2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

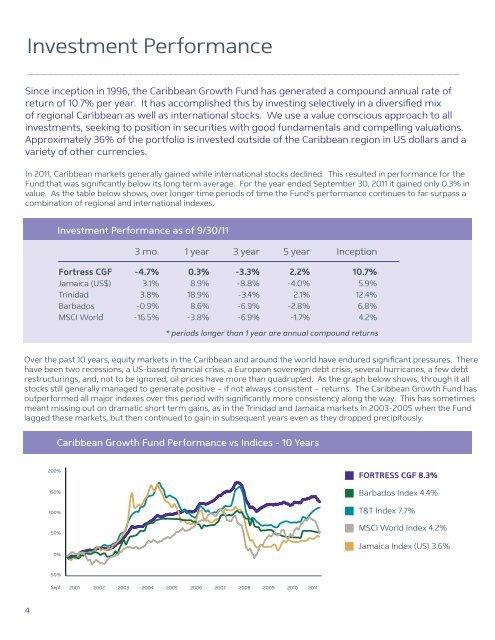

Investment PerformanceSince inception in 1996, the Caribbean Growth <strong>Fund</strong> has generated a compound annual rate ofreturn of 10.7% per year. It has accomplished this by investing selectively in a diversified mixof regional Caribbean as well as international stocks. We use a value conscious approach to allinvestments, seeking to position in securities with good fundamentals and compelling valuations.Approximately 36% of the portfolio is invested outside of the Caribbean region in US dollars and avariety of other currencies.In <strong>2011</strong>, Caribbean markets generally gained while international stocks declined. This resulted in performance for the<strong>Fund</strong> that was significantly below its long term average. For the year ended September 30, <strong>2011</strong> it gained only 0.3% invalue. As the table below shows, over longer time periods of time the <strong>Fund</strong>’s performance continues to far surpass acombination of regional and international indexes.Investment Performance as of 9/30/113 mo. 1 year 3 year 5 year Inception<strong>Fortress</strong> CGF -4.7% 0.3% -3.3% 2.2% 10.7%Jamaica (US$) 3.1% 8.9% -8.8% -4.0% 5.9%Trinidad 3.8% 18.9% -3.4% 2.1% 12.4%Barbados -0.9% 8.6% -6.9% -2.8% 6.8%MSCI World -16.5% -3.8% -6.9% -1.7% 4.2%* periods longer than 1 year are annual compound returnsOver the past 10 years, equity markets in the Caribbean and around the world have endured significant pressures. Therehave been two recessions, a US-based financial crisis, a European sovereign debt crisis, several hurricanes, a few debtrestructurings, and, not to be ignored, oil prices have more than quadrupled. As the graph below shows, through it allstocks still generally managed to generate positive – if not always consistent – returns. The Caribbean Growth <strong>Fund</strong> hasoutperformed all major indexes over this period with significantly more consistency along the way. This has sometimesmeant missing out on dramatic short term gains, as in the Trinidad and Jamaica markets in 2003-2005 when the <strong>Fund</strong>lagged these markets, but then continued to gain in subsequent years even as they dropped precipitously.Caribbean Growth <strong>Fund</strong> Performance vs Indices - 10 Years200%150%100%50%0%FORTRESS CGF 8.3%Barbados Index 4.4%T&T Index 7.7%MSCI World Index 4.2%Jamaica Index (US) 3.6%-50%Sept2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong>4