2011 Annual Report - USNH Financial Services - University System ...

2011 Annual Report - USNH Financial Services - University System ...

2011 Annual Report - USNH Financial Services - University System ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Education is the key to New Hampshire’s long-term welfare, economic prosperity, and quality of life. More thanever, the potential for each person to succeed—and to prosper—is determined by his or her ability to think, to reason, and toparticipate fully in all facets of life in a democratic society. Providing these critical educational programs and services throughteaching, research, and public service is at the heart of the mission of the <strong>University</strong> <strong>System</strong> of New Hampshire (<strong>USNH</strong>).The <strong>University</strong> <strong>System</strong> of New Hampshire is the state’s primary supplier of highly educated citizens and workers. The fourinstitutions of the <strong>University</strong> <strong>System</strong>—the <strong>University</strong> of New Hampshire, Plymouth State <strong>University</strong>, Keene State College, andGranite State College—annually enroll more than 31,000 students and graduate more than 6,000 students at the associate,bachelor, master, and doctoral levels. The institutions annually award more than half of the state’s bachelor’s degrees. In addition,approximately 77,000 alumni of <strong>University</strong> <strong>System</strong> institutions currently live in New Hampshire, contributing to their communitiesand the economy.FY11 HIGHLIGHTS(fiscal year ending June 30, <strong>2011</strong>)• The institutions of <strong>USNH</strong> worked hard in FY11 to generate additional revenuesand save money where they could so that the reduced state revenues in FY12could be better managed. The $27.1 million FY11 net income before otherchanges in net assets represents 3.4 percent of operating revenues, right in linewith the <strong>USNH</strong> goal to generate a 3 percent to 5 percent operating margin on anannual basis.• Granite State College inaugurated its fourth president, Dr. Todd J. Leach, atthe Shepard-McAuliffe Discovery Center in Concord. Under his leadership,the college has begun launching a variety of exciting initiatives aimed atadvancing the College’s mission and fueling record growth including a oneyear40 percent increase in applications.• <strong>USNH</strong>’s three residential institutions are among only 311 institutions nationwidethat earned the Community Engagement Classification by The CarnegieFoundation for the Advancement of Teaching.• The <strong>USNH</strong> Board of Trustees approved a $970 million “all funds” operating budgetfor FY12 that included significant cuts across the entire system to address a verysubstantial $48.4 million reduction in state support. More than 80 percent of thestate funding cut will be offset through expense reductions, which reduces thedirect impact on the students. Cost of attendance (i.e., the full tuition, fees, roomand board “sticker price” for a typical on-campus student) increases for in-statestudents were held to between 8.7 and 9.7 percent at the residential campuses.• From Moody’s June 8, <strong>2011</strong> rating report: “Moody’s affirmation of <strong>USNH</strong>’sAa3 rating and stable outlook heavily incorporates our assessment of <strong>USNH</strong>’sgovernance and management ability to take swift steps to grow privaterevenue streams and contain expenses to balance the FY 2012 budget inresponse to anticipated steep cuts in state funding… Historically, the boardand senior management team’s market-oriented focus has been criticalin light of the <strong>System</strong>’s high reliance on out-of-state students and modestreliance on state appropriations. The <strong>System</strong> benefits from a strong financialmanagement team as demonstrated by multi-year operating surpluses.”Granite StateCollegeLebanonGranite StateCollegeClaremontKeene StateCollegeGranite StateCollegeLittletonPlymouth State<strong>University</strong>ConcordGranite StateCollegeConcordGranite StateCollegeBerlinGranite StateCollegeConwayPlymouth State<strong>University</strong> Granite StateCollegeRochesterGraniteState CollegeManchester<strong>University</strong> ofNew HampshireManchesterGraniteState CollegePortsmouth<strong>University</strong> ofNew HampshireDurhamThe <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> is a publication of the <strong>University</strong> <strong>System</strong> of New Hampshire. Prior year <strong>University</strong> <strong>System</strong> <strong>Annual</strong> <strong>Report</strong>s are available online at finadmin.usnh.eduThe cover of this report features Keene State College Commencement <strong>2011</strong> photos. Photography Credits: UNH Photo <strong>Services</strong> , PSU Office of Public Relations, Mark Corliss, Chris Justice, Michelle Kammerman, Ann Card, Julio DelSesto, and Michael MoorePage 10 photo courtesy Business New Hampshire MagazineThe front section of this report is printed on 80# Chorus Art gloss text (30% post consumer waste and FSC certified) and the back section is printed on 70# Astrolite PC 100 text (100% post consumer waste).<strong>University</strong> <strong>System</strong> of New Hampshire, Dunlap Center, 25 Concord Road, Durham, NH 03824, 603-862-0918

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTKeene State’s 170-acre campus, just a few minutes’walk from downtown Keene, has been called a“showplace of higher education.” Appian Way, themain pedestrian thoroughfare, runs through thecenter of campus.Table of ContentsLetter from the Chancellor. 2<strong>Report</strong> from the <strong>University</strong> <strong>System</strong> of New Hampshire. 3Management’s Responsibility for <strong>Financial</strong> <strong>Report</strong>ingand Internal Controls. 13<strong>Report</strong> of Independent Auditors. 14Management’s Discussion and Analysis. 15<strong>Financial</strong> Statements . 23Notes to the <strong>Financial</strong> Statements. 26<strong>University</strong> <strong>System</strong> of New HampshireBoard of Trustees and Administration .Inside Back Cover1

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTeconomic challenges the nation faces. In <strong>2011</strong>, New Hampshire,through an act of its Legislature, became the only state in thecountry to not offer state grants to financially needy studentsthat want to attend its public colleges and universities.The <strong>University</strong> <strong>System</strong> will be challenged in the coming yearsto demonstrate and articulate its value to the State of NewHampshire in terms of its role to provide New Hampshire withan educated workforce that serves as a catalyst for innovation,capital investment and economic development. The fiscalchallenges will drive certain changes, as will the emphasis onnew educational delivery models and the use of technology inand out of the classroom. This will be an ongoing effort thatwill be discussed year-round, across the state and outside ofthe annual state budget deliberations, with a goal to enhancerecognition that higher education is a wise investment that willpay dividends to New Hampshire now and in the future.Supporting the <strong>USNH</strong> Fourfold VisionBeyond economic issues, this annual report cites several otheractions and accomplishments that support the <strong>USNH</strong> four-foldvision that has been described and referenced in prior annualreports, which is to be:1. Truly student oriented2. Committed to excellence in selected programs and services3. Efficient and effective in the use of resources4. Recognized as the partner of choiceThe FY11 <strong>Annual</strong> <strong>Report</strong> looks back over the 2010-11 fiscal year toreview how these accomplishments have impacted the state andprovides an overview of key financial data from this period. Theseaccomplishments are described in the next section of the reportunder each component of this vision.1. New Hampshire’s <strong>University</strong> <strong>System</strong> is Student-OrientedWhile the four <strong>USNH</strong> institutions have distinctive missions, theyfocus on a core commitment to students and student learning.<strong>USNH</strong> serves the higher educational needs of the people ofNew Hampshire and recognizes its responsibility to regularlyevaluate those needs, institutional offerings, and how and whereprogramming is delivered.Student Excellence at Plymouth State <strong>University</strong> – Studentexcellence was on display at two April <strong>2011</strong> events at PlymouthState <strong>University</strong>. First, students participated in researchprojects connected to an IDeA Network of Biomedical ResearchExcellence (INBRE) from the National Institutes of Health. PSUjoined nine other New Hampshire colleges and universities toform NH-INBRE, which has been awarded $15.4 million to fundresearch programs from its member institutions over the nextfive years and to increase opportunities for faculty and studentresearch. In addition to three specific faculty-led projects, PSUstudents also were encouraged to perform original researchinto a variety of topics. Among the research presented duringthe first day was: the expression of toxin-related genes in browntides; a population analysis of the New Hampshire Loon; and thetesting of the reliability of a portable balance-assessment devicePlymouth State <strong>University</strong> students participate in a research symposium by displaying anddiscussing their original research in the sciences, arts and humanities as part of a national programto increase research opportunities.for use in an older population.The following day students representing more than sixteenacademic departments displayed and demonstrated originalresearch in the sciences, arts and humanities. In addition toposter displays and video presentations, students from theDepartment of Health and Human Performance demonstrated“teaching fitness through games,” incorporating “fun techniques”used in elementary physical education programs.Keene State College Uses Technology to Advance StudentLearning – At Keene State College, student learning comesfirst. To enhance the student experience and strengthen criticalservices, the college continually introduces new technologiesand upgrades its existing infrastructure. In 2010-11, the collegecontinued its four-year initiative to provide wireless Internetaccess across the entire campus. In its second year, this projecthas already introduced wireless access in the college’s library,student center, dining hall, lounges, and classrooms. Oncecompleted, wireless access will be available in the residentialhalls, administrative offices, and outdoor spaces. Keene State isalso implementing a new access control system that will allowmembers of the campus to use a single card to gain entry toresidential, administrative, and academic buildings as well as toconduct financial transactions in the library, laundry facilities,recreational center, dining hall, and on vending machines. Thesecritical new technologies are providing a platform for mobilecomputing, innovative delivery of student services, and newmodes of teaching and learning. They also enhance the safetyand security of the campus community.Granite State College Expands Its North Country Footprint –Granite State College has expanded its presence in Littleton,thanks to new space on Main Street, and has launched outreachprograms in Lancaster and Woodsville, designed to betterreach North Country students. GSC’s new Main Street space5

