Special Annual Report Issue - AgGeorgia Farm Credit

Special Annual Report Issue - AgGeorgia Farm Credit

Special Annual Report Issue - AgGeorgia Farm Credit

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

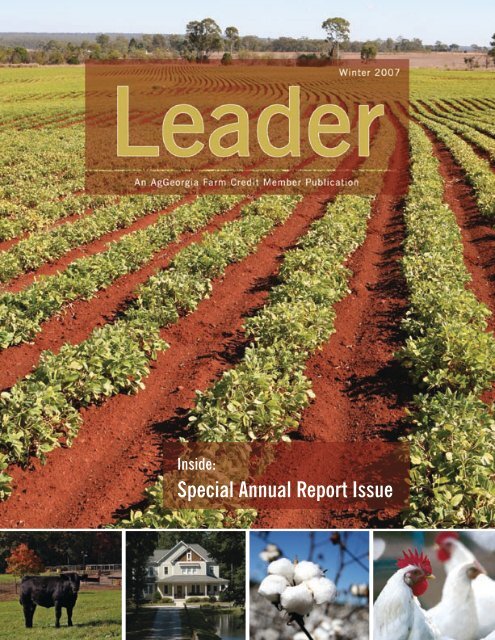

Inside:<strong>Special</strong> <strong>Annual</strong> <strong>Report</strong> <strong>Issue</strong>

Leaderis published quarterly for stockholders, directorsand friends of <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>.PresidentBill NewberryI want a free EmergencyCrank/Battery Radio!Enter our drawing for a free Crank Powered Radio with AM/FM/Shortwave 1 & 2 by fillingout the coupon below and mailing it in. This radio features a Dynamo Hand Crank which providespower anywhere, anytime; AM/FM/SW 1 & 2 radio bands; Crank Powered emergencylight; built-in rechargeable NiMH battery; 360 degree telescopic antenna; earphone jack; DC4.5V Jack; carrying case with shoulder strap. We will be giving away six of these handy itemsso send in your coupon today!The winners of the softsided briefcase in the Fall <strong>Issue</strong> were: Kim Cook of Hall County; Jana Williamsof Cook County; Julia Roberts of Cook County; Charles Eady of Gordon; Steve Milfordof Hart County and Johnnie Mixon of Vienna.NamePhone ( )Street Address (needed for delivery)City County ZipPlease check the appropriate box(es) I would like more information about <strong>Farm</strong> <strong>Credit</strong> services/products Please have a loan officer contact me.Mail this coupon to:<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> | PO Box 2536 | Gainesville, GA 30503BOARD OF DIRECTORSGerald D. AndrewsJohn W. Bagwell Jr.Tuttle W. BarksdaleEdward M. Beckham IIJack Bentley Jr.William L. BrownJames B. CarltonCarroll CastleberryBilly J. ClaryDan N. CrumptonGuy DaughtreyJ.E. “Bud” JonesHoward LawsonRonney S. LedfordJoseph M. MeeksBobby G. MillerDave NeffDan RainesGeorge R. ReevesAnne G. SiskDavid H. SmithJ. T. Woodard Sr.Franklin B. WrightEDITOR & MARKETING MANAGERMary KileyPUblisherAgFirst <strong>Farm</strong> <strong>Credit</strong> BankPublishing DIRECTOrDonna CamachodesignersDarren HillAmanda SimpsonTravis TaylorCassandra ZimmerlyPRINTERSpectra True ColourCirculationKathi DeFlorioAddress changes, questions, comments orrequests for copies of our financial reportsshould be directed to <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>by writing P.O. Box 1548, Dublin, GA 31040 orcalling 800-868-6404. Our quarterly financialreport can also be obtained on our website:www.aggeorgia.comEmail: mkiley@aggeorgia.com.<strong>AgGeorgia</strong>..Winter 2007

Table of ContentsThe annual <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>“Classic” was held the first weekend inJanuary in Tifton, Georgia. There were 70steers and heifers exhibited during thisevent with eleven counties in the southcentral Georgia area being represented.These counties were: Echols, ...Page 8While growing up on his father’sfarm, Gary Paulk never had any ideas,thoughts, dreams or plans of ever growingmuscadines, much less becoming one ofthe largest muscadines growers in thecountry.“I absolutely loved growing up on a farmand my daddy had a big influence...Page 24Where in Georgia is This?This memorial marking the final resting place of Colonel Benjamin Hawkins is locatedwhere in Georgia? Colonel Hawkins served on General George Washington’s staff duringthe Revolutionary War. He was born in 1754 and died in 1816.Answer to the last issue’s photo: This tribute to baseball’s legend Ty Cobb is located inRoyston, Georgia.4 Spotlight on Taylor County6 Taylor County GeorgiaStrawberry Festival 20077 Habersham CountyProperty For Sale8 <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>“Classic”10 Association Newswelcome Our Newest StaffMembersFloyd County Town andCountry DinnerAssociation Presents ServiceAwards11 Association News<strong>AgGeorgia</strong> OfficesCelebrate with CustomerAppreciation Events13 Association News<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>Heifer Show Held inCalhouninsurance Reminder14 Georgia <strong>Farm</strong> <strong>Credit</strong>Associations AwardScholarships to FVSUStudents16 Cotton: From Field to Fabric22 2006 <strong>Farm</strong> Family of theYear24 It Was Hogs to Muscadinesfor Georgia <strong>Farm</strong>er of theYear Gary Paulk26 <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>- Ag Loans & a Whole LotMore32 2006 <strong>Annual</strong> <strong>Report</strong><strong>AgGeorgia</strong>..Winter 2007

Spotlight on Taylor CountyBy: Sybil WillinghamAn arrow head kicked up in a freshlyplowed field is a sudden reminderof the presence of the native peopleswho once lived on the land that is nowTaylor County. It is not hard to imagine thescenes that surrounded them. In some ways,it is much the same today. The fall line thatmarks with a sandy streak that was the seashore divides the county. The northern partis hilly with deep rock formations whilethe southern part is sandy with acrub oakand pine forests. Gopher tortoises burrowin the sand hills. Creeks feed into the FlintRiver and teem with fish. A rare inlandstand of eastern white cedar, exquisitepitcher plants and other rare and endangeredflora and fauna live along the banksof Whitewater Creek and Cedar Creek.When naturalist William Bartram exploredthe area in 1779 he noted the natives that heencountered as well as the plants, animalsand soils of the region.Colonel Benjamin Hawkins wasappointed by George Washington in 1796as Indian agent to all of the tribes east ofthe Mississippi River and South of the OhioRiver. He established a settlement on thenorth side of the Flint River. On the southside of the river was a fort. The combinedarea, called the Agency Reserve, totaled3000 acres and is still visible on the landlot maps as lines drawn at 45-degrees tothe usual land lot north-south orientation.The agency was self-sufficient, with foodplots, orchards, and animal feed lots. Skillsand trades were taught to the Indians. Here,Hawkins entertained travelers, missionariesand tribal leaders. In 1805, the federalgovernment began a road to connect thecities of the east coast with New Orleans.The route, which followed the Lower CreekTrading Path, came through Hawkins’This field of hay promises agood supply of winter feed.Photo by Nancy Payne.agency, crossed the river and headed west.It was called “the federal road” and later theWire Road, for the telegraph wire that wasstrung along the route. The road followspresent day Georgia Highway 208.With more traffic came the desire formore land. The Treaty of Indian Springsceded the area to the government. The Stateof Georgia distributed the newly surveyedland by lottery in 1827. The early settlers ofthe area established small family farms of202 acres. A few plantations later occupiedrich flood plains land along the river andother fertile areas.Churches were soon established bythe faithful. Antioch Baptist Church andCrowell Methodist Church on the northside of the county were founded in the1820s. Other early churches were Bethelneat Butler, and New Hope near Reynolds,and Hays Campground now Union MethodistChurch. Taylor County Camp Groundis the site of an old fashioned camp meetingevery summer. On the grounds are an openair tabernacle, cottages and facilities forthose who come for fellowship and revival.The coming of the railroads broughtmore settlers to the area. Taylor Countywas formed in 1852, taken from parts ofMacon, Marion and Talbot Counties. Itwas named for Mexican War hero PresidentZachary Taylor. Although Reynolds,in the eastern end of the county reservedspace for a county seat, Fifty Mile Stationwas chose because of its central location.It was soon renamed Butler. A fine brickcourthouse was constructed on the squarein the middle of town and served as the seatof local government until 1935 when a new,larger courthouse replaced it. The statelyGreek revival building is the main countyoffice building and courthouse.The residents of Taylor County sawno need to secede from the Union when thequestion came up in 1860. They voted for<strong>AgGeorgia</strong>..Winter 2007

