2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

2011 Report - Fortress Mutual Fund Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

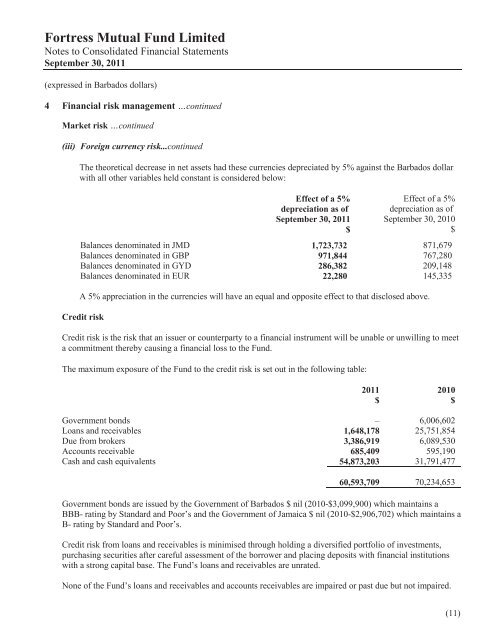

<strong>Fortress</strong> <strong>Mutual</strong> <strong>Fund</strong> LimitedNotes to Consolidated Financial StatementsSeptember 30, <strong>2011</strong>(expressed in Barbados dollars)4 Financial risk management …continuedMarket risk …continued(iii) Foreign currency risk...continuedThe theoretical decrease in net assets had these currencies depreciated by 5% against the Barbados dollarwith all other variables held constant is considered below:Effect of a 5%depreciation as ofSeptember 30, <strong>2011</strong>$Effect of a 5%depreciation as ofSeptember 30, 2010$Balances denominated in JMD 1,723,732 871,679Balances denominated in GBP 971,844 767,280Balances denominated in GYD 286,382 209,148Balances denominated in EUR 22,280 145,335A 5% appreciation in the currencies will have an equal and opposite effect to that disclosed above.Credit riskCredit risk is the risk that an issuer or counterparty to a financial instrument will be unable or unwilling to meeta commitment thereby causing a financial loss to the <strong>Fund</strong>.The maximum exposure of the <strong>Fund</strong> to the credit risk is set out in the following table:<strong>2011</strong>$2010$Government bonds – 6,006,602Loans and receivables 1,648,178 25,751,854Due from brokers 3,386,919 6,089,530Accounts receivable 685,409 595,190Cash and cash equivalents 54,873,203 31,791,47760,593,709 70,234,653Government bonds are issued by the Government of Barbados $ nil (2010-$3,099,900) which maintains aBBB- rating by Standard and Poor’s and the Government of Jamaica $ nil (2010-$2,906,702) which maintains aB- rating by Standard and Poor’s.Credit risk from loans and receivables is minimised through holding a diversified portfolio of investments,purchasing securities after careful assessment of the borrower and placing deposits with financial institutionswith a strong capital base. The <strong>Fund</strong>’s loans and receivables are unrated.None of the <strong>Fund</strong>’s loans and receivables and accounts receivables are impaired or past due but not impaired.(11)