Crnogorski Telekom 2009 Annual Report

Crnogorski Telekom 2009 Annual Report

Crnogorski Telekom 2009 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Contents:Our MissionOur VisionOur StrategyTo our ShareholdersLetter to our shareholders<strong>Crnogorski</strong> <strong>Telekom</strong>’s Board of DirectorsThe Management Committee of <strong>Crnogorski</strong> <strong>Telekom</strong>IntroductionGeneral informationCompetitionRegulatory environmentHuman resourcesCorporate responsibilityThe lines of businessWireline servicesMobile servicesThe financial year <strong>2009</strong>Management report for the <strong>2009</strong> financial yearFinancial statements:Independent Auditor’s <strong>Report</strong>Statement of financial positionStatement of comprehensive incomeStatement of cash flowsStatements of Changes in EquityNotes to the Financial StatementsFurther information1Our Mission / Our Vision

Our MissionWe are the favorite choice for communication and infotainment. We guarantee persistent customer focus, reliability and continuousinnovation.<strong>Crnogorski</strong> <strong>Telekom</strong> remains the best place to work at in Montenegro. We create an organization that encourages innovation andrewards performance.We lead Montenegro towards an information society.We stretch boundaries, create and capture new opportunities and continuously strive for profitability and operational excellence.• We will become and remain market leader in whatever we do.• Serving customers is our culture.• We develop and deliver broadband products everywhere to everyone.• We persistently improve efficiency.• We look after company money as if it was our own.• As one team, we build a company that we love and are proud working for.• We deliver high quality and innovative services.Our VisionWe make your life better by connecting and entertaining you, wherever you are, whatever you do. Life is for sharing.3Our Mission / Our Vision

Our strategyIn <strong>2009</strong>, we have solidified our position in the broadband market and have achieved the highest growth in the TV segment in Montenegro.Despite the difficulties in the economy, we have continuously been investing in innovation by improving the reach and coverage of ournetwork. As the first operator in the country, we have started to roll out a fiber optical network for the households and launched HDTV.We have also started to offer innovative IP-based voice services (Max Telefonija), and have continued mobilizing the internet with appealingdevices such as the iPhone exclusively available to T-Mobile customers and mobile internet-ready netbooks.We have, once again, demonstrated our commitment to Corporate Social Responsibility by reinforcing our Increasing Internet Penetrationprogram, which has been recognized by the Iskra philanthropy award as the best project in <strong>2009</strong>.The foundation for our four strategic goals – “One Company”The strategy of <strong>Crnogorski</strong> <strong>Telekom</strong> relies on four objectives. The foundation of those four objectives is the “One Company” concept.The meaning of “One Company” stretches far beyond the legal merger of <strong>2009</strong> which unified the three former entities of the <strong>Crnogorski</strong><strong>Telekom</strong> Group. “One Company” will constitute the framework for the attitude of the employees of <strong>Crnogorski</strong> <strong>Telekom</strong> towards ourCustomers, and the way they will act as One Team – regardless which of the three former legal entities was employing them previously.5Our strategy

1. Improve efficiencyIn our industry, in order to guarantee that the resources necessary for the development of the business are available, challenging constantlythe status quo of the cost and operating structure of the business is indispensible.To ensure that <strong>Crnogorski</strong> <strong>Telekom</strong> delivers its promises to its Stakeholders in terms of profitability, innovation and business developmentin a sustainable manner, we have decided to launch a multi-year program, Save for Service.The Save for Service project has created a blueprint for a series of significant shifts of paradigm in all functional areas. Every singleunit within the Company will perform more efficiently in the coming years, with maintained or improved quality of services towards theirinternal and external Customers.2. Superior Customer experienceWe believe that one of the fundamentals for Superior Customer Experience is the way our Employees relate to Customers.We are, in 2010, launching a three-year program targeted at improving this attitude even further. The Cultural Change Program will relyon the introduction of five guiding principles, each item being co-sponsored by chief officers of our organization.Those guiding principles are:• Customer delight drives our action• Respect and integrity guide our behavior• Team together –Team apart• Best place to perform and grow• I am T –Count on meWe are convinced that our Customers will start perceiving the benefits of this program very early.We will also continue reforming our sales channels, and introduce new forms of interaction with our Clients, to improve the accessibilityof our products for their convenience and satisfaction.3. Market leadershipOur claim is simple: we strive to become market leaders in whatever we do.We have, in <strong>2009</strong>, solidified our leadership in fixed voice and fixed broadband services. T-Mobile has in <strong>2009</strong> significantly improvedits overall market position compared to the two competitors in both overall revenue and SIM share terms, and we have reinforced ourpostpaid dominance.We have overtaken the second position in Television by producing the highest growth in new customers compared to all of our competitors.These achievements were strongly supported by the extremely successful launch of Pleme, our mobile tariff plan targeted at youngsters,3Play packages (which were acclaimed by the market and generated better than expected results), the Max Telefonija offer (targeted atbusinesses) and our programs targeted to grow Mobile Internet supported by our exclusive iPhone and netbook offers.6

4. Capture broadband potentialThe expansion of services which rely on broadband technology remains a core element of our business strategy.In <strong>2009</strong>, we have grown solidly our presence on the broadband access market and have connected 43.5 thousand ADSL customers,and have registered close to 9 thousand mobile internet package users.We have achieved the highest growth in Television segment with Extra TV, exceeding very significantly the growth of each of our Competitors.Our ongoing efforts to destroy barriers in front of internet literacy in the country have been widely recognized by the Society and variousorganizations. We believe that Public-Private Partnerships (projects in cooperation with the Government) will be a significant stepforward to overcome remaining challenges in terms of providing infrastructure to areas in the country where a broadband infrastructureis not yet available.The extension of our mobile broadband network and the continuation of the rollout of fiber infrastructure remain a priority in 2010. Weexpect that the penetration of IP telephony based services will increase significantly.Shareholder valueMarketLeadershipSuperiorCustomerExperienceImproveEfficiencyCaptureBroadbandPotentialOne Company7Our strategy

Dear Shareholders,It is my pleasure to inform you about the highlights of the business operations of <strong>Crnogorski</strong><strong>Telekom</strong> in <strong>2009</strong>. Despite very difficult year that was predominantly characterized bythe global economic crisis and its effects to the Montenegrin economy, our company succeededin achieving key operational and financial targets, which we see as a proof thatour strategy and its slogan 3 screens, 2 brands, 1 company was a very successful one.<strong>2009</strong> was the year of significant internal organizational change in which we finishedseveral-year ongoing integration process – as of 1st of May we have been operatingas one company – there was a legal merger of the former three entities (<strong>Crnogorski</strong><strong>Telekom</strong>, T-Mobile Crna Gora and Internet Crna Gora) into one company called <strong>Crnogorski</strong><strong>Telekom</strong> A.D. Podgorica. This major project was successfully ended and it resulted insimplified, faster and more efficient and effective operations which will enable us to serveour customers even better.As for the <strong>2009</strong> business achievements, <strong>Crnogorski</strong> <strong>Telekom</strong> not only kept its overallleading position in the Montenegrin telecommunications industry, but managed to makesignificant progress in certain segments.In fixed line of business, we managed to maintain a stable customer base in voice segment,further improve our position in broadcasting market with our Extra TV service andexceed expectations with regards to the sale of ADSL. When it comes to mobile segmentof our business, we further strengthened leadership in the postpaid market, the mostvaluable part of the operations, and at the end of the year we got closer to number oneposition in the overall mobile market for the first time during nine years of existence ofT-Mobile in Montenegro.However, in line with our expectations, revenues of the company were under significantpressure due to changes in regulatory regime, fixed-to-mobile substitution and regionalalliances of the competitors. Hence, the overall revenues of the company suffered 7%drop compared to 2008. It is necessary to underscore that we were ready to react to suchdevelopments and as a consequence we managed to have drop in EBITDA without specialimpacts of only €1.86 million, i.e. 4% compared to 2008. We experienced a heavierreduction in mobile revenues than in fixed segment of operations. It is very importantto point out that we managed mainly to offset the aforementioned drop in revenues oncompany level by a significant increase in ADSL and Extra TV sales results.In the summer of <strong>2009</strong> we launched major cost control program (Save4Service in<strong>Crnogorski</strong> <strong>Telekom</strong>) which was already contributing to this year’s results, but majorimpact is still to come in the coming years – apart from inevitable financial effects, theprogram will improve efficiency and result in leaner internal organization which will beeven more responsive to the customers’ needs.8