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTin the heart of downtown Littleton features a computer lab,two classrooms, a student resource room, and office space foradvisors. The campus serves about 100 students, many of whomcome from surrounding towns. The new Littleton campus isstaffed daily and open for advising, classes, and to accommodatevisitors inquiring about earning a college degree. Previously, thecollege occupied a single room at White Mountains CommunityCollege.Meanwhile, in an effort to better serve those students in thesurrounding communities, GSC has launched an outreachprogram whereby an advisor is available for in-person meetingsonce a month at locations in Lancaster and Woodsville. GSC’sdegree programs in Business Management, Early ChildhoodEducation and Behavioral Science are among the most popularin the North Country.<strong>University</strong> of New Hampshire Academic ProgramsRecognized for Excellence – For the second year running, theMaster of Fine Arts (MFA) in Writing program at the <strong>University</strong> ofNew Hampshire was ranked one of the top fifty programs in thenation by Poets & Writers Magazine. UNH’s overall program wasranked forty-seventh in the nation. Within the MFA program,the creative nonfiction program was ranked seventh, the poetryprogram was ranked thirty-seventh, and the fiction programearned an honorable mention. There are 148 full-time residencyMFA programs in the United States.UNH’s accounting program was named one of the topaccounting programs in the world by Brigham Young <strong>University</strong>,which has been ranking university accounting programs basedon classifications of peer-reviewed research articles since1990. UNH was ranked number two in the world in accountinginformation systems and number twelve in the world inexperimental accounting research. UNH’s ranking in accountinginformation systems put it ahead of nearly 200 institutionsworldwide, including top research institutions.Ground breaking ceremonies were held May 3, <strong>2011</strong> for the new Peter T. Paul College of Businessand Ecomomics. Pictured from left are Whittemore School senior Alyssa King, Whittemore SchoolDean Dan Innis, philanthropist and Alumnus Peter T. Paul, and UNH President Mark Huddleston.Wind Research at UNH – The <strong>University</strong> of New Hampshireis home to the 300-foot long Flow Physics Facility, the largestscientific bondary-layer wind tunnel in the world. It will helpengineers and scientists better understand the dynamics ofturbulent boundary layers, informing the aerodynamics ofsituations such as atmospheric wind over the ocean, the flow ofair over a commercial airplane or of sea water over a submarine.Turbulence is considered to be the last unsolved program inclassical physics and the lack of understanding has many adverseeffects – from its impact on weather prediction to engineeringdesign and practice.2. The <strong>University</strong> <strong>System</strong> Delivers Excellence inSelected Programs<strong>USNH</strong> institutions are distinct, yet complementary in theirmissions, purposes, and offerings. Each institution brings a uniqueset of talents and expertise to its students, the state, and beyond.Together, they meet a full spectrum of higher educational needswhile being recognized individually for excellence in select areasConstruction Begins on New UNH Business School – The<strong>University</strong> of New Hampshire broke ground on the Peter T.Paul College of Business and Economics in May, the first stepin constructing the new building that will help transform theuniversity’s graduate and undergraduate business education andreinforce its long proud history of offering first-rate programs.The new college, which is scheduled to open in January 2013, ismade possible by a generous gift of $25 million, the largest in thehistory of UNH, from alumnus, entrepreneur and philanthropistPeter T. Paul. The new building will allow UNH to meet moredemand for its business programs by expanding capacity from1,700 to 2,500 students.NEASC Extends KSC Accreditation – Keene State Collegeis recognized nationally for the quality of its programs andcollections. Attesting to the strength of Keene’s academicprogram, the New England Association of Schools & Colleges(NEASC) voted in May <strong>2011</strong> that the college be continuedin accreditation for ten years. The college has also garneredFlow Physics Facility director Joe Klewicki, professor of mechanicalengineering at the <strong>University</strong> of New Hampshire, is in front of the two400-horsepower fans that each move 250,000 cubic feet of air per minute.6

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTacknowledgement from First Lady Michelle Obama, whose“Let’s Move!” initiative to end childhood obesity drew nationalattention to Keene’s Early Sprouts program. Early Sprouts is anaward-winning curriculum developed by Keene State educatorsto encourage preschoolers to eat vegetables.KSC to Receive “Granny D” Papers – Already distinguishedfor the depth of its archival resources, Keene State College wasselected to receive a collection of artifacts chronicling the lifeof US political icon Doris “Granny D” Haddock. The collectionconsists of personal papers, correspondence, photographs,scrapbooks, and memorabilia that document Granny D’s work tobring about campaign finance reform, her legendary walk acrossthe country to promote reform, her twenty-two thousand milevoter registration drivefor working women andminorities, and her run forthe United States Senate.The “Granny D” Collectionis a cornerstone of KeeneState’s New HampshireSocial Justice Collection,which documents thehistory of social and civilrights activism in New Hampshire. This world-class collection inthe Mason Library currently consists of archival holdings relatingto the civil rights worker and Episcopal seminarian Jonathan M.Daniels; Christine Sweeney and her landmark civil rights case;New Hampshire Senator Junie Blaisdell; and the work of theAcademy Award winning, socially conscious state filmmakerLouis de Rochemont.New Leader at UNH Law School – After completing a nationalsearch, the <strong>University</strong> of New Hampshire School of Law namedoutgoing Chief Justice JohnT. Broderick Jr. of the NewHampshire Supreme Court, asits new dean and president.In January <strong>2011</strong> he replacedretiring Dean John D. Hutson,who has led the school since2000. Prior to serving on theSupreme Court, Broderick wasa litigation attorney in theManchester, NH, law firm ofDevine, Millimet & Branch, andwas a founding shareholder ofBroderick & Dean ProfessionalAssociation. He is a graduate,magna cum laude, of theCollege of the Holy Cross andthe <strong>University</strong> of Virginia School of Law.UNH Law Now Number Four for Intellectual Property Law inNational Rankings – The <strong>University</strong> of New Hampshire School ofLaw rose to number four in the specialty rankings for intellectualproperty law by U.S. News & World <strong>Report</strong> in the 2012 editionof America’s Best Graduate Schools. It was also recognized as a“top tier” school in the overall rankings. The UNH School of Lawcontinues the tradition of Franklin Pierce Law Center of beingranked among the nation’s top intellectual property (IP) schoolseach and every year since specialty law school rankings beganin 1992. In this year’s rankings, which are based on a survey ofIP faculty members around the country, only Berkeley, Stanford,and George Washington placed ahead of UNH Law.The school broke ground on an addition to the school that willhouse the new Franklin Pierce Center for Intellectual Propertyand named Mary Wong its inaugural director. Wong is chair ofthe Intellectual Property Graduate Programs and a professor oflaw. The primary mission of the new center will be to promoteglobal economic development by facilitating research andtraining in the protection and use of intellectual property fortechnological innovation.PSU Student Wins National Weather Forescasting Contest– Brian Pevear, a 2010 Plymouth State <strong>University</strong> graduate,bested more than 1,800 undergraduate and graduate students,professors, and professionals in the Weather Challenge: theNorth American Collegiate Forecasting Contest. Pevear wonby correctly forecasting the weather for two-week periods inten cities over the academic year using his own methodologyto interpret commonly used weather forecasting tools. “I usedknowledge I picked up over the past four years at PSU’s JuddGregg Meteorology Institute, and used meteorological computermodels to calculate my forecasts,” Pevear said. “The faculty hereat Plymouth State is very, very knowledgeable and I have learnedsomething from all of them.”UNH Serves as a National Resource to Assist Gulf of MexicoCleanup Recovery – The <strong>University</strong> of New Hampshirecontinues to play a major role in the aftermath of the explosionof Deepwater Horizon in the Gulf of Mexico and the resultinglargest oil spill in U.S. history. Nancy Kinner, co-director of theCoastal Response Research Center and professor of civil andBrian Pevear, a 2010 Plymouth State<strong>University</strong> graduate,shows off the national WeatherChallenge award he received.7

