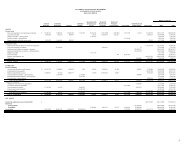

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTLong-term operating investments:Long-term operating investments represent unrestricted amounts invested alongsidethe campuses’ endowment pool which are not expected to be liquidated in the next year,but which are available for operations if needed. The balance of long-term operatinginvestments at June 30, <strong>2011</strong> and 2010 was $6,594,000 and $5,539,000, respectively. Theseamounts consisted of ownership shares of the campuses’ endowment pool and, therefore,the components, credit risk, and all other investment characteristics are identical to thosedescribed below.Endowment and similar investments:Endowment and similar investments are amounts invested primarily for long-termappreciation and consisted of the following as of June 30 ($ in thousands):CampusesAffiliated Entities<strong>2011</strong>) 2010) <strong>2011</strong> 2010Money market funds $ 6,682) $ 1,325) $ 7,885) $ 3,082Mutual funds – bonds 23,082) 18,168) 11,680) 11,743Mutual funds – stocks 36,649) 28,531) 45,518) 38,931US Government obligations 3,565) 5,906Corporate bonds and notes 214) 372Common/preferred stocks 18,095) 17,495) 1,169) 7,090Alternative investments 135,030) 101,373) 65,321) 46,167Investments held by others 14,443) 12,128) 4,771) 4,197Subtotal 233,981) 179,020) 140,123) 117,488Operating amounts invested alongsideendowment pool (6,593) (5,539)Total endowment and similar investments $227,388) $173,481) )$140,123) $117,488Alternative investments include private equity, hedge, natural resource and certain real estatefunds, and are used to improve market returns while managing other portfolio investment riskssuch as inflation and deflation. The estimated fair value of investments is based on quotedmarket prices except for certain alternative investments, for which quoted market prices arenot readily available. The estimated fair value of certain alternative investments is based on5. Property and equipmentvaluations provided by external investment managers and reviewed by management. Becausethese alternative investments may not be readily marketable, their estimated fair values maydiffer from the values that would have been assigned had a ready market for such investmentsexisted, and such differences could be material.Mutual funds, common stocks, and alternative investments are uninsured and uncollateralizedagainst custodial credit risk. The <strong>USNH</strong> investment policy and guidelines, and the UNHFinvestment policy, mitigate the risk associated with uninsured and uncollateralized investmentscollectively through diversification, target asset allocations, and ongoing investment advisorand investment committee review.The endowment and similar investment components as of June 30 are summarized below($ in thousands):CampusesAffiliated Entities<strong>2011</strong>) 2010) <strong>2011</strong> 2010Pooled endowments:Campuses $212,778 $161,176UNHF $128,813 $108,757KEA 5,644 3,775NHPB 855 749Life income and annuity funds 197 177 4,768 4,166Funds held in trust 14,413 12,128 43 41Total $227,388 $173,481 $140,123 $117,488As of June 30, <strong>2011</strong>, <strong>USNH</strong> has three outstanding investment liquidation requests which havebeen limited by the respective fund managers. Two of the liquidations were requested during2009 and one during 2010. The fair value of these investments at June 30, <strong>2011</strong> is $3,454,000.At June 30, 2010, the fair market value of these investments was $6,354,000. The remainingfunds are expected to be collected by June 30, 2013.Commitments with various private equity and similar alternative investment funds which havenot yet been called totaled $5,641,000 for the campuses and $3,420,000 for UNHF at June30, <strong>2011</strong>. This compares to $16,344,000 and $4,374,000, respectively, at June 30, 2010. Thedecrease is related, in part, to <strong>USNH</strong>’s sale of four private equity investments in fiscal year <strong>2011</strong>.These sales reduced <strong>USNH</strong>’s uncalled