2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

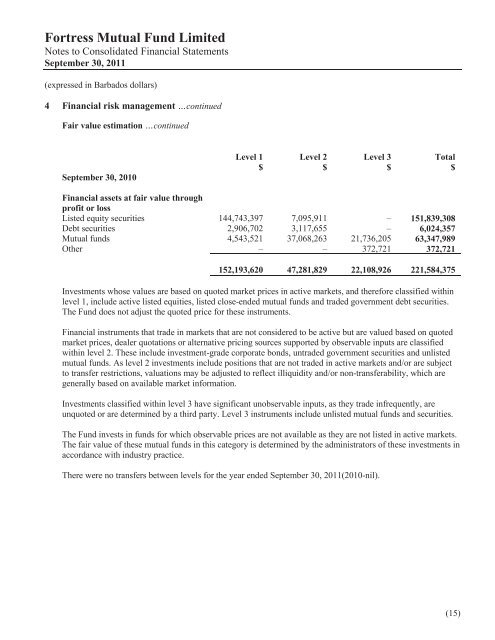

<strong>Fortress</strong> <strong>Mutual</strong> <strong>Fund</strong> LimitedNotes to Consolidated Financial StatementsSeptember 30, <strong>2011</strong>(expressed in Barbados dollars)4 Financial risk management …continuedFair value estimation …continuedSeptember 30, 2010Level 1$Level 2$Level 3$Total$Financial assets at fair value throughprofit or lossListed equity securities 144,743,397 7,095,911 – 151,839,308Debt securities 2,906,702 3,117,655 – 6,024,357<strong>Mutual</strong> funds 4,543,521 37,068,263 21,736,205 63,347,989Other – – 372,721 372,721152,193,620 47,281,829 22,108,926 221,584,375Investments whose values are based on quoted market prices in active markets, and therefore classified withinlevel 1, include active listed equities, listed close-ended mutual funds and traded government debt securities.The <strong>Fund</strong> does not adjust the quoted price for these instruments.Financial instruments that trade in markets that are not considered to be active but are valued based on quotedmarket prices, dealer quotations or alternative pricing sources supported by observable inputs are classifiedwithin level 2. These include investment-grade corporate bonds, untraded government securities and unlistedmutual funds. As level 2 investments include positions that are not traded in active markets and/or are subjectto transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which aregenerally based on available market information.Investments classified within level 3 have significant unobservable inputs, as they trade infrequently, areunquoted or are determined by a third party. Level 3 instruments include unlisted mutual funds and securities.The <strong>Fund</strong> invests in funds for which observable prices are not available as they are not listed in active markets.The fair value of these mutual funds in this category is determined by the administrators of these investments inaccordance with industry practice.There were no transfers between levels for the year ended September 30, <strong>2011</strong>(2010-nil).(15)