Annual Report

Annual Report

Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

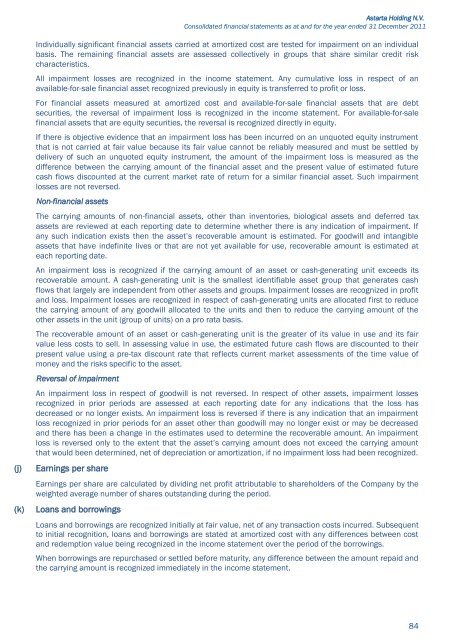

Astarta Holding N.V.Astarta Holding N.V. Consolidated financial statements as at and for the year ended 31 December 2011(j)(k)Individually significant financial assets carried at amortized cost are tested for impairment on an individualbasis. The remaining financial assets are assessed collectively in groups that share similar credit riskcharacteristics.All impairment losses are recognized in the income statement. Any cumulative loss in respect of anavailable-for-sale financial asset recognized previously in equity is transferred to profit or loss.For financial assets measured at amortized cost and available-for-sale financial assets that are debtsecurities, the reversal of impairment loss is recognized in the income statement. For available-for-salefinancial assets that are equity securities, the reversal is recognized directly in equity.If there is objective evidence that an impairment loss has been incurred on an unquoted equity instrumentthat is not carried at fair value because its fair value cannot be reliably measured and must be settled bydelivery of such an unquoted equity instrument, the amount of the impairment loss is measured as thedifference between the carrying amount of the financial asset and the present value of estimated futurecash flows discounted at the current market rate of return for a similar financial asset. Such impairmentlosses are not reversed.Non-financial assetsThe carrying amounts of non-financial assets, other than inventories, biological assets and deferred taxassets are reviewed at each reporting date to determine whether there is any indication of impairment. Ifany such indication exists then the asset’s recoverable amount is estimated. For goodwill and intangibleassets that have indefinite lives or that are not yet available for use, recoverable amount is estimated ateach reporting date.An impairment loss is recognized if the carrying amount of an asset or cash-generating unit exceeds itsrecoverable amount. A cash-generating unit is the smallest identifiable asset group that generates cashflows that largely are independent from other assets and groups. Impairment losses are recognized in profitand loss. Impairment losses are recognized in respect of cash-generating units are allocated first to reducethe carrying amount of any goodwill allocated to the units and then to reduce the carrying amount of theother assets in the unit (group of units) on a pro rata basis.The recoverable amount of an asset or cash-generating unit is the greater of its value in use and its fairvalue less costs to sell. In assessing value in use, the estimated future cash flows are discounted to theirpresent value using a pre-tax discount rate that reflects current market assessments of the time value ofmoney and the risks specific to the asset.Reversal of impairmentAn impairment loss in respect of goodwill is not reversed. In respect of other assets, impairment lossesrecognized in prior periods are assessed at each reporting date for any indications that the loss hasdecreased or no longer exists. An impairment loss is reversed if there is any indication that an impairmentloss recognized in prior periods for an asset other than goodwill may no longer exist or may be decreasedand there has been a change in the estimates used to determine the recoverable amount. An impairmentloss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying amountthat would been determined, net of depreciation or amortization, if no impairment loss had been recognized.Earnings per shareEarnings per share are calculated by dividing net profit attributable to shareholders of the Company by theweighted average number of shares outstanding during the period.Loans and borrowingsLoans and borrowings are recognized initially at fair value, net of any transaction costs incurred. Subsequentto initial recognition, loans and borrowings are stated at amortized cost with any differences between costand redemption value being recognized in the income statement over the period of the borrowings.When borrowings are repurchased or settled before maturity, any difference between the amount repaid andthe carrying amount is recognized immediately in the income statement.84