Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

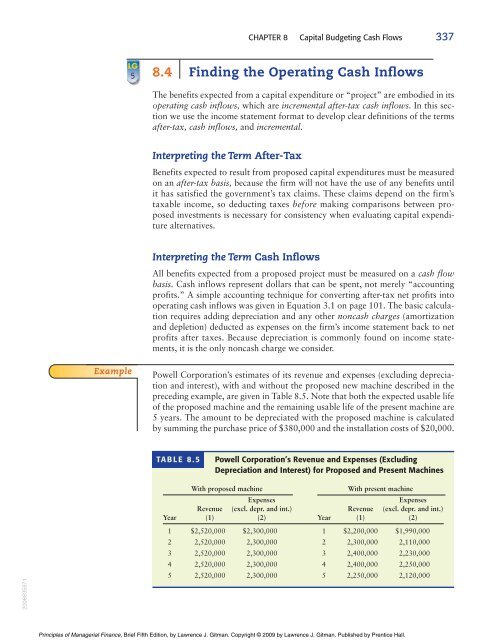

CHAPTER 8 Capital Budgeting Cash Flows 337LG58.4 Finding the Operating Cash InflowsThe benefits expected from a capital expenditure or “project” are embodied in itsoperating cash inflows, which are incremental after-tax cash inflows. In this sectionwe use the income statement format to develop clear definitions of the termsafter-tax, cash inflows, and incremental.Interpreting the Term After-TaxBenefits expected to result from proposed capital expenditures must be measuredon an after-tax basis, because the firm will not have the use of any benefits untilit has satisfied the government’s tax claims. These claims depend on the firm’staxable income, so deducting taxes before making comparisons between proposedinvestments is necessary for consistency when evaluating capital expenditurealternatives.Interpreting the Term Cash InflowsAll benefits expected from a proposed project must be measured on a cash flowbasis. Cash inflows represent dollars that can be spent, not merely “accountingprofits.” A simple accounting technique for converting after-tax net profits intooperating cash inflows was given in Equation 3.1 on page 101. The basic calculationrequires adding depreciation and any other noncash charges (amortizationand depletion) deducted as expenses on the firm’s income statement back to netprofits after taxes. Because depreciation is commonly found on income statements,it is the only noncash charge we consider.ExamplePowell Corporation’s estimates of its revenue and expenses (excluding depreciationand interest), with and without the proposed new machine described in thepreceding example, are given in Table 8.5. Note that both the expected usable lifeof the proposed machine and the remaining usable life of the present machine are5 years. The amount to be depreciated with the proposed machine is calculatedby summing the purchase price of $380,000 and the installation costs of $20,000.TABLE 8.5Powell Corporation’s Revenue and Expenses (ExcludingDepreciation and Interest) for Proposed and Present Machines2008935971With proposed machineWith present machineExpensesExpensesRevenue (excl. depr. and int.) Revenue (excl. depr. and int.)Year (1) (2) Year (1) (2)1 $2,520,000 $2,300,000 1 $2,200,000 $1,990,0002 2,520,000 2,300,000 2 2,300,000 2,110,0003 2,520,000 2,300,000 3 2,400,000 2,230,0004 2,520,000 2,300,000 4 2,400,000 2,250,0005 2,520,000 2,300,000 5 2,250,000 2,120,000Principles of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.