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTMoody’s Investor Service Maintains“Stable” Outlook for <strong>USNH</strong> – On June8, <strong>2011</strong>, Moody’s affirmed its Aa3 ratingand reported that the outlook remains“stable” for <strong>USNH</strong>.In the opinion, Moody’s provided thefollowing summary rating rationale:“The <strong>System</strong>’s rating reflects itsimportant role providing public highereducational alternatives, includingthe state’s land-grant institution,within New Hampshire and a historyof positive operating performance.We expect the <strong>System</strong> to absorbanticipated steep cuts in statefunding through ongoing expensecontainment, increased fund raising,growth of student charges, and atemporary modest use of unrestrictedreserves to balance the budget in FY2012.”The report also cited stronggovernance and management ascritical credit factors. “The strength ofmanagement and governance at <strong>USNH</strong>is highlighted by the <strong>System</strong>’s historyof consistently positive operatingperformance, its ability to produce amulti-year budget forecast that tiesto the audited financial statements(including projected unrestricted netasset balances), and good disclosureincluding unaudited interim financialstatements which also tie to theaudited financials.”environmental engineering, was asked to speak before the National Commission on theBP Deepwater Horizon Oil Spill and Offshore Drilling, established by President BarackObama, about the use of dispersants in the response to the drill. She was sought afterfor her expertise by hundreds of national media outlets and members of Congress. Soonafter, Larry Mayer, director of UNH’s Center for Coastal and Ocean Mapping, was tappedto lead the National Research Council’s committee to study the effects of the spill onecosystem services in the Gulf of Mexico. His center received $35.7 million over five yearsfrom the National Oceanic and Atmospheric Administration (NOAA) in recognition of theimportant work of the Joint Hydrographic Center.GSC Offers its First Master’s Degree – In <strong>2011</strong>, Granite State College marked animportant milestone in the evolution of the college: it unveiled its first-ever graduateprogram, a Master of Science Degree in Project Management. The new program isunique and was created based upon a keen evaluation of the needs of New Hampshire’sworkforce and understanding of the marketplace. No other college or university in NewHampshire currently offers a distinct degree devoted purely to project management.The first cohort of Master’s candidates – 50 students total – came together in the fall of<strong>2011</strong>. The program is designed for individuals who want to make a career change, currentproject managers who want to further develop in their profession, and those in otherdisciplines who want to expand their job opportunities.GSC Introduces Bachelor of Science Degree in Health Care Management –Responding to student interest and employment opportunities within the sector, GraniteState College launched a new Bachelor of Science Degree in Health Care Management.The degree provides graduates with specialized skills that prepare them to coordinatetechnology, people and resources efficiently and creatively in hospitals, nursing homesand health-related organizations. The coursework covers health care administration,policy, emerging trends, financial management and health information systems. Coupledwith GSC’s commitment to providing hands-on, practical experience, the degree offersstudents a competitive edge in the health care management field.3. The <strong>University</strong> <strong>System</strong> Directs Its Operations Efficiently andEffectivelyThe New Hampshire State Legislature in <strong>2011</strong> tackled a significant projected budgetshortfall for the coming biennium by cutting the overall budget by 11 percent over theprevious budget. As a result, nearly every entity that received state support saw a reductionin that support. Both the <strong>University</strong> <strong>System</strong> and the Community College <strong>System</strong> of NewHampshire were forced to absorb some of the largest year-over-year cuts in terms ofpercentage nationally. Despite these cuts, the <strong>USNH</strong> Board of Trustees approved a budgetthat offset more than 80 percent of the funding reductions through spending cutbacks.<strong>USNH</strong> Student CostsAverage<strong>Annual</strong>2008 2009 2010 <strong>2011</strong> 2012 ChangeTuition, room, board, and mandatory feesNH ResidentUNH $ 19,238 20,352 21,617 22,724 24,702 6.4%PSU 15,574 16,574 17,374 18,566 20,358 6.9%KSC 15,748 16,574 17,508 18,530 20,330 6.6%NonresidentUNH 32,198 33,832 35,587 36,694 38,022 4.2%PSU 23,124 24,424 25,544 26,736 27,818 4.7%KSC 23,298 24,424 25,678 26,700 27,790 4.5%Costs reflect tuition, mandatory fees, double room, and typical meal plan.Average Increase 5.7%8

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTOperating Budget – In June <strong>2011</strong>, the <strong>USNH</strong> Board of Trusteesapproved a $970 million “all funds” operating budget forFY12 that included significant cuts across the entire systemto address very substantial reductions in state support. Thestate appropriations reductions total $48.4 million, of whichmore than 80 percent will be offset through expense savings.Despite the unprecedented budget challenges faced by a 48percent reduction in support in a single year, the overall cost ofattendance (i.e., the “sticker price” for all tuition and fees for atypical student living on campus) increases for in-state studentswere held to 8.7 percent at the <strong>University</strong> of New Hampshireand 9.7 percent at Plymouth State <strong>University</strong> and Keene StateCollege. The increase at Granite State College is 5.8 percent. Thebudget includes the elimination of upwards of 200 positions,reductions in employee benefits, hiring and salary freezes, costcutting across the campuses, and modest use of reserves.<strong>USNH</strong> has a positive long-term outlook, despite its near-termbudget challenges. For this reason, the Board has made strategicbudget decisions that will strengthen <strong>USNH</strong> and enable it tothrive well beyond FY12. Importantly, the FY12 budget did notreduce its commitment to deferred maintenance of campusfacilities, or to campus presidents’ strategic initiatives. Nor did<strong>USNH</strong> increase nonresident tuition to the point <strong>USNH</strong> will nolonger be competitive, thereby avoiding loss of the net tuitionfrom nonresidents it depends on. Instead, the Board increasedits strategic investment in campus advancement infrastructureto enhance private giving; it invested in new academic programssuch as nursing at PSU and KSC; it invested in strategic buildingprojects such as the Peter T. Paul College of Business at UNH andthe KSC Technology, Design and Safety Center; and it increasedits commitment to need-based financial aid to ensure continuedaccess and affordability.Strategic investment made at a time of financial stress isthe hallmark of a Board that is disciplined in its fiduciaryresponsibility to provide the people of New Hampshire withhigh-quality educational resources over the long-term. <strong>USNH</strong>is 48 years old this year and is in good financial health. TheBoard of Trustees is charged with making sure <strong>USNH</strong> staysfinancially healthy for at least another half century. The key toaccomplishing this is to properly balance today’s needs withlong-term needs for reinvestment by generating a sufficientoperating margin, even in the most difficult of times.The <strong>USNH</strong> budget included a significant increase for financialaid. The neediest New Hampshire students continue to faceescalating challenges to cover the cost of higher education in avery difficult economic climate. More than 30 percent of <strong>USNH</strong>in-state students are currently eligible for the federal Pell grantsprogram, which is based on family income. In response to theincreased need, <strong>USNH</strong> will spend more than $130 million forstudent financial aid next year. Over the past ten years, <strong>USNH</strong>institutional grant/scholarship dollars for in-state undergraduatestudents has increased by more than five times.NH Public Television Adjusts to Loss of State Funding – Asa result of losing all its state funding ($2.7 million) as of July 1,<strong>2011</strong>, New Hampshire Public Broadcasting/New HampshireOn June 13th, Granite State College celebrated the graduation of over 500 studentsfrom its Bachelors and Associates programs at the Capitol Center for the PerformingArts in Concord. GSC also presented an Honorary Doctorate in Humane Letters toWMUR personality Fred Kocher, the Granite State Award to Northeast Delta DentalCEO Tom Raffio, and the <strong>2011</strong> GSC Distinguished Faculty Award to Craig Nevins.NEW HAMPSHIREPUBLIC TELEVISIONPublic Television (NHPB/NHPTV)underwent a major restructuringat the end of FY11 to offset the 30percent reduction in its $8.8 millionannual budget. Under the directionof the <strong>USNH</strong> Board of Trustees andNHPB Board of Directors, NHPTVeliminated twenty full-time positions,reduced staff salaries and thestation’s 403(b) staff retirement plan contribution, cancelled andrenegotiated dozens of contracts and services to reduce cost,and reduced the station’s educational engagement services.In addition, NH Outlook and Granite State Challenge, two locallyfocused programs produced by NHPTV, were placed on hiatusuntil additional funding can be secured. NHPTV is airing thefull PBS national broadcast schedule, and some locally-focusedprograms. It is offering limited community engagement andonline educational services.Going forward, NHPTV is exploring ways to implement furtheroperational efficiencies. This includes potential collaborationwith other New England public broadcasters to develop astrategic and sustainable model that will allow it to deliverquality PBS national and local programs throughout the region.NHPTV continues to operate from its broadcast center inDurham, as New Hampshire’s only locally owned and operatedstatewide television network.9