When naturalist William Bartram explored the area in 1779 he noted thenatives that he encountered as well as the plants, animals and soils of the region.the co-operationist delegates to the GeorgiaSecession Convention held in Milledgevillein January of 1861. Never-the-less, whenwar came, they were among the first to volunteerto serve in the Army of the Confederacy.By the time the war ended in April of1865, nearly every able-bodied white manin the county between the ages of 15 and55 had served. Many did not return, buriedin some far-away unknown grave. Most ofthe ones who made it home were missinglimbs or suffered from illness contractedin service. A monument on the courthousesquare was erected in 1911 by the Wallace-Edwards Chapter of the United Daughtersof the Confederacy in memory and honorof the Confederate soldiers from TaylorCounty.As the population grew, communitiessprang up around the county, especiallyclose to the railroads. Once thriving settlements,Charing, Mauk, Rupert, Potterville,and Howard remain as living reminders ofa simpler time. Other communities, likePebble, Fickling Mill, Southland, Crossroadsand Crowell are now only road names.Rural schools were built in the 1930s. Whenthe county schools were consolidated in the1950s, the rural schools were given to clubsformed to accept them for the communities.Of those, only Mauk Schoolhouse isstill owned and used by the club. CrowellSchoolhouse is owned and used by CrowellUnited Methodist Church.A historical marker at the intersectionof the Fall Line Freeway and John B. GordonRoad east of Reynolds tells the story ofBeechwood Plantation. Former ConfederateGenral John B. Gordon who laterserved as Georgia Governor and UnitedStates Senator began acquiring land on theFlint River in 1873. His Beechwood Plantationeventually sprawled to 10,000 acres inTaylor and Macon Counties. Here Gordonexperimented with grafted pecan trees, andraised Texas long horned cattle, paintedponies and goats.A historical markerat the intersection of theFall Line Freewayand John B. Gordon Roadeast of Reynolds tellsthe story of BeechwoodPlantation.Taylor County remains mainly agrarian.Fields of corn, peanuts, soybeans,watermelons and cotton stretch across thesummer landscape. Orchards of peach treesyield their luscious fruit from mid-May tomid-August to be packed and shipped topoints all over the country.Pine trees are planted, harvested andplanted again in a continuing cycle thatproduces pulp for paper and other products.The woods also provide the habitat for wildlife and a profitable sideline for landowners.The population of the county swells duringhunting season as sportsmen pursue thattrophy buck, wild hog or bearded turkey.One thing that western Taylor Countyhas plenty of is sand. It is said that the firstrail car of sand was loaded and sent off as aprank. The young pranksters were surprisedwhen a check came for them in payment forthe sand. This became a successful industrythat has thrived for over 100 years.Silver Dollar Raceway near Reynoldsdraws drag racing fans from all over thesouth-east. Billed as “excitement- a quartermile at a time,” the NHRA quarter mile dragstrip hosts races, car shows and specialevents year-round.Local festivals are great small townfun. The Countryside Festival in Butler inthe fall and the Georgia Strawberry Festivalin Reynolds in the spring are opportunitiesfor local folks to show their good ol’southern hospitality to visitors. But thenthe welcome mat is always out in TaylorCounty where everyone is treated like homefolks. Taylor County today remains mainlyagrarian. Photo by E. Kelly Bond.<strong>AgGeorgia</strong>..Winter 2007

Taylor CountyGeorgia Strawberry Festival, 2007With today’s hectic and sometimesscary world, don’t youwish you could go back to asimpler time and place? Well, Reynolds,Georgia becomes “Strawberry RFD” andturns back the clock to April 27 and 28, 1957as it welcomes visitors to the 9th annualGeorgia Strawberry Festival. Don’t expectto sit and rock on the front porch, though.There will be plenty to do starting in thepark on Friday evening. The Women’s Clubladies serve up good ol’ country cookin’ tobe enjoyed under the shade trees while agospel group picks old time gospel favoritesin the gazebo. Fresh strawberry shortcakefinished off the meal. Across the street aregames and rides and more food choices incase you missed the supper.On Saturday, grab some pancakes atthe Methodist Church and find your spotto watch the 10AM Teddy Bear Parade. Allkids are invited to join in! The Trae ChevroletGrand Parade follows with antiquecars and tractors, marching bands and anassortment of other entries. The tractorsand antique engines will be on display inthe park after the parade.Over 100 artists and craftsmen fromaround the southeast will have booths onthe streets and in the park offering uniquehandcrafted products. The Flint EnergiesStrawberry Cook-Off in Flint EnergiesAuditorium is planned for 1PM and drawssome of Georgia’s finest cooks.The festival promises good, wholesomefun for the whole family. 2006 Strawberry Festival Cook-Off WinnersHere are three of the winning recipes fromlast year’s Strawberry Festival Cook-Off.Bridget Wingate with her prize-winningFresh Strawberry Cake. Photo by E. KellyBond.Theresa Windham and her 1st placeLuscious Strawberry Cheesecake.Photo by E. Kelly Bond.Jane Morris and her prize-winningStrawberry Cream Supreme pie. Photo by E.Kelly Bond.<strong>AgGeorgia</strong>..Winter 2007

Fresh Strawberry Cake1st Place Cakes - Bridget WingateIngredients:1 box Yellow cake mix1 cup Sour cream1/3 cup Oil¼ cup Sugar¼ cup Water1pint Whipping cream¾ cup Sugar3 cups StrawberriesDirections:1. Mix first 5 ingredients and bake in 4, 8”cake pans until done. Let cool.2. Beat whipping cream & sugar until stiffpeaks form.3. Layer cake with whipping cream. Thenput some strawberries on top of whippingcream on each layer.4. Finish cake with remaining whippedcream.Luscious StrawberryCheesecake1st Place Cheesecakes - Theresa WindhamIngredients:1 box White cake mix4 tbsp Butter, melted4 Large eggs.2 pkg Cream cheese1 can sweetened condensed milk½ cup Sour cream1 tsp Vanilla½ tsp Almond1 cup Strawberries, choppedDirections:1. Heat oven to 325°. Grease 9” spring-formpan. Reserve ½ cup of cake mix. Blendremainder with 4 tbsp butter and 1 egg.The batter should form a ball. Spread thebatter evenly over the bottom and up 1 inchof the pan side.2. Mix together the cream cheese and thesweetened condensed milk. Add to it thereserved cake mix, 3 eggs, sour cream,vanilla, almond and strawberries.3. Pour onto crust.4. Bake 45-50 minutes5. Chill at least 1 hour.Strawberry CreamSupreme1st Place Pies - Jane G. MorrisIngredients Serves: 12Crust:1 ½ cups Graham crackers, crushed(Crush these in a plastic bag)¼ cup Butter, melted3 tbsp Sugar1 -12 oz Cool WhipFilling:18 oz. Sour cream1 pkg. Instant vanilla pudding &pie filling2 cups Strawberries, sliced(sprinkled with Splenda)2 tbsp Pecans, choppedDirections:1. Mix the graham crackers, butter andsugar in the plastic bag used to crush thecrackers. Press crumb mixture into bottomof a springform pan.2. Whisk cool whip & sour cream together.Add pudding mix and whisk until blended& smooth.3. Spread half of filling over crust. Arrangesliced strawberries over filling, and thenspread the rest of filling over strawberries.Sprinkle with copped pecans.4. Refrigerate.5. Cut into wedges and garnish with astrawberry fan.6. Variation: Add sliced bananas with thestrawberries. NOTE: If bananas are added,serve same day as it is prepared. HabershamCounty PropertyFor SaleFor sale in Habersham County 20.1acres for $365,000 with frontage on statehighway. This property has a stream and abarn and joins U.S. government property.Inquires to be directed to sdean@aggeorgia.com or telephone 706 499-5455.For sale in Habersham County32.48 acres for $1,200,000 with 800 feet onone of the best trout streams in Georgia, theSoque River. The property has a 2200 squarefoot brick dwelling with a full basement.Inquires to be directed to sdean@aggeorgia.com or telephone 706 499-5455. <strong>AgGeorgia</strong>..Winter 2007

<strong>AgGeorgia</strong>Offices Celebratewith CustomerAppreciation EventsThe, Sylvester and Moultrie branchoffices showed their appreciation for theircustomer during recent events.Sylvester Branch held their CustomerAppreciation luncheon on Wednesday,November 8th. Approximately 126 customers,family members and employees enjoyeda seafood buffet prepared by Roscoe Gay.Ray Hendrick, Tara Bozeman, CoreyCottle, Karen Norton, Steve Vick and SteveYearta of the Moultrie office sponsoredlunch at the Colquitt County Ag Center onNovember 30th. Roscoe Gay cooked friedquail and chicken with all the trimmingsfor 135 eager partakers. Several door prizeswere presented to those in attendance. <strong>AgGeorgia</strong>.11.Winter 2007

