Financial Review - Bouygues

Financial Review - Bouygues

Financial Review - Bouygues

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

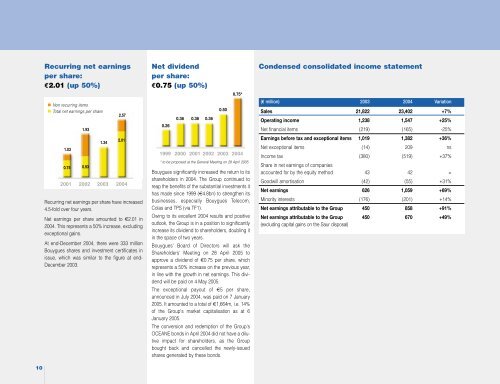

Recurring net earningsper share:€2.01 (up 50%)Non recurring itemsTotal net earnings per share1.030.751.930.931.342.572.012001 2002 2003 2004Recurring net earnings per share have increased4.5-fold over four years.Net earnings per share amounted to €2.01 in2004. This represents a 50% increase, excludingexceptional gains.At end-December 2004, there were 333 million<strong>Bouygues</strong> shares and investment certificates inissue, which was similar to the figure at end-December 2003.Net dividendper share:€0.75 (up 50%)0.260.36 0.360.360.500.75*1999 2000 2001 2002 2003 2004* to be proposed at the General Meeting on 28 April 2005<strong>Bouygues</strong> significantly increased the return to itsshareholders in 2004. The Group continued toreap the benefits of the substantial investments ithas made since 1999 (€4.8bn) to strengthen itsbusinesses, especially <strong>Bouygues</strong> Telecom,Colas and TPS (via TF1).Owing to its excellent 2004 results and positiveoutlook, the Group is in a position to significantlyincrease its dividend to shareholders, doubling itin the space of two years.<strong>Bouygues</strong>' Board of Directors will ask theShareholders' Meeting on 28 April 2005 toapprove a dividend of €0.75 per share, whichrepresents a 50% increase on the previous year,in line with the growth in net earnings. This dividendwill be paid on 4 May 2005.The exceptional payout of €5 per share,announced in July 2004, was paid on 7 January2005. It amounted to a total of €1,664m, i.e. 14%of the Group's market capitalisation as at 6January 2005.The conversion and redemption of the Group'sOCEANE bonds in April 2004 did not have a dilutiveimpact for shareholders, as the Groupbought back and cancelled the newly-issuedshares generated by these bonds.Condensed consolidated income statement(€ million) 2003 2004 VariationSales 21,822 23,402 +7%Operating income 1,238 1,547 +25%Net financial items (219) (165) -25%Earnings before tax and exceptional items 1,019 1,382 +36%Net exceptional items (14) 209 nsIncome tax (380) (519) +37%Share in net earnings of companiesaccounted for by the equity method 43 42 =Goodwill amortisation (42) (55) +31%Net earnings 626 1,059 +69%Minority interests (176) (201) +14%Net earnings attributable to the Group 450 858 +91%Net earnings attributable to the Group 450 670 +49%(excluding capital gains on the Saur disposal)10