Financial Review - Bouygues

Financial Review - Bouygues

Financial Review - Bouygues

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

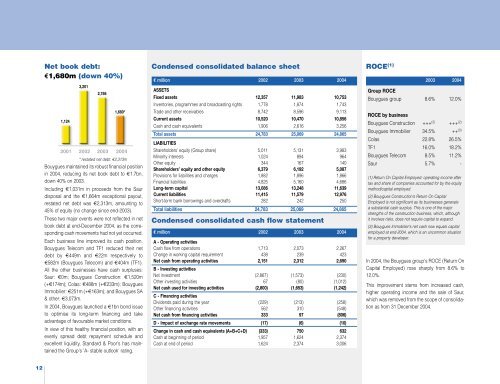

Net book debt:€1,680m (down 40%)1,1243,2012,7861,680*2001 2002 2003 2004* restated net debt: €2,313m<strong>Bouygues</strong> maintained its robust financial positionin 2004, reducing its net book debt to €1.7bn,down 40% on 2003.Including €1,031m in proceeds from the Saurdisposal and the €1,664m exceptional payout,restated net debt was €2,313m, amounting to45% of equity (no change since end-2003).These two major events were not reflected in netbook debt at end-December 2004, as the correspondingcash movements had not yet occurred.Each business line improved its cash position.<strong>Bouygues</strong> Telecom and TF1 reduced their netdebt by €449m and €22m respectively to€582m (<strong>Bouygues</strong> Telecom) and €404m (TF1).All the other businesses have cash surpluses:Saur: €0m; <strong>Bouygues</strong> Construction: €1,520m(+€174m); Colas: €488m (+€233m); <strong>Bouygues</strong>Immobilier: €251m (+€163m); and <strong>Bouygues</strong> SA& other: €3,073m.In 2004, <strong>Bouygues</strong> launched a €1bn bond issueto optimise its long-term financing and takeadvantage of favourable market conditions.In view of this healthy financial position, with anevenly spread debt repayment schedule andexcellent liquidity, Standard & Poor's has maintainedthe Group's 'A- stable outlook' rating.Condensed consolidated balance sheet€ million 2002 2003 2004ASSETSFixed assets 12,357 11,983 10,753Inventories, programmes and broadcasting rights 1,778 1,874 1,743Trade and other receivables 8,742 8,596 9,113Current assets 10,520 10,470 10,856Cash and cash equivalents 1,906 2,616 3,256Total assets 24,783 25,069 24,865LIABILITIESShareholders’ equity (Group share) 5,011 5,131 3,983Minority interests 1,024 894 964Other equity 344 167 140Shareholders’ equity and other equity 6,379 6,192 5,087Provisions for liabilities and charges 1,882 1,896 1,866<strong>Financial</strong> liabilities 4,825 5,160 4,686Long-term capital 13,086 13,248 11,639Current liabilities 11,415 11,579 12,976Short-term bank borrowings and overdrafts 282 242 250Total liabilities 24,783 25,069 24,865Condensed consolidated cash flow statement€ million 2002 2003 2004A - Operating activitiesCash flow from operations 1,713 2,073 2,267Change in working capital requirement 438 239 423Net cash from operating activities 2,151 2,312 2,690B - Investing activitiesNet investment (2,867) (1,573) (230)Other investing activities 67 (80) (1,012)Net cash used for investing activities (2,800) (1,653) (1,242)C - Financing activitiesDividends paid during the year (229) (213) (258)Other financing activities 562 310 (548)Net cash from financing activities 333 97 (806)D - Impact of exchange rate movements (17) (6) (10)Change in cash and cash equivalents (A+B+C+D) (333) 750 632Cash at beginning of period 1,957 1,624 2,374Cash at end of period 1,624 2,374 3,006ROCE (1)2003 2004Group ROCE<strong>Bouygues</strong> group 8.6% 12.0%ROCE by business<strong>Bouygues</strong> Construction +++ (2) +++ (2)<strong>Bouygues</strong> Immobilier 34.5% ++ (3)Colas 22.8% 26.5%TF1 16.0% 18.2%<strong>Bouygues</strong> Telecom 8.5% 11.2%Saur 5.7% -(1) Return On Capital Employed: operating income aftertax and share of companies accounted for by the equitymethod/capital employed.(2) <strong>Bouygues</strong> Construction's Return On CapitalEmployed is not significant as its businesses generatea substantial cash surplus. This is one of the majorstrengths of the construction business, which, althoughit involves risks, does not require capital to expand.(3) <strong>Bouygues</strong> Immobilier's net cash now equals capitalemployed at end-2004, which is an uncommon situationfor a property developer.In 2004, the <strong>Bouygues</strong> group's ROCE (Return OnCapital Employed) rose sharply from 8.6% to12.0%.This improvement stems from increased cash,higher operating income and the sale of Saur,which was removed from the scope of consolidationas from 31 December 2004.12