2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

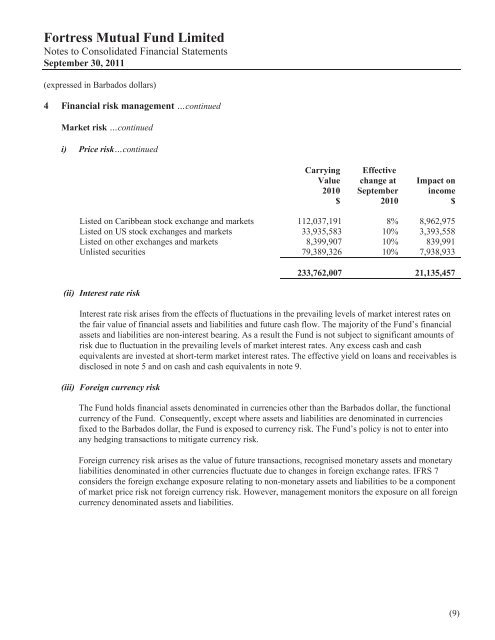

<strong>Fortress</strong> <strong>Mutual</strong> <strong>Fund</strong> LimitedNotes to Consolidated Financial StatementsSeptember 30, <strong>2011</strong>(expressed in Barbados dollars)4 Financial risk management …continuedMarket risk …continuedi) Price risk…continuedCarryingValue2010$Effectivechange atSeptember2010Impact onincome$Listed on Caribbean stock exchange and markets 112,037,191 8% 8,962,975Listed on US stock exchanges and markets 33,935,583 10% 3,393,558Listed on other exchanges and markets 8,399,907 10% 839,991Unlisted securities 79,389,326 10% 7,938,933(ii) Interest rate risk233,762,007 21,135,457Interest rate risk arises from the effects of fluctuations in the prevailing levels of market interest rates onthe fair value of financial assets and liabilities and future cash flow. The majority of the <strong>Fund</strong>’s financialassets and liabilities are non-interest bearing. As a result the <strong>Fund</strong> is not subject to significant amounts ofrisk due to fluctuation in the prevailing levels of market interest rates. Any excess cash and cashequivalents are invested at short-term market interest rates. The effective yield on loans and receivables isdisclosed in note 5 and on cash and cash equivalents in note 9.(iii) Foreign currency riskThe <strong>Fund</strong> holds financial assets denominated in currencies other than the Barbados dollar, the functionalcurrency of the <strong>Fund</strong>. Consequently, except where assets and liabilities are denominated in currenciesfixed to the Barbados dollar, the <strong>Fund</strong> is exposed to currency risk. The <strong>Fund</strong>’s policy is not to enter intoany hedging transactions to mitigate currency risk.Foreign currency risk arises as the value of future transactions, recognised monetary assets and monetaryliabilities denominated in other currencies fluctuate due to changes in foreign exchange rates. IFRS 7considers the foreign exchange exposure relating to non-monetary assets and liabilities to be a componentof market price risk not foreign currency risk. However, management monitors the exposure on all foreigncurrency denominated assets and liabilities.(9)