Gas Turbine Efficiency - overcoming your power problems

Gas Turbine Efficiency - overcoming your power problems

Gas Turbine Efficiency - overcoming your power problems

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

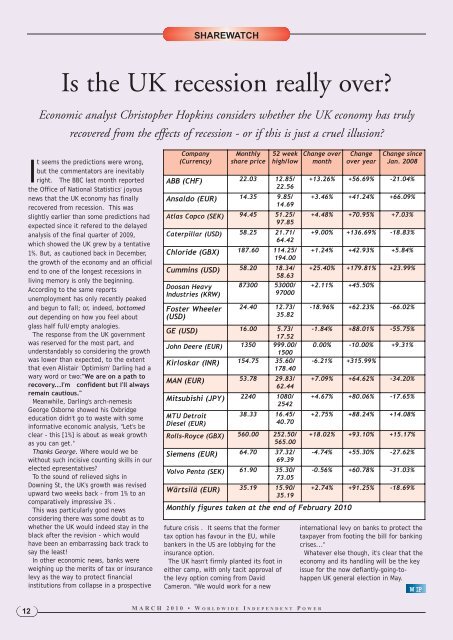

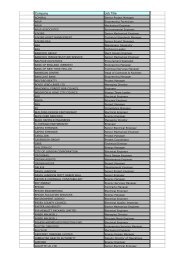

SHAREWATCHIs the UK recession really over?Economic analyst Christopher Hopkins considers whether the UK economy has trulyrecovered from the effects of recession - or if this is just a cruel illusion?It seems the predictions were wrong,but the commentators are inevitablyright. The BBC last month reportedthe Office of National Statistics' joyousnews that the UK economy has finallyrecovered from recession. This wasslightly earlier than some predictions hadexpected since it refered to the delayedanalysis of the final quarter of 2009,which showed the UK grew by a tentative1%. But, as cautioned back in December,the growth of the economy and an officialend to one of the longest recessions inliving memory is only the beginning.According to the same reportsunemployment has only recently peakedand begun to fall; or, indeed, bottomedout depending on how you feel aboutglass half full/empty analogies.The response from the UK governmentwas reserved for the most part, andunderstandably so considering the growthwas lower than expected, to the extentthat even Alistair 'Optimism' Darling had awary word or two:"We are on a path torecovery...I'm confident but I'll alwaysremain cautious."Meanwhile, Darling's arch-nemesisGeorge Osborne showed his Oxbridgeeducation didn't go to waste with someinformative economic analysis, "Let's beclear - this [1%] is about as weak growthas you can get."Thanks George. Where would we bewithout such incisive counting skills in ourelected epresentatives?To the sound of relieved sighs inDowning St, the UK's growth was revisedupward two weeks back - from 1% to ancomparatively impressive 3% .This was particularly good newsconsidering there was some doubt as towhether the UK would indeed stay in theblack after the revision - which wouldhave been an embarrassing back track tosay the least!In other economic news, banks wereweighing up the merits of tax or insurancelevy as the way to protect financialinstitutions from collapse in a prospectiveCompany(Currency)Monthlyshare pricefuture crisis . It seems that the formertax option has favour in the EU, whilebankers in the US are lobbying for theinsurance option.The UK hasn't firmly planted its foot ineither camp, with only tacit approval ofthe levy option coming from DavidCameron. "We would work for a new52 weekhigh/lowABB (CHF) 22.03 12.85/22.56Ansaldo (EUR) 14.35 9.85/14.69Atlas Copco (SEK) 94.45 51.25/97.85Caterpillar (USD) 58.25 21.71/64.42Chloride (GBX) 187.60 114.25/194.00Cummins (USD) 58.20 18.34/58.63Doosan HeavyIndustries (KRW)Foster Wheeler(USD)87300 53000/9700024.40 12.73/35.82GE (USD) 16.00 5.73/17.52John Deere (EUR) 1350 999.00/1500Kirloskar (INR) 154.75 35.60/178.40MAN (EUR) 53.78 29.83/62.44Mitsubishi (JPY) 2240 1080/2542MTU DetroitDiesel (EUR)38.33 16.45/40.70Rolls-Royce (GBX) 560.00 252.50/565.00Siemens (EUR) 64.70 37.32/69.39Volvo Penta (SEK) 61.90 35.30/73.05Wärtsilä (EUR) 35.19 15.90/35.19Change overmonthChangeover yearChange sinceJan. 2008+13.26% +56.69% -21.04%+3.46% +41.24% +66.09%+4.48% +70.95% +7.03%+9.00% +136.69% -18.83%+1.24% +42.93% +5.84%+25.40% +179.81% +23.99%+2.11% +45.50%-18.96% +62.23% -66.02%-1.84% +88.01% -55.75%0.00% -10.00% +9.31%-6.21% +315.99%Monthly figures taken at the end of February 2010+7.09% +64.62% -34.20%+4.67% +80.06% -17.65%+2.75% +88.24% +14.08%+18.02% +93.10% +15.17%-4.74% +55.30% -27.62%-0.56% +60.78% -31.03%+2.74% +91.25% -18.69%international levy on banks to protect thetaxpayer from footing the bill for bankingcrises..."Whatever else though, it's clear that theeconomy and its handling will be the keyissue for the now defiantly-going-tohappenUK general election in May.WIP12MARCH 2010 • WORLDWIDE I NDEPENDENT P OWER