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTPlymouth State <strong>University</strong> President Sara Jayne Steen (bottomleft) is pictured with colleagues as part of the university’srecognition as “a best company to work for.”Granite State College Inaugurates New President On April7, <strong>2011</strong> Granite State College celebrated the inaugurationof its fourth president, Dr. Todd J. Leach, at the McAuliffe-Shepard Discovery Center in Concord. He became presidentof Granite State College on July 1, 2010, succeeding Dr. KarolLaCroix, who retired in 2010.Under the leadership of its new president, Granite StateCollege has begun launching a variety of exciting initiativesaimed at advancing the College’s mission and fueling recordgrowth. Enrollments at GSC are currently among the highestin the College’s history. In his inaugural address, titled“Access Through Innovation,” Dr. Leach discussed GraniteState College’s mission to serve the state’s adult learners andwhat that mission means for the State of New Hampshire.“The mission of connecting adult students with dynamichigher education experiences that prepare and empowerstudents to better their careers and their lives is not onlya compelling one, but one that is a prerequisite to theeconomic health and vitality of New Hampshire,” saidDr. Leach in his address. “Higher education today is nowessential to both career mobility and job stability.”Among those in attendance at Dr. Leach’s inauguration were (L to R) <strong>USNH</strong> Chancellor EdwardMacKay, <strong>USNH</strong> Board of Trustees Chairman Edward Dupont, Vice Chairman George Epstein andSecretary Peter Lamb. Over one dozen delegates from other colleges and universities attendedthe celebration.KSC Technology, Design and Safety Center will MaximizeEnergy Efficiency – Effective and efficient stewardship ofresources is central to the Keene State mission. The college hashad great success achieving this aim through environmentallyresponsible initiatives and by encouraging privately driveninvestments that advance the college’s mission. To unifythree of its leading academic programs—Safety Studies,Architecture, and Sustainable Product Design and Innovation(SPDI)—the college has begun construction of a state-of-theartTechnology, Design and Safety Center, which will achievezero net energy performance and LEED Platinum certification.A photovoltaic solar array across the building’s entire roofwill provide approximately 50 percent of the center’s annualenergy demand, controlling the college’s carbon footprint andgenerating significant savings over time. The center will inspire21st century learning and teaching and will expand totalenrollment capacity in Safety Studies, Architecture, and SPDIfrom 340 to 500 majors.By promoting private investment, the college has also securedessential new student housing with minimal expense. With thecollege’s approval, J. Chakalos Investments LLC will constructa four-story, thirty-seven-unit apartment building for KeeneState students at a location near campus. The building willoffer two-, three-, and four-bedroom units and will be able tohouse 135 students. The building will also offer limited parkingfor residents.GSC Applications Up Over 50 Percent – Granite StateCollege’s applications are up more than 50 percent overlast year. Attributable to a number of initiatives includingoverhauling the application, eliminating cumbersomeapplication fees, and streamlining internal processes, thecollege has been able to drastically increase its application rate.Additionally, the rate of conversion from inquiry to enrollmenthas increased significantly, thanks to the efforts to make theapplication and enrollment processes more student-centered,friendly, clear, and accessible.10

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTPSU Named One of the Best Large Companies to Work for –Employee engagement was one of the reasons Business NewHampshire Magazine chose Plymouth State <strong>University</strong> as oneof the five best large companies to work for in New Hampshire.It is the first time an educational institution was included inthe “Best Large Companies” ranking by the magazine. Thecriteria included employee satisfaction within the workplace,innovative workplace programs and benefits. “The selection ispublic recognition of the high quality of our community, of ourcommitment to our students and our region, of our commitmentto each other,” PSU President Sara Jayne Steen said. “People herework actively to make PSU a good place to live and learn, and I’mpleased that their good work is being acknowledged.”PSU Community Helps Planning and Budgeting DecisionMaking – In this year of financial challenges, the Planning andBudget Leadership Group (PBLG) at Plymouth State <strong>University</strong>has provided an important campus voice in aligning strategicpriorities with available resources. The PBLG reviewed a numberof cost-saving and revenue-enhancing recommendations thatmaximize the use of available resources in order to achieve themission of the <strong>University</strong>. These recommendations, based on acampus-wide participatory process, assisted the president andcabinet in making decisions.4. The <strong>University</strong> <strong>System</strong> Is Recognized as aPartner of Choice by Others<strong>USNH</strong> recognizes that in order to fulfill its mission, theinstitutions and the system as a whole must be engaged in itscommunities and with its many constituencies to provide thebest service possible.Each institution can cite numerous collaborative effortson the local, state, and even national levels where thesepartnerships create significant benefits to those who are served.From relatively new uses of technology and innovations insustainability, to health care, lifelong learning, and economicdevelopment, these collaborations truly demonstrate why<strong>USNH</strong> and its institutions are partners of choice. All four<strong>USNH</strong> institutions are regularly sought out by businesses forcollaborations. Some recent examples include the following:KSC Sought After as a Critical Partner for Innovation – Agroup of Keene State College faculty has been invited by theAssociation of American Colleges & Universities (AAC&U) topartner with institutions across the country to re-imaginegeneral education. As a part of AAC&U’s Shared Futures: GlobalLearning and Social Responsibility Initiative, these facultymembers will develop a national agenda for global learning. Thecollege is also a partner institution within the New HampshireIDeA Network of Biological Research Excellence (NH-INBRE).Sponsored by the National Center for Research Resources atthe National Institutes of Health, NH-INBRE is a collaborativenetwork of New Hampshire colleges and universities that issupporting advances in scientific discovery and training the nextgeneration of researchers. On the state level, Keene State hasThe David F. Putnam Science Center at Keene State College features state-of-the-art labs andequipment for scientific research.been designated by New Hampshire Governor John Lynch asthe only institution in the state responsible for implementationof the Occupational Safety and Health Administration (OSHA)Consultation Program. OSHA Consultation Centers offer freeand confidential advice to small and medium-sized businessesin all states across the country. Keene State already hosts oneof twenty-five OSHA Training Institute Education Centers in thenation. Keene State’s center is ranked fourth among its peers. Itoffers both bachelor of science and master of science degrees.Carnegie Foundation Recognizes KSC, PSU and UNH –<strong>USNH</strong>’s three residential institutions are among only 311institutions nationwide that earned the Community EngagementClassification by The Carnegie Foundation for the Advancementof Teaching. The classification recognizes demonstratedcommitment to community partnerships, educational outreach,and service learning. It also shows that teaching, learning,and research are done in collaboration with communities andenhance the well-being of the region through application ofknowledge to economic development.PSU Becomes Even More Welcoming – With the opening of thenew Eugene and Joan Savage Welcome Center and Ice Arena,PSU has additional opportunities to provide sports entertainmentand exercise for central New Hampshire. The Hanaway Rink atthe PSU Ice Arena has become home to a number of communityactivities, from learn-to-skate sessions and family skating events tothe popular weekend “teen nights.” The PSU men’s and women’shockey teams are also enjoying their home ice advantage overvisiting teams in the new arena.The PSU Welcome Center also plays a larger role as a regionalwelcome center. The Center’s lobby now contains banners andinformation promoting the Plymouth Chamber of Commerce andother local business and tourism organizations. Other regionalbusiness and attraction information is available for visitors to the<strong>University</strong> and others visiting the area.11

