annual report - Jindal Group of Companies

annual report - Jindal Group of Companies

annual report - Jindal Group of Companies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

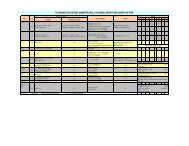

8.6 In view <strong>of</strong> the Accounting Standard - AS 22 "Accounting for Taxes on Income", the deferred tax liability comprises <strong>of</strong> thefollowing Major components <strong>of</strong> deferred tax assets and deferred tax liabilities:As atAs at31.03.2011 31.03.2010(Rs.)(Rs.)Deferred Tax LiabilityFixed Assets 159,028,846 172,615,969Provision for Gratuity -595,734 -578,555(A) 158,433,112 172,037,414Deferred Tax AssetsFE Fluctuation Inadmissible u/s 43A -48,995 -164,995Un-amortisation <strong>of</strong> merger & de-merger <strong>of</strong> expenses - 135,149Provision for leave encashment 1,271,974 1,510,906(B) 1,222,979 1,481,060Net Deferred Tax Liability (A - B) 157,210,133 170,556,3548.7 “Earning per Share” computed in accordance with Accounting Standard AS- 20.(Amount in Rs.)Particulars 2010-11 2009-10a) NumeratorNet Pr<strong>of</strong>it after taxation as per Pr<strong>of</strong>it & Loss A/c 1,004,650,458 841,429,728b) Denominator:Weighted average <strong>of</strong> No. <strong>of</strong> equity shares outstanding 22,931,104 22,931,104Basic & Diluted ( Face value <strong>of</strong> Rs.5 each) 43.81 36.698.8 Financial <strong>report</strong>ing <strong>of</strong> Interest in Joint Ventures as per Accounting Standard AS -27:Name <strong>of</strong> theCompanyDate <strong>of</strong> initialInvestmentCountry <strong>of</strong>IncorporationAs on31.03.2011% Ownership InterestAs on31.03.2010Discovery Drilling 25th April, 2006 Singapore 49% 49%Pte Ltd. (DDPL)Virtue Drilling 31st March, 2008 Singapore 49% 49%Pte Ltd. (VDPL)55