A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

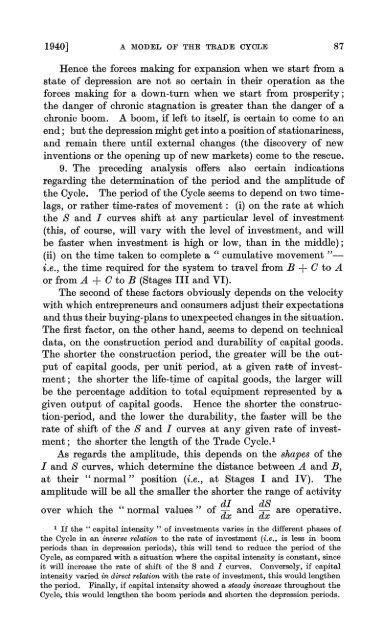

1940] A MODEL OF THE TRADE CYCLE 87Hence <strong>the</strong> forces making for expansion when we start from astate <strong>of</strong> depression are not so certam in <strong>the</strong>ir operation as <strong>the</strong>forces making for a down-turn when we start from prosperity;<strong>the</strong> danger <strong>of</strong> chronic stagnation is greater than <strong>the</strong> danger <strong>of</strong> achronic boom. A boom, if left to itself, is certain to come to anend; but <strong>the</strong> depression might get into a position <strong>of</strong> stationariness,and remain <strong>the</strong>re until external changes (<strong>the</strong> discovery <strong>of</strong> newinventions or <strong>the</strong> opening up <strong>of</strong> new markets) come to <strong>the</strong> rescue.9. <strong>The</strong> preceding analysis <strong>of</strong>fers also certain indicationsregarding <strong>the</strong> determination <strong>of</strong> t~e period and <strong>the</strong> amplitude <strong>of</strong><strong>the</strong> <strong>Cycle</strong>. <strong>The</strong> period <strong>of</strong> <strong>the</strong> Oycle seems to depend on two timelags,or ra<strong>the</strong>r time-rates <strong>of</strong> movement: (i) on <strong>the</strong> rate at which<strong>the</strong> Sand Icurves shift at any particular level <strong>of</strong> investment(this, <strong>of</strong> course, will vary with <strong>the</strong> level <strong>of</strong> investment, and willbe faster when investment is high or low, than in <strong>the</strong> middle);(ii) on <strong>the</strong> time taken to complete a ,t' cumulative movement "i.e., <strong>the</strong> time required for <strong>the</strong> system to travel from B + O to Aor from A + O to B (Stages III and VI).<strong>The</strong> second <strong>of</strong> <strong>the</strong>se factors obviously depends on <strong>the</strong> velocitywith which entrepreneurs and consumers adjust <strong>the</strong>ir expectationsand thus <strong>the</strong>ir buying-plans to unexpected changes in <strong>the</strong> situation.<strong>The</strong> first factor, on <strong>the</strong> o<strong>the</strong>r hand, seems to depend on technicaldata, on <strong>the</strong> construction period and durability <strong>of</strong> capitaI goods.<strong>The</strong> shorter <strong>the</strong> construction period, <strong>the</strong> greater will be <strong>the</strong> output<strong>of</strong> capitaI goods, per unit' period, at a given rat~ <strong>of</strong> investment;<strong>the</strong> shorter <strong>the</strong> life-tjme <strong>of</strong> capitaI goods, <strong>the</strong> larger willbe <strong>the</strong> percentage addition to total equipment represented by agiven output <strong>of</strong> capitaI goods. Hence <strong>the</strong> shorter <strong>the</strong> construction-period,and <strong>the</strong> lower <strong>the</strong> durability, <strong>the</strong> faster will be <strong>the</strong>rate <strong>of</strong> Sllift <strong>of</strong> <strong>the</strong> Sand I curves at any given rate <strong>of</strong> investment;<strong>the</strong> shorter <strong>the</strong> length <strong>of</strong> <strong>the</strong> <strong>Trade</strong> <strong>Cycle</strong>. 1As regards <strong>the</strong> amplitude, this depends on <strong>the</strong> shapes <strong>of</strong> <strong>the</strong>I and S curves, which determine <strong>the</strong> distance between A and B,at <strong>the</strong>ir "normal" position (i.e., at Stages I and IV). <strong>The</strong>amplitude will be alI <strong>the</strong> smaller <strong>the</strong> shorter <strong>the</strong> range <strong>of</strong> activityover which <strong>the</strong> "normal values" <strong>of</strong> ~~ and ~~ are operative.1 If <strong>the</strong> " capitaI intensity " <strong>of</strong> investments varies in <strong>the</strong> different phases <strong>of</strong><strong>the</strong> CycIe in an inverse relation to <strong>the</strong> rate <strong>of</strong> investment (i.e., is less in boomperiods than in depression periods), this will tend to reduce <strong>the</strong> period <strong>of</strong> <strong>the</strong>CycIe, as compared with a situation where <strong>the</strong> capitaI intensity is constant, sinceit will increase <strong>the</strong> rate <strong>of</strong> shift <strong>of</strong> <strong>the</strong> Sand I curves. ConverseIy, if capitaIintensity varied in direct relation with <strong>the</strong> rate <strong>of</strong> investment, this wouId Ieng<strong>the</strong>n<strong>the</strong> periodo Finally, if capitaI intensity showed a steady increase throughout <strong>the</strong>CycIe, this wouId Ieng<strong>the</strong>n <strong>the</strong> boom periods and shorten <strong>the</strong> depression periods.