The Key to YourMortgage FinancingWhy landbank is the home loan solutionCompetitive market ratesKnowledgeable and experienced loanofficers to efficiently process your loanLarger tracts consideredProperty may be used for both residentialand agricultural purposesProperty may be accessed by a private roadEasements may be permissible providedsuch easements do not render the propertyunmarketableProperty may be located in areas less than25% developedFast loan approval and closingConvenient online applicationwww.landbanksolutions.comWhitney Bledsoe | 800.768.3276Donna Edwards | 866.615.7088Rhonda Shannon | 800.768.3031

Association News<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>Heifer Show Held in CalhounShown here are two photos of the winners of the <strong>Farm</strong> <strong>Credit</strong> Heifer Show held this pastNovember in Calhoun. Madison Miller of the Gordon County 4H showed the Champion 5thGrade or below Reserve Champion Angus. Madison was also the Showmanship winner forher class. Supreme Champion Heifer Shown by Lea Crump Gordon County 4-HerReserve Supreme Heifer shown by Kallie Johnson Cherokee County 4-HerInsuranceReminder<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>, Agricultural <strong>Credit</strong>Association (Association) loan agreementsand/or commitment letters stipulate thatborrowers obtain and maintain insuranceon property pledged as security for loanswith the association named as mortgagee orloss payee as appropriate.This notice is a reminder that theminimum amount of coverage requiredto be maintained is the lesser of your loanbalance(s), the actual cash value of theproperty, the replacement cost of the propertyor the amount stipulated by your loanofficer. Since the amount required could beless than the amount for which the propertycan be insured, you are encouraged toconsider higher limits where applicable toadequately protect your equity interest inthe property.If the property securing your loan consistsof improved real estate, unless otherwiseadvised, at a minimum, your policymust insure against the following perils:fire and lightening, wind, hail, aircraft orvehicle damage, riot or civil commotion,explosion, smoke damage, water damage(other than flood), falling objects, weightof snow, ice or sleet and vandalism. Lossor damage from flooding is also required ifyour loan was made after October 4, 1996,and at the time the loan was made the propertywas located in a government mandate<strong>Special</strong> Flood Hazard Area and flood insurancewas available.If the property securing your indebtednessconsists of personal property includingvehicles, machinery or equipment, in additionto the causes of loss cited in the precedingparagraph, the property must also be<strong>AgGeorgia</strong>.13.Winter 2007

insured against theft, and where applicable,such as with mobile machinery and equipment,collision and upset.If your current coverage does notconform to these requirements, pleasecontact your insurance representative andeffect the necessary changes to insure yourcoverage does comply with these requirements.Please contact your local <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> representative if you have anyquestions or comments. Georgia <strong>Farm</strong><strong>Credit</strong> AssociationsAward Scholarshipsto FVSU StudentsThe Georgia <strong>Farm</strong> <strong>Credit</strong> Associationsawarded scholarships to three students inthe Fort Valley State University College ofAgriculture, Home Economics and AlliedPrograms in January.Jack Drew, chief operating officer ofthe <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> Agricultural<strong>Credit</strong> Association, and Lisa Corbett, vicepresident of the AgSouth <strong>Farm</strong> <strong>Credit</strong>ACA, presented $500 GFCA scholarshipsto Nicole M. Cook, a senior majoring inanimal science and veterinary science technologyand Esther Nicole Hunt and AshleeMcGhee, both juniors majoring in plantscience.The scholarships awarded during a10 a.m. presentation ceremony in the C.W.Pettigrew <strong>Farm</strong> and Community LifeCenter on Jan. 11 were the first given toFVSU students by the Georgia <strong>Farm</strong> <strong>Credit</strong>Associations.During the scholarship presentation,Drew said that the Georgia <strong>Farm</strong> <strong>Credit</strong>Associations are “proud to continue ourlegacy of promoting agricultural educa-FVSU ag students awarded GFCA scholarships (From left) Neal Leonard, USDA-1890 liaisonofficer at FVSU, Dr. Mack Nelson, FVSU dean of the College of Agriculture, Home Economicsand Allied Programs; FVSU students Nicole M. Cook, Esther Nicole Hunt and Ashlee McGhee;Lisa Corbett, AgSouth <strong>Farm</strong> <strong>Credit</strong> vice president; Jack Drew, <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> chiefoperating officer; Mary Kiley, <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> marketing manager; and Dr. MarkLatimore, FVSU interim head of agricultural instruction, pause for a group photo during theGFCA scholarship presentation ceremony in FVSU’s C.W. Pettigrew Center, Jan. 11.tion through the inception of a scholarshipprogram at Fort Valley State University.”“<strong>Farm</strong> <strong>Credit</strong> has always supportedFFA, 4-H and other ag education programsthroughout the state and we look forwardto contributing to the education of studentsat FVSU’s College of Agriculture throughour state scholarship program,” he told thestudents.Nelson said that the college – and theuniversity – deeply appreciated the supportand commitment to education and agriculturethat the GFCA offered through itsscholarship program.“We look forward to a growing relationshipbetween the Georgia <strong>Farm</strong> <strong>Credit</strong>Associations and this university,” Nelsonsaid. “It is through the active commitmentof both private and public sector agenciesthat education – not just agricultural education,but all education – will continue togrow and flourish at Fort Valley State Universityand other seats of higher learning inGeorgia and the nation.”<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> ACA, withcorporate offices in Dublin, AgSouth <strong>Farm</strong><strong>Credit</strong> ACA, headquartered in Statesboro,and Southwest Georgia <strong>Farm</strong> <strong>Credit</strong>ACA, based in Bainbridge, play a key rolein serving the credit needs of Georgia’sfarmers, ranchers, and ag cooperatives, andthe mortgage needs of Georgia’s homeownerswith a combined loan volume in thestate in excess of $2.1 billion. <strong>AgGeorgia</strong>.14.Winter 2007

When you find the “perfect piece of land,” call us.Landbank, a new service from <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>, offers the perfect solution forabsolutely anyone interested in a loan to purchase land.Experience the difference experience makes.800.868.6404 | www.landbanksolutions.com<strong>AgGeorgia</strong>.15.Winter 2007

Cotton:From Field to FabricArticle and photos courtesy of the Georgia Cotton Commission.CottonCotton remains the most miraculous fiberunder the sun, even after 8,000 years. Noother fiber comes close to duplicating allof the desirable characteristics combinedin cotton. The fiber of a thousand facesand almost as many uses, cotton is notedfor its versatility, appearance, performanceand above all, its natural comfort. From alltypes of apparel, including astronauts’ inflightspace suits, to sheets and towels, andtarpaulins and tents, cotton in today’s fastmovingworld is still nature’s wonder fiber.It provides thousands of useful productsand supports millions of jobs as it movesfrom field to fabric.Economics of CottonA National Cotton Council analysisaffirms that today’s modern cotton productionsystem provides significant benefits torural America’s economy and environment.Healthy rural economies are based on stablefarm income, and cotton yields and pricesare often among the healthiest of all fieldcrops, vegetable or fruit.Cotton continues to be the basicresource for thousands of useful productsmanufactured in the U.S. and overseas. U.S.textile manufacturers use an annual averageof 7.6 million bales of cotton. A bale is about500 pounds of cotton. More than half of thisquantity (57%) goes into apparel, 36% intohome furnishings and 7% into industrialproducts. If all the cotton produced annuallyin the U.S. were used in making a singleproduct, such as blue jeans or men’s dressshirts, it would make more than 3 billionpairs of jeans and more than 13 billion men’sdress shirts.An often-overlooked component of thecrop is the vast amount of cottonseed that isproduced along with the fiber. <strong>Annual</strong> cottonseedproduction is about 6.5 billion tons,of which about two-thirds is fed whole tolivestock. The remaining seed is crushed,producing a high-grade salad oil and ahigh protein meal for live- stock, dairy andpoultry feed. More than 154 million gallonsof cottonseed oil are used for food productsranging from margarine and cooking oils tosalad dressing.Young cotton seedlings emerge from the soil within a week or two of planting. Flower budsform a month to six weeks later and the blossoms appear <strong>AgGeorgia</strong>.16.Winter in another three weeks. Bolls 2007open 50 to 70 days after bloom allowing air to dry the white, clean fiber inside.The average U.S. crop moving fromthe field through cotton gins, warehouses,oilseed mills and textile mills to the consumer,accounts for more than $35 billionin products and services. This injection ofspending is a vital element in the health ofrural economies in the 17 major cotton-producingstates from Virginia to California.The gross dollar value of cotton andits extensive system of production, harvestingand ginning provides countless jobs formechanics, distributors of farm machinery,consultants, crop processors and peoplein other support services. Other alliedindustries such as banking, transportation,warehousing and merchandising alsobenefit from a viable U.S. cotton productionsystem.<strong>Annual</strong> business revenue stimulatedby cotton in the U.S. economy exceeds $120billion, making cotton America’s numberone value-added crop. The farm value ofU.S. cotton and cottonseed production isapproximately $5 billion. Overseas sales ofU.S. cotton make a significant contributionto the reduction in the U.S. trade deficit.<strong>Annual</strong> values of U.S. cotton sold overseashave averaged more than $2 billion.Recently, the U.S. has supplied over 10.5million bales of the world’s cotton exports,accounting for about 37% of the total worldexport market. The largest customers forU.S. cotton are Asia and Mexico. Exportsof yarn, denim and other U.S.-manufacturedcotton products have increased dramaticallysince the early 1990s, from 1.38 millionbale equivalents in 1990, to more than 4million bale equivalents in 1998.Crop ProductionThe Cotton Belt spans the southernhalf of the Unites States, from Virginia toCalifornia. Cotton is grown in 17 states andis a major crop in 14. Its growing season ofapproximately 150 to 180 days is the longest