commitments by $5,683,000. (See Note 12 for discussionof endowment returns used for operations.)Property and equipment activity for the years ended June 30, <strong>2011</strong> and 2010 is summarized as follows ($ in thousands):2010 <strong>2011</strong>Balance Additions and 2010 Balance Additions and <strong>2011</strong> BalanceJune 30, 2009 other changes Retirements June 30, 2010 other changes Retirements June 30, <strong>2011</strong>Land $ 11,936) $ 276) $ -) $ 12,212) $ 185) $ -) $ 12,397)Buildings and improvements 1,210,979) $118,772) (5,655) 1,324,096) 53,815) (726) 1,377,185)Equipment 126,573) 8,644) (11,448) 123,769) 11,912) (41,048) 94,633)Construction in progress, net 113,129) (57,052) -) 56,077) (18,342) -) 37,735)Total property and equipment 1,462,617) 70,640) (17,103) 1,516,154) 47,570) (41,774) 1,521,950)Less: accumulated depreciation (548,093) (47,744) 15,176) (580,661) (50,730) 40,360) (591,031)Property and equipment, net $ 914,524) $ 22,896) $ (1,927) $ 935,493) $ (3,160) $ (1,414) $ 930,919)The state is providing funding for academic and research facility renovation and expansionprojects under the Knowledge Economy Education Plan for New Hampshire (KEEP-NH).Contractual obligations for construction related to KEEP-NH projects totaled $22,794,000and $9,402,000 at June 30, <strong>2011</strong> and 2010, respectively. The state provides funding to<strong>USNH</strong> for all amounts expended under the KEEP-NH program, up to the authorized total of$209,500,000. After expenditures and obligations, no KEEP-NH funds remain as of June 30,<strong>2011</strong>. Approximately $27,429,000 of KEEP-NH funds were uncommitted as of June 30, 2010.(See Note 8 for further discussion on state-funded plant facilities.)Contractual obligations for construction related to other major projects totaled $35,632,000and $1,490,000 at June 30, <strong>2011</strong> and 2010, respectively. <strong>USNH</strong> also received an additional$25,000,000 KEEP-NH capital appropriation in fiscal year 2010. This one-time appropriationis for deferred maintenance and other capital projects not completed under the originallegislation. As of June 30, <strong>2011</strong>, <strong>USNH</strong> has incurred $14,511,000 of costs eligible forreimbursement under this appropriation.6. Accrued employee benefitsAccrued employee benefits at June 30 were as follows ($ in thousands):2010 2010 <strong>2011</strong> <strong>2011</strong>Payments to/ Accrued expenses Payments to/ Accrued expensesBalance on behalf of & other Balance on behalf of & other Balance CurrentJune 30, 2009 participants changes June 30, 2010 participants changes June 30, <strong>2011</strong> portionOperating staff retirement plan $ 6,550 $ (714) $ 577) $ 6,413 $ (675) $ 645) $ 6,383 $ 675Additional retirement contribution 2,577 (58) 398) 2,917 (444) (179) 2,294 229Employee separation incentives 4,719 (2,254) 751) 3,216 (3,673) 6,342) 5,885 3,481Long-term disability 3,435 (647) 522) 3,310 (707) 678) 3,281 707Workers’ compensation 1,488 (1,305) 3,319) 3,502 (1,211) 1,211) 3,502 1,211Compensated absences 18,096 (834) 1,774) 19,036 (1,479) 1,165) 18,722 1,705Other 1,647 (1,000) 401) 1,048 -) 343) 1,391 909Total accrued employee benefits $38,512 $(6,812) $7,742) $39,442 $(8,189) $10,205) $41,458 $8,91728

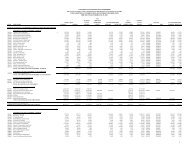

<strong>USNH</strong> <strong>2011</strong> ANNUAL REPORTThe operating staff retirement plan is a defined benefit plan closed to new participants since1987. At June 30, <strong>2011</strong> there were approximately 223 current annuitants and 81 participantswith deferred benefits, all fully vested. This compares to 221 current annuitants and 104participants as of June 30, 2010 with deferred benefits, all fully vested. <strong>USNH</strong> has cash andunrestricted funds functioning as endowment assets of $7,091,000 and $6,553,000 at June30, <strong>2011</strong> and 2010, respectively, designated to fund the third-party actuarially determinedobligations of the plan.The calculations for the operating staff retirement plan are based on