January - Early Edition - CI Investments

January - Early Edition - CI Investments

January - Early Edition - CI Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

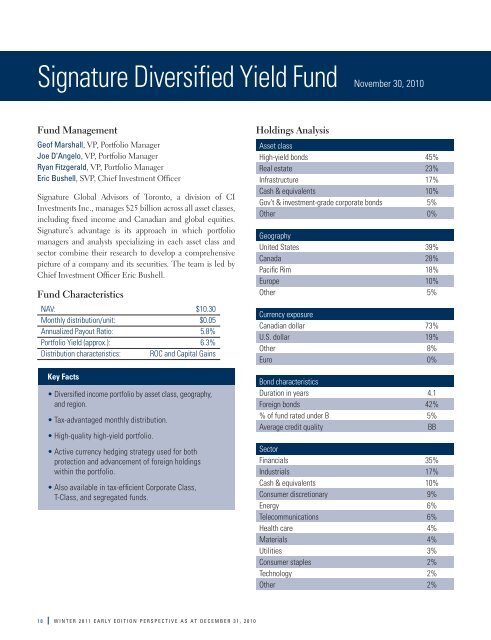

Signature Diversified Yield Fund November 30, 2010Fund ManagementGeof Marshall, VP, Portfolio ManagerJoe D’Angelo, VP, Portfolio ManagerRyan Fitzgerald, VP, Portfolio ManagerEric Bushell, SVP, Chief Investment OfficerSignature Global Advisors of Toronto, a division of <strong>CI</strong><strong>Investments</strong> Inc., manages $25 billion across all asset classes,including fixed income and Canadian and global equities.Signature’s advantage is its approach in which portfoliomanagers and analysts specializing in each asset class andsector combine their research to develop a comprehensivepicture of a company and its securities. The team is led byChief Investment Officer Eric Bushell.Fund CharacteristicsNAV: $10.30Monthly distribution/unit: $0.05Annualized Payout Ratio: 5.8%Portfolio Yield (approx.): 6.3%Distribution characteristics: ROC and Capital GainsKey Facts• Diversified income portfolio by asset class, geography,and region.• Tax-advantaged monthly distribution.• High-quality high-yield portfolio.• Active currency hedging strategy used for bothprotection and advancement of foreign holdingswithin the portfolio.• Also available in tax-effi cient Corporate Class,T-Class, and segregated funds.Holdings AnalysisAsset classHigh-yield bonds 45%Real estate 23%Infrastructure 17%Cash & equivalents 10%Gov’t & investment-grade corporate bonds 5%Other 0%GeographyUnited States 39%Canada 28%Pacific Rim 18%Europe 10%Other 5%Currency exposureCanadian dollar 73%U.S. dollar 19%Other 8%Euro 0%Bond characteristicsDuration in years 4.1Foreign bonds 42%% of fund rated under B 5%Average credit qualityBBSectorFinancials 35%Industrials 17%Cash & equivalents 10%Consumer discretionary 9%Energy 6%Telecommunications 6%Health care 4%Materials 4%Utilities 3%Consumer staples 2%Technology 2%Other 2%18 WINTER 2011 EARLY EDITION PERSPECTIVE AS AT DECEMBER 31, 2010