As for T-Com, the overall fixed operations are very stable with significantly slower churn invoice segment than in other European countries. Thanks to the strong focus on our strategicbroadband services, the number of ADSL customers was higher than 43,500 (56%increase compared to 2008), whereas Extra TV service had almost 30,000 customers atthe end of the year (71% growth year over year). It is very important to point out that ExtraTV had by far the highest number of new customers in the market during the year, thusproving its superior quality. In addition, for the first time we launched 3play offer whichhas been a real success on the market.<strong>2009</strong> was one more year of a very intensive competition in Montenegrin mobile market.However, T-Mobile managed to increase its overall customer base to 36.7% (comparedto 36.1% in 2008), maintaining stable leadership in the postpaid segment - 44.5% ofmarket share in postpaid segment compared to 42.9% in 2008. All in all, T-Mobile gotcloser to the overall market leading position then ever.When it comes to our dividend policy payment, <strong>2009</strong> will definitely be remembered as thehistoric year – a year in which we paid out the highest amount of dividend in the history ofthe country amounting to € 59.800.000.We also continued being number one company in corporate social responsibility aspectfor which we received an official award – it was the first time such award was given in thecountry and we are very proud to receive this public recognition for our activities.The aforementioned activities, inter alia, contributed to the fact that <strong>Crnogorski</strong> <strong>Telekom</strong>’sTRI*M results (customer satisfaction) are on the highest level in MT Group, but we aregoing to strive for even better achievements in this regard as well.I would also like to use this opportunity to thank our employees for their commitmentand contribution to the successes of the company. They are definitely considered as akey asset of the company and therefore we are going to carry on working on their furtherimprovement and education which is essential for the forthcoming challenges.Last but no least, I would like to thank you, our shareholders, for the shown trust. We areconfident that with our customer focus, permanent innovations, investments in both fixedand mobile networks and constant increase in efficiency, we are going to achieve operationalexcellence and sustainable profitability on a long run. However, in order to achievethe aforementioned, we need to take one step at the time. We all already see that the yearof 2010 will not be an easy year in many aspects, but similarly to what I said at the verybeginning of my letter, I am convinced that our 2010 strategy and its slogan – one company,one team, one mission – will bring even better results than those we had in <strong>2009</strong>.Daniel SzaszChairman of the Board of DirectorsDear Shareholders9

<strong>Crnogorski</strong> <strong>Telekom</strong>’s Board of DirectorsDániel SzászGereon HammelTripko KrgovićGábor PálHans-Peter SchultzJános SzabóDénes SzluhaDániel Szász, Chairman of the Board of Directors of <strong>Crnogorski</strong> <strong>Telekom</strong> a.d.Szasz Daniel, age 38, is an economist. He started his career at General Motors Group,where he held various managerial and treasury leadership positions since 1994 at Opelcompanies in Hungary and Germany. He delivered tasks of GM Daewoo Central and EasternEurope managing director from 2002. He was appointed Chief Financial Officer ofT-Online Hungary Plc. effective of January 1, 2004. In 2007, he was appointed Chairmanof the Board of Directors and Chairman of the Management Committee of <strong>Crnogorski</strong><strong>Telekom</strong>.Gereon Hammel was born in May 1968 and holds a business degree.In 1989 he started his professional career at the Bayer AG Group in the Fast MovingConsumer Goods business unit. From 1992 he managed the Household Detergent businessof Bayer Italy. In 1994 he moved back to Germany and was appointed as regionalmanager for the Bayer subsidiaries in Scandinavia, Poland and Africa. In 2000 he built upa Regional Financial Controlling and participated as a member of the national managementteam in the development of an international head office based in the UK for the UK,Scandinavia, Finland, France, Poland, Russia and Africa.In 2001 he joined Michael Page Frankfurt an international recruitment consultancy andwas responsible for the Executive Search of Finance positions.In August 2002 he moved to T-Mobile International and was responsible for projects inthe South Eastern European region (SEE). Between 2006 and <strong>2009</strong> he holds the positionof a Vice President for T-Mobile International’s Joint Venture Management in Hungary,Montenegro and for projects in SEE. Today he works as Senior Expert within Deutsche<strong>Telekom</strong>’s SEE Marketing department.10Tripko Krgović is born in 1977, in Belgrade. He finished his basic and masterstudies on Faculty of Economics in Podgorica.His professional carrier began in 1996 in family business. From 2004 he works in SecuritiesCommission, in market supervision department. In 2005 he holds position of Investmentmanager in Moneta Investment Fund. From 2006-2008 he was the Chief ExecutiveOfficer of Moneta Broker-Diler AD Podgorica, where he is still a Board member. Beside<strong>Crnogorski</strong> <strong>Telekom</strong>, he is Board member of Otrantkomerc, AD Ulcinj. He is the memberof Minority Shareholders Council and a represent of minority shareholders in severalMontenegrin companies.

Gábor Pál - Born in Budapest, 1968. Earned his degree at the Finance and LogisticsManagement faculty of the Budapest University of Economics in 1993, followed bya second degree at the Programmer Mathematician faculty of Eötvös Lóránd Universityin 1994. He participated in the PhD program of the Budapest University of Economicsfrom 1996. He started to work for NN Hungary Insurance Company as insurance mathematicianin 1993, followed by his employment by Westel Mobile Co. Ltd. from 1994as financial analyst. In 2000 he was promoted director of finance of the company, andbecame executive director of finance as of January 1, 2004 at Westel and the renamed onMay 3, 2004 company, T–Mobile Hungary Ltd. After the merge of T-Mobile Hungary withMagyar <strong>Telekom</strong> Plc. in March 2006, he is director of finance and controlling of the MobileServices Line of Business at Magyar <strong>Telekom</strong>. Since January 2008 Strategy, Planningand Control director of Consumer Business Unit of Magyar <strong>Telekom</strong> Plc. Participated inseveral Magyar <strong>Telekom</strong> acquisition projects in the region. Former member of the BoD ofMobimak in Macedonia, currently member of the BoD at <strong>Crnogorski</strong> <strong>Telekom</strong>, Makedonski<strong>Telekom</strong>. Member of the BoD of M Factory Zrt, Budapest.Hans-Peter Schultz was born in 1958. He graduated as Electrical engineer in1981. After joining Deutsche <strong>Telekom</strong> in 1985 he was working in different positions andprojects in DT’s international business. Until 2001 he was responsible for both internationalaffairs and projects mainly in South-East Europe. In 1996 he joined Deutsche<strong>Telekom</strong>’s Moscow Office where he managed the restructuring of DT’s satellite business,the integration of regional mobile businesses into DT’s affiliate “Mobile TeleSystems”and the introduction of Global One Russia. In 2002 Hans-Peter Schultz moved back toDeutsche <strong>Telekom</strong> in Bonn were he was responsible for DT’s business in Israel in the“Region CEE, Middle East”. In the headquarters of T-Home (until <strong>2009</strong>) and in the newdivision “Southern and Eastern Europe” of Deutsche <strong>Telekom</strong> (since 2010) he managesT-Home’s fixed line business of the Group in Slovakia.János Szabó was born in Hódmezovásárhely (Hungary) in 1961. He qualifiedwith a degree at the Budapest University of Economics in 1986 majoring in internationalrelations. After working in foreign services for three years, he continued in various financeand consultant positions in the private business sector. He became Director Finance ofDelco Remy Hungary (subsidiary of a US based automotive supplier) in 1995. Later hewas deputy general manager of the operation, responsible for sales, purchasing andoperations. In 1998 he was moved to the position of Director Finance Europe in charge ofthe finance activities and acquisitions of the European operations. Later he has becomeCFO and managing director of a joint venture between Delco Remy and Hitachi. FromApril, 2003 he was the director finance of the Wireline Services LOB of Magyar <strong>Telekom</strong>/later T-Com. The role was extended to fixed line network and IT operations in 2006. SinceJanuary 2008 he is Director of Group Planning & Controlling of Magyar <strong>Telekom</strong> Group.He is member of the BoD of MakTel and TMMK companies, and chairman of AC ofMakTel Group.Dénes Szluha was born in Budapest in 1968. He qualified with a degree at theSzent István Universtity, Gödöllő in 1994, majoring in economics. His career started at themarketing department of Shell Gas Hungary than continued at the advisory firm Deloitte.In 1998 he joined the leading Hungarian private equity fund manager with investors suchas EBRD, Bank Vontobel, Dresdner Kleinwort Wasserstein. He was responsible as an investmentmanager for acquisitions, portfolio management and sale of major investmentsin primarily the IT and telecommunications industry.In 2002 he joined Matáv (today Magyar <strong>Telekom</strong> or MT) as senior project manager. Currentlyhe holds the position of Portfolio Management Director. In his current capacitieshis team is responsible for managing international and domestic portfolio companies, aswell as working on the acquisition strategy. He is Board member in Makedonski <strong>Telekom</strong>,T-Mobile Macedonia and <strong>Crnogorski</strong> <strong>Telekom</strong>.11Dear Shareholders