the benefits providedby the plan at the time of the last biennial plan valuation, July 1, <strong>2011</strong>. The investment returnassumption (discount rate) used in determining the accrued pension benefit obligation was8.5% for both years.The accumulated operating staff retirement plan benefit obligation and funded status atJune 30 consisted of the following ($ in thousands):<strong>2011</strong> 2010Retired participants and beneficiaries $4,682) $4,361)Active participants 945) 1,144)Other participants 756) 908)Accrued pension benefit obligation 6,383) 6,413)Less: funds functioning as endowment assets available for benefits (7,089) (6,551)(Over) funded plan balance $ (706) $ (138)<strong>USNH</strong>’s additional retirement contribution program is mandatory for all newly-hired employeesbut was optional for employees hired before July 1, 1994. Employees covered under this planhave an additional 1% of their salary contributed to their defined contribution retirementplan (see below) by <strong>USNH</strong> in lieu of postretirement medical benefits. In addition, employeesmeeting certain service guidelines prior to July 1, 1994 are eligible for a guaranteed minimumretirement contribution. There were 696 and 762 employees meeting these requirementsas of June 30, <strong>2011</strong> and 2010, respectively. Based on third-party actuarial calculations, <strong>USNH</strong>has accrued $2,294,000 and $2,917,000 at June 30, <strong>2011</strong> and 2010, respectively, for therelated obligations. <strong>USNH</strong> had designated cash assets of $2,888,000 and $2,917,000 for theseobligations as of June 30, <strong>2011</strong> and 2010, respectively, fully funding the plan.The calculations for the additional retirement contribution program are based on the benefitsprovided by the plan at the time of the last biennial plan valuation, July 1, <strong>2011</strong>, and weredeveloped using the Projected Unit Credit Cost Method. The discount rate used in determiningthe accrued additional retirement contribution was 8.5% for both <strong>2011</strong> and 2010.Early retirement and employee separation incentive programs were provided to various facultyand staff during <strong>2011</strong> and 2010. Incentives include stipends, as well as medical, educationaland other termination benefits. The net present value of future costs associated with theseincentive options is accrued as of the date of acceptance into the program. The balances atJune 30, <strong>2011</strong> and 2010 represent accruals for 112 and 117 participants, respectively.<strong>USNH</strong> sponsors other benefit programs for its employees, including long-term disability,workers’ compensation, and compensated absences. Long-term disability payments areprovided through an independent insurer; the associated medical benefits are accrued andpaid by <strong>USNH</strong> until age 65, at which point the postretirement medical plan takes over, ifapplicable. Workers’ compensation accruals include amounts for medical costs and annualstipends. A small number of chronic workers’ compensation cases will require stipends andregular employee medical benefits for life. Coverage for such claims is provided throughan independent insurer. <strong>USNH</strong> also accrues amounts for compensated absences as earned.These accrued balances at June 30 represent vacation and earned time amounts payable toemployees upon termination of employment.In addition, eligible employees may elect to participate in defined contribution retirementplans administered by others. Contributions by <strong>USNH</strong> under these plans in <strong>2011</strong> and 2010amounted to $22,943,000 and $22,947,000, respectively.7. Postretirement medical benefitsThe primary defined benefit postretirement medical plan, the <strong>University</strong> <strong>System</strong> of NewHampshire Medicare Complementary Plan, was optional for all full-time status employees hiredbefore July 1, 1994. At June 30, <strong>2011</strong> and 2010, there were approximately 419 and 452 activeemployees who, along