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTMurals created by Plymouth State <strong>University</strong> students adorn a vacant Brown Company building and capture Berlin’s cultural history and heritage.PSU Student Murals Depict Berlin’s Cultural History – The richhistory of the Brown Company in Berlin and the surroundingcommunities is coming to life thanks to a unique partnershipwith the Center for Rural Partnerships at Plymouth State<strong>University</strong>, Tri-County Community Action Program (CAP), WhiteMountain Lumber, and the Neil and Louise Tillotson Fund of theNew Hampshire Charitable Foundation. The highlight of thepartnership is a group of twenty-four murals created by PSUstudents displayed on the side of a vacant Brown Companybuilding in Berlin depicting Berlin’s cultural history and heritage.The former research and development building opened in1915, and over the next fifty years the company’s scientistspioneered innovations in the wood pulp and paper industries,transformed the use of forest products, and enhanced the valueand productivity of forests across New England and the world. It islisted on the 2010 “Seven to Save” list as a state threatened historicresource.UNH Expands Global Initiatives to Attract InternationalStudents – The <strong>University</strong> of New Hampshire advanced its effortsto make the institution more global and diverse with the launch ofthe state’s only Confucius Institute and a new partnership with anAustralian firm that recruits and supports international students.In addition to providing UNH students with access to a completecurriculum in Chinese language and culture, the institute alsoprovides opportunities for cultural learning and exchange forprimary through post-secondary schools in the region.A second effort—the university’s partnership with Navitas—willnot only make UNH a more diverse and international institutionwith the students it brings to campus, but will broaden theuniversity’s revenue stream. The first group of students arrived oncampus in May.GSC Delivering Leadership Training – Granite State Collegeand Bruce Mast & Associates, Inc. (BMA) joined forces to provideempowering hands-on leadership development programs tobusinesses and their employees statewide. Based in Portsmouth,BMA is a human resource firm that focuses on leadership andorganizational development. BMA’s proprietary five-sessionStepping Up To Leadership® program and the ten-sessionLeadership On The Line® program are each custom-tailored to NewHampshire’s business community. The Stepping Up To Leadershipprogram was first offered at GSC campuses, in Rochester, Conwayand Claremont, with additional program expansions planned for<strong>2011</strong>.Stepping Up To Leadership offers employers and current businessleaders compelling perspectives and insights into the kinds ofleadership roles—and the leaders needed to fill them—necessaryto ensure the further growth and success of their businesses.Meanwhile, individuals identified as emerging leaders garner afundamental understanding of leadership and its impact, bothpersonal and from an organizational perspective, as well as anunderstanding of the basic tools of leadership. GSC and BMAserve a common constituency (the businesses in the State of NewHampshire) and share a common commitment to assist thosebusinesses in building effective leaders.12

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTManagement’s Responsibility for <strong>Financial</strong><strong>Report</strong>ing and Internal ControlsThe accompanying financial statements, footnotes,management’s discussion and analysis, and all informationin this <strong>Annual</strong> <strong>Report</strong> are the responsibility of management.Management has prepared the financial statements and accompanyingnotes in accordance with generally accepted accounting principles and,in the process, has made judgments and estimates which affect theamounts as reported. Management is responsible for the integrity andobjectivity of all representations in this report.The financial reporting process utilizes an on-line budgeting andaccounting system with spending controls on operating funds andelectronic access and approvals. Managers of all <strong>USNH</strong> funds havecontinual on-line access to the status of their accounts in order tomeasure operating results against the budget and to assure effectivecustodianship of funds. Transactions as recorded in the accountingsystem are aggregated and reflected in regular monthly reports tomanagement, in periodic interim reports to the Board of Trustees’<strong>Financial</strong> Affairs Committee, and in the annual audited financialstatements, approved by the full Board.The internal control systems include an organizational structure thatprovides for careful recruitment and training of qualified personnel,proper segregation of financial duties, and a program of regular internalaudits. These controls are designed to provide reasonable assurancethat assets are safeguarded against loss from unauthorized use ordisposition, transactions are executed in accordance with management’sauthorization, and such transactions are recorded properly, resultingin financial statements that are free from material misstatement.Management seeks to continually improve internal controls, given coststhereof and management’s assessment of the probability andpotential consequences of future events. According to the “InternalControl – Integrated Framework” report published by the NationalCommission on Fraudulent <strong>Financial</strong> <strong>Report</strong>ing (the TreadwayCommission), internal controls can be judged effective if managementhas “reasonable assurance that (1) they understand the extent to whichthe entity’s operating objectives are being achieved, (2) publishedfinancial statements are being prepared reliably, and (3) applicable lawsand regulations are being complied with.” Based on these requirementsit is management’s opinion that the internal control systems employedby <strong>USNH</strong> are effective.The Audit Committee of the Board of Trustees is responsible foroverseeing <strong>USNH</strong>’s financial reporting process and internal controlsystems, as well as recommending and engaging independent publicaccountants for the annual audit. The internal auditors, while employeesof <strong>USNH</strong> are nevertheless objective in the planning, conducting andreporting of their audits. The Audit Committee, the voting membersof which are solely outside trustees, meets at least three times per yearand at the request of the Director of Internal Audit. Both internal andexternal auditors have unencumbered access to the Audit Committee atall times.PricewaterhouseCoopers LLP, certified public accountants, have issuedtheir unqualified opinion as to the fair presentation of the financialstatements that follow. Thus, for all 48 years of its existence, <strong>USNH</strong> hasreceived only unqualified opinions from its independent auditors. Aspart of their audit, PricewaterhouseCoopers LLP assessed the accountingprinciples used and significant estimates made by management.Although it is not practical to examine all transactions and accountbalances, the auditors have conducted a study and evaluation of <strong>USNH</strong>internal control systems and performed tests of transactions andaccount balances to provide reasonable assurance that the financialstatements are free from material misstatement.The <strong>Report</strong> of Independent Auditors, which expresses the auditor’sopinion on the <strong>2011</strong> financial statements, is reproduced on the followingpage.Kenneth B. CodyVice Chancellor for <strong>Financial</strong> Affairsand Treasurer/CFOCarol A. MitchellController13

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORT<strong>Report</strong> of Independent AuditorsTo the Governor, State of New Hampshire;Legislative Fiscal Committee,State of New Hampshire;The Board of Trustees,<strong>University</strong> <strong>System</strong> of New Hampshire:In our opinion, the accompanying consolidated statements of net assets and the related consolidatedstatements of revenues, expenses and changes in net assets and cash flows, present fairly, in all materialrespects, the financial position of the <strong>University</strong> <strong>System</strong> of New Hampshire (<strong>USNH</strong>) at June 30, <strong>2011</strong> and2010, and its consolidated revenues, expenses and changes in net assets and cash flows for the yearsthen ended in conformity with accounting principles generally accepted in the United States of America.These financial statements are the responsibility of the <strong>USNH</strong>’s management. Our responsibility is toexpress an opinion on these financial statements based on our audits. We conducted our audits of thesestatements in accordance with auditing standards generally accepted in the United States of America.Those standards require that we plan and perform the audit to obtain reasonable assurance about whetherthe financial statements are free of material misstatement. An audit includes examining, on a test basis,evidence supporting the amounts and disclosures in the financial statements, assessing the accountingprinciples used and significant estimates made by management, and evaluating the overall financialstatement presentation. We believe that our audits provide a reasonable basis for our opinion.The Management’s Discussion and Analysis on pages 15 through 22 is not a required part of the basicfinancial statements but is supplementary information required by the Governmental AccountingStandards Board. We have applied certain limited procedures, which consist principally of inquiries ofmanagement regarding the presentation of the supplementary information. However, we did not audit theinformation and express no opinion on it.September 23, <strong>2011</strong>14PricewaterhouseCoopers LLP, 125 High Street, Boston, MA 02110T: (617) 530 5000, F: (617) 530 5001, www.pwc.com/us