Zoltan Pinkola, Strategy and Business Development OfficerBorn in 1972. Holds a degree in economics. Started his career with an international audit and financial advisoryfirm, Mazars in Budapest where he managed statutory audits, due diligence reviews of privatized companies andlead miscellaneous financial consultancy assignments through four years.He joined HBO Europe in 1997, holding various managerial positions initially in the Finance area, successivelytransferring to Business Development, managing projects related to the territorial expansion of HBO in CentralEurope and to the launch of new pay TV channels and services in the region.He has joined Magyar <strong>Telekom</strong> in March 2006, and <strong>Crnogorski</strong> <strong>Telekom</strong> in July 2006. He has been a member ofthe Management Committee of the Group and has fulfilled various executive positions since then. He holds theposition of Strategy and Business Development Officer since October 2007.Beata Prisztacs, Chief Human Resources OfficerBeata Prisztacs was born in 1970 in Pecs, Hungary. She graduated in 1993 on the Economics Faculty of PecsUniversity. She started her career in the Tourist Office of County Baranya in Pecs, first as marketing manager andlater as director of the company.In 1998 she joined Magyar <strong>Telekom</strong> and while working in different areas of the company she gained experiencein the field of Controlling, Sales and Human Resources. In 2003 she moved to Skopje, to the Macedonian subsidiaryof Magyar <strong>Telekom</strong> as senior consultant to the CHRLO, later as director of the HR Area.Eva Ulićević, Chief Technical Officer of <strong>Crnogorski</strong> <strong>Telekom</strong>Born in 1970. She holds a degree in Mathematical Science and Master of Mathematical Science. She started hercareer on 1993 at Mathematical Faculty of Montenegro University in Podgorica, as the Assistant to the Professor.From 1996 she worked in ProMonte GSM Podgorica as Deputy of CIO. In 2000 she was engaged as the TeamLeader of Oracle Academic Initiative Project while 2001 she worked in SEMA (LHS) Communications SystemsInc, Miami Florida USA as Senior Software Analyst Engineer for BSCS. From 2002 she is working for <strong>Crnogorski</strong><strong>Telekom</strong> Group at the several executive positions: CIO of T-Mobile, IT Director of <strong>Crnogorski</strong> <strong>Telekom</strong> Group(2005) and currently as CTO of <strong>Crnogorski</strong> <strong>Telekom</strong> Group (2006).14

Manfred Knapp, Chief Financial OfficerManfred Knapp holds a degree in Business Administration and Management from Fachhochschule fürWirtschaft, Berlin.Before joining Deutsche <strong>Telekom</strong> Group in 1997, Manfred Knapp covered several senior Controlling andFinance Management positions in different industries where he gained broad management experience in allareas of Finance Management.Mr. Knapp joined Deutsche <strong>Telekom</strong> in 1997. In 1998 Manfred Knapp was assigned to the mobile operatorWind in Italy as Controlling Director. From 1999 he managed the controlling area of Deutsche <strong>Telekom</strong> CarrierServices Business. In 2001 Manfred Knapp joined Slovak <strong>Telekom</strong> as Controlling Director and Deputy CFO.Since May 1, <strong>2009</strong> Manfred Knapp is responsible for the Finance area of <strong>Crnogorski</strong> <strong>Telekom</strong> as CFO.Tibor Vidos, Regulatory & Government Relations and Legal OfficerBorn in 1954. He holds a degree in physics and a doctorate in biology from the Eötvös University of Sciences inBudapest. In 1989 after having spent several years in academic research he became the executive secretary ofa political party during the democratic transition of Hungary. In 1991 he established the Hungarian subsidiaryof the then market leading British lobby firm GJW Government Relations which he managed until 2000. Between2000 and 2003 he assisted the democratic development of Indonesia by working there as the Directorof Political Party Programs of the National Democratic Institute (NDI). Between 2003 and 2004 he was the ChiefExternal Relations Officer of Invitel; one of the incumbent fixed line telephone operators in Hungary. He joined<strong>Crnogorski</strong> <strong>Telekom</strong> in April 2005 as Regulatory and Government Relations Director. He holds his current positionsince January 2008.Milija Zeković, Chief Sales OfficerBorn in 1971. He holds a degree in Economics from University of Montenegro. After completing studies in 1995he started his career at „Kartonka“, Podgorica, as production and sales manager.He started to work as Sales manager in T-Mobile (formerly Monet) in 2000.. In 2006 he became the Directorof Sales for residential customers and small and medium enterprises. In July 2008 he was appointed CSO of<strong>Crnogorski</strong> <strong>Telekom</strong>.Dear Shareholders15

IntroductionGeneral information<strong>Crnogorski</strong> <strong>Telekom</strong> (CT) is the biggest telecommunication company in Montenegro. It provides full range of fix, mobile and internettelecommunication services.<strong>Crnogorski</strong> <strong>Telekom</strong> is the main fixed line service provider in Montenegro. Its exclusive rights expired in 2003. <strong>Crnogorski</strong> <strong>Telekom</strong> provideslocal, national and international services, in addition to a wide range of telecommunications services involving leased line circuitsand data networks.On April 1 2005, Magyar <strong>Telekom</strong> obtained 76.53 percent interest in <strong>Crnogorski</strong> <strong>Telekom</strong> and thus became the majority owner of theCompany.Deutsche <strong>Telekom</strong> AG holds 59.21% of the Magyar <strong>Telekom</strong> shares. Deutsche <strong>Telekom</strong> and Magyar <strong>Telekom</strong> have a number of subsidiariesworldwide, with whom <strong>Crnogorski</strong> <strong>Telekom</strong> has regular transactions. Related party transaction details are given in the company’sFinancial Statements, Note 34.For the past five years, <strong>Crnogorski</strong> <strong>Telekom</strong>’s major operational goals were to finalize digitalization of the fixed line network and to increasethe capacity and reliability of data network, consequently creating conditions for increase of subscribers of broadband and voiceservices. The digitalization rate reached 100 percent by the end of 2007 and ADSL coverage exceeded 94% of PSTN customer base bythe end of <strong>2009</strong>.In December 2007 <strong>Crnogorski</strong> <strong>Telekom</strong> started IPTV services.In 2006, T-Com and T-Mobile brands were launched.T-Mobile Crna Gora is the second entrant in the mobile market in Montenegro and by YE <strong>2009</strong> it held 36.7% of mobile market (SIMcard) share. From the foundation in 2000, T-Mobile has always offered innovative and advanced services to the Montenegrin market andhas been experiencing dynamic growth.T-Mobile uses all advanced technologies such as UMTS, HSDPA, GPRS, EDGE. 3G network was launched in 2007.On May 1, <strong>2009</strong> <strong>Crnogorski</strong> <strong>Telekom</strong> a.d., T-Mobile Crna Gora d.o.o and Internet Crna Gora d.o.o were merged into one legal entity,<strong>Crnogorski</strong> <strong>Telekom</strong> a.d. The services are marketed under T-Com and T-Mobile brands.Introduction17

