the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

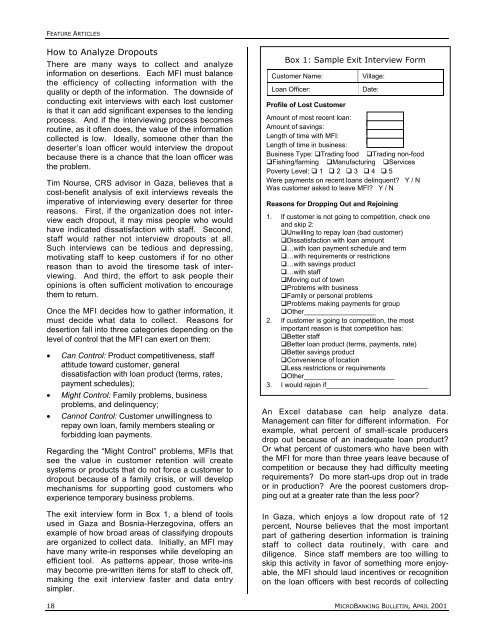

FEATURE ARTICLESHow to Analyze DropoutsThere are many ways to collect and analyzeinformation on desertions. Each MFI must balance<strong>the</strong> efficiency of collecting information with <strong>the</strong>quality or depth of <strong>the</strong> information. The downside ofconducting exit interviews with each lost customeris that it can add significant expenses to <strong>the</strong> lendingprocess. And if <strong>the</strong> interviewing process becomesroutine, as it often does, <strong>the</strong> value of <strong>the</strong> informationcollected is low. Ideally, someone o<strong>the</strong>r than <strong>the</strong>deserter’s loan officer would interview <strong>the</strong> dropoutbecause <strong>the</strong>re is a chance that <strong>the</strong> loan officer was<strong>the</strong> problem.Tim Nourse, CRS advisor in Gaza, believes that acost-benefit analysis of exit interviews reveals <strong>the</strong>imperative of interviewing every deserter for threereasons. First, if <strong>the</strong> organization does not intervieweach dropout, it may miss people who wouldhave indicated dissatisfaction with staff. Second,staff would ra<strong>the</strong>r not interview dropouts at all.Such interviews can be tedious and depressing,motivating staff to keep customers if for no o<strong>the</strong>rreason than to avoid <strong>the</strong> tiresome task of interviewing.And third, <strong>the</strong> effort to ask people <strong>the</strong>iropinions is often sufficient motivation to encourage<strong>the</strong>m to return.Once <strong>the</strong> MFI decides how to ga<strong>the</strong>r information, itmust decide what data to collect. Reasons fordesertion fall into three categories depending on <strong>the</strong>level of control that <strong>the</strong> MFI can exert on <strong>the</strong>m:• Can Control: Product competitiveness, staffattitude toward customer, generaldissatisfaction with loan product (terms, rates,payment schedules);• Might Control: Family problems, businessproblems, and delinquency;• Cannot Control: Customer unwillingness torepay own loan, family members stealing orforbidding loan payments.Regarding <strong>the</strong> “Might Control” problems, MFIs thatsee <strong>the</strong> value in customer retention will createsystems or products that do not force a customer todropout because of a family crisis, or will developmechanisms for supporting good customers whoexperience temporary business problems.The exit interview form in Box 1, a blend of toolsused in Gaza and Bosnia-Herzegovina, offers anexample of how broad areas of classifying dropoutsare organized to collect data. Initially, an MFI mayhave many write-in responses while developing anefficient tool. As patterns appear, those write-insmay become pre-written items for staff to check off,making <strong>the</strong> exit interview faster and data entrysimpler.Box 1: Sample Exit Interview FormCustomer Name:Loan Officer:Village:Date:Profile of Lost CustomerAmount of most recent loan:Amount of savings:Length of time with MFI:Length of time in business:Business Type: Trading food Trading non-foodFishing/farming Manufacturing ServicesPoverty Level: 1 2 3 4 5Were payments on recent loans delinquent? Y / NWas customer asked to leave MFI? Y / NReasons for Dropping Out and Rejoining1. If customer is not going to competition, check oneand skip 2:Unwilling to repay loan (bad customer)Dissatisfaction with loan amount…with loan payment schedule and term…with requirements or restrictions…with savings product…with staffMoving out of townProblems with businessFamily or personal problemsProblems making payments for groupO<strong>the</strong>r___________________2. If customer is going to competition, <strong>the</strong> mostimportant reason is that competition has:Better staffBetter loan product (terms, payments, rate)Better savings productConvenience of locationLess restrictions or requirementsO<strong>the</strong>r________________________3. I would rejoin if___________________________An Excel database can help analyze data.Management can filter for different information. Forexample, what percent of small-scale producersdrop out because of an inadequate loan product?Or what percent of customers who have been with<strong>the</strong> MFI for more than three years leave because ofcompetition or because <strong>the</strong>y had difficulty meetingrequirements? Do more start-ups drop out in tradeor in production? Are <strong>the</strong> poorest customers droppingout at a greater rate than <strong>the</strong> less poor?In Gaza, which enjoys a low dropout rate of 12percent, Nourse believes that <strong>the</strong> most importantpart of ga<strong>the</strong>ring desertion information is trainingstaff to collect data routinely, with care anddiligence. Since staff members are too willing toskip this activity in favor of something more enjoyable,<strong>the</strong> MFI should laud incentives or recognitionon <strong>the</strong> loan officers with best records of collecting18 MICROBANKING BULLETIN, APRIL 2001