Bulk Vessel - Clarksons Shipping Intelligence Network

Bulk Vessel - Clarksons Shipping Intelligence Network

Bulk Vessel - Clarksons Shipping Intelligence Network

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

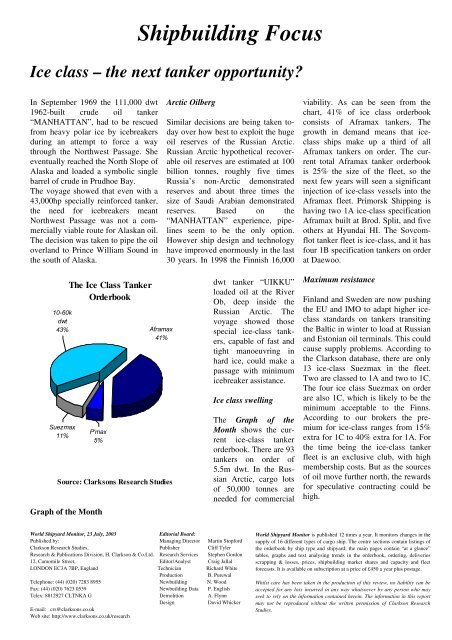

Shipbuilding FocusIce class – the next tanker opportunity?In September 1969 the 111,000 dwt1962-built crude oil tanker“MANHATTAN”, had to be rescuedfrom heavy polar ice by icebreakersduring an attempt to force a waythrough the Northwest Passage. Sheeventually reached the North Slope ofAlaska and loaded a symbolic singlebarrel of crude in Prudhoe Bay.The voyage showed that even with a43,000hp specially reinforced tanker,the need for icebreakers meantNorthwest Passage was not a commerciallyviable route for Alaskan oil.The decision was taken to pipe the oiloverland to Prince William Sound inthe south of Alaska.Arctic OilbergSimilar decisions are being taken todayover how best to exploit the hugeoil reserves of the Russian Arctic.Russian Arctic hypothetical recoverableoil reserves are estimated at 100billion tonnes, roughly five timesRussia’s non-Arctic demonstratedreserves and about three times thesize of Saudi Arabian demonstratedreserves. Based on the“MANHATTAN” experience, pipelinesseem to be the only option.However ship design and technologyhave improved enormously in the last30 years. In 1998 the Finnish 16,000viability. As can be seen from thechart, 41% of ice class orderbookconsists of Aframax tankers. Thegrowth in demand means that iceclassships make up a third of allAframax tankers on order. The currenttotal Aframax tanker orderbookis 25% the size of the fleet, so thenext few years will seen a significantinjection of ice-class vessels into theAframax fleet. Primorsk <strong>Shipping</strong> ishaving two 1A ice-class specificationAframax built at Brod. Split, and fiveothers at Hyundai HI. The Sovcomflottanker fleet is ice-class, and it hasfour 1B specification tankers on orderat Daewoo.Graph of the MonthThe Ice Class TankerOrderbook10-60kdwt43% Aframax41%Suezmax11%P'max5%Source: <strong>Clarksons</strong> Research Studiesdwt tanker “UIKKU”loaded oil at the RiverOb, deep inside theRussian Arctic. Thevoyage showed thosespecial ice-class tankers,capable of fast andtight manoeuvring inhard ice, could make apassage with minimumicebreaker assistance.Ice class swellingThe Graph of theMonth shows the currentice-class tankerorderbook. There are 93tankers on order of5.5m dwt. In the RussianArctic, cargo lotsof 50,000 tonnes areneeded for commercialMaximum resistanceFinland and Sweden are now pushingthe EU and IMO to adapt higher iceclassstandards on tankers transitingthe Baltic in winter to load at Russianand Estonian oil terminals. This couldcause supply problems. According tothe Clarkson database, there are only13 ice-class Suezmax in the fleet.Two are classed to 1A and two to 1C.The four ice class Suezmax on orderare also 1C, which is likely to be theminimum acceptable to the Finns.According to our brokers the premiumfor ice-class ranges from 15%extra for 1C to 40% extra for 1A. Forthe time being the ice-class tankerfleet is an exclusive club, with highmembership costs. But as the sourcesof oil move further north, the rewardsfor speculative contracting could behigh.World Shipyard Monitor, 23 July, 2003Editorial Board:Published by: Managing Director Martin StopfordClarkson Research Studies, Publisher Cliff TylerResearch & Publications Division, H. Clarkson & Co.Ltd. Research Services Stephen Gordon12, Camomile Street, Editor/Analyst Craig JallalLONDON EC3A 7BP, England Technician Richard WhiteProduction B. PurewalTelephone: (44) (020) 7283 8955 Newbuilding N. WoodFax: (44) (020) 7623 0539 Newbuilding Data P. EnglishTelex: 8812927 CLTNKA G Demolition A. FlynnDesignDavid WhickerE-mail: crs@clarksons.co.ukWeb site: http://www.clarksons.co.uk/researchWorld Shipyard Monitor is published 12 times a year. It monitors changes in thesupply of 16 different types of cargo ship. The centre sections contain listings ofthe orderbook by ship type and shipyard; the main pages contain “at a glance”tables, graphs and text analysing trends in the orderbook, ordering, deliveriesscrapping & losses, prices, shipbuilding market shares and capacity and fleetforecasts. It is available on subscription at a price of £450 a year plus postage.Whilst care has been taken in the production of this review, no liability can beaccepted for any loss incurred in any way whatsoever by any person who mayseek to rely on the information contained herein. The information in this reportmay not be reproduced without the written permission of Clarkson ResearchStudies.