CompetitionT-ComIn 2007, the third mobile operator entered into the Montenegrintelecommunications market, as one of the licensed operators fordevelopment and exploitation of WiMAX-based network. In 2008 itlaunched fixed voice and broadband internet services.By <strong>2009</strong>, only 2 out of 10 licensed VoIP operators started withoperations. Agreements on interconnection/access were signedwith both operators. According to these contracts outgoing callservices to CT customers through carrier selection and freephoneservice are offered.Nine Multichannel Multipoint Distribution Service (“MMDS”) andCATV licenses were awarded in 2007. First broadband internetservices were offered in Q4 <strong>2009</strong>.CT underground infrastructure is currently used by the competitorsto a limited extent.Strong competition is developing in wholesale segment.T-MobileT-Mobile started its commercial operations as the second mobiletelecommunications service provider in Montenegro in 2000, fouryears after the first mobile provider started its operations. In 2007,a third mobile operator entered the Montenegrin mobile market.In <strong>2009</strong>, T-Mobile increased SIM market share by 0,6pp to 36,7percent and remained market leader in the postpaid segment with44,5 percent market share.Competition in mobile services is intense and driven by pricing,subscription options, subsidized handsets, coverage, as well asquality and portfolio of services offered.The goal of T-Mobile is to increase its market share by introducingsegment-oriented price plans, continuously offering new attractivehandsets, exploiting synergies of Deutsche <strong>Telekom</strong>, and maintainingexisting customer relations and community involvementas a sponsor of important social, cultural, sports and educationalevents.In <strong>2009</strong>, CT could increase pay TV customer market share by 8pp,to a market share of 26,9%.In September <strong>2009</strong>, <strong>Crnogorski</strong> <strong>Telekom</strong> started commerciallywith voice over IP services for business customers, using IP Centrexplatform.18

Regulatory environmentFollowing the privatization of <strong>Crnogorski</strong> <strong>Telekom</strong>, the gradual liberalization of the telecommunications markets in Montenegro hasstarted and this process has become more intense in recent years. The competition law came into force on January 2006 and the consumerprotection law was adopted in May 2007.The Law on Electronic Communications was adopted in July 2008. According to the expectations of the government the law will speedup the development of electronic communications networks and services; stimulate competition; provide open and equal access tonetworks and electronic communications services; improve efficiency and introduce new technologies and services; provide efficientcustomer protection; provide easy access to information on tariffs and services; stimulate Internet usage and encourage investment inthe telecommunications sector.The Agency for Electronic Communications has initiated a market analysis to identify operators that are significant market players (SMP)in order to prescribe SMP operators to introduce remedies as defined by the relevant EU directives. Until SMP operators are identifiedit shall be considered that <strong>Crnogorski</strong> <strong>Telekom</strong> is an operator with SMP in the markets of fixed voice telephony network and services,including the market of access to network for data transfer and leased lines, while all telephone network operators (including T-MobileCrna Gora) are operators with SMP in markets of termination of calls in their respective networks. The law on Electronic Communicationshowever does not prescribe what obligations the SMP operators have to fulfill before the first market analysis is completed.The Agency for Electronic Communication and Postal Services adopted the Rule Book on Number Portability, according to which providingof the service will start until August 2011 at the latest.Mobile operators will have to start to register prepaid users as of 1 March 2010 but have time to register the existing ones until May 2011Regulatory feesUnder the new regulatory regime <strong>Crnogorski</strong> <strong>Telekom</strong> pays fees for market supervision, numeration and the usage of radio frequencies.These fees are higher than the ones paid under the previous law when a flat 1 percent gross revenue fee was paid.Carrier selectionRIO of CT has not been updated since April 2008. Carrier Selection was already included in that version of RIO. Up to now, only oneoperator signed interconnection agreement with <strong>Crnogorski</strong> <strong>Telekom</strong> in July 2008, with Carrier Selection included.Sharing of infrastructureThe RIO also defines terms and conditions of collocation, for the purpose of interconnection realized at <strong>Crnogorski</strong> <strong>Telekom</strong>’s premises.This includes renting of space at buildings, masts and ducts as well. RIO conditions are valid only for operators looking or interconnection/accesswhile usage of infrastructure by operators for other purposes is subject to commercial negotiations.Termination of callsFixed termination fee (“FTR”) has been reduced by 10 percent in July, 2008 to level of 0.027 EUR/min. Termination of international callsin <strong>Crnogorski</strong> <strong>Telekom</strong>’s network transited by domestic operators is still subject of commercial negotiations with competitors.Mobile termination fee („MTR“) has not been changed since May 2007, when it was set on current level of 0.10 EUR/min. In May <strong>2009</strong>,inter-operator SMS/MMS termination fees have been introduced for the first time at Montenegrin mobile market.Reduction of FTR and MTR and the intention to equalize fees regardless of traffic origin have been announced by the Agency for ElectronicCommunications together with the introduction of cost-based termination in the forthcoming period.Local governments and state owned companies have repeatedly attempted to force CT to pay extremely high fees or charges based onvarious legal pretexts. CT has successfully challenged most of these attempts.IntroductionMontenegro and the European UnionMontenegro became independent in 2006 and signed a Stabilization and Association Agreement with the European Union at the end of2007. The Interim Stabilization and Association Agreement came into force on January 1, 2008. Montenegro has submitted its applicationfor membership in the EU in December 2008.19

Human resourcesLegal integration – merging our strengthsOn the May 1, <strong>2009</strong> the integration process has successfully finished with the merger of T-Mobile CG and Internet CG into <strong>Crnogorski</strong><strong>Telekom</strong>. This resulted in the transfer of the employees. All employees of TMCG and ICG accepted the transfer and became employeesof <strong>Crnogorski</strong> <strong>Telekom</strong>. The Collective Bargaining Agreements (CBA) of the predecessor companies stay valid for the employees foradditional one year. During this period the Employer need to harmonize with the Trade Union the new, modern and integrated CBA of theintegrated company.On the way to performance based cultureIn company’s HR strategy the creation of a performance-based corporate culture plays an outstanding role. Performance is the real measureof value, both for the company and for the individual contribution to the company’s success. As part of the extended performancemanagement system, individual target settings and evaluation was introduced as a pilot project, with the participation of all functionalareas.The performance management system supports the understanding and the implementation of the strategy. It supports the motivationof the employees, gives a transparent and documented evaluation of results by the manager and an objective self evaluation of performanceby the employee. It creates also the objective basis for the implementation and further evolution of staff development programsand remuneration schemes.Innovation program – Our competitive advantageHuman resourcesLearning from the results of a survey means taking visible and consistent actions. This was in focus during the review of the results ofthe Employee Survey conducted in the last quarter of 2008. The “Innovation Management” program was established in <strong>2009</strong> as a directresponse to the employee feedback.With the program, the Company was seeking to gain a competitive edge by mobilizing the innovation potential, commitment and ideasof its employees, who were really encouraged to make an extra effort and to utilize their innovative potential. The program showedclearly the real innovative potential of the company and the commitment and the loyalty of the employees. This was opportunity to capitalizethe human resource potential in the company, as real sustainable competitive advantage.Many ideas were reviewed and analyzed, and the winning ideas are already in the process of implementation. By this program, innovationbecomes part of the corporate DNA.21

