A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

A Model of the Trade Cycle Author(s): Nicholas Kaldor Source: The ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

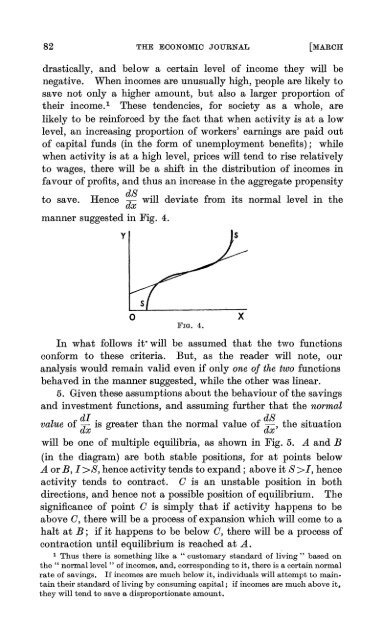

82 TRE ECONOMIC JOURNAL [MARCHdrastically, and below a certain level <strong>of</strong> incorne <strong>the</strong>y will benegative. When incornes are unusually high, people are likely tosave not only a higher amount, but also a larger proportion <strong>of</strong><strong>the</strong>ir income.! <strong>The</strong>se tendencies, for society as a whole, arelikely to be reinforced by <strong>the</strong> fact that when activity is at a lowlevel, an increasing proportion <strong>of</strong> workers' earnings are paid out<strong>of</strong> capitaI funds (in <strong>the</strong> form <strong>of</strong> unemployment benefits); whilewhen activity is at a high level, prices will tend to rise relativelyto wages, <strong>the</strong>re will be a shift in <strong>the</strong> distribution <strong>of</strong> incomes infavour <strong>of</strong> pr<strong>of</strong>its, and thus an increase in <strong>the</strong> aggregate propensityto save.Rence ~~ will deviate from its normal level in <strong>the</strong>manner suggested in Fig. 4.yoFIG. 4.In what follows it· will be assumed that <strong>the</strong> two functionsconform to <strong>the</strong>se criteria. But, as <strong>the</strong> reader will note, ouranalysis would remain valid even if on:ly one oj <strong>the</strong> two functionsbehaved in <strong>the</strong> manner suggested, while <strong>the</strong> o<strong>the</strong>r was lineare5. Given <strong>the</strong>se assumptio11S about <strong>the</strong> behaviour <strong>of</strong><strong>the</strong> savingsand investment functions, and assuming fur<strong>the</strong>r that <strong>the</strong> normalvalue <strong>of</strong> ~~ is greater than <strong>the</strong> normal value <strong>of</strong> ~~, <strong>the</strong> situationwill be one <strong>of</strong> multiple equilibria, as shown in Fig. 5. A and B(in <strong>the</strong> diagram) are both stable positions, for at points belowA or B, 1>8, hence activity tends to expand; above it 8 >1, hellceactivity tends to contract. ° is an unstable position in bothdirections, and hence not a possible position <strong>of</strong> equilibrium. <strong>The</strong>significance <strong>of</strong> point °is simply that if activity happens to beabove 0, <strong>the</strong>re will be a process <strong>of</strong> expansion which will come to ahalt at B; if it happens to be below 0, <strong>the</strong>re will be a process <strong>of</strong>contraction until equilibrium is reached at A. .1 Thus <strong>the</strong>re is something like a " customary standard <strong>of</strong> Iiving" based on<strong>the</strong> " normallevel " <strong>of</strong> incomes, and, corresponding to it, <strong>the</strong>re is a certain normalrate <strong>of</strong> savings. If incomes are much beIow it, individuais will attempt to maintain<strong>the</strong>ir standard <strong>of</strong> living by consuming capitaI; if incomes are much above it,<strong>the</strong>y will tend to save a disproportionate amount.x