January - Early Edition - CI Investments

January - Early Edition - CI Investments

January - Early Edition - CI Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

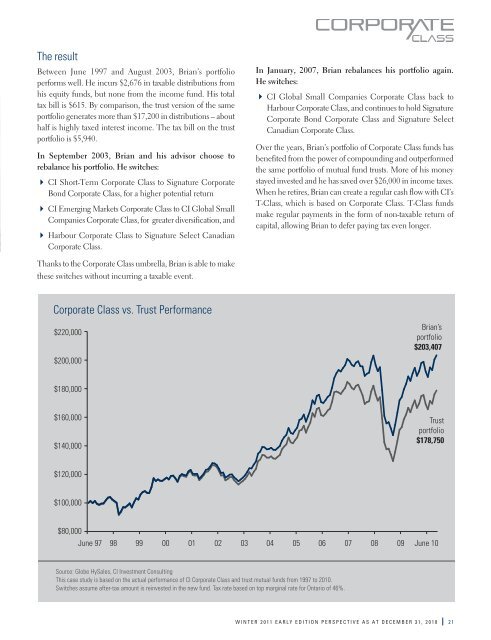

The resultBetween June 1997 and August 2003, Brian’s portfolioperforms well. He incurs $2,676 in taxable distributions fromhis equity funds, but none from the income fund. His totaltax bill is $615. By comparison, the trust version of the sameportfolio generates more than $17,200 in distributions – abouthalf is highly taxed interest income. The tax bill on the trustportfolio is $5,940.In September 2003, Brian and his advisor choose torebalance his portfolio. He switches: <strong>CI</strong> Short-Term Corporate Class to Signature CorporateBond Corporate Class, for a higher potential return <strong>CI</strong> Emerging Markets Corporate Class to <strong>CI</strong> Global SmallCompanies Corporate Class, for greater diversification, and Harbour Corporate Class to Signature Select CanadianCorporate Class.In <strong>January</strong>, 2007, Brian rebalances his portfolio again.He switches: <strong>CI</strong> Global Small Companies Corporate Class back toHarbour Corporate Class, and continues to hold SignatureCorporate Bond Corporate Class and Signature SelectCanadian Corporate Class.Over the years, Brian’s portfolio of Corporate Class funds hasbenefited from the power of compounding and outperformedthe same portfolio of mutual fund trusts. More of his moneystayed invested and he has saved over $26,000 in income taxes.When he retires, Brian can create a regular cash flow with <strong>CI</strong>’sT-Class, which is based on Corporate Class. T-Class fundsmake regular payments in the form of non-taxable return ofcapital, allowing Brian to defer paying tax even longer.Thanks to the Corporate Class umbrella, Brian is able to makethese switches without incurring a taxable event.Corporate Class vs. Trust Performance$220,000$200,000Brian’sportfolio$203,407$180,000$160,000$140,000Trustportfolio$178,750$120,000$100,000$80,000June 97 98 99 00 01 02 03 04 05 06 07 08 09 June 10Source: Globe HySales, <strong>CI</strong> Investment ConsultingThis case study is based on the actual performance of <strong>CI</strong> Corporate Class and trust mutual funds from 1997 to 2010.Switches assume after-tax amount is reinvested in the new fund. Tax rate based on top marginal rate for Ontario of 46%.WINTER 2011 EARLY EDITION PERSPECTIVE AS AT DECEMBER 31, 2010 21