Corporate responsibilityThe concept of Corporate Social Responsibility is important for <strong>Crnogorski</strong> <strong>Telekom</strong>. As one of the leading companies in the country,<strong>Crnogorski</strong> <strong>Telekom</strong> is proactively involved in all areas important for Montenegrin society.Following the codes of business ethics and corporate governance, as well as by understanding the needs of the community, <strong>Crnogorski</strong><strong>Telekom</strong> gives its contribution to the development of the Montenegrin society.CT supports educational initiatives, sports, culture and public health by sponsorships and donations.Corporate social responsibility23

ISKRA Philanthropy AwardIn <strong>2009</strong> <strong>Crnogorski</strong> <strong>Telekom</strong> received the ISKRA PhilanthropyAward for the best national project, given by NGO Fund for ActiveCitizenship, in partnership with Montenegrin Chamber of Commerceand the Office for sustainable development of the Governmentof Montenegro.It was the first time this kind of award was awarded in Montenegro,with the goal to promote development of the values suchas solidarity, humanity and social responsibility, and <strong>Crnogorski</strong><strong>Telekom</strong> received it for already several years ongoing project onincreasing IT literacy in the country, thus contributing to the overallprogress of Montenegrin society.The ISKRA award was a recognition for Company’s dedicationto the principles of sustainable growth and its striving to make agood balance between economic and social goals, by contributingin achieving higher life standards in the community.Development of information society in MontenegroBeing the leading broadband provider in the country, <strong>Crnogorski</strong><strong>Telekom</strong> is responsible to be the first country’s partner on its wayto becoming an information society. In order to enable internetto become a part of everyday lives of majority of Montenegrincitizens, together with the Government of Montenegro, the Companyinitiated a project aiming to increase the level of informaticsliteracy and internet penetration in Montenegro.The goal of the project, which started in 2008 and is planned tolast until 2012, is increasing the computer literacy, increasing thelevel of knowledge and using the internet, raising the general levelof awareness on the importance of the Internet and promotinginformation culture in Montenegro.All primary and secondary schools in Montenegro got their ownwebsites.For the third year in a row, <strong>Crnogorski</strong> <strong>Telekom</strong> enables freeinternet access via ADSL to all elementary and high schools in thecountry. The project was implemented together with Ministry ofeducation and science.24

The lines of businessWireline servicesTelephonyLoyalty programIn 2008, “Ritam Klub” was introduced, the first joined fix andmobile loyalty program. In Ritam klub customers can collect andspend points for: traffic, subscriptions, handsets, ADSL Modems,video cams, mp3 players and other goods. At the end of <strong>2009</strong>,more than 28.6 thousand of either fix or mobile customers joinedthe club.Flat and OCP packagesIn 2008, T-Com introduced flat voice packages (Komfor andKomfor+) offering unlimited calls towards the T-Com fixed networkin Montenegro and 100 extra minutes for calls within the fixednetwork in Serbia (Komfor+). These packages were launched toprevent churn.In December <strong>2009</strong> new semi-flat voice packages Komfor Veče(free on net calls in off peak) and Komfor Vikend (free on net callsin off peak and during the weekend) were launched with goodsuccess.3PLAYIn September <strong>2009</strong>, first 3Play offer on the Montenegrin marketwas launched with great success. It consists of two packages, ExtraTrio Mini and Extra Trio Flat, which combine Voice, ADSL andExtra TV services. At the end of <strong>2009</strong>, more than 6.100 customerssubscribed for the offer.IP Centrex solutionIn September <strong>2009</strong> <strong>Crnogorski</strong> <strong>Telekom</strong> started Max telephonyservice for business customers, based on IP Centrex solution.Fiber to the home (FTTH) projectIn <strong>2009</strong>, CT invested in most advanced FTTH technology inselected locations.ADSLIn <strong>2009</strong>, CT could increase number of ADSL customers by morethan 15.6 thousand (or by 56%) to 43,6 thousand customers.ADSL penetration by household reached 23% by YE <strong>2009</strong> and iscomparable to the ADSL penetration of neighboring countries.Extra TVExtra TV launch was very successful and IPTV penetration isthe highest in DT Group. At the end of <strong>2009</strong>, there were almost30.000 customers connected. The customer satisfaction of ExtraTV users is very high. ExtraTV had the most significant customermarket share increase in Montenegro in <strong>2009</strong>, with share of 29%at the end of year (increase of 8pp). Number of Extra TV customersincreased by 71% YoY.Two more channel packages have been added in <strong>2009</strong> (sport andentertainment). There is also a long list of Extra TV additional featuresimplemented through developed applications in <strong>2009</strong> (newweather forecast, classifieds, Extra TV Chat, Extra TV SMS).OtherImplementation of new Montenegrin numbering plan was successfullyfinished and parallel usage of new and old national areaand short codes finished in <strong>2009</strong>.Implementation of new national Internet domain (.me) was successfullyimplemented during 2008. Also, parallel usage (12months) of public mail addresses and web domains finished in<strong>2009</strong>.The lines of business27

Mobile servicesTotal T-Mobile customers increased YoY by 58,9 thousand (14,2%) to 474,6 thousand. Postpaid customer number increased by 17,5thousand (14,6%) to 136,9 thousand. Prepaid customer number increased by 41,5 thousand (14,0%) to 337,6 thousand.Total SIM market share increased from 36,1% to 36,7%. Market share in postpaid increased from 42,9% to 44,5% and T-Mobile remainedmarket leader in that segment. Prepaid SIM market share was 34,2% by YE <strong>2009</strong> (33,4% in 2008).SIM card penetration is among the highest in Europe with 208%.In January <strong>2009</strong>, T-Mobile introduced “Dueti”, a combined postpaid and prepaid service.In March <strong>2009</strong>, T-Mobile launched exclusively iPhone in Montenegro.In March <strong>2009</strong> T-Mobile, together with T-Com, executed refreshment of Ritam Club.In April, Smart Family was introduced, an addition to the most successful postpaid package (Smart) on the market.In May, Dupli Net was launched – ADSL and Mobile Internet in one package, first joint product ofT-Mobile and T-Com.Also in May, T-Mobile started with strong campaign for youth segment based on youth oriented prepaid tariff “Pleme”. Till the end of the<strong>2009</strong>, more than 90.000 prepaid customers joined.At the beginning of summer season, T-Mobile launched Holiday prepaid package in order to offer calling and SMS benefits to tourists.In September, T-Mobile introduced the upgrade of Mobile Internet packages. This upgrade was based on more GB for a lower price.In November, T-Mobile introduced the new version of Smart (residential) and Smart Team (business) postpaid tariff models. These tariffmodels offer additional benefits: more minutes included into subscription, free SMS.In <strong>2009</strong> T-Mobile continued to improve coverage and to extend capacities in 2G and 3G networks. 16 new base stations were implementedin 2G network, while in 3G the existing capacity was extended for more than 40%.28

Sales channels<strong>Crnogorski</strong> <strong>Telekom</strong> has developed different sales channels in order to provide best services to its residential and business customers.<strong>Crnogorski</strong> <strong>Telekom</strong>’s direct sales channels consist of own shop network of 14 T-Centers, Key Account Managers, SME Coordinatorsand Call Center. <strong>Crnogorski</strong> <strong>Telekom</strong>’s indirect sales channels include the partner shop’s network (consisted of 14 exclusive PartnerShops which use a similar design to the own shops), dealers, web sales and “door to door” sales. Dealers’ network consists of approximately1,400 contracted points of sale for prepaid vouchers and SIM cards.Business customers are served by Key Account Managers taking care of the top 400 clients and SME Coordinators who are in chargefor SME and SOHO companies. Top clients are segmented by industries (e.g. banks, hotels, large manufacturers, government, etc.) andsmall companies are divided by regions.The lines of business29

