propulsioncontrol. A close collaboration with ship designers andleading electronic suppliers has created a strong focuson developing products that are a part of eco-friendlyhybrid and diesel-electric propulsion systems.Among our partners, there is a great interest indevelop ing propulsion solutions in collaboration with<strong>Scana</strong>. A continued commitment to complete packageswithin hybrid and diesel-electric solutions is expectedto yield in creased results. <strong>Scana</strong> Propulsion’s productline is “drawn in” with several design firms, and they aremarke ting these products in different ship design fortheir clients.<strong>Scana</strong> Marine Service has a strong commitment toselling service to the global market. This commitmenthas yielded positive results. Synergies between thepropulsion companies and a continued internationalcommitment are expected to increase turnover andprofit for the service organisation. Sales and marketingof service is aimed mainly at <strong>Scana</strong>’s own products, inthe form of start-up, maintenance, replacements andshipwrecking, plus other special services and inspection.<strong>2010</strong> was a challenging year, with a low order intake and,globally, a high number of planned builds cancellations.<strong>Scana</strong> Propulsion is not untouched by this situation. Butbecause of a large share of contracts with the offshorefleet, the largest cancellation wave among bulk andcargo vessels has been avoided. In <strong>2010</strong>, the companysigned important strategic orders within the <strong>Scana</strong>commitment areas offshore and special vessels with,among others, Brazil, China, Singapore and Norway.As a consequence of the general market developmentin the recent years, <strong>Scana</strong> Propulsion is expecting aprudent turnover growth for 2011. Our commitment withinservice counteracts a lower activity within new sales.Solstad Offshores Normand Pioneer har en motorkapasitet på 27 900 hk og er utrustet med en 140 tonns kran. Dette gjør skipet særlig egnet tilkonstruksjonsarbeid på havbunnen. <strong>Scana</strong> Volda AS har levert gir til Normand Pioneer og en rekke andre fartøy hos Solstad Offshore AS.

26<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>ProductsThe product line of <strong>Scana</strong> Propulsion:• Controllable pitch propellers from 520-1900 mm hubdiameter (8 metre max outer diameter)• Fixed propellers in diesel-electric propulsion systemswith gears• Reduction gears up to 20,000 kW engine output• Tunnel thrusters up to 3,000 mm diameter and 3,000kW• Maritime control systems for ship propulsion andmanoeuvring• Rudder control, control machines, thrusters controls• Joystick systems• Agency agreements for positioning sensors, joysticksand instrumentation• Service and customer support:– Planned repairs and maintenance at dry docks– Service according to customer wishes and demands– Rebuildings and modernisations for increased safetyand better operations economy, plus eco-friendlysolutions– Parts– Training, consultation and surveillanceProduct developmentIn the market for high-technological solutions,development is of paramount importance – especiallydevelopment governed by specifications from thecustomer. Consequently, <strong>Scana</strong> Propulsion hascontinuous product development and upgrade as anintegral part of the group’s work. Deliveries are adaptedto each ship and are detailed in collaboration withshipowners and ship designers. The development teamfor mechanical solutions in <strong>Scana</strong> Propulsion is locatedat <strong>Scana</strong> Volda, who develops, projects, manufacturesand sells propulsion solutions for all ship types, in ascale of up to 20,000 kW engine output. The group alsohas a department at <strong>Scana</strong> Mar-El for developing andmanufacturing remote control systems.<strong>Scana</strong> Mar-El has an agency department that sellscomponents of a very high quality. These are utilisedwithin offshore, telecommunications, energy, sea andland based defence installations and other industry.The department represents large international players inadvanced, high-tech components and has technologicalfirms in Norway in its customer portfolio.<strong>Scana</strong> Propulsion has a strong market focus andfrequently commercialises new products. In <strong>2010</strong>,<strong>Scana</strong> delivered the first contract for a new, high-tech,remote controlled system as a replacement for anexisting system, making the company ready to supplyto a increasingly demanding and complex market. Later,the joystick system Marco V was introduced, a productsparking great interest in the market.

27<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Important new orders in <strong>2010</strong><strong>Scana</strong> entered a contract with Ulstein Verft AS for thesupply of remote controlled gear and propeller systemsfor seismic vessels for the shipping company Polarcus.The design is Ulstein SX134 from Ulstein Design &Solutions, having the characteristic X-Bow hull. Thiscontract strengthens <strong>Scana</strong>’s position as market leaderin the advanced ship operations segment. The deliveryis for a market segment tending towards eco-friendlyand flexible systems through the use of diesel-electricsolutions.<strong>Scana</strong> entered a contract with STX OSV AS for thedelivery of remote controlled gear and propeller systemsfor three anchor handling vessels for Norskan Offshorein Brazil. The ships will be built in Brazil, commissionedby Petrobras. This is a strategically important deliveryfor the activity in Brazil, in the segment for advancedoffshore vessels.<strong>Scana</strong> signed a contract with the Turkish shipyardTersan Shipyard for the delivery of complete propulsionsystems, consisting of gears, propeller, tunnel thrustersand remote control for a longliner for the shippingcompany Frøyanes AS. The propulsion system is adiesel-electric solution with Siemens electromotors,giving the vessel a fuel saving solution with greatflexibility.vessel. The delivery consists of two controllable pitchpropellers and one fixed pitch propeller with an axlesystem, each propeller with a diameter of 1,700 mm.With the polish Gdansk Shiprepair Yard “Remontowa”,a contract was signed to deliver tunnel thrusters fortwo supply vessels, with an option for deliveries foran additional two ships. The vessels will be operatedby Ezra Holding Ltd. from Singapore. The deliveryfor each ship is four controllable pitch thrusters withremote control and DP-demands. This is a delivery to acommitment area in an important geographical marketand confirms <strong>Scana</strong>’s position as an international playerin a demanding market.In <strong>2010</strong>, we delivered 2 out of a total of 8 deliveries forbulk ships at Nantong Mingde Heavy Industry StockCo. Ltd. in China. The delivery was for controllable pitchpropellers and tunnel thrusters. The shipyard is thepolish Polsteam.<strong>Scana</strong> has signed several contracts for single units oftunnel thrusters and controllable pitch propellers.A contract for propeller delivery was signed withNorthern Shipyard in Poland for equipment to a rescue

28<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Ragnar ØhrnSCANA skarpenord<strong>Scana</strong> Skarpenord was originally established as a subsidiary of Norsk Hydro, Rjukan Fabrikker, inthe late 60’s. The company has been on the market with its current product range since the middleof the 70’s, and is among the leading suppliers of hydraulic valve systems for the ship and oil & gasindustry. <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong> took control of the company in 1989.In <strong>2010</strong>, the company has adapted the organisation toa tighter market, due to changes in the world economythe recent years. The company has strengthened itscompetitive power through increasing its efficiency, andis now competitive in a rising market.Products and servicesThe company develops, manufactures and supplieshydraulic systems for remote control of valves in cargo,ballast boom and coolant systems on board tankersand dry cargo ships. The remote control systems arealso installed in production ships, rigs and permanentoffshore installations.One of our key products is hydraulic actuators, mounteddirectly on valves. The actuators are one of our designsand manufactured at Rjukan. The control systemsfor the actuators include magnetic valve centrals,oil generators and PC-based terminals for systemoperation.There are no other concepts or technologies todaythat can replace the company’s products, and they willremain highly relevant in the foreseeable future.The company has a strong commitment to after salesand service. The organisation is well prepared to deliver

30<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: H. B. NohSCANA KOREA HYDRAULIC LTD.The company develops, manufactures and supplies systems for remote control of valves in cargo,ballast and other systems for ships, offshore vessels and permanent offshore installations.The LNG-ship Iberica Knutsen was built at the Daewoo shipyard in South Korea. <strong>Scana</strong> Skarpenord AS and <strong>Scana</strong> Korea has supplied systems for remote control forboth this and several other ships in the Knutsen OAS fleet.<strong>Scana</strong> Korea was established as a joint venturecompany in 1998. The company was at the time aminor supplier of valve remote control systems in Korea.At present, the market share in Korea has reachedapproximately 25 %. Consequently, the company is the2nd largest local supplier in Korea. <strong>Scana</strong>’s ownershipis 49 %.In <strong>2010</strong>, the company has renewed the highest possiblequalification among Samsung shipyard suppliers. Thecompany’s order intake in <strong>2010</strong> is strengthened as aresult of good competitive power and several contractsin South Korea, securing a robust order reservefor 2011. By the end of <strong>2010</strong>, the company had 50employees and a turnover of NOK 180 million and asatisfactory operating result.Markets and customers<strong>Scana</strong> Korea’s key customers are shipyards that buildlarger types of ships, such as tankers, LNG tankers,LNG carriers, LPG carriers, bulk carriers and largeoffshore vessels, such as FPSOs (production ships),rigs etc. The main customers are currently shipyardsat Hyundai, Samsung, DSME, STX, Hyundai-Mipo,Hyundai-Samho, SPP and other medium and smallsized shipyards in Korea.In <strong>2010</strong>, the company successfully completedsophisticated valve remote control systems to two hugeFPSO projects (Pazflor and Usan). In 2011, the CLOVproject will be of prominent importance. Major Koreanshipyards are working on several offshore projects that<strong>Scana</strong> Korea Hydraulic Ltd. will tender for.Products and servicesNo other products or technologies can currently besubstituted for the company’s products. They willgenerate a high level of interest in the foreseeable future.The company includes tank level gauging systems in apackage delivery with valve remote control systems, andas a result, the contract volume per project is increased.

31<strong>Scana</strong> has once more succeeded in achieving “Samsung Q Gold Mark” at the Samsung shipyard in Korea. This is the highest possible qualityachievement for a supplier to Samsung. Companies in all <strong>Scana</strong>’s business areas supply products and services to the great shipyards in Korea.Contracts for new ships in the global market has been increasing since <strong>2010</strong>. Korea has a prominent position in construction of advancedvessels for transportation of oil and LNG, container ships and drilling and production units for the oil & gas business.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>

32<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>BUSINESS AREA Oil & GASThe Oil & Gas activities in <strong>Scana</strong> were establishedas a separate business area in 2006. The activities inthe business area has a wide scope – from design,engineering and consultancy services, to production,assembly and testing of equipment and products,components and parts developed in-house, as well asmaintenance and repair of mechanical components forthe oil & gas industry.Strategic positionThe trend in recent years has been that customerswant fewer suppliers, and that these are capableof taking an overall responsibility for a number ofdisciplines. Customers want the supplier to have a clearresponsibility for quality and timely deliveries, all throughone point of contact. This has led to consolidation andmerging of players in the supplier industry.Through its own companies, <strong>Scana</strong> Oil and Gas hasestablished an environment that is embedded in theentire value chain. This broad spectrum of expertiseand overall focus on product life cycle – from designto operation and maintenance, will strengthen <strong>Scana</strong>’scompetitive position.In 2008, <strong>Scana</strong>, through acquisitions in Houston,established <strong>Scana</strong> Offshore Services. The companysupplies engineering services, purchases andconstruction, in addition to project management ofblowout preventer systems (BOP). The companydelivers systems to several of the world’s largest drillingcontractors and is a niche-supplier with substantialdevelopment potential.<strong>Scana</strong> also has a service unit in Singapore, performingengineering services. In 2009, <strong>Scana</strong> established abusiness in Brazil to position sales towards large projectdevelopments the coming years. Through its offices,the <strong>Scana</strong> group can serve customers in all the marketsegments the group operates in (steel and machine,energy and marine).<strong>Scana</strong> Offshore Services has provided <strong>Scana</strong> with anoperative pier head in the important petroleum marketin the Gulf of Mexico. <strong>Scana</strong> Offshore Services has inaddition established an office in Singapore to servethe large construction and maintenance market inSoutheast Asia.ProductsThe main products for the business area Oil & Gas aredesign and production of components and systems,laboratory services, in addition to maintenance andrepair of oil and gas industry equipment.<strong>Scana</strong> Offshore Vestby AS offers established productsand systems for anchoring, cargo loading andoffloading. Through <strong>Scana</strong> Skarpenord, valve control isoffered, in addition to electric, hydraulic and pneumaticautomation solutions within ballast and liquid basedloading and unloading systems.<strong>Scana</strong> Offshore Technology AS offers thermic treatmentand maintenance services aimed at drilling devices andequipment. The company works closely with the officesin Houston and Singapore.<strong>Scana</strong>’s has a considerable production and skill inthe manufacture of risers to drilling and productionrigs through <strong>Scana</strong> Subsea AB. <strong>Scana</strong> is establishedin Houston through <strong>Scana</strong> Offshore Services Inc.,possessing a strong competence within design andproject management with regard to blowout preventersystems. SOS Inc. delivers systems to rig owners anddrilling contractors.Markets and customers<strong>Scana</strong>’s ambition is to establish a strong market positionwithin the supply of special solutions to the oil andgas industry. The majority of <strong>Scana</strong>’s customers areglobal players in design, production and/or operators ofproduction facilities, drilling and production equipment,as well as manufacturers of subsea facilities. Thecustomers’ head offices and production facilities arelocated both in USA and Europe, and are served by<strong>Scana</strong>’s sales and service offices locally.It is <strong>Scana</strong>’s goal to increase the activity towardsthese customers and establish long-term contractualrelationships in order to decrease vulnerability andincrease value within the business area.

33<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Oil &Gas

34<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Peter Jansson<strong>Scana</strong> subsea<strong>Scana</strong> Subsea is a company that delivers subsea and riser applications to the oil and gas industry.With high material and production skills and competence, the company takes an overallresponsibility for manufacture, assembly and testing of complex products. The companyadds value for customers through optimal production solutions.The company works with sales, contract managementand product development. Production is done by thesteel producing companies within the <strong>Scana</strong> group,accompanied by established partners and vendors ofservices outside the group. The company will utilise<strong>Scana</strong>’s strong market position within steel and forgedproduction of long and heavy components.Markets and customers<strong>Scana</strong> Subsea exports 100 % of its turnover. Customersrange from oil companies to system/product suppliersinternationally, with the USA representing the largestmarket. The North Sea, Brazil and Southeast Asia arealso important commitment areas.<strong>2010</strong> became a good year for <strong>Scana</strong> Subsea, securingseveral large contracts for risers to the North Sea andthe Gulf of Mexico. Sales increased by more than100 % compared to recent years. An importantcompetitive advantage is <strong>Scana</strong>’s experience inhandling long and heavy products. This enables <strong>Scana</strong>to accept orders with shorter delivery times than manyof our competitors. The company also has a strongsales network.Risers will continue to be the company’s most importantproduct. In addition, the company works hard to expandthe product range. For 2011, an increase in demandfor risers is expected. In addition, the company canutilise production capacity in the <strong>Scana</strong> group in timesof relatively low production. This provides access to anumber of smaller and shorter projects.Through establishing <strong>Scana</strong> Subsea, <strong>Scana</strong> attainsa more efficient project mangament and takesresponsibility for the entire manufacturing process.The effects of this is increased efficiency and reducedcost for the customers resulting in increased orderintake.Products and servicesThe company’s main products are forged, rotatingsymmetrical, long and thin components with a hightechnical content. These are delivered to riser andtendon systems within the oil and gas industry. Materialengineering and metallurgical skills are also a part of thecompany´s deliveries.<strong>Scana</strong> has won contracts for delivery of forged and machined tandon systemswith high tensile materials for several major development projets in the gulfof Mexico and Brasil. <strong>Scana</strong> also won the contract for delivery of forgedproduction risers to Snorre TLP on the Norwegian Continental shelf.The company’s products are often key components forthe customers. <strong>Scana</strong> Subsea supplies componentswith different degrees of completion, depending on thecustomers’ requirements. The company emphasisesresearch and development to further strengthen thequality of its products and has an ongoing cooperationwith research institutes in Sweden.

Managing director: Ørnulf Myrvoll<strong>Scana</strong> OffShore vestby<strong>Scana</strong> Offshore Vestby is acknowledged as a creative and solid partner within the offshore,industrial and maintenance market. Based on significant knowledge and skills within design,engineering, materials and production, the company has developed and delivered systems,components and carried out maintenance and upgrade assignments.35<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>In early 2011, <strong>Scana</strong> got a significant breakthrough in Brazil when Vestby won a contract for the delivery of unloading systems to eight FPSOs to be operating inBrazilian waters.<strong>Scana</strong> Offshore Vestby traces its roots back to 1953. At<strong>Scana</strong> Offshore Vestby, there are strong competencieswithin design, engineering, purchase, manufactureand installation aimed at the oil and gas industry. Thecompany also serves select customers within theenergy and industry market and cooperates smoothlywith other <strong>Scana</strong> companies.Markets and customers<strong>Scana</strong> Offshore Vestby supplies advanced products andsystems to customers in the offshore market. In <strong>2010</strong>,the activity has been low because the financial recessionstill affects the company’s primary product areas withinfloating manufacture (FPSO). During <strong>2010</strong>, the companyhas strengthened its sales and market initiatives, bothwithin the offshore and maintenance market. Thus,the company has increased its international activitiestowards new customer groups. Increased interestand activity throughout <strong>2010</strong> is expected to yieldresults in 2011. In early 2011, <strong>Scana</strong> was able to gain aconsiderable breakthrough in Brazil by the award of aletter of intent for the delivery of unloading systems toeight FPSOs to be operating in Brazilian waters.Products and servicesThe company is particularly strong with regard tothe manufacture of prototypes and heavy, complexproducts and systems. <strong>Scana</strong> Offshore Vestbyassembles, tests and installs anchoring, loading andunloading systems for floating production units. Thecompany undertakes orders within maintenance andupgrade of equipment to the offshore industry.Based on our leading expertise in thermal coating, thecompany is positioned as a supplier of modification andmaintenance on risers and valve components. Furtherdevelopment of the engineering and manufacturingenvironments at Vestby will help strengthen the productand service portfolio towards complete and improvedsystems deliveries.The company’s main products and services are:• Hose reels for unloading oil from floating productionand storage units• Linear anchor winches for floating production andstorage units• Turret and buoy solutions• Gas-tight, multiphace swivels for loading andoffloading systems• Advanced thermal spraying for corrosion protectionand wear-resistant materials• Riser repairs and refurbishments, plus upgrade ofcomponents• Production of deployment machines• Maintenance on offshore equipment

36<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Managing director: Per-Allan RøsandSCANA OFFSHORE TECHNOLOGY<strong>Scana</strong> Offshore Technology primarily carries out equipment maintenance and repairs for the oil andgas industry, plus manufactures tools and equipment for these kinds of services.<strong>Scana</strong> Offshore Technology was established December2005. The company is co-localised with <strong>Scana</strong> SteelStavanger at Jørpeland, near Stavanger.Markets and customersThe company’s customers are mainly oil companies,equipment manufacturers, drilling- and servicecompanies in the petroleum industry. In <strong>2010</strong> also,<strong>Scana</strong> Offshore Technology has increased its turnover.The company business philosophy is to work closelywith original equipment manufacturers and, as a resultof this strategy, establish close relationships with severaloriginal equipment manufactures as an approved repairand maintenance workshop for the North Sea market.The company has kept up with the increased demandby investing in additional machinery, welding and testequipment for use offshore. The company has employedboth sales and mechanical personnel, in addition toestablishing a new offshore service department withexperienced technicians.Products and services<strong>Scana</strong> Offshore Technology organises its activities in fivemain areas:• Rig equipment and systems• Subsea equipment and systems• Processing equipment• Offshore service• Preventive maintenanceThe products and services delivered to these five mainareas are based on the following disciplines:• Engineering and project management• Material inspection, testing and verification• Thermal spraying, cladding and welding of advancedmaterials• Machining• Offshore assembly, test and installation<strong>Scana</strong> has a strong market position within petroleumindustry component manufacture, and will also attainthe same position within maintenance and repair workin close collaboration with equipment manufacturers.This is a market area with short delivery deadlines,and the company shall grow in line with its customersand increase the capacity of machinery and personnelaccordingly. Our largest customers are experiencingan increasing workload and a major increase in sales,and consequently, this leads to a major increase in ourplanned upgrades and recertifications.<strong>Scana</strong> Offshore Technology is investigating newproduct areas and services that are compatible withour heavy drilling and processing equipment portfolio.The company has a strong focus on repairs oncompensating equipment (e.g. riser tensioners, guidelinetensioners) and marine riser equipment in a purpose builtworkshop.

Managing director: Tyler KiefSCANA OFFSHORE SERVICES<strong>Scana</strong> Offshore Services provides our clients with innovative, specifically engineered products andservices with an emphasis on quality, cost, and time. Our focus is on new technology solutions,customer satisfaction, and to uphold the highest professional standards in the oil and gas industry.The company works out of Houston and Singapore.37<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>Markets and customers<strong>Scana</strong> Offshore Services is developing subsea systemsfor offshore service companies, international drillingcontractors and drill intervention companies. Our workincludes intervention devices, well capping systems andblow out preventers. The company provides controlsystem integration, ROV intervention and pressurecontrol equipment.Products and services<strong>Scana</strong> Offshore Services provides design, engineeringand manufacturing services to our customers in theoffshore oil and gas market. Based on our extensiveexperience in the industry, <strong>Scana</strong> Offshore Services canoffer complete product support from conceptual designto fabrication and installation.Products and services include motion compensatedriser lift frames, subsea intervention tool systems, ROVoperations equipment, hydraulic hose equipment, startingequipment and other tools for drilling and production. Thecompany is also an agent for used subsea installationsand equipment, and offers overhaul, testing andinstallation services.

39<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>ZamechThe company further develops with regard to futureenvironmental and market related requirements throughour cooperation with <strong>Scana</strong> Volda’s gear and propellertechnology and remote controlled systems from <strong>Scana</strong>Mar-El.SkarpenordThe production of hydraulic actuators and systems atSkarpenord yields no negative discharges. The wastefrom the production is scrap iron/metal and is sold asscrap metal. This is both environmentally friendly andprovides income. The company mainly uses electricalpower for the production, but some diesel fuel is usedfor heating the production halls.OIL & GASOffshore Technology<strong>Scana</strong> Offshore Technology repairs equipment and isISO 9001 certified. Our activity has very little negativeimpact on the outer environment, but we continuallymonitor and prepare new measurable standards to howour activity may have an impact on the environment.Offshore VestbyThe company was established in 1953, but has movedto modern production halls. The company has today nonegative discharges or emissions to the environment,neither water, nor air. With regard to thermal treatment,the company now builds new premises accordingto present regulations. Offshore Vestby is also acompetence and design company that has no negativeimpact on the outer environmentHealth, environment and safety (HES)The group consists of companies that affect the outerenvironment through noise and discharges/emissions.The group is licenced for its activities and the impacton the environment is not regarded as exceeding thedischarge permissions. The group works continually toreduce discharges/emissions, waste to deposits andother negative environmental impact. Residue from theproduction is waste managed and handled accordingto regulations, in addition to being recycled whenapplicable. The companies within the steel businessarea buy large quantities of scrap for remelting, and arethereby also prominent in the recycling industry.

40<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> <strong>Scana</strong> <strong>Industrier</strong> <strong>ASA</strong>annual accounts <strong>2010</strong>41 Directors’ reportSCANA GROUP47 Profit and loss account48 Balance sheet49 Cash flow statement50 Statement of change in shareholders equity51 Notes51 Note 1. Group accounting principles55 Note 2. Estimate uncertainty55 Note 3. Segment information58 Note 4. Investments in associated and other companies59 Note 5. Specification of other revenues and other costs60 Note 6. Tax61 Note 7. Earnings per share61 Note 8. Intangible assets63 Note 9. Tangible fixed assets64 Note 10. Staff costs68 Note 11. Pensions and other long-term employeebenefits69 Note 12. Stocks70 Note 13. Trade receivables71 Note 14. Other short-term receivables71 Note 15. Bank deposits71 Note 16. Share capital and premiums71 Note 17. Interest-bearing debt72 Note 18. Other current liabilities72 Note 19. Creditors73 Note 20. Leasing obligations73 Note 21. Related-party transactions74 Note 22. Financial risk75 Note 23. Financial instruments79 Note 24. Shares and shareholders80 Note 25. Pledged assets and guarantees80 Note 26. Retained assets81 Note 27. Own shares82 Note 28. Events after balance sheet dateParent company83 Profit and loss account84 Balance sheet85 Cash flow statement86 Notes86 Note 1. Accounting principles86 Note 2. Shares87 Note 3. Tangible fixed assets87 Note 4. Tax88 Note 5. Shareholders’ equity88 Note 6. Guarantees88 Note 7. Related-party transactions89 Note 8. Remuneration and fees89 Note 9. Share capital89 Note 10. Receivables due after one year89 Note 11. Bank deposits89 Note 12. Short-term interest-bearing debt90 Note 13. Long-term interest-bearing debt90 Note 14. Pledged assets90 Note 15. Financial instruments91 Declaration by the Board of Directors andthe CEO and group chief executive92 Auditors´ report