January - Early Edition - CI Investments

January - Early Edition - CI Investments

January - Early Edition - CI Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

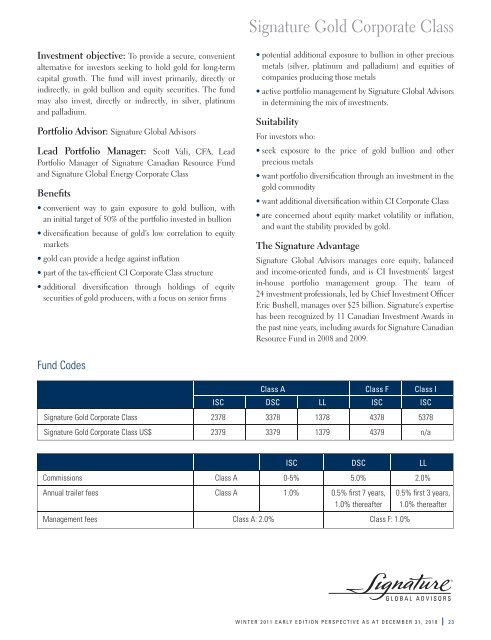

Signature Gold Corporate ClassInvestment objective: To provide a secure, convenientalternative for investors seeking to hold gold for long-termcapital growth. The fund will invest primarily, directly orindirectly, in gold bullion and equity securities. The fundmay also invest, directly or indirectly, in silver, platinumand palladium.Portfolio Advisor: Signature Global AdvisorsLead Portfolio Manager: Scott Vali, CFA, LeadPortfolio Manager of Signature Canadian Resource Fundand Signature Global Energy Corporate ClassBenefits• convenient way to gain exposure to gold bullion, withan initial target of 50% of the portfolio invested in bullion• diversification because of gold’s low correlation to equitymarkets• gold can provide a hedge against inflation• part of the tax-efficient <strong>CI</strong> Corporate Class structure• additional diversification through holdings of equitysecurities of gold producers, with a focus on senior firms• potential additional exposure to bullion in other preciousmetals (silver, platinum and palladium) and equities ofcompanies producing those metals• active portfolio management by Signature Global Advisorsin determining the mix of investments.SuitabilityFor investors who:• seek exposure to the price of gold bullion and otherprecious metals• want portfolio diversification through an investment in thegold commodity• want additional diversification within <strong>CI</strong> Corporate Class• are concerned about equity market volatility or inflation,and want the stability provided by gold.The Signature AdvantageSignature Global Advisors manages core equity, balancedand income-oriented funds, and is <strong>CI</strong> <strong>Investments</strong>’ largestin-house portfolio management group. The team of24 investment professionals, led by Chief Investment OfficerEric Bushell, manages over $25 billion. Signature’s expertisehas been recognized by 11 Canadian Investment Awards inthe past nine years, including awards for Signature CanadianResource Fund in 2008 and 2009.Fund CodesClass A Class F Class IISC DSC LL ISC ISCSignature Gold Corporate Class 2378 3378 1378 4378 5378Signature Gold Corporate Class US$ 2379 3379 1379 4379 n/aISC DSC LLCommissions Class A 0-5% 5.0% 2.0%Annual trailer fees Class A 1.0% 0.5% fi rst 7 years, 0.5% fi rst 3 years,1.0% thereafter 1.0% thereafterManagement fees Class A: 2.0% Class F: 1.0%WINTER 2011 EARLY EDITION PERSPECTIVE AS AT DECEMBER 31, 2010 23