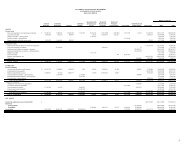

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTManagement’s Discussion and AnalysisI. IntroductionThe following unaudited Management’s Discussion and Analysisincludes an analysis of the financial condition and results of activitiesof the <strong>University</strong> <strong>System</strong> of New Hampshire (<strong>USNH</strong>) for the fiscalyear ended June 30, <strong>2011</strong>. This analysis provides a comparisonof significant amounts and measures to prior periods and, whereappropriate, presents management’s outlook for the future.<strong>USNH</strong> is a Section 501(c)(3) corporation organized under the lawsof the State of New Hampshire to serve the people of the stateas the premier public provider of higher education, research andpublic service. <strong>USNH</strong> accomplishes its mission by operating foureducational institutions that collectively offer a full array of highereducation options for the state. These institutions include the<strong>University</strong> of New Hampshire, with campuses in Durham (UNH)and Manchester (UNHM); Plymouth State <strong>University</strong> (PSU); KeeneState College (KSC); and Granite State College (GSC). While <strong>USNH</strong>performs public service and conducts scholarly research across theglobe, most of <strong>USNH</strong>’s activities take place at the three residentialcampuses (UNH, PSU and KSC), the urban campus (UNHM), thenine regional sites of GSC, and the Cooperative Extension andSmall Business Development Centers located throughout thestate. The accompanying financial statements also include theactivities and balances of the state’s only public television station,New Hampshire Public Broadcasting (NHPB); the <strong>University</strong> of NewHampshire Foundation, Inc. (UNHF); and the Keene EndowmentAssociation (KEA) - three legally separate but affiliated entities.These statements do not include the activities and balances of theUNH School of Law, a legally separate corporate entity for whichUNH is the sole member, since majority control over the operationsdoes not currently reside with UNH.II. <strong>Financial</strong> Highlights and EconomicOutlookThe state economic environment has been a major concern for <strong>USNH</strong>,particularly over the past year. State general appropriations haveprovided a small, but stable, revenue stream for the past twenty-five +years. For 2012 and 2013 <strong>USNH</strong>’s general appropriation will be reducedto $51.7 million and $54.7 million, respectively. <strong>USNH</strong> has taken anumber of steps to address this unprecedented reduction including(1) modifying fringe benefit programs, (2) offering early retirementincentives, (3) reducing staffing levels, (4) increasing tuition rates forNH residents, and (5) making strategic investments that will enhancerevenue or reduce costs over the long-term.<strong>USNH</strong> has a positive long-term outlook, despite its near-term budgetchallenges. For this reason, the Board of Trustees has made strategicdecisions that will strengthen <strong>USNH</strong> and enable it to thrive beyond2012. Importantly, the 2012 budget does not reduce our commitmentto funding deferred maintenance needs in existing facilities, nor does itincrease tuition to levels where we are no longer competitive with othercolleges and universities. Instead, the Board took difficult cost cuttingmeasures while also increasing funding for campus strategic initiativesthat will ultimately strengthen <strong>USNH</strong> for the long-term. The Board alsoincreased <strong>USNH</strong>’s commitment to need-based financial aid as well toensure continued access and affordability for our students.The remainder of this report describes the results of financialoperations for the year ended June 30, <strong>2011</strong> as compared to prior years.<strong>USNH</strong> management and trustees are determined to build on thesesuccesses to address the challenges we face, and to meet our fiduciaryresponsibility to provide the state with high-quality educationalresources.<strong>2011</strong> Revenues = $911 Million(not including capital additions/deductions)(shown here at gross amounts, not netted for student financial aid)($ in millions)Chart 1: <strong>2011</strong> Revenues by SourceSales of auxiliary services$192 (21%)Resident tuition$167 (18%)Chart 2: <strong>2011</strong> Revenues by InstitutionPSU$120 (13%)GSC$19 (2%)NHPB and other$17 (2%)Gifts, investmentincome andother revenue$57 (6%)Nonresident tuition$193 (21%)KSC & KEA$130 (14%)General appropriations$100 (11%)Federal PellGrants$24 (3%)Grants andcontracts$147 (16%)Student fees$31 (4%)UNH(includes UNHM & UNHF)$625 (69%)15

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTA. RevenuesChart 1 shows revenue diversification in <strong>2011</strong>, and Chart 2 shows these samerevenues broken down by institution.<strong>USNH</strong> general appropriations for <strong>2011</strong> were 11% of total revenue. The 2012 stateoperating appropriation will decrease by $48.3 million so that state appropriationsare expected to be only 5.7% of total revenue in 2012 (see Chart 3).$450400350300250200150100500Chart 3: Twenty-Five Year Revenue Comparison(not including capital additions/deductions)($ in millions)19881989199019911992199319941995199619971998199920002001200220032004200520062007200820092010*BudgetedGrants and contracts, auxiliary enterprises, gifts, and other incomeTuition and fees (not netted for financial aid)State of NH general appropriations<strong>2011</strong>*2012Table 1: Full-Time Equivalent (FTE)Credit Enrollment in the Fall of Each Year2006 2007 2008 2009 2010UNH 13,741 13,856 13,925 14,250 14,211PSU 5,322 5,554 5,677 5,400 5,234KSC 4,550 4,815 4,979 5,084 5,096UNHM 848 861 840 889 913GSC 1,038 1,031 1,064 1,220 1,278Total <strong>USNH</strong> FTEs 25,499 26,117 26,485 26,843 26,732NH Resident 16,059 16,374 16,374 16,747 16,927Nonresident 9,440 9,743 10,111 10,096 9,805Total <strong>USNH</strong> FTEs 25,499 26,117 26,485 26,843 26,732Table 2: Freshman Applications, Acceptances and Enrollees atUNH at Durham in the Fall of Each Year2006 2007 2008 2009 2010Freshman applications received 13,991 15,122 16,246 16,132 16,545Freshman acceptances as % ofapplications (selectivity ratio) 67% 59% 65% 72% 73%Freshman enrolled as % ofacceptances (matriculation yield) 33% 30% 26% 26% 24%Student tuition and fees accounted for $390.9 million or 43%of <strong>USNH</strong> revenue in <strong>2011</strong> as enrollments at <strong>USNH</strong> institutionscontinued to grow. In the past four years, credit enrollmentsat <strong>USNH</strong> have increased 4.8%, or 1,233 FTE students, includingincreases of 868 resident students and 365 nonresident students(see Table 1).As seen in Table 2, there has been an 18% growth in annualapplications to the flagship campus, UNH at Durham, over thepast four years. During this period of growth <strong>USNH</strong> institutionshave maintained or improved the quality of their incomingstudents. Approximately 47% of new UNH students in the fallof 2010 ranked in the top 20% of their high school class. Thisis equal to the percentage in 2006. The combined SAT scoresfor new UNH students averaged 1105 in the fall of 2010, nearlyidentical to the 1104 average in the fall of 2006.The growth in enrollments combined with the economicdownturn has resulted in significant increases in need-basedstudent financial aid, particularly in 2010 and <strong>2011</strong>. Need-basedawards were up $10.1 million (14.8%) from 2010 to <strong>2011</strong> whileother types of aid remained fairly constant. This compares toan increase of $19.0 million (38.5%) from 2009 to 2010, and anincrease of $38.0 million or 94.2% over the 2007 level.All campuses are working to generate revenues from facilitiesusage over the full year rather than just during the traditionalsemesters. In 2010 UNH added a highly successful shortsemester during the winter break. In addition, each campus isexpanding online as well as summer session courses to increasecapacity for additional enrollments without adding significantcosts. Summer housing opportunities are also being added tocomplement these programs.Auxiliary revenues grew $4.2 million and $11.1 million in<strong>2011</strong> and 2010, respectively. The primary components ofthis revenue stream are enrollment-driven including studenthousing, dining, health, recreation and transportation fees. In<strong>2011</strong> and 2010 auxiliary revenue also included $1.6 million and$0.9 million, respectively, from renewable energy credit andelectricity sales generated by UNH’s recently completed ECOLinerenewable methane gas pipeline (see the Capital and DebtActivities section for more information on energy infrastructureinitiatives).Grant revenues in <strong>2011</strong> are up $28.3 million or 19.9% over 2010.This compares to an increase of $7.9 million or 5.9% from 2009to 2010. Sponsors of UNH awards include the US government,the state, foundations, non-profits and the commercial sector.The ten-year record of UNH competitively-won awards forresearch and other sponsored programs is shown in Chart4. The large increase in <strong>2011</strong> is due to a single $44.5 million,three-year American Recovery and Reinvestment Acts (ARRA)award to UNH for the Network New Hampshire Now projectto implement high-speed broadband “dark fiber” to all tencounties of the state. Including cost sharing commitments frompublic and private partner organizations, this complex projectis expected to cost $65.9 million and includes 450 miles of fiber.Upon completion in 2013, the benefits will include high-speedinternet access for nearly all major institutions and businesses inNew Hampshire.Facilities and administrative cost recoveries on grants andcontracts totaled approximately $20.6 million in <strong>2011</strong> and $18.4million and $18.5 million in each of 2010 and 2009, respectively.This important unrestricted revenue stream is used to support16

