2011 Annual Report - USNH Financial Services - University System ...

2011 Annual Report - USNH Financial Services - University System ...

2011 Annual Report - USNH Financial Services - University System ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

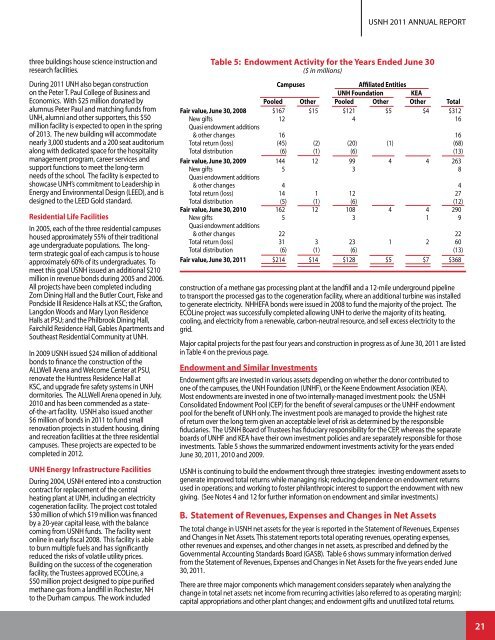

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTthree buildings house science instruction andresearch facilities.During <strong>2011</strong> UNH also began constructionon the Peter T. Paul College of Business andEconomics. With $25 million donated byalumnus Peter Paul and matching funds fromUNH, alumni and other supporters, this $50million facility is expected to open in the springof 2013. The new building will accommodatenearly 3,000 students and a 200 seat auditoriumalong with dedicated space for the hospitalitymanagement program, career services andsupport functions to meet the long-termneeds of the school. The facility is expected toshowcase UNH’s commitment to Leadership inEnergy and Environmental Design (LEED), and isdesigned to the LEED Gold standard.Residential Life FacilitiesIn 2005, each of the three residential campuseshoused approximately 55% of their traditionalage undergraduate populations. The longtermstrategic goal of each campus is to houseapproximately 60% of its undergraduates. Tomeet this goal <strong>USNH</strong> issued an additional $210million in revenue bonds during 2005 and 2006.All projects have been completed includingZorn Dining Hall and the Butler Court, Fiske andPondside III Residence Halls at KSC; the Grafton,Langdon Woods and Mary Lyon ResidenceHalls at PSU; and the Philbrook Dining Hall,Fairchild Residence Hall, Gables Apartments andSoutheast Residential Community at UNH.In 2009 <strong>USNH</strong> issued $24 million of additionalbonds to finance the construction of theALLWell Arena and Welcome Center at PSU,renovate the Huntress Residence Hall atKSC, and upgrade fire safety systems in UNHdormitories. The ALLWell Arena opened in July,2010 and has been commended as a stateof-the-artfacility. <strong>USNH</strong> also issued another$6 million of bonds in <strong>2011</strong> to fund smallrenovation projects in student housing, diningand recreation facilities at the three residentialcampuses. These projects are expected to becompleted in 2012.UNH Energy Infrastructure FacilitiesDuring 2004, <strong>USNH</strong> entered into a constructioncontract for replacement of the centralheating plant at UNH, including an electricitycogeneration facility. The project cost totaled$30 million of which $19 million was financedby a 20-year capital lease, with the balancecoming from <strong>USNH</strong> funds. The facility wentonline in early fiscal 2008. This facility is ableto burn multiple fuels and has significantlyreduced the risks of volatile utility prices.Building on the success of the cogenerationfacility, the Trustees approved ECOLine, a$50 million project designed to pipe purifiedmethane gas from a landfill in Rochester, NHto the Durham campus. The work includedTable 5: Endowment Activity for the Years Ended June 30($ in millions)CampusesAffiliated EntitiesUNH FoundationKEAPooled Other Pooled Other Other TotalFair value, June 30, 2008 $167) $15) $121) $5) $4 $312)New gifts 12) ) 4) 16)Quasi endowment additions& other changes 16) 16)Total return (loss) (45) (2) (20) (1) (68)Total distribution (6) (1) (6) (13)Fair value, June 30, 2009 144) 12) 99) 4) 4 263)New gifts 5) ) 3) 8)Quasi endowment additions& other changes 4) 4)Total return (loss) 14) 1) 12) 27)Total distribution (5) (1) (6) (12)Fair value, June 30, 2010 162) 12) 108) 4) 4 290)New gifts 5) ) 3) 1 9)Quasi endowment additions )& other changes 22) 22)Total return (loss) 31) 3) 23) 1) 2 60)Total distribution (6) (1) (6) (13)Fair value, June 30, <strong>2011</strong> $214) $14) $128) $5) $7 $368)construction of a methane gas processing plant at the landfill and a 12-mile underground pipelineto transport the processed gas to the cogeneration facility, where an additional turbine was installedto generate electricity. NHHEFA bonds were issued in 2008 to fund the majority of the project. TheECOLine project was successfully completed allowing UNH to derive the majority of its heating,cooling, and electricity from a renewable, carbon-neutral resource, and sell excess electricity to thegrid.Major capital projects for the past four years and construction in progress as of June 30, <strong>2011</strong> are listedin Table 4 on the previous page.Endowment and Similar InvestmentsEndowment gifts are invested in various assets depending on whether the donor contributed toone of the campuses, the UNH Foundation (UNHF), or the Keene Endowment Association (KEA).Most endowments are invested in one of two internally-managed investment pools: the <strong>USNH</strong>Consolidated Endowment Pool (CEP) for the benefit of several campuses or the UNHF endowmentpool for the benefit of UNH only. The investment pools are managed to provide the highest rateof return over the long term given an acceptable level of risk as determined by the responsiblefiduciaries. The <strong>USNH</strong> Board of Trustees has fiduciary responsibility for the CEP, whereas the separateboards of UNHF and KEA have their own investment policies and are separately responsible for thoseinvestments. Table 5 shows the summarized endowment investments activity for the years endedJune 30, <strong>2011</strong>, 2010 and 2009.<strong>USNH</strong> is continuing to build the endowment through three strategies: investing endowment assets togenerate improved total returns while managing risk; reducing dependence on endowment returnsused in operations; and working to foster philanthropic interest to support the endowment with newgiving. (See Notes 4 and 12 for further information on endowment and similar investments.)B. Statement of Revenues, Expenses and Changes in Net AssetsThe total change in <strong>USNH</strong> net assets for the year is reported in the Statement of Revenues, Expensesand Changes in Net Assets. This statement reports total operating revenues, operating expenses,other revenues and expenses, and other changes in net assets, as prescribed and defined by theGovernmental Accounting Standards Board (GASB). Table 6 shows summary information derivedfrom the Statement of Revenues, Expenses and Changes in Net Assets for the five years ended June30, <strong>2011</strong>.There are three major components which management considers separately when analyzing thechange in total net assets: net income from recurring activities (also referred to as operating margin);capital appropriations and other plant changes; and endowment gifts and unutilized total returns.21