In the western statesnearly the entire cropis irrigated.of any annually planted crop in the country.Since there is much variation in climate andsoil, production practices differ from regionto region. In the western states, for example,nearly the entire crop is irrigated.Planting begins in February in southTexas and as late as June in northern areasof the Cotton Belt. Land preparation actuallystarts in the fall, shortly after harvest.Stalks from the old crop are shredded toreduce food supplies for overwinteringpests. Usually, this residue is left on thesurface to protect the soil from erosion. Theuse of heavy mechanical harvesters compactsthe soil, sometimes requiring tillageto loosen the soil for the next crop’s roots.PlantingPlanting is accomplished with 6, 8, 10or 12-row precision planters that place theseed at a uniform depth and interval. Youngcotton seedlings emerge from the soil withina week or two after planting, dependingon temperature and moisture conditions.Squares, or flower buds, form a month tosix weeks later and creamy to dark yellowblossoms appear in another three weeks.Pollen from the flower’s stamen is carried tothe stigma, thus pollinating the ovary. Overthe next three days, the blossoms graduallyturn pink and then dark red before fallingoff, leaving the tiny fertile ovary attached tothe plant. It ripens and enlarges into a podcalled a cotton boll.Individual cells on the surface of seedsstart to elongate the day the red flower fallsoff (abscission), reaching a final length ofover one inch during the first month afterabscission. The fibers thicken for the nextmonth, forming a hollow cotton fiber insidethe watery boll. Bolls open 50 to 70 daysafter bloom, letting air in to dry the white,clean fiber and fluff it for harvest.<strong>AgGeorgia</strong>.17.Winter 2007

The cotton belt spans the southern half of the United States, from Virginia to California and is a major crop in Georgia.Soil ConservationCotton producers expend extra effortsto minimize soil erosion. Cotton is sensitiveto wind-blown soil because the plant’sgrowing point is perched on a delicate stem,both of which are easily damaged by abrasionfrom wind-blown soil. For that reason,many farmers use minimum tillage practiceswhich leave plant residue on the soilsurface thereby preventing wind and watererosion.Conservation tillage, the practice ofcovering the soil in crop residue year ‘round,is common in windy areas. A growingnumber of producers also are moving tominimum tillage, or a no-till system, toreduce soil movement. In the rain belt, landterracing and contour tillage are standardpractices on sloping land to prevent thewashing away of valuable topsoil.IrrigationThe cotton plant’s root system is veryefficient at seeking moisture and nutrientsfrom the soil. From an economic standpoint,cotton’s water use efficiency allowscotton to generate more revenue per gallonof water than any other major field crop.Most of the U.S. cotton acreage is grownonly on rain moisture. A trend toward supplementalirrigation to carry a field throughdrought has increased in acreage and helpedstabilize yields.Cotton’s peak need for water occursduring July, when it is most vulnerable towater stress. A limited supply of irrigationwater is being stretched over manyacres via the use of highly efficient irrigationmethods such as low energy precisionapplications, sprinklers, surge and dripirrigation. Not only has irrigation stabilizedyields for many growers, it also has allowedproduction in the desert states of California,Arizona and New Mexico.HarvestingWhile harvesting is one of the finalsteps in the production of cotton crops, itis one of the most important. The crop mustbe harvested before weather can damage orcompletely ruin its quality and reduce yield.Cotton is machine harvested in the U.S.,beginning in July in south Texas and inOctober in more northern areas of the Belt.Stripper harvesters, used chiefly in Texasand Oklahoma, have rollers or mechanicalbrushes that remove the entire boll fromthe plant. In the rest of the Belt, spindlepickers are used. These cotton pickers pullthe cotton from the open bolls using revolvingbarbed spindles that entwine the fiberand release it after it has separated from theboll.Seed Cotton StorageOnce harvested, seed cotton mustbe removed from the harvester and storedbefore it is delivered to the gin. Seed cottonis removed from the harvester and placed inmodules, relatively compact units of seedcotton. A cotton module, shaped like a giantbread loaf, can weigh up to 25,000 pounds.GinningFrom the field, seed cotton moves tonearby gins for separation of lint and seed.The cotton first goes through dryers toreduce moisture content and then throughcleaning equipment to remove foreignmatter. These operations facilitate processingand improve fiber quality. The cotton<strong>AgGeorgia</strong>.18.Winter 2007

Since it is a non-perishable crop, cotton storedin a government-approved warehouse provides asecure basis for a monetary loan.is then air conveyed to gin stands whererevolving circular saws pull the lint throughclosely spaced ribs that prevent the seedfrom passing through. The lint is removedfrom the saw teeth by air blasts or rotatingbrushes, and then compressed intobales weighing approximately 500 pounds.Cotton is then moved to a warehouse forstorage until it is shipped to a textile millfor use. A typical gin will process about 12bales per hour, while some of today’s moremodern gins may process as many as 60bales an hour.ClassingAfter the lint is baled at the gin,samples taken from each bale are classedaccording to fiber strength, length, lengthuniformity, color, non-fiber content andfineness using high volume instrumentation(HVI) and the aid of an expert calleda Classer. Scientific quality control checksare made periodically to ensure that instrumentand Classer accuracy is maintained.Cotton of a given variety producesfibers of approximately the same length.Since the fibers may vary within a bale,length uniformity allows a determinationof the variability within that bale. Otherquality factors also are important. Thefiber’s fineness is important for determiningthe type of yarns that can be made from thefiber—the finer the cotton fibers, the finerthe yarns. Color or brightness of the fibersalso is important.Cotton that is very white generally isof higher value than cottons whose colormay have yellowed with exposure to elementsbefore harvesting. Cotton, beinga biological product, typically containsparticles of cotton leaves called trash. Theamount of trash also influences the cotton’svalue since the textile mill must removetrash before processing. The fiber’s strengthalso is an important measurement that ultimatelyinfluences the fabrics made fromthese fibers. The U.S. Department of Agriculture(USDA) establishes classing standardsin cooperation with the entire cottonindustry.MarketingCotton is ready for sale after instrumentclassing establishes the qualityparameters for each bale. The marketing ofcotton is a complex operation that includesall transactions involving buying, selling orreselling from the time the cotton is ginneduntil it reaches the textile mill. Growersusually sell their cotton to a local buyeror merchant after it has been ginned andbaled, but if they decide against immediatesale they can store it and borrow moneyagainst it. Since it is a non-perishable crop,cotton stored in a government-approvedwarehouse provides a secure basis for amonetary loan.CottonseedCotton actually is two crops, fiber andseed. About one-third of the cottonseedproduced from a typical crop is crushedfor oil and meal used in food products andin livestock and poultry feed. For each 100pounds of fiber produced by the cottonplant, it also produces about 162 pounds ofcottonseed.Approximately 5 percent of the totalseed crop is reserved for planting; theremainder is used for feeding as wholeseeds or as raw material for the cottonseedprocessing industry. After being separatedfrom the lint at the gin, the cotton’s seed istransported to a cottonseed crushing mill.There it is cleaned and conveyed to delintingmachines which, operating on the sameprinciple as a gin, remove the remainingshort fibers which are known as linters. Thelinters go through additional processingsteps before being made into a wide varietyAggeorgia.19.Winter 2007

