the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

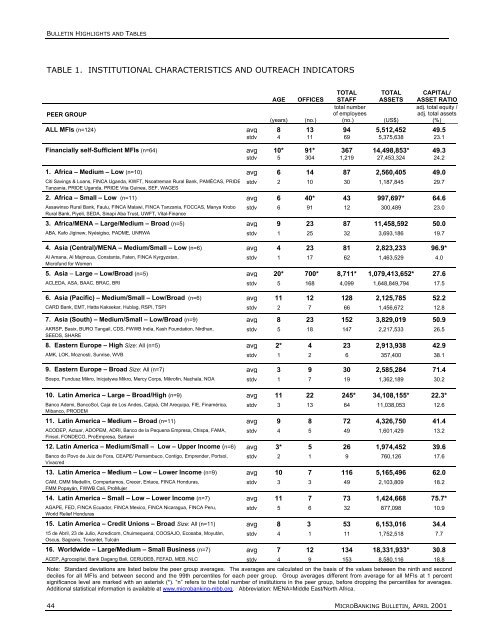

BULLETIN HIGHLIGHTS AND TABLESTABLE 1. INSTITUTIONAL CHARACTERISTICS AND OUTREACH INDICATORSPEER GROUP44 MICROBANKING BULLETIN, APRIL 2001AGE(years)OFFICES(no.)TOTALSTAFFtotal numberof employees(no.)TOTALASSETS(US$)CAPITAL/ASSET RATIOadj. total equity /adj. total assets(%)ALL MFIs (n=124) avg 8 13 94 5,512,452 49.5stdv 4 11 69 5,375,638 23.1Financially self-Sufficient MFIs (n=64) avg 10* 91* 367 14,498,853* 49.3stdv 5 304 1,219 27,453,324 24.21. Africa – Medium – Low (n=10) avg 6 14 87 2,560,405 49.0Citi Savings & Loans, FINCA Uganda, KWFT, Nsoatreman Rural Bank, PAMÉCAS, PRIDE stdv 2 10 30 1,187,845 29.7Tanzania, PRIDE Uganda, PRIDE Vita Guinea, SEF, WAGES2. Africa – Small – Low (n=11) avg 6 40* 43 997,697* 64.6Assawinso Rural Bank, Faulu, FINCA Malawi, FINCA Tanzania, FOCCAS, Manya Krobo stdv 6 91 12 300,489 23.0Rural Bank, Piyeli, SEDA, Sinapi Aba Trust, UWFT, Vital-Finance3. Africa/MENA – Large/Medium – Broad (n=5) avg 9 23 87 11,458,592 50.0ABA, Kafo Jiginew, Nyésigiso, PADME, UNRWA stdv 1 25 32 3,693,186 19.74. Asia (Central)/MENA – Medium/Small – Low (n=6) avg 4 23 81 2,823,233 96.9*Al Amana, Al Majmoua, Constanta, Faten, FINCA Kyrgyzstan, stdv 1 17 62 1,463,529 4.0Microfund for Women5. Asia – Large – Low/Broad (n=5) avg 20* 700* 8,711* 1,079,413,652* 27.6ACLEDA, ASA, BAAC, BRAC, BRI stdv 5 168 4,099 1,648,849,794 17.56. Asia (Pacific) – Medium/Small – Low/Broad (n=6) avg 11 12 128 2,125,785 52.2CARD Bank, EMT, Hatta Kaksekar, Hublag, RSPI, TSPI stdv 2 7 66 1,456,672 12.87. Asia (South) – Medium/Small – Low/Broad (n=9) avg 8 23 152 3,829,019 50.9AKRSP, Basix, BURO Tangail, CDS, FWWB India, Kash Foundation, Nirdhan, stdv 5 18 147 2,217,533 26.5SEEDS, SHARE8. Eastern Europe – High Size: All (n=5) avg 2* 4 23 2,913,938 42.9AMK, LOK, Moznosti, Sunrise, WVB stdv 1 2 6 357,400 38.19. Eastern Europe – Broad Size: All (n=7) avg 3 9 30 2,585,284 71.4Bospo, Fundusz Mikro, Inicjatywa Mikro, Mercy Corps, Mikrofin, Nachala, NOA stdv 1 7 19 1,362,189 30.210. Latin America – Large – Broad/High (n=9) avg 11 22 245* 34,108,155* 22.3*Banco Ademi, BancoSol, Caja de Los Andes, Calpiá, CM Arequipa, FIE, Finamérica, stdv 3 13 64 11,038,053 12.6Mibanco, PRODEM11. Latin America – Medium – Broad (n=11) avg 9 8 72 4,326,750 41.4ACODEP, Actuar, ADOPEM, ADRI, Banco de la Pequena Empresa, Chispa, FAMA, stdv 4 5 49 1,601,429 13.2Finsol, FONDECO, ProEmpresa, Sartawi12. Latin America – Medium/Small – Low – Upper Income (n=6) avg 3* 5 26 1,974,452 39.6Banco do Povo de Juiz de Fora, CEAPE/ Pernambuco, Contigo, Emprender, Portsol, stdv 2 1 9 760,126 17.6Vivacred13. Latin America – Medium – Low – Lower Income (n=9) avg 10 7 116 5,165,496 62.0CAM, CMM Medellín, Compartamos, Crecer, Enlace, FINCA Honduras, stdv 3 3 49 2,103,809 18.2FMM Popayán, FWWB Cali, ProMujer14. Latin America – Small – Low – Lower Income (n=7) avg 11 7 73 1,424,668 75.7*AGAPE, FED, FINCA Ecuador, FINCA Mexico, FINCA Nicaragua, FINCA Peru, stdv 5 6 32 877,098 10.9World Relief Honduras15. Latin America – Credit Unions – Broad Size: All (n=11) avg 8 3 53 6,153,016 34.415 de Abril, 23 de Julio, Acredicom, Chuimequená, COOSAJO, Ecosaba, Moyután, stdv 4 1 11 1,752,518 7.7Oscus, Sagrario, Tonantel, Tulcán16. Worldwide – Large/Medium – Small Business (n=7) avg 7 12 134 18,331,933* 30.8ACEP, Agrocapital, Bank Dagang Bali, CERUDEB, FEFAD, MEB, NLC stdv 4 9 153 8,580,116 18.8Note: Standard deviations are listed below <strong>the</strong> peer group averages. The averages are calculated on <strong>the</strong> basis of <strong>the</strong> values between <strong>the</strong> ninth and seconddeciles for all MFIs and between second and <strong>the</strong> 99th percentiles for each peer group. Group averages different from average for all MFIs at 1 percentsignificance level are marked with an asterisk (*). “n” refers to <strong>the</strong> total number of institutions in <strong>the</strong> peer group, before dropping <strong>the</strong> percentiles for averages.Additional statistical information is available at www.<strong>microbanking</strong>-mbb.org. Abbreviation: MENA=Middle East/North Africa.