with their dependents, may eventually be eligible to receive benefitsunder this program. The eligibility requirements state that retired employees must havecompleted at least 10 years of service after age 52, participated in the active retirement plansduring their last 10 years of service, and participated in <strong>USNH</strong>’s active medical plan at the timeof retirement. Retired employees are not required to contribute to the plan.For measurement purposes, annual rates of increase of 8.25% to 8.50% in the per capita costof covered healthcare services, and 10% for prescriptions are assumed for <strong>2011</strong> for the primaryplan. These rates are assumed to decrease gradually to 5.5% by 2017 and remain at that levelthereafter. The healthcare cost trend and discount rate assumption have a significant effect onthe amounts reported. The discount rate used in determining the accumulated postretirementobligation was 7.5% for <strong>2011</strong> and 8.5% for 2010.Third party actuaries are used to determine the postretirement benefit obligation and annualexpense amounts. The actuarially determined postretirement benefit expense for the primaryplan was $10,113,000 for <strong>2011</strong> and $5,113,000 for 2010. The primary plan is a single-employerplan administered by <strong>USNH</strong>. The plan is funded on a pay-as-you-go basis with benefitspaid when due. Actuarial calculations reflect a long-term perspective. By definition suchcalculations involve estimates and, accordingly, are subject to revision. These calculations arebased on the benefits provided by the plan at the time of the last biennial plan valuation, June30, <strong>2011</strong>, and were developed using the Projected Unit Credit Cost Method.Total annual other postemployment benefit (OPEB) cost for the primary post-retirementmedical plan for the years ended June 30, <strong>2011</strong> and 2010, and the liability as of June 30, <strong>2011</strong>and 2010 included the following components ($ in thousands):<strong>2011</strong> 2010<strong>Annual</strong> required contribution $ 7,168) $ 6,810)Interest on net OPEB obligation 4,394) 4,012)Adjustment to annual required contribution (1,449) (5,709)<strong>Annual</strong> OPEB cost 10,113) 5,113)Contributions made (4,789) (4,999)(Decrease) increase in net OPEB obligation 5,324) 114)Net OPEB obligation at beginning of year 46,759) 46,645)Net OPEB obligation at end of year $52,083) $46,759)Current portion $ 5,208) $ 4,678)Additional postretirement medical plans are maintained by NHPB and the State of NewHampshire Police which covers safety officers at UNH and PSU. These plans are separate fromthe primary plan. The postretirement obligation for the NHPB plan was $104,000 as of June 30,<strong>2011</strong>, and $208,000 as of June 30, 2010. In addition, <strong>USNH</strong> has accrued $348,000 as of June 30,<strong>2011</strong> and 2010 for potential obligations under the State of New Hampshire Police Plan.8. Long-term debtLong-term debt activity for the years ended June 30, <strong>2011</strong> and 2010 was as follows ($ in thousands):2010 <strong>2011</strong>Balance Additions and 2010 Balance Additions and <strong>2011</strong> Balance CurrentJune 30, 2009 other changes Retirements June 30, 2010 other changes Retirements June 30, <strong>2011</strong> portionNHHEFA bondsSeries 2001 1 $ 55,535 $ 34 $ (3,855) $ 51,714 $ - $(45,473) $ 6,241 $ 4,030Series 2002 34,050 - (2,116) 31,934 - (2,231) 29,703 2,310Series 2005A 62,014 9 (1,451) 60,572 9 (1,300) 59,281 1,500Series 2005B 87,058 410 (950) 86,518 410 (980) 85,948 85,948Series 2006B-2 62,253 - (1,240) 61,013 - (1,289) 59,724 1,200Series 2007 46,434 16 -) 46,450 16 -) 46,466 -Series 2009A 108,493 - (207) 108,286 - (207) 108,079 -Series <strong>2011</strong>A - - -) -) 6,815 -) 6,815 -Series <strong>2011</strong>B - - -) -) 42,570 (881) 41,689 -Capital leases 19,041 - (1,225) 17,816 - (1,290) 16,526 1,382Total bonds and leases $474,878 $469 $(11,044) $464,303 $49,820 $(53,651) $460,472 $96,3701includes interest swaption described in Note 929