30This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

The financial year <strong>2009</strong>Management report for the <strong>2009</strong> financial year<strong>2009</strong> was financially and operationally a challenging year, because of the economic downturn and the difficult market conditions.<strong>Crnogorski</strong> <strong>Telekom</strong> was mainly focused on expanding the broadband services in both fixed and mobile segments and on the stabilizationof voice services. In fix voice segment we experienced moderate customer churn, while ADSL and Extra TV customer numberssignificantly increased. In mobile segment we kept postpaid leadership and increased market share.Even though the number of customers developed positively, we experienced revenue decline of 7,2%, and revenues reached 122,9million. Decrease of voice services revenues, both retail and wholesale and both in fix and mobile segment was the major driver of YoYdecline. This trend could not be completely offset by strong broadband Internet and TV revenues growth. During <strong>2009</strong> we successfullylaunched multiyear cost efficiency program that resulted in YoY cost reduction of EUR 7.6 million* (-9.0%). YoY EBITDA* decrease waslimited to 3,9% and EBITDA of 45,7 million was achieved.The financial year <strong>2009</strong>Highlights• Revenues decreased by 7,2% to amount of 122,9 million, mainly driven by development of voice revenues• EBITDA* decreased by 3,9%, to 45,7 million, and an EBITDA margin of 37% was achieved• Capital expenditure was 17,6 million, out of which 11,8 million in T-Com (greater part was related to IPTV and to developmentof access and broadband infrastructure) and 5,8 million in T-Mobile (investments into core and radio networks represent themajor share)• Dividend for 2008 in amount of 9,8 million was paid out in June, while 50,0 million of advance dividend (related to retained earningsof former T-Mobile Crna Gora and Internet Crna Gora) was paid out in July* Excluding special effects31

Revenue contribution by segment (after consolidation)T-Mobile47%T-Com53%EBITDA excluding SI developmentMilions5045403530252015105047,545,72008 <strong>2009</strong>32

EBITDA contribution by segment (after consolidation)T-Mobile47%T-Com53%The financial year <strong>2009</strong>T-ComT-Com achieved revenues of 71,7 million, a decrease of 4,3 million (-5,7%). Major contributors to this development are voice revenues,both retail (-2,6 million; -8,0%) and wholesale (-3,9 million; -17,0%). Moderate decrease of customers and decrease of usage causedvoice retail revenues decrease, while decreased traffic volumes (mainly of transit traffic) are the reason for voice wholesale revenuesdecrease YoY. Fixed line customer churn was moderate with 4,1 thousand (2,4%). CT Fixed line revenues and customers developmentis better than the international trends.33

T-Com Revenue structure (before consolidation)Milions807060504030201002008 <strong>2009</strong>Retail voice Wholesale voice Internet & TV Data OtherInternet&TV revenues continued to strongly increase. ADSL revenues increased significantly YoY (2,6 million; 48.0%) driven by customerbase increase of 15,7 thousand or by 56,2%. IPTV revenues increased by 24,0%, mainly due to customer increase of 12,4 thousandYOY or by 70,7%.Based on the cost efficiency project, OPEX* decrease of 3,1 million (-6.0%) YoY could compensate a significant part of revenue decline.Therefore EBITDA* decrease was limited to 5,0% YoY and reached 23,7million.Thousands180160170,2166,11401201008060402027,843,517,529,90Fix voice customers ADSL customers Extra TV customers2008 <strong>2009</strong>* Excluding special effects34

T-MobileRevenues of T-Mobile for the year <strong>2009</strong> amounted to 65,1 million and decreased by 9.9% compared to 2008. This trend is primarily theresult of the continuing decrease of voice revenues as result of intensive competition and economic crisis. Another driver was significantdecrease of visitors revenues (YoY decrease 2,9 million, -36%).EBITDA* for the year <strong>2009</strong> decreased by 2,7% to 21,9 million.Milions807060T-Mobile Revenue structure (before consolidation)The financial year <strong>2009</strong>504030201002008 <strong>2009</strong>Voice revenues Non-voice revenues Handset and activation OtherBy YE <strong>2009</strong>, 474,5 thousand customers used T-Mobile services (+12,4% YoY). In this period, the customer number growth comparedto last year mainly was driven by gain in both prepaid and postpaid segments. Trend in the <strong>2009</strong> was the gradual reduction of prices ofcalls and services. Customers could enjoy more call minutes, messages or data, which was demonstrated in the significant traffic growthas well as higher discounts.Thousands500450400350300250200150100500474,6415,7337,6296,2119,5137,0Postpaid subscribers Prepaid customers Total customers2008 <strong>2009</strong>2008 <strong>2009</strong>Mobile penetration in Montenegro (%) (**) 186 209T-Mobile Crna Gora’s market share (%) (**) 36,1 36,7* Excluding special effects** Data published by the Montenegrin Agency for Electronic communications and postal activities.35

36This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

CRNOGORSKI TELEKOM A.D. PODGORICAInternational Financial <strong>Report</strong>ing StandardsFinancial Statements andIndependent Auditor’s <strong>Report</strong>The financial year <strong>2009</strong>For the year ended 31 December <strong>2009</strong>This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.37

CONTENTSPageIndependent Auditor’s <strong>Report</strong> 39Statement of financial position 41Statement of comprehensive income 42Statement of cash flows 43Statements of Changes in Equity 44Notes to the Financial Statements 45-11638This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

39The financial year <strong>2009</strong>

STATEMENT OF FINANCIAL POSITIONIn EURAt December 31,Notes <strong>2009</strong> 2008ASSETSNon current assetsIntangible assets 5 14.031.941 15.301.380Goodwill 6 941.624 941.624Property and equipment 7 118.655.551 121.748.147Available for sale financial assets 8 25.374 25.374Investments in associates 9 - 225.389Deferred income tax asset 23 9.429 7.971Long term loans and other receivables 10 8.362.434 6.726.871Total non current assets 142.026.353 144.976.756The financial year <strong>2009</strong>Current assetsCash and cash equivalents 11 3.181.592 17.147.736Short term bank deposits 12 45.200.000 62.150.000Trade and other receivables 13 19.365.120 21.669.927Advances and prepayments 14 53.553.167 3.633.145Current income tax prepayment - 928.583Inventories 15 2.923.783 3.649.258Restricted cash 16 461.903 600.449Total current assets 124.685.565 109.779.098Total assets 266.711.918 254.755.854LIABILITIESCurrent liabilitiesTrade and other payables 20 14.219.104 16.656.790Accrued liabilities and advances 21 10.220.593 12.334.872Current income tax payable 1.538.321 60.892Provision for liabilities and charges 22 1.801.966 5.194.542Total current liabilities 27.779.984 34.247.096Non current liabilitiesDeferred income tax liability 23 2.656.551 2.663.012Provision for liabilities and charges 22 766.773 1.150.788Other long term liabilities 3.293 3.142Total non current liabilities 3.426.617 3.816.942Total liabilities 31.206.601 38.064.038EQUITYCapital and reserves attributable to theequity holders of the companyShare capital 18 140.996.394 140.996.394Statutory reserves 19 5.644.103 5.058.637Retained earnings 88.864.820 70.636.785Total shareholders’ equity 235.505.317 216.691.816Total liabilities and equity 266.711.918 254.755.854The accompanying notes on pages 45 to 116 are an integral part of these financial statements.These financial statements have been approved for issue by the Board of Directorsof <strong>Crnogorski</strong> <strong>Telekom</strong> A.D. on April 15, 2010 and on their behalf are signed bySlavoljub Popadic Manfred Knapp Miloš RadovićChief Executive Officer Chief Financial Officer Accounting DirectorThis version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.41

