2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

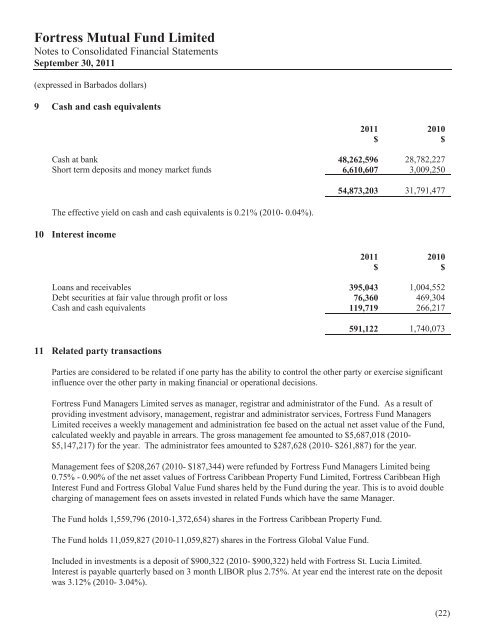

<strong>Fortress</strong> <strong>Mutual</strong> <strong>Fund</strong> LimitedNotes to Consolidated Financial StatementsSeptember 30, <strong>2011</strong>(expressed in Barbados dollars)9 Cash and cash equivalents<strong>2011</strong>$2010$Cash at bank 48,262,596 28,782,227Short term deposits and money market funds 6,610,607 3,009,250The effective yield on cash and cash equivalents is 0.21% (2010- 0.04%).10 Interest income54,873,203 31,791,477<strong>2011</strong>$2010$Loans and receivables 395,043 1,004,552Debt securities at fair value through profit or loss 76,360 469,304Cash and cash equivalents 119,719 266,21711 Related party transactions591,122 1,740,073Parties are considered to be related if one party has the ability to control the other party or exercise significantinfluence over the other party in making financial or operational decisions.<strong>Fortress</strong> <strong>Fund</strong> Managers Limited serves as manager, registrar and administrator of the <strong>Fund</strong>. As a result ofproviding investment advisory, management, registrar and administrator services, <strong>Fortress</strong> <strong>Fund</strong> ManagersLimited receives a weekly management and administration fee based on the actual net asset value of the <strong>Fund</strong>,calculated weekly and payable in arrears. The gross management fee amounted to $5,687,018 (2010-$5,147,217) for the year. The administrator fees amounted to $287,628 (2010- $261,887) for the year.Management fees of $208,267 (2010- $187,344) were refunded by <strong>Fortress</strong> <strong>Fund</strong> Managers Limited being0.75% - 0.90% of the net asset values of <strong>Fortress</strong> Caribbean Property <strong>Fund</strong> Limited, <strong>Fortress</strong> Caribbean HighInterest <strong>Fund</strong> and <strong>Fortress</strong> Global Value <strong>Fund</strong> shares held by the <strong>Fund</strong> during the year. This is to avoid doublecharging of management fees on assets invested in related <strong>Fund</strong>s which have the same Manager.The <strong>Fund</strong> holds 1,559,796 (2010-1,372,654) shares in the <strong>Fortress</strong> Caribbean Property <strong>Fund</strong>.The <strong>Fund</strong> holds 11,059,827 (2010-11,059,827) shares in the <strong>Fortress</strong> Global Value <strong>Fund</strong>.Included in investments is a deposit of $900,322 (2010- $900,322) held with <strong>Fortress</strong> St. Lucia Limited.Interest is payable quarterly based on 3 month LIBOR plus 2.75%. At year end the interest rate on the depositwas 3.12% (2010- 3.04%).(22)