A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

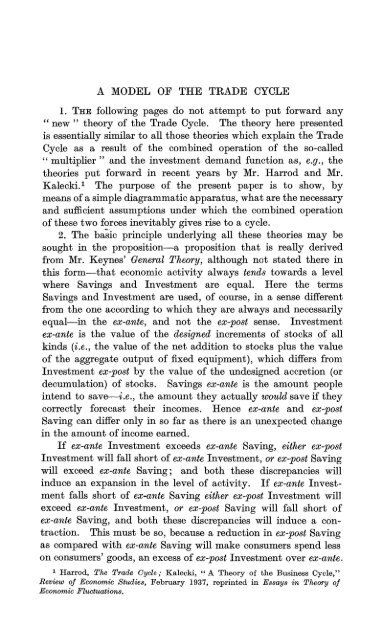

A MODEL OF TRE TRADE CYCLEl. TRE following pages do not attempt to put forward any" new " <strong>the</strong>ory <strong>of</strong> <strong>the</strong> <strong>Trade</strong> <strong>Cycle</strong>. <strong>The</strong> <strong>the</strong>ory here presentedis essentially similar to alI those <strong>the</strong>ories which explain <strong>the</strong> <strong>Trade</strong><strong>Cycle</strong> as a result <strong>of</strong> <strong>the</strong> combined operation <strong>of</strong> <strong>the</strong> so-called" multiplier " and <strong>the</strong> investment demand function as, e.g., <strong>the</strong><strong>the</strong>ories put forward in recent years by Mr. Harrod and Mr.Kalecki. 1 <strong>The</strong> purpose <strong>of</strong> <strong>the</strong> present paper is to show, bymeans <strong>of</strong> a simple diagrammatic,apparatus, what are <strong>the</strong> necessaryand sufficient assumptions under which <strong>the</strong> combined operation<strong>of</strong> <strong>the</strong>se two forces inevitably gives rise to a cycle.2. <strong>The</strong> baslc principle underlying alI <strong>the</strong>se <strong>the</strong>ories may besought in <strong>the</strong> proposition-a proposition that is really derivedfrom Mr. Keynes' General <strong>The</strong>ory, although not stated <strong>the</strong>re inthis form-that economic activity always tends towards a levelwhere Savings and Investment are equa!. Here <strong>the</strong> termsSavings and Investment are used, <strong>of</strong> course, in a sense differentfrom <strong>the</strong> one according to which <strong>the</strong>y are always and necessarilyequal-in <strong>the</strong> ex-ante, and not <strong>the</strong> ex-post sense. Investmentex-ante is <strong>the</strong> value <strong>of</strong> <strong>the</strong> designed increments <strong>of</strong> stocks <strong>of</strong> alIkinds (i.e., <strong>the</strong> value <strong>of</strong> <strong>the</strong> net addition to stocks plus <strong>the</strong> value<strong>of</strong> <strong>the</strong> aggregate output <strong>of</strong> fixed equipment), which differs fromInvestment ex-post by <strong>the</strong> value <strong>of</strong> <strong>the</strong> undesigned accretion (ordecumulation) <strong>of</strong> stocks. Savings ex-ante is <strong>the</strong> amount peopleintend to save-i.e., <strong>the</strong> amount <strong>the</strong>y actually would save if <strong>the</strong>ycorrectly forecast <strong>the</strong>ir incomes. Hence ex-ante and ex-postSaving can differ only in so far as <strong>the</strong>re is an unexpected changein <strong>the</strong> amount <strong>of</strong> incorne earned.If ex-ante Investment exceeds ex-ante Saving, ei<strong>the</strong>r ex-postInvestment will fall short <strong>of</strong> ex-ante Investment, or ex-post Savingwill exceed ex-ante Saving; and both <strong>the</strong>se discrepancies willinduce an expansion in <strong>the</strong> level <strong>of</strong> activity. If ex-ante Investmentfalls short <strong>of</strong> ex-ante Saving ei<strong>the</strong>r ex-post Investment willexceed ex-ante Investment, or ex-post Saving will fall short <strong>of</strong>ex-ante Saving, and both <strong>the</strong>se discrepancies will induce a contraction.This must be so, because a reduction in ex-post Savingas compared with ex-ante Saving will make consumers spend lesson consumers' goods, an excess <strong>of</strong> ex-post Investment over ex-ante~1 Harrod, <strong>The</strong> <strong>Trade</strong> Oycle,. Kalecki, "A <strong>The</strong>ory <strong>of</strong> <strong>the</strong> Business <strong>Cycle</strong>,"Review oJ Economie Studies, February 1937, reprinted in Essays in <strong>The</strong>ory oJEconomic Fluctuations.