For each 100 pounds of fiber produced by the cotton plant,it also produces about 162 pounds of cottonseed.of products ranging from mattress stuffingto photographic film. After the linters areremoved, the seed is put through a machinethat employs a series of knives to loosen thehulls from the kernel. The seeds are thenpassed through shakers and beaters.The separated hulls are marketed forlivestock feed or industrial products andthe kernels are ready for the extraction ofoil, the seed’s most valuable byproduct.Solvent extraction or presses remove theoil. After further processing, the oil is usedin cooking or salad oil, shortening andmargarine. Limited quantities also go intosoaps, pharmaceuticals, cosmetics, textilefinishes and other products. The remainingmeat of the kernel is converted into meal,the second most valuable by-product. Highin protein, it is used in feed for all classesof livestock and poultry. Cottonseed mealmakes an excellent natural fertilizer forlawns, flower beds and gardens.Yarn ProductionModernization efforts have broughtmajor changes to the U.S. textile industry.Equipment has been streamlined and manyoperations have been fully automated withcomputers. Machine speeds have greatlyincreased. At most mills the opening ofcotton bales is fully automated. Lint fromseveral bales is mixed and blended togetherto provide a uniform blend of fiber properties.To ensure that the new high-speedautomated feeding equipment performs atpeak efficiency and that fiber propertiesare consistent, computers group the balesfor production/feeding according to fiberproperties.The blended lint is blown by air fromthe feeder through chutes to cleaning andcarding machines that separate and alignthe fibers into a thin web. Carding machinescan process cotton in excess of 100 poundsper hour. The web of fibers at the front ofthe card is then drawn through a funnelshapeddevice called a trumpet, providinga soft, rope-like strand called a sliver (pronouncedSLY-ver). As many as eight strandsof sliver are blended together in the drawingprocess. Drawing speeds have increased tremendouslyover the past few years and nowcan exceed 1,500 feet per minute.Roving frames draw or draft the sliversout even more thinly and add a gentle twistas the first step in ring spinning of yarn.Ring spinning machines further draw theroving and add twist making it tighter andthinner until it reaches the yarn thicknessor “count” needed for weaving or knittingfabric. The yarns can be twisted many timesper inch. Ring spinning frames continue toplay a role in this country, but open-endspinning, with rotors that can spin five tosix times as fast as a ring spinning machine,are becoming more widespread. In openendspinning, yarn is produced directly fromsliver. The roving process is eliminated.Other spinning systems have alsoeliminated the need for roving, as well asaddressing the key limitation of both ringand open-end spinning, which is mechanicaltwisting. These systems, air jet andVortex, use compressed air currents to stabilizethe yarn. By removing the mechanicaltwisting methods, air jet and Vortex arefaster and more productive than any othershort-staple spinning system. After spinning,the yarns are tightly wound aroundbobbins or tubes and are ready for fabricforming. Ply yarns are two or more singleyarns twisted together. Cord is plied yarntwisted together.FabricManufacturingCotton fabric manufacturing startswith the preparation of the yarn for weavingor knitting. <strong>Annual</strong>ly, textile mills in theU.S. normally produce about eight billionsquare yards each of woven and three billionsquare yards of knitted cotton goods.Cotton fabrics, as they come fromthe loom in their rough, unfinished stages,are known as greige goods. Most undergovarious finishing processes to meet specificend-use requirements. Some mills, in additionto spinning and weaving, also dye orprint their fabrics and finish them. Otherssell greige goods to converters who have thecloth finished in independent plants.Finishing processes are numerous andcomplex, reflecting today’s tremendousrange and combination of colors, texturesand special qualities. In its simplest form,finishing includes cleaning and preparingthe cloth, dyeing or printing it and thentreating it to enhance performance characseeCotton, page 31<strong>AgGeorgia</strong>.20.Winter 2007

<strong>AgGeorgia</strong>.21.Winter 2007

2006 <strong>Farm</strong> Family of the Year –Broad River Soil & Water ConservationDistrict And Ag-Georgia <strong>Farm</strong> <strong>Credit</strong>Apartnership was created three yearsago between the Broad River Soiland Water Conservation Districtand <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>. The partnershipwas developed so that the <strong>Farm</strong> Familyof the Year could be better recognized andhonored for their contribution to the protectionof our natural resources and theircommitment to the betterment of theircommunity.The 2006 <strong>Farm</strong> Family of the Year isa beef cattle operation located in the quitecommunity of Smithonia. Chantilly <strong>Farm</strong> isthe center of life for Ted and Patsy Hughes.Their farming is their life and lifestyle. TheHughes are active in their church and community.They enjoy gardening, fishing intheir well stocked pond, and watchingwildlife from their deck at sunrise. Theyhave so many animals and birds on theirfarm which they take much pleasure inseeing and listening to their singing andchatter. Also, the Hughes are very hospitableand enjoy inviting friends and familyto their farm. Last year Chantilly <strong>Farm</strong> wasincluded in the farm tour, sponsored by theOglethorpe County Chamber of Commerce,the <strong>Farm</strong> Bureau and the Cattleman’s Association.The Hughes enjoy reading, music,and playing with their three grandchildren.The current farming operation consistsof a cow/calf operation. Presently theoperation consist of 65 brood cows andthe Hughes precondition and stocker theircalves to market as heavy feeders. Chantilly<strong>Farm</strong> purchased the first 93 acres in 1966, 53additional acres were purchased last year,and they rent 30 acres adjoining the farm.An extensive health program is maintained.Also they have introduced a programfor reducing parasites in their herd management.Their working facility is in-doorsand their corrals are protected by heavy useareas providing a sound and stable foundationfor working animals.The grazing program installed in 1979that is called the “Wagon Wheel” wherethe pastures are arranged around the hubs.The Hughes have installed three of thesehubs that are 75’ x 75’ heavy use areas, andthey serve 17 pastures that average 4-5 acreseach. The spring located on the farm wasnot considered to be in a desirable locationto adequately rotate their animals on thepastures. To overcome this they developedthe spring by installing an l000 gallon septictank designed especially for the spring withnine 4” holes in the bottom. The spring wasdug out with a track hoe and tank installedon a bed of gravel. The area was back filledwith gravel and dirt. Now they have anaccessible water supply with 1000 gallonsin reserve, and 50 to 60 gallons per minuteover-flow.Chantilly <strong>Farm</strong> utilizes a 60 day breedingprogram for their brood cows. Becausethe calves are so bunched, when they worktheir cattle, they can do everything neededat the same time. Because the cattle are allsame color, nearly the same size, and thesame quality, they are able to market themas groups. Their calves are born in Decemberand January, weaned and preconditionedin August or September, turned outon grass with supplemental feed to meettheir planned market weight, and marketedat a selected weight.The hay produced is simply excessgrass there is not just hay fields set aside.When they get to a pasture in the rotationthat they really don’t need, they cut it forhay. A major part of their plan includes overseedingpastures with rye grass for wintergrazing and hay. As much as possible Chantilly<strong>Farm</strong> tries to maintain clover standsin their pastures that are mixed fescue/common bermuda. To maintain their standsof grasses they manage the timing of theirfertilization program. If the Bermuda startsgaining, they simply fertilize in the winter.And if the fescue starts getting ahead, theyfertilize in the summer. Soil testing andapplying lime and poultry litter as recom-<strong>AgGeorgia</strong>.22.Winter 2007

The Hughes since their first year farming, have been acutely awareof the need for soil and water conservation.mended keeps the vegetation healthy. Alltheir poultry litter comes from one sourcewhich assists with knowing the quality ofmaterial received. The Hughes spot spraywith 2-4-D and Remedy to control weedsand brush in pastures and on fence lines.Five Strands of electric fences are utilizedon perimeter fences and bull lots and singleto 3 strands for cross fences. Very little bushhogging is utilized due to the intensive rotationalgrazing system.The Hughes since their first yearfarming, have been acutely aware of the needfor soil and water conservation. Some of theadditional conservation practices installedare farm ponds, waterways, and filter strips.Their ponds and creeks are fenced and livestockare not allowed in them. They havefenced out wetlands and provided areas forwildlife habitat. Conservation is a numberone priority for Chantilly <strong>Farm</strong>.Ted and Patsy Hughes’ plan for thefuture of Chantilly <strong>Farm</strong> is to continue tooperate their farm in a manner that providesthem with top quality livestock for market,and continue to improve the productivityand appearance of their land. “We are gratefulto the NRCS for the information, technicalexpertise, and opportunity they provide.Our land is our greatest asset and we wantto protect it, and improve it, and pass it onto our children in better shape than whenwe acquired it.”We, the Broad River Soil and WaterConservation District and <strong>AgGeorgia</strong> <strong>Farm</strong><strong>Credit</strong>, are proud to announce the <strong>Farm</strong>Family of the Year in the Broad River Soiland Water Conservation District as beingChantilly <strong>Farm</strong> of the Smithonia communityin Oglethorpe County. The successof this farm is due to their devotion to theland, hard work and their ability to run thisoperation with wise business decisions.Congratulations to Ted and Patsy Hughes! <strong>AgGeorgia</strong>.23.Winter 2007

