Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

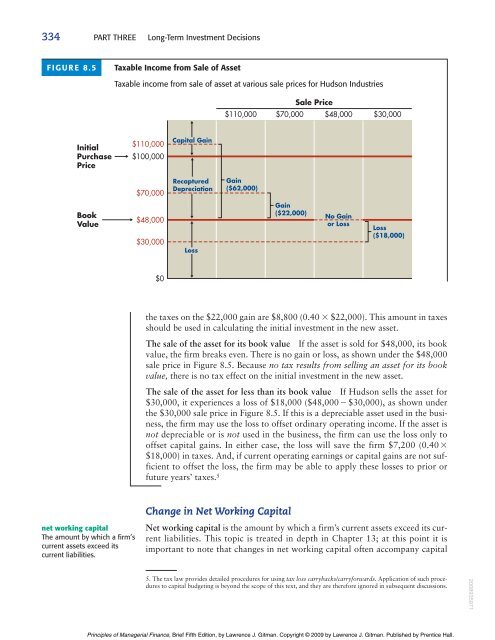

334 PART THREE Long-Term Investment DecisionsFIGURE 8.5Taxable Income from Sale of AssetTaxable income from sale of asset at various sale prices for Hudson IndustriesSale Price$110,000 $70,000 $48,000$30,000InitialPurchasePrice$110,000$100,000Capital Gain$70,000RecapturedDepreciationGain($62,000)BookValue$48,000$30,000LossGain($22,000)No Gainor LossLoss($18,000)$0the taxes on the $22,000 gain are $8,800 (0.40 $22,000). This amount in taxesshould be used in calculating the initial investment in the new asset.The sale of the asset for its book value If the asset is sold for $48,000, its bookvalue, the firm breaks even. There is no gain or loss, as shown under the $48,000sale price in Figure 8.5. Because no tax results from selling an asset for its bookvalue, there is no tax effect on the initial investment in the new asset.The sale of the asset for less than its book value If Hudson sells the asset for$30,000, it experiences a loss of $18,000 ($48,000 $30,000), as shown underthe $30,000 sale price in Figure 8.5. If this is a depreciable asset used in the business,the firm may use the loss to offset ordinary operating income. If the asset isnot depreciable or is not used in the business, the firm can use the loss only tooffset capital gains. In either case, the loss will save the firm $7,200 (0.40 $18,000) in taxes. And, if current operating earnings or capital gains are not sufficientto offset the loss, the firm may be able to apply these losses to prior orfuture years’ taxes. 5net working capitalThe amount by which a firm’scurrent assets exceed itscurrent liabilities.Change in Net Working CapitalNet working capital is the amount by which a firm’s current assets exceed its currentliabilities. This topic is treated in depth in <strong>Chapter</strong> 13; at this point it isimportant to note that changes in net working capital often accompany capital5. The tax law provides detailed procedures for using tax loss carrybacks/carryforwards. Application of such proceduresto capital budgeting is beyond the scope of this text, and they are therefore ignored in subsequent discussions.2008935971Principles of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.