2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

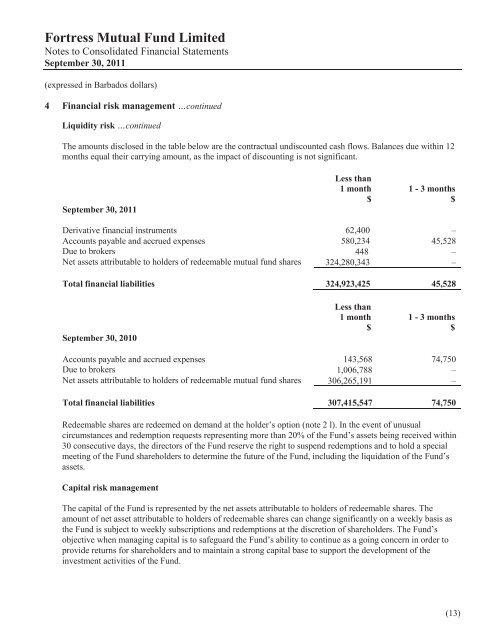

<strong>Fortress</strong> <strong>Mutual</strong> <strong>Fund</strong> LimitedNotes to Consolidated Financial StatementsSeptember 30, <strong>2011</strong>(expressed in Barbados dollars)4 Financial risk management …continuedLiquidity risk …continuedThe amounts disclosed in the table below are the contractual undiscounted cash flows. Balances due within 12months equal their carrying amount, as the impact of discounting is not significant.September 30, <strong>2011</strong>Less than1 month$1 - 3 months$Derivative financial instruments 62,400 –Accounts payable and accrued expenses 580,234 45,528Due to brokers 448 –Net assets attributable to holders of redeemable mutual fund shares 324,280,343 –Total financial liabilities 324,923,425 45,528September 30, 2010Less than1 month$1 - 3 months$Accounts payable and accrued expenses 143,568 74,750Due to brokers 1,006,788 –Net assets attributable to holders of redeemable mutual fund shares 306,265,191 –Total financial liabilities 307,415,547 74,750Redeemable shares are redeemed on demand at the holder’s option (note 2 l). In the event of unusualcircumstances and redemption requests representing more than 20% of the <strong>Fund</strong>’s assets being received within30 consecutive days, the directors of the <strong>Fund</strong> reserve the right to suspend redemptions and to hold a specialmeeting of the <strong>Fund</strong> shareholders to determine the future of the <strong>Fund</strong>, including the liquidation of the <strong>Fund</strong>’sassets.Capital risk managementThe capital of the <strong>Fund</strong> is represented by the net assets attributable to holders of redeemable shares. Theamount of net asset attributable to holders of redeemable shares can change significantly on a weekly basis asthe <strong>Fund</strong> is subject to weekly subscriptions and redemptions at the discretion of shareholders. The <strong>Fund</strong>’sobjective when managing capital is to safeguard the <strong>Fund</strong>’s ability to continue as a going concern in order toprovide returns for shareholders and to maintain a strong capital base to support the development of theinvestment activities of the <strong>Fund</strong>.(13)