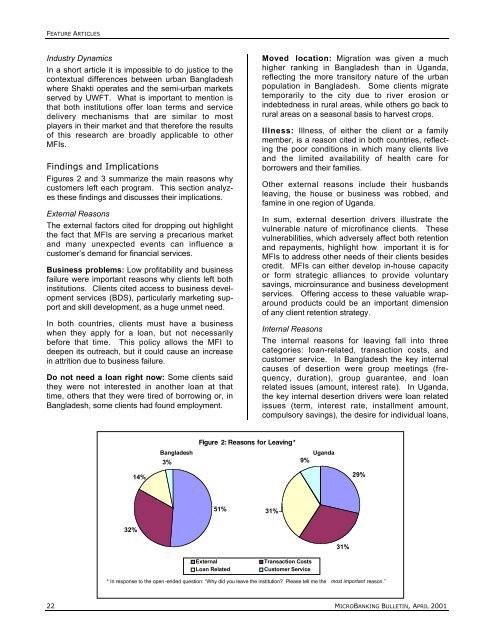

FEATURE ARTICLESIndustry DynamicsIn a short article it is impossible to do justice to <strong>the</strong>contextual differences between urban Bangladeshwhere Shakti operates and <strong>the</strong> semi-urban marketsserved by UWFT. What is important to mention isthat both institutions offer loan terms and servicedelivery mechanisms that are similar to mostplayers in <strong>the</strong>ir market and that <strong>the</strong>refore <strong>the</strong> resultsof this research are broadly applicable to o<strong>the</strong>rMFIs.Findings and ImplicationsFigures 2 and 3 summarize <strong>the</strong> main reasons whycustomers left each program. This section analyzes<strong>the</strong>se findings and discusses <strong>the</strong>ir implications.External ReasonsThe external factors cited for dropping out highlight<strong>the</strong> fact that MFIs are serving a precarious marketand many unexpected events can influence acustomer’s demand for financial services.Business problems: Low profitability and businessfailure were important reasons why clients left bothinstitutions. Clients cited access to business developmentservices (BDS), particularly marketing supportand skill development, as a huge unmet need.In both countries, clients must have a businesswhen <strong>the</strong>y apply for a loan, but not necessarilybefore that time. This policy allows <strong>the</strong> MFI todeepen its outreach, but it could cause an increasein attrition due to business failure.Do not need a loan right now: Some clients said<strong>the</strong>y were not interested in ano<strong>the</strong>r loan at thattime, o<strong>the</strong>rs that <strong>the</strong>y were tired of borrowing or, inBangladesh, some clients had found employment.Moved location: Migration was given a muchhigher ranking in Bangladesh than in Uganda,reflecting <strong>the</strong> more transitory nature of <strong>the</strong> urbanpopulation in Bangladesh. Some clients migratetemporarily to <strong>the</strong> city due to river erosion orindebtedness in rural areas, while o<strong>the</strong>rs go back torural areas on a seasonal basis to harvest crops.Illness: Illness, of ei<strong>the</strong>r <strong>the</strong> client or a familymember, is a reason cited in both countries, reflecting<strong>the</strong> poor conditions in which many clients liveand <strong>the</strong> limited availability of health care forborrowers and <strong>the</strong>ir families.O<strong>the</strong>r external reasons include <strong>the</strong>ir husbandsleaving, <strong>the</strong> house or business was robbed, andfamine in one region of Uganda.In sum, external desertion drivers illustrate <strong>the</strong>vulnerable nature of microfinance clients. Thesevulnerabilities, which adversely affect both retentionand repayments, highlight how important it is forMFIs to address o<strong>the</strong>r needs of <strong>the</strong>ir clients besidescredit. MFIs can ei<strong>the</strong>r develop in-house capacityor form strategic alliances to provide voluntarysavings, microinsurance and business developmentservices. Offering access to <strong>the</strong>se valuable wraparoundproducts could be an important dimensionof any client retention strategy.Internal ReasonsThe internal reasons for leaving fall into threecategories: loan-related, transaction costs, andcustomer service. In Bangladesh <strong>the</strong> key internalcauses of desertion were group meetings (frequency,duration), group guarantee, and loanrelated issues (amount, interest rate). In Uganda,<strong>the</strong> key internal desertion drivers were loan relatedissues (term, interest rate, installment amount,compulsory savings), <strong>the</strong> desire for individual loans,Figure 2: Reasons for Leaving *Bangladesh3%9%Uganda14% 29%51%31%32%31%ExternalLoan RelatedTransaction CostsCustomer Service* In response to <strong>the</strong> open -ended question: “Why did you leave <strong>the</strong> institution? Please tell me <strong>the</strong> most important reason.”22 MICROBANKING BULLETIN, APRIL 2001

