Annual Report

Annual Report

Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

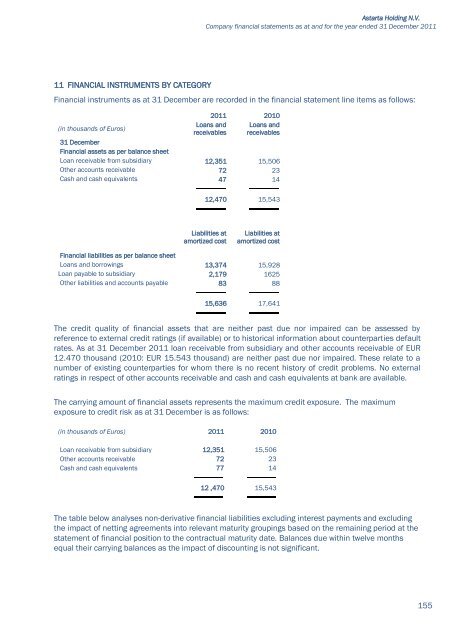

Astarta Holding N.V.Company financial statements as at and for the year ended 31 December 201111 FINANCIAL INSTRUMENTS BY CATEGORYFinancial instruments as at 31 December are recorded in the financial statement line items as follows:2011 2010(in thousands of Euros)Loans and Loans andreceivables receivables31 DecemberFinancial assets as per balance sheetLoan receivable from subsidiary 12,351 15,506Other accounts receivable 72 23Cash and cash equivalents 47 1412,470 15,543Liabilities atamortized costLiabilities atamortized costFinancial liabilities as per balance sheetLoans and borrowings 13,374 15,928Loan payable to subsidiary 2,179 1625Other liabilities and accounts payable 83 8815,636 17,641The credit quality of financial assets that are neither past due nor impaired can be assessed byreference to external credit ratings (if available) or to historical information about counterparties defaultrates. As at 31 December 2011 loan receivable from subsidiary and other accounts receivable of EUR12.470 thousand (2010: EUR 15.543 thousand) are neither past due nor impaired. These relate to anumber of existing counterparties for whom there is no recent history of credit problems. No externalratings in respect of other accounts receivable and cash and cash equivalents at bank are available.The carrying amount of financial assets represents the maximum credit exposure. The maximumexposure to credit risk as at 31 December is as follows:(in thousands of Euros) 2011 2010Loan receivable from subsidiary 12,351 15,506Other accounts receivable 72 23Cash and cash equivalents 77 1412 ,470 15,543The table below analyses non-derivative financial liabilities excluding interest payments and excludingthe impact of netting agreements into relevant maturity groupings based on the remaining period at thestatement of financial position to the contractual maturity date. Balances due within twelve monthsequal their carrying balances as the impact of discounting is not significant.155