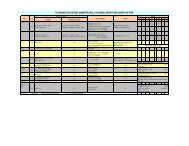

5. (i) Confirmation for one <strong>of</strong> the loans <strong>of</strong> Rs. 1087 Lacs outstanding as on 31st March, 2011 has not been received so far.(ii)The identification <strong>of</strong> Micro, Small & Medium Sized Enterprise Suppliers (MSMES) is based on management's knowledge<strong>of</strong> their status.6. In the opinion <strong>of</strong> the Management and to the best <strong>of</strong> their knowledge and belief, the value <strong>of</strong> current assets, loans andadvances, if realised in the ordinary course <strong>of</strong> business would not be less than the amount at which they are stated in theBalance Sheet.7. MANAGERIAL REMUNERATIONRemuneration to Managing Director (s) :ITEMSYear ended(Amount in Rs.)31.03.2011 31.03.2010Note:Salary 47,34,516 57,71,071Contribution to PF 13,884 10,920Perquisites 1,483,167 254,144Total 62,31,567 60,36,135a) Including allowances but excluding contribution towards retirement benefits, since it is determined on the basis <strong>of</strong>actuarial valuation for all employees in a consolidated manner including managerial employees.b) Computation <strong>of</strong> net pr<strong>of</strong>it in accordance with the relevant provisions <strong>of</strong> the <strong>Companies</strong> Act, 1956 has not been disclosedas no commission is payable to the Managing Director.8. Disclosures as required by Accounting Standards referred to in sub-section (3C) <strong>of</strong> the section 211 <strong>of</strong> the <strong>Companies</strong> Act,1956 (to the extent applicable and mandatory):8.1 The amount <strong>of</strong> Exchange Difference (Net):a) The Foreign Exchange Loss (Net) Rs. 68,299,178/- (Previous Year Rs.73,970,541/-) resulting from settlement, restatement<strong>of</strong> foreign exchange transactions and losses on account <strong>of</strong> mark to market adjustments on outstanding derivativeinstruments (if any) has been adjusted in the Pr<strong>of</strong>it & Loss Account.b) Forward contracts entered in to for hedging purpose and outstanding as at year end:31.03.2011 31.03.2010Amount in Equivalent Amount in EquivalentForeign Currency Indian Rupees Foreign Currency Indian(USD) (USD) RupeesFor receivables 32,500,000 1,448,850,000 24,000,000 1,077,600,00050

(c)Foreign Currency Exposure that are not hedged by derivative transactions or otherwiseParticularsCurrencyAs at31.03.2011 31.03.2010Foreign INR Foreign INRCurrencyCurrencyForeign Currency Receivables USD 40,022,654 1,784,209,765 52,146,790 2,341,390,886Foreign Currency Payables USD 15,519,991 692,039,626 33,146,551 1,488,611,628Pound 2,014 144,323 - -SGD 1,712 60,600 5017 160952EURO - - 11978 726,702Foreign Currency Loan Taken USD - - 2,119,083 95,167,901Foreign Currency Loan Given USD 20,032,162 893,033,781 16,699,683 749,815,774to Joint Venture DDPLEquity Participation in SGD 7,625,220 222,411,019 7,625,220 222,411,019Joint Venture DDPLEquity Participation in SGD 13,767,623 400,765,072 13,767,623 400,765,072Joint Venture VDPL8.2 Disclosure as per Accounting Standard - 15(a)Gratuity:(i)(ii)The employees' gratuity fund scheme managed by LIC <strong>of</strong> India is a defined benefit plan. The present value <strong>of</strong>obligation is determined based on actuarial valuation using the projected unit credit method, which recogniseseach period <strong>of</strong> service as giving rise to additional unit <strong>of</strong> employee benefit entitlement and measures each unitseparately to build up the final obligation.Actuarial Valuation <strong>of</strong> Gratuity is based on the maximum liability <strong>of</strong> Rs.10,00,000/- i.e. as provided under the GratuityAct.(b)Leave EncashmentThe obligation for leave encashment is recognised and disclosed as per the Actuarial Valuation Report.51