2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

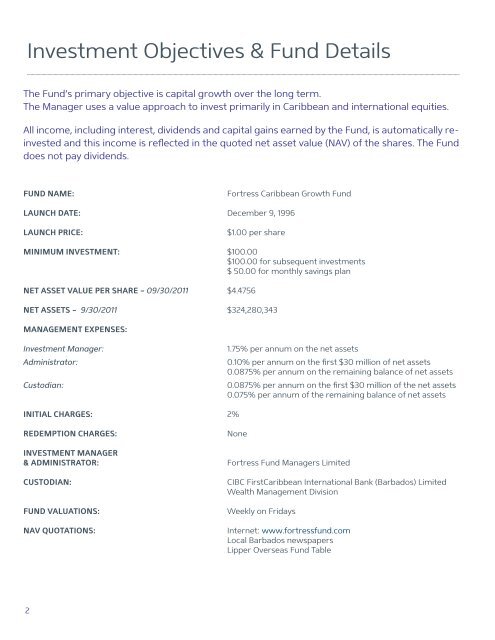

Investment Objectives & <strong>Fund</strong> DetailsThe <strong>Fund</strong>’s primary objective is capital growth over the long term.The Manager uses a value approach to invest primarily in Caribbean and international equities.All income, including interest, dividends and capital gains earned by the <strong>Fund</strong>, is automatically reinvestedand this income is reflected in the quoted net asset value (NAV) of the shares. The <strong>Fund</strong>does not pay dividends.FUND NAME:<strong>Fortress</strong> Caribbean Growth <strong>Fund</strong>LAUNCH DATE: December 9, 1996LAUNCH PRICE:$1.00 per shareMINIMUM INVESTMENT: $100.00$100.00 for subsequent investments$ 50.00 for monthly savings planNET ASSET VALUE PER SHARE – 09/30/<strong>2011</strong> $4.4756NET ASSETS – 9/30/<strong>2011</strong> $324,280,343MANAGEMENT EXPENSES:Investment Manager:Administrator:Custodian:1.75% per annum on the net assets0.10% per annum on the first $30 million of net assets0.0875% per annum on the remaining balance of net assets0.0875% per annum on the first $30 million of the net assets0.075% per annum of the remaining balance of net assetsINITIAL CHARGES: 2%REDEMPTION CHARGES:INVESTMENT MANAGER& ADMINISTRATOR:CUSTODIAN:FUND VALUATIONS:NAV QUOTATIONS:None<strong>Fortress</strong> <strong>Fund</strong> Managers LimitedCIBC FirstCaribbean International Bank (Barbados) LimitedWealth Management DivisionWeekly on FridaysInternet: www.fortressfund.comLocal Barbados newspapersLipper Overseas <strong>Fund</strong> Table2