FEATURE ARTICLES<strong>the</strong> group guarantee, and needing more supportfrom <strong>the</strong> institution to solve problems.Loan-RelatedIn Uganda, issues relating to <strong>the</strong> loan (price, term,amount, requirements) were stronger desertiondrivers than in Bangladesh. This finding reflects <strong>the</strong>fact that loans in Uganda are more expensive, forshorter terms, and require several additional guaranteesbesides <strong>the</strong> group and compulsory savings.Interest rate: In Uganda effective interest rates(taking compulsory savings into account) are four tofive times higher than in Bangladesh. A segment ofUFWT borrowers found that rate to be beyond atolerable threshold. While it is important toacknowledge <strong>the</strong> contextual differences (e.g. lowerpopulation density and higher salaries) that make<strong>the</strong> cost of doing business substantially higher inUganda, <strong>the</strong> challenge is to continuously lowercosts and pass on those savings to clients.Loan term: Clients in Uganda mentioned that <strong>the</strong>16-week loan term was a reason for dropping out,whereas <strong>the</strong> 50-week term at Shakti was not anissue. Since in both countries clients are predominantlyengaged in trading, this finding does notnecessarily reflect a mismatch between businessactivity and loan term. Instead, it may be moreuseful to look at <strong>the</strong> combination of short terms withhigh interest rates that produce prohibitively largeinstallment sizes for some clients.Clients in both countries left because <strong>the</strong>y could notrepay <strong>the</strong> loan, but this was a bigger factor inUganda. This difference relates to larger installments,as well as to <strong>the</strong> fact that a higher percentageof Ugandan clients used <strong>the</strong>ir loan for nonbusinesspurposes such as paying for school fees.Borrowing requirements: In Uganda, <strong>the</strong> strictborrowing requirements—including 30 percentcompulsory savings, two co-guarantors and apledged asset—was a major desertion driver. Inboth Bangladesh and Uganda, and indeed in manygroup-lending methodologies, some element ofcompulsory savings is required. If an MFI is tocontinue to demand compulsory savings <strong>the</strong>n itshould only require a fair minimum, it should offer topay reasonable interest on it, and, within limits, itshould provide clients with flexibility in access (e.g.<strong>the</strong> ability to draw down on some portion of thatmoney to pay an installment if necessary).Loan amount: Accessing larger loans is among <strong>the</strong>top five needs that clients express no matter where<strong>the</strong>y live. Managing <strong>the</strong> tension between <strong>the</strong>demand for larger loans and <strong>the</strong> MFI’s credit risk isa careful balancing act.Clients in both programs identified <strong>the</strong> low loanamount as a reason for leaving. Offering largerloans and <strong>the</strong>reby retaining growth-oriented clientsis a key to profitability, but it presents a challengefor group lenders. Many clients are now demandingindividual loans, <strong>the</strong>refore <strong>the</strong> development of thisproduct is a key retention strategy for grouplenders.Transaction CostsGroup meetings: The frequency and length ofgroup meetings was a desertion driver in ShaktiFoundation. Shakti meetings occur every week andattendance is compulsory, whereas at UWFT,clients can choose to meet weekly, biweekly ormonthly, and attendance is not enforced.Figure 3: Top Ten Reasons for Desertion*BangladeshUganda1. Loan amount was too small (33%)2. Too many meetings (28%)3. The meetings were too long (25%)4. A member defaulted and I did not want to pay for her(25%)5. Loan was too expensive (high interest rates) (22%)6. The institution does not understand my special needs asa woman (20%)7. I do not need a loan right now (18%)8. I had to go to <strong>the</strong> village (17%)9. I (or someone in my family) got sick (17%)10. My business was not profitable (17%)1. Loan period was too short (65%)2. Interest on my voluntary savings was too low (64%)3. Loan was too expensive - high interest rates (57%)4. Compulsory savings too high (54%)5. I wanted to borrow as an individual, not as a group (53%)6. The weekly payment amount was too much (51%)7. I felt like I was borrowing my own money back (50%)8. No opportunities to participate in decisions made by <strong>the</strong>institution (46%)9. A member defaulted; I did not want to pay for her (43%)10. When a problem arose, not enough support from staff(43%)* In response to <strong>the</strong> close-ended question: “Now, I will read you a list of reasons that o<strong>the</strong>r people had for leaving X institution. Please tellme which ones of <strong>the</strong> following reasons apply to you.” Ranking based on most frequently answered reasons.MICROBANKING BULLETIN, APRIL 2001 23