It Was Hogs To Muscadines ForGeorgia <strong>Farm</strong>er Of The Year Gary PaulkMOULTRIE, GA – While growingup on his father’s farm, GaryPaulk never had any ideas,thoughts, dreams or plans of ever growingmuscadines, much less becoming one of thelargest muscadines growers in the country.“I absolutely loved growing up ona farm and my daddy had a big influenceon me,” said Paulk of Wray, GA. “I wasinvolved in the 4-H programs and showedhogs while in high school.After graduating from high school,Paulk went to Valdosta State and studiedpre-med, but transferred to the Universityof Florida where he graduated with a degreein agronomy. He and his wife, Ann, returnedhome to the farm where he managed hisfather’s hog operation.“We had a Farrow-to-finish operationwith 300 sows,” said Paulk, “I wasresponsible for raising the pigs and marketingroughly 20 pigs per year per sow. Theaverage delivery was 100 plus pigs a week.”It wasn’t long, however, that thingswould change for Paulk.“In talking to J.A. Ledger, a retiredcounty agent who had a nursery, I asked forsome advice for the future,” said Paulk. “Hesaid to take a look at grapes. He said ‘there’sscuppernong vines on every tree up anddown the road and people love ‘em.”So, Paulk decided to give blueberriesand grapes a try. And the gamble has beenrewarding as Paulk has developed intothe largest muscadine grape grower in thesoutheast, leading to his selection as the2006 Swisher Sweets/Sunbelt Expo Southeastern<strong>Farm</strong>er of the Year for Georgia. Hewas nominated for the award by PhillipEdwards of the University of GeorgiaExtension Service.Paulk and eight other finalists fromAlabama, Florida, Kentucky, Mississippi,North Carolina, South Carolina, Tennesseeand Virginia will be honored duringChip Blaylock and Tom Ryan present Gary Paulk (center) with theGeorgia <strong>Farm</strong>er of the Year Award.the Sunbelt Expo in Moultrie, GA, duringthe dates of Oct. 16-19. The 2006 SwisherSweets/Sunbelt Expo Southeastern <strong>Farm</strong>erof the Year will be announced at a luncheonon Tuesday, Oct. 17.Paulk, as the Georgia state winner,will receive $2,500 from Swisher Internationalof Jacksonville, FL, who along withthe Sunbelt Expo, have sponsored theSoutheastern <strong>Farm</strong>er of the Year Award for17 years. He will also receive a jacket, and a$200 gift certificate from the Williamson-Dickie Company; a $500 gift certificatefrom Southern States; and a fireproof homesafe ($300 value) from Misty Morn SafeCompany.Additionally, the 2006 Southeastern<strong>Farm</strong>er of the Year will receive a $14,000cash award from Swisher; a customdesignedjacket, another $500 gift certificateand $500 cash from Dickies; the use ofa Massey Ferguson tractor of their choicefor a year from Massey Ferguson NorthAmerica; a $3,600-custom designed gunsafe from Misty Morn; and another $500gift certificate from Southern States.“Today, when it comes to the muscadinegrape business, there’s nothing wedon’t do,” said Paulk. “In addition to planting,growing and processing, we sell freshmuscadines to Wal-Mart, BiLo and Publix.”see Muscadine, page 31<strong>AgGeorgia</strong>.24.Winter 2007

We Put Our Profits in Your Pockets!And we’ve proved it again last March when member-borrowers of <strong>AgGeorgia</strong> <strong>Farm</strong><strong>Credit</strong> received patronage refunds totaling nearly$16.5 MillionApproximately thirty percent or $4.9 million of the refund was paid in cash. Thebalance was placed in allocated surplus in the names of the individual memberborrowers.This is the 19th consecutive year we’ve paid a patronage refund. Since 1988,<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> has returned a total of $202 million to its member-borrowersthrough patronage refunds and surplus revolvements.When we distribute our profits to our borrowers, it reduces the effective cost ofborrowing and it proves that there are distinct financial benefits in doing businesson a cooperative basis!<strong>AgGeorgia</strong>.25.Winter 2007

<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> -Ag Loans and a Whole Lot MoreA Proud Historyof ServiceFor over 90 years the <strong>Farm</strong> <strong>Credit</strong>System has played a key role in financingthe transformation of American agricultureinto the world’s most productive sourceof food and fiber. As a financial cooperative,owned and directed by its borrowers,<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>, as a part of the<strong>Farm</strong> <strong>Credit</strong> System, has a unique historyand proud record of serving farmers, ranchers,and rural Americans.With total assets of over $154 billioninvested in the operations of Americanfarmers, ranchers, ag cooperatives, ruralutilities and rural home mortgages, the<strong>Farm</strong> <strong>Credit</strong> System today is the largestsingle source of agricultural credit in theUnited States.Today <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> servesthe credit needs of 79 counties in Georgiaand has assets in excess of $1 billion. Oursuccessful business results over the yearshave allowed <strong>AgGeorgia</strong> to pay patronageevery year since 1988–more than$202 million has been paid in cash to ourpatrons!Whether you are seeking an educationalexperience for your child throughan agricultural project loan, financing for ahome, crop operating funds, a poultry operation,timber investment, recreational land,or access to the capital markets for agribusiness,<strong>AgGeorgia</strong> has the products andthe experienced staff to serve your needs.DID YOU KNOW that <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> does Ag loans and a wholelot more? Sure, we’ve been making loansto farmers for over 90 years, but did youknow that we also offer insurance, leasing,appraisal services and mortgage loans? Wecan help you with a processing and marketingor a farm related business loan.Loan Programsand Interest RateOptions<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> offers a widevariety of loan programs and interest rateoptions that are flexible to meet the diverseneeds of its borrowers, yet, competitivewithin the marketplace. While somelenders only offer short term loans withlimited products and rates, <strong>AgGeorgia</strong> <strong>Farm</strong><strong>Credit</strong> offers a full service menu of financingoptions. Short and intermediate termloans are available on a variable or a fixedrate basis for the life of the loan. Long-termmortgage loans are also available under ourvariable, adjustable and fixed rate programs.However simple or complex your operation,we have the loan program and interest rateproduct for you.Quick<strong>Credit</strong>The Quick<strong>Credit</strong> program offersrapid turn-around on smaller, non-residentialcredit requests by one or two individuals.An excellent quick and efficientdelivery of credit, amounts up to $200,000can be applied for with certain limits ontotal indebtedness and program participation.Loan decisions can be made almostinstantly; time to closing would be based oncollateral requirements. Check with yourlocal branch office for details on this innovativeprogram.Trade <strong>Credit</strong>Trade <strong>Credit</strong> is a service offered to areaparticipating equipment dealers for point ofsale financing. Providing a convenience foryou, the customer, and assisting the salesmanin completing the sale, Trade <strong>Credit</strong>offers fast and efficient service while youare processing your equipment purchase.Ask your equipment salesman if they are aparticipating dealer, if not, contact us fordetails.Guaranteed Loans<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> has beendesignated as a preferred lender in conjunctionwith the USDA/<strong>Farm</strong> ServiceAgency’s Guaranteed <strong>Farm</strong> Loan program.FSA guaranteed loans provide lenders witha guarantee against certain loss of principaland interest on a loan. The guarantee<strong>AgGeorgia</strong>.26.Winter 2007

