Financial Review - Bouygues

Financial Review - Bouygues

Financial Review - Bouygues

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

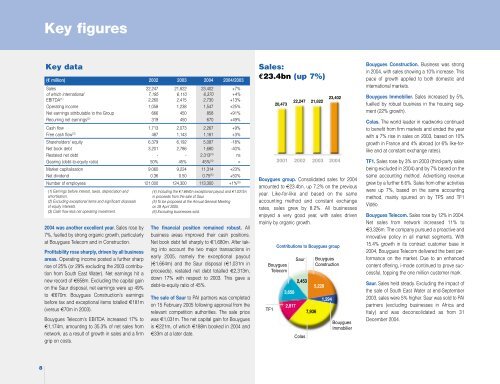

Key figuresKey data(€ million) 2002 2003 2004 2004/2003Sales 22,247 21,822 23,402 +7%of which international 7,195 6,110 6,370 +4%EBITDA (1) 2,260 2,415 2,730 +13%Operating income 1,058 1,238 1,547 +25%Net earnings attributable to the Group 666 450 858 +91%Recurring net earnings (2) 319 450 670 +49%Cash flow 1,713 2,073 2,267 +9%Free cash flow (3) 487 1,143 1,181 +3%Shareholders' equity 6,379 6,192 5,087 -18%Net book debt 3,201 2,786 1,680 -40%Restated net debt - - 2,313 (4) nsGearing (debt-to-equity ratio) 50% 45% 45% (4) =Market capitalisation 9,060 9,224 11,314 +23%Net dividend 0.36 0.50 0.75 (5) +50%Number of employees 121,000 124,300 113,300 +1% (6)(1) Earnings before interest, taxes, depreciation andamortisation.(2) Excluding exceptional items and significant disposalsof equity interests.(3) Cash flow less net operating investment.2004 was another excellent year. Sales rose by7%, fuelled by strong organic growth, particularlyat <strong>Bouygues</strong> Telecom and in Construction.Profitability rose sharply, driven by all businessareas. Operating income posted a further sharprise of 25% (or 29% excluding the 2003 contributionfrom South East Water). Net earnings hit anew record of €858m. Excluding the capital gainon the Saur disposal, net earnings were up 49%to €670m. <strong>Bouygues</strong> Construction's earningsbefore tax and exceptional items totalled €181m(versus €70m in 2003).<strong>Bouygues</strong> Telecom's EBITDA increased 17% to€1,174m, amounting to 35.3% of net sales fromnetwork, as a result of growth in sales and a firmgrip on costs.(4) Including the €1.664bn exceptional payout and €1.031bnin proceeds from the sale of Saur.(5) To be proposed at the Annual General Meetingon 28 April 2005.(6) Excluding businesses sold.The financial position remained robust. Allbusiness areas improved their cash positions.Net book debt fell sharply to €1,680m. After takinginto account the two major transactions inearly 2005, namely the exceptional payout(€1,664m) and the Saur disposal (€1,031m inproceeds), restated net debt totalled €2,313m,down 17% with respect to 2003. This gave adebt-to-equity ratio of 45%.The sale of Saur to PAI partners was completedon 15 February 2005 following approval from therelevant competition authorities. The sale pricewas €1,031m. The net capital gain for <strong>Bouygues</strong>is €221m, of which €188m booked in 2004 and€33m at a later date.Sales:€23.4bn (up 7%)<strong>Bouygues</strong> group. Consolidated sales for 2004amounted to €23.4bn, up 7.2% on the previousyear. Like-for-like and based on the sameaccounting method and constant exchangerates, sales grew by 8.2%. All businessesenjoyed a very good year, with sales drivenmainly by organic growth.TF120,4733,6582,81722,2472,453Colas21,8227,9365,2281,29423,4022001 2002 2003 2004Contributions to <strong>Bouygues</strong> group<strong>Bouygues</strong>TelecomSaur<strong>Bouygues</strong>Construction<strong>Bouygues</strong>Immobilier<strong>Bouygues</strong> Construction. Business was strongin 2004, with sales showing a 10% increase. Thispace of growth applied to both domestic andinternational markets.<strong>Bouygues</strong> Immobilier. Sales increased by 5%,fuelled by robust business in the housing segment(22% growth).Colas. The world leader in roadworks continuedto benefit from firm markets and ended the yearwith a 7% rise in sales on 2003, based on 10%growth in France and 4% abroad (or 6% like-forlikeand at constant exchange rates).TF1. Sales rose by 3% on 2003 (third-party salesbeing excluded in 2004) and by 7% based on thesame accounting method. Advertising revenuegrew by a further 6.6%. Sales from other activitieswere up 7%, based on the same accountingmethod, mainly spurred on by TPS and TF1Vidéo.<strong>Bouygues</strong> Telecom. Sales rose by 12% in 2004.Net sales from network increased 11% to€3,326m. The company pursued a proactive andinnovative policy in all market segments. With15.4% growth in its contract customer base in2004, <strong>Bouygues</strong> Telecom delivered the best performanceon the market. Due to an enhancedcontent offering, i-mode continued to prove successful,topping the one million customer mark.Saur. Sales held steady. Excluding the impact ofthe sale of South East Water at end-September2003, sales were 5% higher. Saur was sold to PAIpartners (excluding businesses in Africa andItaly) and was deconsolidated as from 31December 2004.8