the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

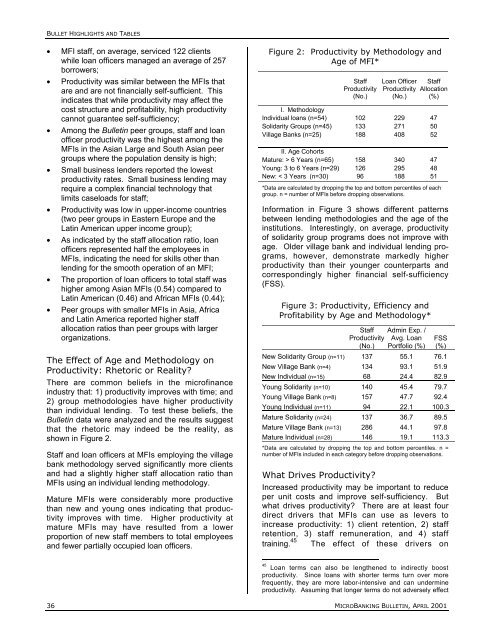

BULLET HIGHLIGHTS AND TABLES• MFI staff, on average, serviced 122 clientswhile loan officers managed an average of 257borrowers;• Productivity was similar between <strong>the</strong> MFIs thatare and are not financially self-sufficient. Thisindicates that while productivity may affect <strong>the</strong>cost structure and profitability, high productivitycannot guarantee self-sufficiency;• Among <strong>the</strong> Bulletin peer groups, staff and loanofficer productivity was <strong>the</strong> highest among <strong>the</strong>MFIs in <strong>the</strong> Asian Large and South Asian peergroups where <strong>the</strong> population density is high;• Small business lenders reported <strong>the</strong> lowestproductivity rates. Small business lending mayrequire a complex financial technology thatlimits caseloads for staff;• Productivity was low in upper-income countries(two peer groups in Eastern Europe and <strong>the</strong>Latin American upper income group);• As indicated by <strong>the</strong> staff allocation ratio, loanofficers represented half <strong>the</strong> employees inMFIs, indicating <strong>the</strong> need for skills o<strong>the</strong>r thanlending for <strong>the</strong> smooth operation of an MFI;• The proportion of loan officers to total staff washigher among Asian MFIs (0.54) compared toLatin American (0.46) and African MFIs (0.44);• Peer groups with smaller MFIs in Asia, Africaand Latin America reported higher staffallocation ratios than peer groups with largerorganizations.The Effect of Age and Methodology onProductivity: Rhetoric or Reality?There are common beliefs in <strong>the</strong> microfinanceindustry that: 1) productivity improves with time; and2) group methodologies have higher productivitythan individual lending. To test <strong>the</strong>se beliefs, <strong>the</strong>Bulletin data were analyzed and <strong>the</strong> results suggestthat <strong>the</strong> rhetoric may indeed be <strong>the</strong> reality, asshown in Figure 2.Staff and loan officers at MFIs employing <strong>the</strong> villagebank methodology served significantly more clientsand had a slightly higher staff allocation ratio thanMFIs using an individual lending methodology.Mature MFIs were considerably more productivethan new and young ones indicating that productivityimproves with time. Higher productivity atmature MFIs may have resulted from a lowerproportion of new staff members to total employeesand fewer partially occupied loan officers.Figure 2: Productivity by Methodology andAge of MFI*StaffProductivity(No.)Loan OfficerProductivity(No.)StaffAllocation(%)I. MethodologyIndividual loans (n=54) 102 229 47Solidarity Groups (n=45) 133 271 50Village Banks (n=25) 188 408 52II. Age CohortsMature: > 6 Years (n=65) 158 340 47Young: 3 to 6 Years (n=29) 126 295 48New: < 3 Years (n=30) 96 188 51*Data are calculated by dropping <strong>the</strong> top and bottom percentiles of eachgroup. n = number of MFIs before dropping observations.<strong>Information</strong> in Figure 3 shows different patternsbetween lending methodologies and <strong>the</strong> age of <strong>the</strong>institutions. Interestingly, on average, productivityof solidarity group programs does not improve withage. Older village bank and individual lending programs,however, demonstrate markedly higherproductivity than <strong>the</strong>ir younger counterparts andcorrespondingly higher financial self-sufficiency(FSS).Figure 3: Productivity, Efficiency andProfitability by Age and Methodology*Staff Admin Exp. /Productivity Avg. Loan(No.) Portfolio (%)FSS(%)New Solidarity Group (n=11) 137 55.1 76.1New Village Bank (n=4) 134 93.1 51.9New Individual (n=15) 68 24.4 82.9Young Solidarity (n=10) 140 45.4 79.7Young Village Bank (n=8) 157 47.7 92.4Young Individual (n=11) 94 22.1 100.3Mature Solidarity (n=24) 137 36.7 89.5Mature Village Bank (n=13) 286 44.1 97.8Mature Individual (n=28) 146 19.1 113.3*Data are calculated by dropping <strong>the</strong> top and bottom percentiles. n =number of MFIs included in each category before dropping observations.What Drives Productivity?Increased productivity may be important to reduceper unit costs and improve self-sufficiency. Butwhat drives productivity? There are at least fourdirect drivers that MFIs can use as levers toincrease productivity: 1) client retention, 2) staffretention, 3) staff remuneration, and 4) stafftraining. 45 The effect of <strong>the</strong>se drivers on45Loan terms can also be leng<strong>the</strong>ned to indirectly boostproductivity. Since loans with shorter terms turn over morefrequently, <strong>the</strong>y are more labor-intensive and can undermineproductivity. Assuming that longer terms do not adversely effect36 MICROBANKING BULLETIN, APRIL 2001