Our successful business results over the years have allowed<strong>AgGeorgia</strong> to pay patronage every year since 1988–more than $202 million hasbeen paid in cash to our patrons!permits opportunity for agricultural creditto farmers who do not meet normal underwritingstandards. Loan purposes can be foroperating, farm land purchases, real estateimprovements and debt refinancing.Servicesand BenefitsPatronage ProgramA major difference between <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> and other lenders is that<strong>Farm</strong> <strong>Credit</strong> returns its profits to its borrowers.As a cooperative we can share ourprofits with our borrowers through PatronageRefunds. A patronage refund is a wayof distributing the association’s net incometo its member-stockholders. A member’srefund is based on the proportion of interestearned on his or her loan to the total interestearned by the association and is a way torefund a portion of the interest you paid onyour loan. This reduces your effective costof borrowing. So it pays to do business with<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>.AccountAccessAccountAccess is your loan information–aclick away. View your accountinformation online at any time at www.aggeorgia.com. You can also make your loanpayments when it’s convenient for you...24hours a day, 7 days a week. Your annualyear-end statement or IRS 1098 and 1099tax forms are also available online throughAccountAccess.LoanLineLoanLine is around-the-clock phoneaccess to loan information. At <strong>Farm</strong> <strong>Credit</strong>,we understand that your day doesn’t endat five o’clock. That’s why we’ve createdLoanLine, your 24-hour toll-free telephoneaccess to loan information. LoanLine, worksaround your schedule. Dial toll-free 1-877-LoanLine (1-877-562-6546).AutoDraftAutoDraft is the fastest, easiest wayto make your <strong>Farm</strong> <strong>Credit</strong> installment.AutoDraft electronically deducts your loanpayment from your bank account every timeit’s due. No need to write a check, no cumbersomepayment book to keep up with, noenvelope to mail. Your payment is alwayson time, so you don’t have to worry aboutlate payments. AutoDraft is the easiest, nohassleway to keep up with your account.AgrilineAn Agriline Account gives you accessto your line of credit 24 hours a day, sevendays a week. You write yourself a loancheck whenever and wherever you want.With your Agriline Account, you’ll receivechecks personalized with either your nameand address or the name and address of yourbusiness. You are mailed a monthly statementwith all the details of your accountactivity the previous month. Borrowing hasnever been more convenient.FastCashFastCash is the safe, dependable wayto draw funds from your Line of <strong>Credit</strong> loan.All you do is call us, let us know how muchyou need, and we’ll deposit that amountelectronically into your checking or savingsaccount. Just call before 2:00 p.m., and thefunds will be in your account the next day.If your call is received after 2:00 p.m., yourtransaction will be processed promptly thenext business day. The exact time of daythe money is credited to your account maydepend on your bank’s practices.Sweep AccountsAutoBorrow and AgSweep are specialbusiness accounts that are linked to your<strong>Farm</strong> <strong>Credit</strong> Line of <strong>Credit</strong> Loan. Thesetools were developed by <strong>Farm</strong> <strong>Credit</strong> andare designed solely for <strong>Farm</strong> <strong>Credit</strong> borrowersto help you manage your cash foroptimal efficiency. AutoBorrow’s specialfeatures automatically move your cash tothe right place each day to minimize yourexpenses and maximum your income,transferring money to pay down your <strong>Farm</strong><strong>Credit</strong> line of credit loan or drawing theAggeorgia.27.Winter 2007

Whether you’re expanding your operations or just starting out inthe poultry industry, we’re ready to help you grow.exact dollar amount needed from your lineof credit loan to cover expenses. You haveaccess to your account and can view all ofyour AutoBorrow transactions online fromyour home or office computer. AgSweep is acash management product that links a <strong>Farm</strong><strong>Credit</strong> loan to a Command Deposit Accountat a commercial bank. Advances and paymentsare automatically posted to the <strong>Farm</strong><strong>Credit</strong> loan depending on the balance in thecommand deposit account.Appraisal ServicesThe complexity of today’s financialand legal environments demands expertisefor appraisal services. Appraisals of agriculturalenterprises (real estate, machinery,equipment, and livestock) and ruralproperties require qualified experts whounderstand the intricacy of modern agricultureand today’s rural environment. Ourappraisers have the resources, informationand knowledge to enable them to providevaluable services for purchasing, selling,borrowing/lending and financial planning.The comprehensive evaluation you receivefrom an <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> state certifiedappraiser is your assurance of a superiorvaluation for your financial needs. Ourexpertise ensures accuracy on complexproperties or situations, and adheres to therequirements of the Uniform Standards ofProfessional Appraisal Practice (USPAP).Experts inAgricultural andLand LoansPoultryAs a poultry operator, you have ademanding business. To be successful, youmust monitor everything from light andtemperature to water and airflow insideyour poultry houses. You also need an experiencedlender, one who understands thepoultry industry and knows how to helpyou succeed. At <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>,you’ll find loan officers who specialize infinancing poultry operations. They understandthe complex needs and demands of asuccessful operation and are committed toyour success. Whether you’re expandingyour operations or just starting out in thepoultry industry, we’re ready to help yougrow.Cattle<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> loan officersknow cattle operations first-hand, whichmeans you don’t have to “translate” yourbusiness to us. We understand the specialrequirements of cattle operations. Whetheryou need to purchase brood cattle, establishpasture, purchase machinery, equipmentor vehicles, need money for feed, fertilizer,veterinary costs or farm improvements,contact us. Our commitment to agriculture,along with our experience with cattlemen,makes us the best.Row CropsWe make agricultural loans. <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> loan officers know agriculturallending like no one else; that’sprobably because a good number of themgrew up on farms themselves. We have theknowledge to review your personal situationand provide customized solutions foryour needs. While agricultural lendingseems to be a come-and-go trend for manylenders, <strong>Farm</strong> <strong>Credit</strong> has been providingcredit to farmers for over 90 years. Whetheryou’re growing peanuts, cotton, watermelonsor vegetables we understand the specialrequirements of all farming operations. Letus show you what we can do for you.TimberA successful timber operation demandsa long term commitment. And you needa lender who is willing to go the distancewith you. <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> loan officersunderstand what it takes to financeyour investment in timberland; we havespecialists in the industry. Our knowledge,competitive rates and flexible terms makeus the logical choice for financing whetheryou’re looking for investment property,machinery, need funds for road maintenance,fire roads and drainage ditches, oroperating expenses. If you want to invest intimberland or just want land in the countrycall us, we know where to begin.<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is proud tooffer an innovative loan service that willenhance your choices in financing your landpurchases. With a landbank loan you canfinance your home mortgage, rural propertiesand land for investment or recreationalpurposes.<strong>AgGeorgia</strong>.28.Winter 2007

Land Purchases<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is the landspecialist. We are dedicated to being yourlender of choice when you need a loan forland. Of course, we finance all the needs ofthe full time farmer, which includes farmableland, pastureland and timberland. Wealso finance part-time farmers and landownerswho just want to own land as a stableinvestment for the future. In addition, wealso finance the same kinds of land for nonfarminglandowners. Our loan officers fullyunderstand the unique reasons for owningland and we will create the perfect loanpackage for your specific needs. Contact usif you’re interested in purchasing land, refinancingthe loan you currently have on yourland, or in discussing financing options forland.Lifestyle LoansThere’s nothing like escaping to yourown place in the country. Perhaps you’relooking for a quiet weekend retreat, a newhunting camp or a spot where your childrencan explore nature. Maybe you plan tobuild a retirement home on that special sitesomeday. Whether your ideal experience ishunting, fishing, riding horses, digging inthe dirt or just relaxing, that place can beyours. <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is the expertin financing rural real estate. With morethan 90 years of country lending experience,we understand the goals and dreams of ourcustomers and the considerations involvedin purchasing land in the country.Mortgage Loans<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is the keyto your mortgage financing. Through ourtrademark landbank loan service our SecondaryMarket option allows financing forproperties located virtually anywhere forprimary residence, second home, or investmentpurposes. Program alternatives withnumerous program choices are just a fewof the reasons why landbank is your homeloan solution. We offer competitive marketrates and our knowledgeable and experiencedloan officers will efficiently processyour loan with fast approval and closing.You can even apply for a loan online. Homeloan advantages feature optional in-houserural property financing with patronagedividends.Construction to Permanent Options:Our landbank construction loans give youcontrol and flexibility of your funds forconstruction. These loans are set up withease and convenience, and they allow youto determine the amount to be converted topermanent, long-term financing.EquipmentOur loan staff is prepared to provideyou with fast approval of equipment loans.Financing your equipment with <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> will allow you to take advantageof dealer cash discounts and modernizeyour equipment. A variety of terms andinterest rate plans are offered to provideyou with flexible financing.Aggeorgia.29.Winter 2007Recreational PropertiesThere’s nothing like a day spenthunting or fishing. Except, maybe a dayspent hunting and fishing on your ownland. Imagine your own country retreatwhere you can spend as much time as youwant, doing what you love. <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong> has sound, dependable creditand financial solutions to help you putyour roots in your country getaway spot.Our competitive interest rates and flexibleterms make us the logical choice for financingyour retreat in the country. Whetheryou’re looking for a place to hunt, fish, orsimply want to make a solid investment inthe land, we know where to begin.NurseryAt <strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong>, we understandnursery and greenhouse operations.Our loan officers are knowledgeable andcan help tailor a financial package to fityour situation. So whether you’re a commercialoperator, or a part-time operator,we’ll keep you growing.