STATEMENT OF COMPREHESIVE INCOMERevenuesIn EURFor the year ended December 31,Notes <strong>2009</strong> 2008Fixed line and Internet revenues 24 a 64.988.950 67.486.452Mobile lines revenues 24 b 57.801.956 64.861.659Total revenues 122.790.906 132.348.111Other income 25 365.345 211.441Operating expensesEmployee related expenses 26 (21.311.304) (26.048.892)Depreciation, amortization and impairment 27 (21.882.988) (21.637.264)Payments to other network operators 28 (23.578.578) (27.393.589)Cost of telecommunications equipment sales (5.192.165) (5.167.529)Other operating expenses 29 (24.602.791) (30.841.122)Total operating expenses (96.567.826) (111.088.396)Operating profit 26.588.425 21.471.156Finance income 30 5.786.068 6.850.074Finance costs 30 (536.670) (880.810)Finance income – net 5.249.398 5.969.264Profit before income tax 31.837.823 27.440.420Income tax expenses 31 (3.224.322) (2.799.353)Total comprehensive income for the year 28.613.501 24.641.067Attributable to:Equity holders of the company 28.613.501 24.641.067Earnings per share of the Company during theperiod (expressed in EUR per share)-basic 0,6053 0,5213-diluted 0,6053 0,5213The accompanying notes on pages 45 to 116 are an integral part of these financial statements.42This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

STATEMENT OF CASH FLOW(In EUR)For the year ended December 31,Note <strong>2009</strong> 2008Cash flows from operating activitiesCash generated from operations 39 43.819.047 38.453.063Interest paid 30 (16.937) (3.114)Income tax paid 23 (826.228) (5.797.610)Net cash generated from operating activities 42.975.882 32.652.339Cash flows from investing activitiesPurchase of tangible and intangible assets 5,7 (17.320.523) (14.990.517)Short term bank deposits 12 16.950.000 (22.050.000)Interest received 30 4.630.903 5.393.760Proceeds from disposal of associates 5,7 154.612 1.856.059Long term loans and other receivables 10 (1.635.563) 1.053.177Net cash used in investing activities 2.779.429 (28.737.521)The financial year <strong>2009</strong>Cash flows from financing activitiesDividends paid to shareholders and minority interest (59.721.455) (21.440.415)Net cash used in financing activities (59.721.455) (21.440.415)Net decrease in cash and cash equivalents (13.966.144) (17.525.597)Cash and cash equivalents, beginning of period 17.147.736 34.673.333Cash and cash equivalents, end of period 11 3.181.592 17.147.736The accompanying notes on pages 45 to 116 are an integral part of these financial statements.This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.43

STATEMENT OF CHANGES IN EQUITYShare Capital Statutory reserves Retained earnings TotalBalance at January 1, 2008 140.996.394 2.919.357 70.134.998 214.050.749Dividends - - (22.000.000) (22.000.000)Allocation of retained earnings (Note 19) - 2.139.280 (2.139.280) -Total comprehensive income for the year 2008 - - 24.641.067 24.641.067Balance at December 31, 2008 140.996.394 5.058.637 70.636.785 216.691.816Balance at January 1, <strong>2009</strong> 140.996.394 5.058.637 70.636.785 216.691.816Dividends - - (9.800.000) (9.800.000)Allocation of retained earnings (Note 19) - 585.466 (585.466) -Total comprehensive income for the year <strong>2009</strong> - - 28.613.501 28.613.501Balance at December 31, <strong>2009</strong> 140.996.394 5.644.103 88.864.820 235.505.317The accompanying notes on pages 45 to 116 are an integral part of these financial statements.44This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

1. GENERAL INFORMATION<strong>Crnogorski</strong> <strong>Telekom</strong> A.D. Podgorica (“<strong>Telekom</strong>” or the “Company”) provides fixed line, mobile, internet and other telecommunicationservices in Montenegro.The Company is the principal provider of fixed telephony services in the Republic of Montenegro, as well as of local, national and internationaltelephony services, in addition to a wide range of other telecommunication services involving leased circuits, data networks,telex and telegraph services. In accordance with the Republic of Montenegro Telecommunications Law, the Company’s market positionas an exclusive supplier of fixed-line telephony services was officially terminated on December 31, 2003.<strong>Crnogorski</strong> <strong>Telekom</strong> A.D., Podgorica was founded and registered with the Commercial Court of Podgorica under Decision numberedFi. 5490/98 of December 31, 1998, subsequent to the completion of the ownership transformation and separation processes of thetelecommunication and postal businesses of the Public Enterprise of Post, Telegraph and Telecommunications of the Republic of Montenegro(“JP PTT Crna Gora”).The financial year <strong>2009</strong>In accordance with the Republic of Montenegro Company Law, the Company was re-registered on November 6, 2002 into the CentralRegister of the Commercial Court of Podgorica under registration entry numbered 4-0000618/001.During 2000, <strong>Telekom</strong> rolled out a GSM 900 mobile network and in May 2000 launched its commercial operation as a provider of mobiletelephony. On July 28, 2000 <strong>Telekom</strong> registered Monet D.O.O. (which was later renamed to T-mobile CG d.o.o.) as it’s fully ownedsubsidiary and subsequently transferred the mobile telephony business to Monet. The Montenegro mobile telephony market is liberalizedand <strong>Crnogorski</strong> <strong>Telekom</strong> (T-mobile CG d.o.o., as its subsidiary before merging date) competes with other operators “Pro Monte”D.O.O. and M tel D.O.O.<strong>Crnogorski</strong> <strong>Telekom</strong> A.D. (Internet Crna Gora d.o.o., as its subsidiary before merging date) also operates in the area of provisioning ofweb services, line leases, reproduction of computer media, consulting services and in development of computer software.Following a successful privatization tender <strong>Crnogorski</strong> <strong>Telekom</strong> A.D. was acquired by Magyar <strong>Telekom</strong> NyRt. (hereinafter referred to asMagyar <strong>Telekom</strong>). Magyar <strong>Telekom</strong> obtained control of <strong>Crnogorski</strong> <strong>Telekom</strong> on March 31, 2005 and by the end of 2005 it had a 76.53%stake which did not change by 31 December <strong>2009</strong>. Deutche <strong>Telekom</strong> AG is the ultimate controlling owner of Magyar <strong>Telekom</strong> holding59.21% of the issues shares.As of April 30, <strong>2009</strong>, the Company owned 100% of the capital of T-mobile CG d.o.o., the Montenegrin mobile company and 100% ofthe share capital of Internet Crna Gora..On April 30, <strong>2009</strong> the General Assembly of <strong>Crnogorski</strong> <strong>Telekom</strong> A.D made decision about merging of previously existed three companies:<strong>Crnogorski</strong> telekom A.D., and it’s subsidiaries T Mobile d.o.o. and Internet d.o.o., into one unique legal entity “<strong>Crnogorski</strong> <strong>Telekom</strong>A.D.”. The merger was registered on May 11, <strong>2009</strong> at the Court of Registrar of the Republic of Montenegro under registration number4-0000618/028.<strong>Telekom</strong> is domiciled in Podgorica, in the Republic of Montenegro at the following street address: Moskovska 29. As at December 31,<strong>2009</strong> the Company had 917 employees (31 December 2008: 949 employees).This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.45

