the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

the microbanking bulletin - Microfinance Information Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

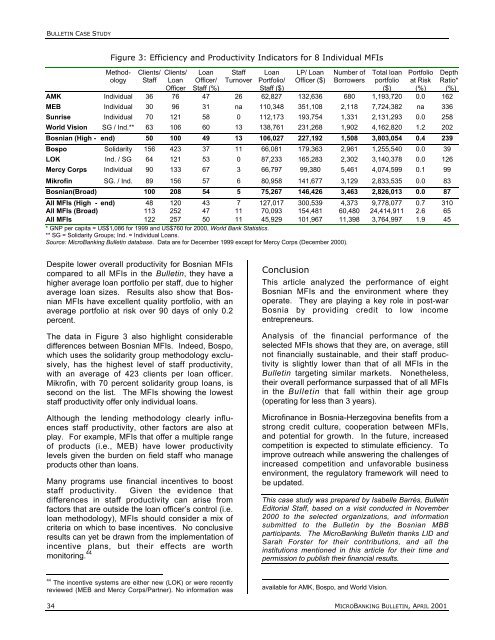

BULLETIN CASE STUDYFigure 3: Efficiency and Productivity Indicators for 8 Individual MFIsMethodologyClients/StaffClients/LoanOfficerLoanOfficer/Staff (%)StaffTurnoverLoanPortfolio/Staff ($)LP/ LoanOfficer ($)Number ofBorrowersTotal loanportfolio($)Portfolioat Risk(%)AMK Individual 36 76 47 26 62,827 132,636 680 1,193,720 0.0 162MEB Individual 30 96 31 na 110,348 351,108 2,118 7,724,382 na 336Sunrise Individual 70 121 58 0 112,173 193,754 1,331 2,131,293 0.0 258World Vision SG / Ind.** 63 106 60 13 138,761 231,268 1,902 4,162,820 1.2 202Bosnian (High - end) 50 100 49 13 106,027 227,192 1,508 3,803,054 0.4 239Bospo Solidarity 156 423 37 11 66,081 179,363 2,961 1,255,540 0.0 39LOK Ind. / SG 64 121 53 0 87,233 165,283 2,302 3,140,378 0.0 126Mercy Corps Individual 90 133 67 3 66,797 99,380 5,461 4,074,599 0.1 99Mikrofin SG. / Ind. 89 156 57 6 80,958 141,677 3,129 2,833,535 0.0 83Bosnian(Broad) 100 208 54 5 75,267 146,426 3,463 2,826,013 0.0 87All MFIs (High - end) 48 120 43 7 127,017 300,539 4,373 9,778,077 0.7 310All MFIs (Broad) 113 252 47 11 70,093 154,481 60,480 24,414,911 2.6 65All MFIs 122 257 50 11 45,929 101,967 11,398 3,764,997 1.9 45* GNP per capita = US$1,086 for 1999 and US$760 for 2000, World Bank Statistics.** SG = Solidarity Groups; Ind. = Individual Loans.Source: MicroBanking Bulletin database. Data are for December 1999 except for Mercy Corps (December 2000).DepthRatio*(%)Despite lower overall productivity for Bosnian MFIscompared to all MFIs in <strong>the</strong> Bulletin, <strong>the</strong>y have ahigher average loan portfolio per staff, due to higheraverage loan sizes. Results also show that BosnianMFIs have excellent quality portfolio, with anaverage portfolio at risk over 90 days of only 0.2percent.The data in Figure 3 also highlight considerabledifferences between Bosnian MFIs. Indeed, Bospo,which uses <strong>the</strong> solidarity group methodology exclusively,has <strong>the</strong> highest level of staff productivity,with an average of 423 clients per loan officer.Mikrofin, with 70 percent solidarity group loans, issecond on <strong>the</strong> list. The MFIs showing <strong>the</strong> loweststaff productivity offer only individual loans.Although <strong>the</strong> lending methodology clearly influencesstaff productivity, o<strong>the</strong>r factors are also atplay. For example, MFIs that offer a multiple rangeof products (i.e., MEB) have lower productivitylevels given <strong>the</strong> burden on field staff who manageproducts o<strong>the</strong>r than loans.Many programs use financial incentives to booststaff productivity. Given <strong>the</strong> evidence thatdifferences in staff productivity can arise fromfactors that are outside <strong>the</strong> loan officer’s control (i.e.loan methodology), MFIs should consider a mix ofcriteria on which to base incentives. No conclusiveresults can yet be drawn from <strong>the</strong> implementation ofincentive plans, but <strong>the</strong>ir effects are worthmonitoring. 44ConclusionThis article analyzed <strong>the</strong> performance of eightBosnian MFIs and <strong>the</strong> environment where <strong>the</strong>yoperate. They are playing a key role in post-warBosnia by providing credit to low incomeentrepreneurs.Analysis of <strong>the</strong> financial performance of <strong>the</strong>selected MFIs shows that <strong>the</strong>y are, on average, stillnot financially sustainable, and <strong>the</strong>ir staff productivityis slightly lower than that of all MFIs in <strong>the</strong>Bulletin targeting similar markets. None<strong>the</strong>less,<strong>the</strong>ir overall performance surpassed that of all MFIsin <strong>the</strong> Bulletin that fall within <strong>the</strong>ir age group(operating for less than 3 years).<strong>Microfinance</strong> in Bosnia-Herzegovina benefits from astrong credit culture, cooperation between MFIs,and potential for growth. In <strong>the</strong> future, increasedcompetition is expected to stimulate efficiency. Toimprove outreach while answering <strong>the</strong> challenges ofincreased competition and unfavorable businessenvironment, <strong>the</strong> regulatory framework will need tobe updated.This case study was prepared by Isabelle Barrès, BulletinEditorial Staff, based on a visit conducted in November2000 to <strong>the</strong> selected organizations, and informationsubmitted to <strong>the</strong> Bulletin by <strong>the</strong> Bosnian MBBparticipants. The MicroBanking Bulletin thanks LID andSarah Forster for <strong>the</strong>ir contributions, and all <strong>the</strong>institutions mentioned in this article for <strong>the</strong>ir time andpermission to publish <strong>the</strong>ir financial results.44The incentive systems are ei<strong>the</strong>r new (LOK) or were recentlyreviewed (MEB and Mercy Corps/Partner). No information wasavailable for AMK, Bospo, and World Vision.34 MICROBANKING BULLETIN, APRIL 2001