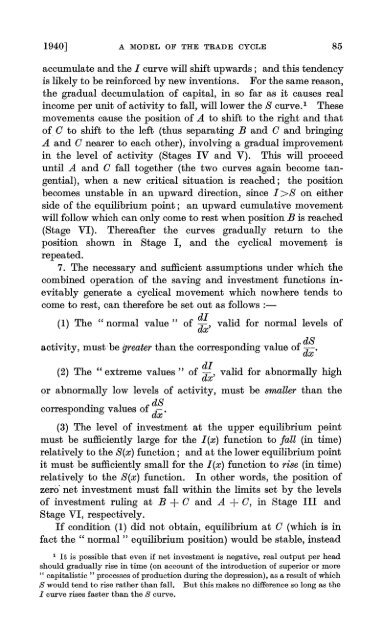

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1940] A MODEL OF THE TRADE CYCLE 85accumulate and <strong>the</strong> I curve will shift upwards; and this tendencyis likely to be reinforced by new inventions. For <strong>the</strong> same reason,<strong>the</strong> graduaI decumulation <strong>of</strong> capitaI, in so far as it causes realincome per unit <strong>of</strong> activity to fall, willlower <strong>the</strong> S curve.! <strong>The</strong>semovements cause <strong>the</strong> position <strong>of</strong> A to shift to <strong>the</strong> right and that<strong>of</strong>. G to shift to <strong>the</strong> left (thus separating Band C ànd bringingA and C nearer to each o<strong>the</strong>r), involving a graduaI improvementin <strong>the</strong> level <strong>of</strong> activity (Stages IV and V). This will proceeduntil A and G fall toge<strong>the</strong>r (<strong>the</strong> two curves again become tangential),when a new criticaI situation is reached; <strong>the</strong> positionbecomes unstable in an upward direction, since I >S on ei<strong>the</strong>rside <strong>of</strong> <strong>the</strong> equilibrium point; an upward cumulative movementwill follow which can only come to rest when position B is reached(Stage VI). <strong>The</strong>reafter <strong>the</strong> curves gradually return to <strong>the</strong>position shown in Stage I, and <strong>the</strong> cyclical movement isrepeated.7. <strong>The</strong> necessary and sufficient assumptions under which <strong>the</strong>combined operation <strong>of</strong> <strong>the</strong> saving and investment functions inevitablygenerate a èyclical movement which nowhere tends tocome to rest, can <strong>the</strong>refore be set out as follows :-(l) <strong>The</strong> "normal value" <strong>of</strong> ~;, valid for normal levels <strong>of</strong>activity, must'be greater than <strong>the</strong> corresponding value <strong>of</strong>~~.(2) <strong>The</strong> "extreme values" <strong>of</strong> ~~, valid for abnormally highor abnormally low levels <strong>of</strong> activity, must be smaller than <strong>the</strong>corresponding values <strong>of</strong> ~~.(3) <strong>The</strong> level <strong>of</strong> investment at <strong>the</strong> upper equilibrium paintmust be sufficiently large for <strong>the</strong> I(x) function to JaZZ (in time)relatively to <strong>the</strong> S(x) function; and at <strong>the</strong> lower equilibrium pointit must be sufficiently small for <strong>the</strong> I(x) function to rise (in time)relatively to <strong>the</strong> S(x) function.In o<strong>the</strong>r words, <strong>the</strong> position <strong>of</strong>zero' net investment must fall within <strong>the</strong> limits set by <strong>the</strong> levels<strong>of</strong> investment ruling at B + C and A +. C, in Stage III andStage VI, respectively.If condition (1) did not obtain, equilibrium at C (which is infact <strong>the</strong> " normal " equilibrium position) would be stable, instead1 It is possible that even if net investment is negative, real output per headshould gradually rise in time (on account <strong>of</strong> <strong>the</strong> introduction <strong>of</strong> superior or more" capitalistic " processes <strong>of</strong> production during <strong>the</strong> depression), as a result <strong>of</strong> whichS would tend to rise ra<strong>the</strong>r than falle But this makes no difference so long as <strong>the</strong>I curve rises faster than <strong>the</strong> S curve.