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTinfrastructure at each campus. During 2010, UNH successfully negotiatednew facilities and administrative cost rates for federally-sponsoredprograms for the next four years. The recovery rate for UNH on-campusresearch awards was 46% for <strong>2011</strong> and will increase by one-half percenteach year until reaching 47.5% for 2014 awards.As noted above, the general economy has impacted <strong>USNH</strong> with decreasedgeneral appropriation revenue and increased student financial aid costs.The economy is also impacting our gift revenue streams. Gift revenues ofall types (noncapital, endowment and plant) totaled $22.2 million in <strong>2011</strong>and $21.6 million in 2010, respectively. This is down significantly from the$29.4 million received in 2009. <strong>USNH</strong> has targeted gift revenues as an areaof focus for future years, and has committed $14.7 million between fiscalyears 2007 and 2014 to supplement ongoing development operatingbudgets. The added investments are designed to improve advancementinfrastructure and fundraising results to help offset the reduced stateappropriation level going forward.B. Investing ActivitiesThe <strong>USNH</strong> endowment pool generated gains of 18.5% in <strong>2011</strong>. Thiscompares to gains of 9.7% in 2010 and a loss of 23.2% in 2009. The largeloss of 2009 was unprecedented and effectively offset all previous gainsat that time. <strong>USNH</strong> began working with investment consultants, PrimeBuchholz, in late 2009 and with their assistance <strong>USNH</strong> has completelyrestructured the investment pool and adopted a new investment policy.In addition to reducing general appropriation revenue beginning in 2012,the state also announced that the UNIQUE endowment program wouldno longer be available to fund public institutions in New Hampshire. Thisrevenue stream generated $4.4 million during both <strong>2011</strong> and 2010, andwas an important source of annual additions to the <strong>USNH</strong> endowment.Chart 5 shows the change in <strong>USNH</strong> endowment and similar asset balancesover the past ten years. The State of New Hampshire adopted the UniformPrudent Management of Institutional Funds Act (UPMIFA) in 2009. Asa result of this new legislation, both <strong>USNH</strong> and UNHF updated theirendowment spending policies to allow payout from underwater trueendowment funds beginning in 2010. Management capped the <strong>USNH</strong>endowment payout-for-purpose in <strong>2011</strong> and 2010 at 85% of the 2009payout-per-unit level to mitigate the impact of the 2009 losses on theinvestment valuations, and will maintain this level for 2012 as well.<strong>USNH</strong>’s non-endowment operating investments generated positive returnsin <strong>2011</strong>. The <strong>2011</strong> earnings of $9.7 million compare to $14.7 million in 2010and a loss of $0.3 million in 2009. <strong>USNH</strong> revised its operating investmentguidelines and further diversified its operating investments in <strong>2011</strong> toensure preservation of capital and adequate liquidity.C. Cost Containment<strong>USNH</strong> has a long tradition of efficient operations, tight spending controls,balanced budgets, and now is committed to further reductions. As notedabove, <strong>USNH</strong> has put several measures in place in response to the dramaticgeneral appropriations decrease beginning in 2012. Employee separationexpenses totaled $6.3 million in <strong>2011</strong>. This compares to $0.8 million in2010. The majority of the <strong>2011</strong> costs were for separation incentives offeredby UNH. Targeted staff reductions are being implemented at all campusesin 2012 as well.Medical and dental costs net of employee cost sharing increased a total of7.8% in <strong>2011</strong>, in addition to increases of 6.7% in 2010 and 10.1% in 2009.The average annual increase over the past ten years was 7.2% per year. Inresponse to the continued increases in benefit costs, a full review of allsalary and benefit offerings called “Total Rewards” was conducted in <strong>2011</strong>including comparison with peer employers in the state and across thecountry. Specific benefit program changes to be implemented in 2012Chart 4: Awards for Competitive Sponsored Programs,UNH Only($ in millions)$180160140120100806040200$400350300250200150100502002 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong>Chart 5: Total <strong>USNH</strong> Endowment & Similar Funds(includes UNHF & KEA)Ten-Year Growth($ in millions)0Accumulated market appreciationBook value of gifts and other additions2002 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong>Chart 6: Uses of Total Revenue byFunctional Classification($ in millions)InstructionResearch and public serviceAuxiliary servicesStudent financial aidAcademic and student supportDepreciationOperations and maintenanceInstitutional support<strong>2011</strong> = $911 Total2010 = $857 TotalInterest expense2009 = $803 TotalFundraisingVoluntary contribution to stateOperating margin*$0 50 100 150 200 250*Used to pay principal on debt, support plant acquistions/renovations, and supplement net assets.17

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTinclude reduced employer defined contribution retirement plan rates,self-insuring for medical insurance, unbundling pharmacy and medicalcoverage, increased employee medical premiums, and medical planchanges designed to promote consumerism by covered individuals. Otherchanges will impact new hires only, including reductions in vacation andearned time accrual rates.The residential campuses are engaged in alternative energy initiativesto mitigate the continued escalation of petroleum-based fuel costs andreduce carbon footprints. The UNH ECOLine pipeline is the largest ofthese initiatives. The pipeline transports processed landfill gas to thecogeneration plant on the Durham campus. Now that it has been in placefor a full year, renewable methane gas is the primary source of energy forheating, cooling and electricity on the Durham campus. The reduced utilitycosts are offset, in part, by additional debt service and depreciation relatedto the project, but the net benefits to the campus have been substantial(see Note 8 for additional information).General administrative overhead, reflected in Chart 6 as institutionalsupport, is one of the smallest components of <strong>USNH</strong> expenses and iswell-controlled. As shown on the previous page, expenses associatedwith instruction, financial aid and services to students have far-outpacedincreases in general overhead expenses over the last several years.<strong>USNH</strong> made a voluntary contribution of $25 million to the State of NewHampshire during June 2010. The contribution was made to help mitigatefiscal difficulties at the state level and was not a reduction of the generalappropriation revenue base. The operating margin included in Chart 7above represents the Net Income Before Other Changes in Net Assets fromthe Statement of Revenues, Expenses and Changes in Net Assets.D. State Capital SupportIn 2001 the state authorized the first phase ($100 million) of a twophasecapital program to expand and renovate teaching and researchfacilities, primarily for science and engineering. This program, known asthe Knowledge Economy Education Plan for New Hampshire (KEEP-NH),is expected to bolster the state’s high tech job market for years to come.Funding for phase two of KEEP-NH, an additional $109.5 million, wasapproved in June 2005. Spending and commitments against the combinedKEEP-NH appropriation through June 30, <strong>2011</strong> totaled $186.7 million.The remaining $22.8 million will be expended over the next two yearsto renovate and expand Parsons Hall at UNH. (See Note 5 for additionalinformation on KEEP-NH spending to date.)<strong>USNH</strong> was also authorized $25 million of additional KEEP-NH appropriationsin 2010 for deferred maintenance and other capital projects. Approximately$14.5 million of this third KEEP-NH appropriation has been spent throughJune 30, <strong>2011</strong>. The remainder is expected to be spent in 2012. These fundsare being used to support projects smaller than the ground-up renovationsprimarily funded by the original KEEP-NH legislation. (See Table 4 for detailon recent major capital projects.)E. <strong>Financial</strong> Indicators<strong>USNH</strong> has adopted 18 key performance indicators, including financialmeasures, for each campus and the <strong>University</strong> <strong>System</strong> as a whole. Two ofthe most important financial measures are the operating margin and theunrestricted financial resources (net assets) to total debt (UNA to debt)ratios. Management monitors these ratios carefully and considers themprimary indicators of financial health. In April 2010, Moody’s recalibratedits long term US municipal ratings to its global rating scale and many publicuniversities received higher ratings. This process resulted in a new ratingfor <strong>USNH</strong> of Aa3 whereas previously <strong>USNH</strong> had been rated A1. Charts 7 &8 reflect the A1 median for 2007 & 2008 and the Aa3 median beginning in2009.7%6%5%4%3%2%1%0%Chart 7: <strong>USNH</strong> <strong>Annual</strong> Operating Margin2007 2008 2009 2010 <strong>2011</strong>Chart 8: Unrestricted <strong>Financial</strong> Resources (Net Assets)to Total Debt60%50%40%30%20%10%0%New debt$427 (38%)<strong>USNH</strong>Moody's Median<strong>USNH</strong>Moody's Median2007 2008 2009 2010 <strong>2011</strong>Chart 9: Capital Funding Sources, 2001-2013Total = $1.1 Billion($ in millions)Internalborrowings(cash)$85 (7%)State capitalappropriations$235 (21%)Operatingbudget$277 (25%)Gifts, grantsand other$100 (9%)18