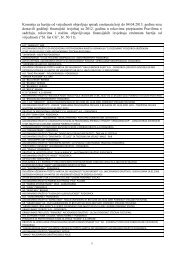

1. GENERAL INFORMATION (continued)Investigation into certain consultancy contractsAs previously disclosed, in the course of conducting their audit of Magyar <strong>Telekom</strong>’s 2005 financial statements, PricewaterhouseCoopersKönyvvizsgáló és Gazdasági Tanácsadó Kft. (“PWC”) identified two contracts the nature and business purposes of which were notreadily apparent to them. In February 2006, Magyar <strong>Telekom</strong>’s Audit Committee retained White & Case (the “independent investigators”),as its independent legal counsel, to conduct an internal investigation into whether the Magyar <strong>Telekom</strong> and/or any of its affiliateshad made payments under those, or other contracts, potentially prohibited by U.S. laws or regulations, including the Foreign CorruptPractices Act (“FCPA”), or internal company policy. The Audit Committee also informed the U.S. Department of Justice (“DOJ”) and theU.S. Securities and Exchange Commission (“SEC”), and the Hungarian Supervisory Financial Authority of the internal investigation.On December 2, <strong>2009</strong>, the Audit Committee provided Magyar <strong>Telekom</strong>’s Board of Directors with a “<strong>Report</strong> of Investigation to the AuditCommittee of Magyar <strong>Telekom</strong> Nyrt.” dated November 30, <strong>2009</strong> (the “Final <strong>Report</strong>”). The Audit Committee indicated that it considersthat, with the preparation of the Final <strong>Report</strong> based on currently available facts, White & Case has completed its independent internalinvestigation.The Final <strong>Report</strong> includes the following findings and conclusions, based upon the evidence available to the Audit Committee and itscounsel:As previously disclosed, with respect to Montenegrin contracts, there is “insufficient evidence to establish that the approximately EUR7 million in expenditures made pursuant to four consultancy contracts ... were made for legitimate business purposes”, and there is “affirmativeevidence that these expenditures served improper purposes.” These contracts were not appropriately recorded in the booksand records of Magyar <strong>Telekom</strong> and its relevant subsidiaries.In 2007 the Supreme State Prosecutor of the Republic of Montenegro informed the Board of Directors of <strong>Crnogorski</strong> <strong>Telekom</strong>, of herconclusion that the contracts subject to the internal investigation in Montenegro included no elements of any type of criminal act forwhich prosecution would be initiated in Montenegro.Hungarian authorities also commenced their own investigations into Magyar <strong>Telekom</strong>’s activities in Montenegro. The Hungarian NationalBureau of Investigation has informed Magyar <strong>Telekom</strong> that it closed its investigation as of May 20, 2008 without identifying anycriminal activity.United States authorities commenced their own investigations concerning the transactions which were the subject of the internal investigationto determine whether there have been violations of U.S. law.We cannot predict when the ongoing investigations will be concluded, what the final outcome of those investigations may be, or theimpact, if any, they may have on our financial statements or results of operations. The authorities could seek criminal or civil sanctions,including monetary penalties, against us or our affiliates, as well as additional changes to our business practices and compliance programs.46This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.

2. summary of significant accounting policies2.1. Basis of PreparationThe financial statements of the <strong>Crnogorski</strong> <strong>Telekom</strong> A.D. have been prepared in accordance with the International Financial <strong>Report</strong>ingStandards (IFRS) as issued by the International Accounting Standards Board (IASB) and effective at the time of preparing the financialstatements and with the requirements of the Law on Accounting and Auditing of Montenegro. The financial statements have been preparedunder historical cost convention.The Company maintains its accounting records and prepares its financial statements in accordance with the Accounting and AuditingLaw of the Republic of Montenegro (Official Gazette of the Republic of Montenegro, numbered No 69/2005) and in particular, based onthe relevant legal decision defining the mandatory application of IFRS in the Republic of Montenegro (Official Gazette of the Republic ofMontenegro, numbered 69/2002). In conformity with these provisions, the IFRS were applied for the first time as the primary accountingbasis for the reporting year commencing January 1, 2003.The financial year <strong>2009</strong>The official currency in the Republic of Montenegro and the functional currency of <strong>Crnogorski</strong> <strong>Telekom</strong> A.D. is the Euro (EUR).These financial statements of the Company were approved for issue by the Company’s Board of Directors (the Board), however, the<strong>Annual</strong> General Meeting (AGM) of the owners, authorized to accept these financials, has the right to require amendments before acceptance.As the controlling shareholders are represented in the Board of the Company that approved these financial statements forissuance, the probability of any potential change required by the AGM is extremely remote, and has never happened in the past.Standards, amendments and interpretations effective and initially adopted by the Company in <strong>2009</strong>In the current period, the Company has adopted all of the new and revised Standards and Interpretations issued by the InternationalAccounting Standards Board (the IASB) and the International Financial <strong>Report</strong>ing Interpretations Committee (the IFRIC) of the IASB thatare relevant to its operations and effective for annual reporting periods beginning on 1 January <strong>2009</strong>. The initial application of thesepronouncements did not have a material impact on the Company’s results of operations, financial position or cash flows. Listed beloware those new or amended standards or interpretations:- IAS 1 (revised) - Presentation of Financial Statements. Revised IAS 1 introduces overall requirements for the presentation of financialstatements, guideline for their structure and minimum requirements for their contents. The revised standard prohibits the presentationof items of income and expenses (that is, ‘non-owner changes in equity’) in the statement of changes in equity, requiring ‘non-ownerchanges in equity’ to be presented separately from owner changes in equity. All non-owner changes in equity are required to be shownin a performance statement, but entities can choose whether to present one performance statement (the statement of comprehensiveincome) or two statements (the income statement and statement of comprehensive income). Where entities restate or reclassify comparativeinformation, they will be required to present a restated balance sheet as at the beginning comparative period in addition to thecurrent requirement to present balance sheets at the end of the current period and comparative periodThe amendment also clarifies that some rather than all financial assets and liabilities classified as held for trading in accordance with IAS39, ‘Financial instruments: Recognition and measurement’ are examples of current assets and liabilities respectively. The amendmentsdid not have any effect on financial statements of the Company.This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.47

2. summary of significant accounting policies (continued)2.1. Basis of Preparation (continued)- IAS 19 (Amendment), ‘Employee benefits (effective from 1 January <strong>2009</strong>). The amendment is part of the IASB’s annual improvementsproject published in May 2008. The amendment clarifies that a plan amendment that results in a change in the extent to which benefitpromises are affected by future salary increases is a curtailment, while an amendment that changes benefits attributable to past servicegives rise to a negative past service cost if it results in a reduction in the present value of the defined benefit obligation. The definition ofreturn on plan assets has been amended to state that plan administration costs are deducted in the calculation of return on plan assetsonly to the extent that such costs have been excluded from measurement of the defined benefit obligation. The distinction betweenshort term and long term employee benefits will be based on whether benefits are due to be settled within or after 12 months of employeeservice being rendered. IAS 37, ‘Provisions, contingent liabilities and contingent assets, requires contingent liabilities to be disclosed,not recognized. The application of the amendments did not have a material effect on the financial statements of the Company.- IAS 23 (revised) - Borrowing costs - Under the revised IAS 23 an entity must capitalize borrowing costs that are directly attributable tothe acquisition, construction or production of a qualifying asset as part of the cost of that asset. The definition of borrowing costs hasalso been amended so that interest expense is calculated using the effective interest method defined in IAS 39 ‘Financial instruments:Recognition and measurement’. This eliminates the inconsistency of terms between IAS 39 and IAS 23. <strong>Crnogorski</strong> <strong>Telekom</strong> A.D.applied IAS 23 as of January 1, <strong>2009</strong>, which did not have an impact on the financial statements since the Company did not have anyborrowed funds in the reported periods.- IFRS 2 (amended) Share-based Payment. Main change and clarifications include references to vesting conditions and cancellations.The changes to IFRS 2 must be applied in periods beginning on or after January 1, <strong>2009</strong>. The Company applied IFRS 2 as of January 1,<strong>2009</strong>, which had immaterial impact on the financial statements as the Company has no significant share based compensations.- IFRS 7 (amended) Financial Instruments: Disclosures (Improving Disclosures about Financial Instruments). The amendment requiresenhanced disclosures about fair value measurements and liquidity risk in the wake of the recent financial crisis. The entity is required todisclose an analysis of financial instruments using a three-level fair value measurement hierarchy. The amendment (a) clarifies that thematurity analysis of liabilities should include issued financial guarantee contracts at the maximum amount of the guarantee in the earliestperiod in which the guarantee could be called; and (b) requires disclosure of remaining contractual maturities of financial derivativesif the contractual maturities are essential for an understanding of the timing of the cash flows. An entity further has to disclose a maturityanalysis of financial assets it holds for managing liquidity risk, if that information is necessary to enable users of its financial statementsto evaluate the nature and extent of liquidity risk. As the Company does not have issued financial guarantees nor financial derivatives,there is no effect on the financial statements of the Company.48This version of our report/ the accompanying documents is a translation from the original, which was prepared in Montenegrin. All possible care has been taken to ensure that the translation is anaccurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation.