Annual Report

Annual Report

Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

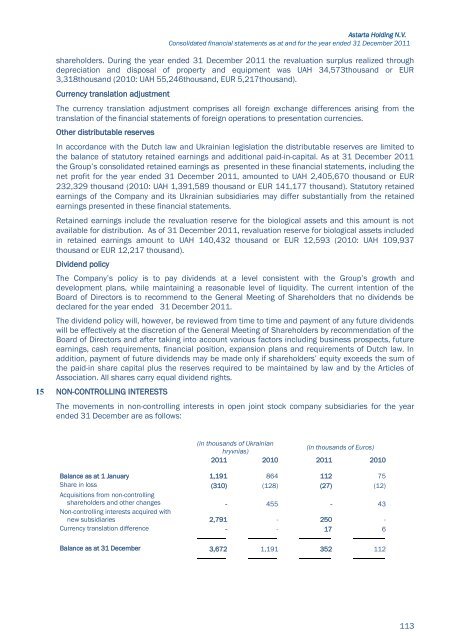

Astarta Holding N.V.Consolidated financial statements as at and for the year ended 31 December 2011shareholders. During the year ended 31 December 2011 the revaluation surplus realized throughdepreciation and disposal of property and equipment was UAH 34,573thousand or EUR3,318thousand (2010: UAH 55,246thousand, EUR 5,217thousand).Currency translation adjustmentThe currency translation adjustment comprises all foreign exchange differences arising from thetranslation of the financial statements of foreign operations to presentation currencies.Other distributable reservesIn accordance with the Dutch law and Ukrainian legislation the distributable reserves are limited tothe balance of statutory retained earnings and additional paid-in-capital. As at 31 December 2011the Group’s consolidated retained earnings as presented in these financial statements, including thenet profit for the year ended 31 December 2011, amounted to UAH 2,405,670 thousand or EUR232,329 thousand (2010: UAH 1,391,589 thousand or EUR 141,177 thousand). Statutory retainedearnings of the Company and its Ukrainian subsidiaries may differ substantially from the retainedearnings presented in these financial statements.Retained earnings include the revaluation reserve for the biological assets and this amount is notavailable for distribution. As of 31 December 2011, revaluation reserve for biological assets includedin retained earnings amount to UAH 140,432 thousand or EUR 12,593 (2010: UAH 109,937thousand or EUR 12,217 thousand).Dividend policyThe Company’s policy is to pay dividends at a level consistent with the Group’s growth anddevelopment plans, while maintaining a reasonable level of liquidity. The current intention of theBoard of Directors is to recommend to the General Meeting of Shareholders that no dividends bedeclared for the year ended 31 December 2011.The dividend policy will, however, be reviewed from time to time and payment of any future dividendswill be effectively at the discretion of the General Meeting of Shareholders by recommendation of theBoard of Directors and after taking into account various factors including business prospects, futureearnings, cash requirements, financial position, expansion plans and requirements of Dutch law. Inaddition, payment of future dividends may be made only if shareholders’ equity exceeds the sum ofthe paid-in share capital plus the reserves required to be maintained by law and by the Articles ofAssociation. All shares carry equal dividend rights.15 NON-CONTROLLING INTERESTSThe movements in non-controlling interests in open joint stock company subsidiaries for the yearended 31 December are as follows:(in thousands of Ukrainian(in thousands of Euros)hryvnias)2011 2010 2011 2010Balance as at 1 January 1,191 864 112 75Share in loss (310) (128) (27) (12)Acquisitions from non-controllingshareholders and other changes - 455 - 43Non-controlling interests acquired withnew subsidiaries 2,791 - 250 -Currency translation difference - - 17 6Balance as at 31 December 3,672 1,191 352 112113