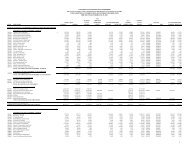

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTBeginning in 2010, <strong>USNH</strong> now includes the impact of postretirement medical obligations inits calculation of operating expenses and unrestricted net assets to ensure consistency of ourcalculations with the related Moody’s medians. Prior year values have not been restated.<strong>USNH</strong>’s standard targeted annual operating margin ratio is 3% to 5% per year. The 2008 and 2009ratios for <strong>USNH</strong> were 2.9% and 3.0%, respectively. This compares to a Moody’s A1 median of 1.1% in2008 and an Aa3 median of 0.9% in 2009. The 2010 ratio of 2.3% compares to the Aa3 median of 2.6%.The 2007 ratio was positively impacted by a one-time settlement received from an investment claim.The 2010 ratio was negatively impacted by <strong>USNH</strong>’s $25 million voluntary contribution to the State ofNew Hampshire, and had this payment not been made, <strong>USNH</strong> would have had an operating margin of5.7% (see Note 15 for additional information). The <strong>2011</strong> margin of 3.4% was negatively impacted byaccruals attributable to a reduction in the discount rate used for valuing for post-retirement medicalobligations, and plan termination costs for the Health Reimbursement Account employee benefitplan approved by <strong>USNH</strong> Trustees as part of the Total Rewards initiative. (The <strong>2011</strong> medians are not yetavailable.)<strong>USNH</strong>’s targeted UNA to debt ratio going forward is 35% or above. Monitoring the UNA to debtlevel is particularly important as <strong>USNH</strong> nears completion of a 12-year $1+ billion capital facilityimprovement plan, financed through debt, operating surpluses and state KEEP-NH appropriationsas detailed in Chart 9 (see the Capital and Debt Activities section for additional information).Unrestricted net assets were up $59.5 million (39.9%) from June 30, 2010 to June 30, <strong>2011</strong>. However,the entire increase related to amounts committed for future uses including separation incentiveofferings ($9.6 million), unspent internal borrowings committed by the <strong>System</strong> at June 30, <strong>2011</strong> ($41.0million) and unrestricted quasi-endowment funds held for future principal payments due on theSeries 2007 and Series 2009A Bonds bullets ($5.4 million and $3.0 million, respectively). Accordinglymanagement expects the UNA to debt ratio to be 35% to 38% at June 30, 2012. (See notes 11 and 8for further information.)III. Using the <strong>Financial</strong> StatementsA. Statement of Net AssetsThe Statement of Net Assets depicts the financial position of <strong>USNH</strong> at one point in time – June 30 –and includes all assets and liabilities of <strong>USNH</strong> and its component units. The Statement of Net Assetsis the primary statement used to report financial condition. Assets are measured at fair value, exceptTable 3: Summary Information Derived from theStatement of Net Assets as of June 30($ in millions)2007 2008 2009 2010 <strong>2011</strong>Cash and operating investments $ 226 $ 226 $ 218 $ 262 $ 301Endowment and similar investments 295 312 263 291 368Property and equipment, net 780 852 915 935 931Other assets* 105 87 107 97 110Total assets $1,406 $1,477 $1,503 $1,585 $1,710Postretirement medical benefits $ 52 $ 51 $ 47 $ 47 $ 53Deferred obligations - interest swaps* 19 28 25Long-term debt 419 458 475 464 460Other liabilities 138 135 138 149 162Total liabilities $ 609 $ 644 $ 679 $ 688 $ 700Invested in capital assets, net $ 409 $ 430 $ 476 $ 488 $ 493Restricted 283 278 234 260 308Unrestricted 105 125 114 149 209Total net assets $ 797 $ 833 $ 824 $ 897 $1,010* <strong>USNH</strong> adopted the provisions of GASB Statement No. 53, Accounting and <strong>Financial</strong> <strong>Report</strong>ing for DerivativeInstruments, as of July 1, 2008. This statement requires that derivative assets and liabilities be reported at their fairvalue. Under GASB definitions, <strong>USNH</strong>’s derivative instruments qualified as effective hedges for both 2010 and <strong>2011</strong>.Accordingly, the fair value of <strong>USNH</strong>’s interest rate swaps outstanding is presented in the Statement of Net Assets as adeferred obligation rather than flowing through the Statement of Revenues, Expenses and Changes in Net Assets. Anoffsetting deferred receivable is included in Other Assets. <strong>USNH</strong> entered into the swap agreements to reduce effectiveinterest and synthetically fix rates over the term of the respective debt issues. Thus, <strong>USNH</strong> intends to hold the swapcontracts to maturity. <strong>USNH</strong> has recorded deferred obligations and offsetting deferred receivables of $25 million and$28 million at June 30, <strong>2011</strong> and 2010, respectively (see Note 9 for additional information).for property and equipment, which are shownat historical cost less accumulated depreciationand other assets. Net assets represent theresidual interest in the <strong>University</strong> <strong>System</strong>’sassets after liabilities are deducted. Over time,an increase in net assets is one indicator of aninstitution’s improving financial health. Factorscontributing to future financial health includethe size and quality of student enrollments;quality and distinction of the faculty; growthand diversification of revenue streams;prudent management of costs, financial assetsand facilities; the ability to generate annualoperating surpluses; and the discipline tosave those surpluses for long-term strategicpurposes. Table 3 shows summary informationderived from the Statement of Net Assets atJune 30 for the past five years.Total assets increased by $304 million or 22%over the past four years. The major componentsof assets are cash and operating investments,endowment and similar investments, andproperty and equipment. Other assets includeaccounts and notes receivable, prepaidexpenses, debt proceeds held by others forconstruction purposes, and deferred receivablesrelated to interest rate swaps.Endowment investments were valued at $368million as of June 30, <strong>2011</strong>, an increase of$77 million from 2010 and $105 million since2009. These values are reflective of currenteconomic conditions (see the Endowment andSimilar Investments discussion for additionalinformation). The net increase in property andequipment was $151 million over the past fouryears. These increases are primarily a result ofthe KEEP-NH projects and utilization of bondproceeds for construction as described below.Liabilities are primarily comprised of accruedpostretirement medical benefits and long-termdebt. The long-term debt of <strong>USNH</strong> primarilyconsists of bonds and capital leases payable.Between 2006 and <strong>2011</strong>, <strong>USNH</strong> issued $221million of revenue bonds to finance newconstruction, as described more fully beginningon the following page. Other liabilities includeaccounts payable, deferred revenue, accruedemployee benefits, government advancesrefundable (amounts provided by the USGovernment under the Perkins Loan Programthat would be refundable should <strong>USNH</strong> ceaseoperating its revolving loan programs), anddeferred obligations related to interest rateswaps.Total <strong>USNH</strong> net assets have grown from $797million at June 30, 2007 to $1,010 million atJune 30, <strong>2011</strong>, an increase of 27% in the pastfour years. Net assets are reported in threenet asset categories. The invested in capitalassets amount is the historical cost of propertyand equipment reduced by total accumulated19