<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is not only a lender,but we are on your team in helping you succeed.TurfTurf growers are in a unique businesswith different needs and requirements thanmany other types of agriculture. <strong>AgGeorgia</strong><strong>Farm</strong> <strong>Credit</strong>’s turf specialists know yourbusiness and are able to provide you with avariety of options to assist you in financingyour special needs, whether that is operatingfunds, equipment or land purchases.Operating Loans<strong>AgGeorgia</strong> loan officers understand theyearly cyclical nature of agriculture. That’swhy we offer annual and revolving lines ofcredit to farm owners and operators. Paymentscan be arranged to coincide withyour crop or livestock income. Borrowingfor your operating capital may allow youto take advantage of cash discounts, lock inprices by paying ahead, and receive tax benefitsby prepaying expenses.Marketing &Processing LoansThe costs involved with agriculturalproduction do not stop with the rawproduct. This loan program supports marketingand/or processing activities relatedto the production of agricultural products.<strong>Farm</strong> <strong>Credit</strong> loan officers understand theunique needs of today’s diverse agricultureindustry. We can save you money nowby providing you with a customized loanpackage that meets your needs.Agricultural-RelatedBusiness Loans<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> also providesloans for those who furnish farm-relatedservices directly related to the productionof agricultural products. The key aspectof this category is the service provided.Examples of services include: crop spraying,fertilizer spreading, custom harvesting,grain drying/storage, livestock breeding,veterinary services, hauling for farmers, andrecord keeping. This list is not intended tobe all-inclusive; there are many other qualifyingservices not listed here. <strong>Farm</strong> <strong>Credit</strong>loan officers are available to meet with youto discuss a customized loan package thatwill meet your needs now and in the future.LeasingThrough <strong>Farm</strong> <strong>Credit</strong> Leasing, weoffer lease financing for all types of vehicles,equipment, machinery, implementsand buildings. FCL also provides relatedservices such as specification assistance,volume purchase discounts, fleet incentivesand rebates for cars, vans, SUVs and lighttrucks. FCL can also sell your equipment atlease end. <strong>Farm</strong> <strong>Credit</strong> Leasing actively syndicatesand funds multimillion-dollar leaseprojects. Let us assist you on your nextleasing project.Managing Risk<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> is not only alender, but we are on your team in helpingyou succeed. We offer services to helpmanage against unforeseen risk with productssuch as crop insurance and term lifeinsurance.Crop InsuranceWe are a licensed crop insuranceagency prepared to help you protect yourinvestment. <strong>Farm</strong> <strong>Credit</strong> offers Multi-Peril, Hail, and Group Risk crop insuranceprograms.Term Life InsuranceAnother advantage to being an<strong>AgGeorgia</strong> <strong>Farm</strong> <strong>Credit</strong> member is beingable to purchase Premier Life Insurance.Each policy is individually underwrittenand the amount of insurance does notdecrease. Once your debt to <strong>Farm</strong> <strong>Credit</strong> ispaid off, as long as the premiums are paid,the insurance is yours to keep. Each policyis guaranteed renewable and you can nameyour own beneficiary. One, five, and tenyear options are available. <strong>AgGeorgia</strong>.30.Winter 2007

Cotton continued from page 20teristics. To produce a smooth surface inpreparation for dyeing and finishing, thegreige goods are passed rapidly over gasfiredjets or heated copper plates to singeoff lint and loose threads. Moving at speedsthat can be greater than 200 yards a minute,the material is scoured and bleached in acontinuous process that involves the use ofhydrogen peroxide. The time for the chemicalsto do the preparation reactions occursfrom piling the fabric on conveyor belts thatpass through steaming chambers, or stackingin large steam-heated, J-shaped boxesbefore the goods are withdrawn from thebottom.If a more lustrous cloth is desired,the goods are immersed under tension ina caustic soda solution and then later neutralized.The process, called mercerizing,causes the fiber to swell permanently. Thisgives the fabric a silken sheen, improves itsstrength and increases its affinity for dye.Mercerizing also can be done at the yarnstage.FinishingFinishing, as the term implies, is thefinal step in fabric production. Hundredsof finishes can be applied to textiles, andthe methods of application are as varied asthe finishes. Cotton fabrics are probablyfinished in more different ways than anyother type of fabrics. Some finishes changethe look and feel of the cotton fabric, whileothers add special characteristics such asdurable press, water repellency, flame resistance,shrinkage control and others. Severaldifferent finishes may be applied to a singlefabric.Cotton’s Major UsesU.S. textile mills presently consumeapproximately 7.6 million bales of cottona year. Eventually, about 57% of it is convertedinto apparel, more than a third intohome furnishings and the remainder intoindustrial products. Cotton’s competitiveshare of U.S. produced textile end-usesshows a steady increase, presently standingat approximately 34%. Cotton’s share of theretail apparel and home furnishings markethas grown from a historic low of 34% in theearly 1970s to more than 60% today. Cottonis used for virtually every type of clothing,from coats and jackets to foundation garments.Most of its apparel usage, however, isfor men and boys’ clothing. Cotton suppliesover 70% of this market, with jeans, shirtsand underwear being major items. In homefurnishings, cotton’s uses range from bedspreadsto window shades. It is by far thedominant fiber in towels and washcloths,supplying almost 100% of that market.Cotton is popular in sheets and pillowcases,where it holds over 60% of the market.Industrial products containing cotton areas diverse as wall coverings, book bindingsand zipper tapes. The biggest cotton usersin this category, however, are medical supplies,industrial thread and tarpaulins. Muscadine continued from page 24There’s 192 acres of muscadine grapeson the farm today that yield 5,000 poundsper acre. In his Muscadine Products Corporation,there’s 30,000 gallons of bulkmuscadine juice produced, 5,000 cases ofbottled muscadine juice, 2,200 cases and1,000 pounds of muscadine seed and skinnutraceuticals.“We even tried figs, peaches, plum,nectarines, strawberries and even kiwi,”said Paulk. “Determining the most feasibleand sustainable crops for our farm has beena challenge.”With the sow operation gone, Paulkdoesn’t live by muscadines alone. His operationcovers 1,368 acres and also includescotton, which is grown on 318 acres, yielding800 pounds per acre. There also 160acres of peanuts with a 3,500 pound peracre yield, 80 acres of pecans, which are intheir first year of rejuvenation, 350 acres oftimber and 6 acres of organic blueberries.“When we first went into the muscandinebusiness, many people told us ‘youcan’t sell those things’” said Paulk. “Now,we sell them New York to Miami and insome spots all over the country.“As our current markets and the familiarityof muscadines expand, we are planningon offering more muscadine products,”he continued. “We also plan to help establishour local winery over the next severalyears. The winery will add value to evenmore muscadines for processing.”Another area scheduled for expansionis agritourism. “We want to expand farmtours of our farms,” said Paulk. “We havehad several in the past and want to addmore. We also plan to plant food plots andparticipate in CRP programs so that quail,turkey and deer hunting will be a part ofour agritourism plan.”Paulk’s wife, Ann, plays a major role inthe farming operation as bookkeeper. Sheis also a kindergarten teacher. They havefour children – son Chris, who works forthe muscadine corporation; son Eric, whois a medical resident in Greenville, NC;daughter Amy, who attends Valdosta State;and daughter Anna, who is a junior in highschool.“<strong>Farm</strong>ing is not just a livelihood,” saidPaulk. “It’s a way of life. And I’m very thankfulto be a part of the agriculture industry. Ihope people will say someday that I madecontributions to our society.”Previous state winners from Georgiainclude: Timothy McMillan of Enigma,1990; Bud Butcher of Senoia, 1991; JamesLee Adams of Camilla, 1992; John Morganof Mystic, 1993; Alan Verner of Rutledge,1994; Donnie Smith of Willachoochee, 1995;Armond Morris of Ocilla, 1996; ThomasColeman, Jr, of Hartsville, 1997; GlennHeard of Bainbridge, 1998; Bob McLendonof Leary, 1999; James Lee Adams of Camilla,2000; Daniel Johnson of Alma, 2001;Armond Morris of Ocilla, 2002; Jim Donaldsonof Metter, 2003; Joseph Boddiford, Jr. ofSylvania, 2004; and Jimmy Webb of Leary,2005.James Lee Adams of Camilla wasselected as the Southeastern <strong>Farm</strong>er ofthe Year in 2000 and Armond Morris gaveGeorgia its second overall winner in 2002. <strong>AgGeorgia</strong>.31.Winter 2007